CleanSpark (NASDAQ:CLSK) is the 2nd Bitcoin (BTC-USD) mining company that I plan to hold over the long term because I believe CLSK stock is quite undervalued at current price levels.

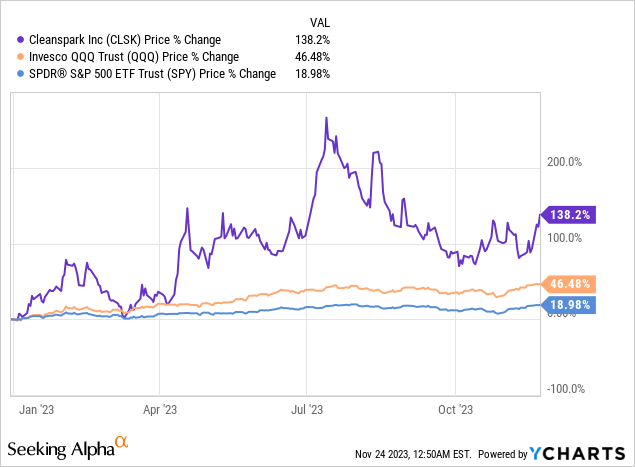

CLSK shares are up 138% YTD and have greatly outperformed both the S&P 500 (SPY) and NASDAQ 100 (QQQ) by a wide margin.

Many of my followers are well aware of my bullish stance on Marathon Digital Holdings (MARA), which I covered here in one of my past articles.

CleanSpark benefits from a lot of the same tailwinds since the company operates in the same industry. However, CleanSpark has been aggressively stacked Bitcoin over the last few months while Marathon Digital has reduced its Bitcoin holdings.

Led by Co-founder and CEO Zachary Bradford, CleanSpark is another founder-led crypto company that could surprise investors during the upcoming crypto bull run.

CLSK Company Overview (cleanspark.com)

CleanSpark Company Overview (cleanspark.com)

The company owns 100% of its Bitcoin mining facilities in Georgia plus co-owns another facility in New York.

It’s possible that Bitcoin mining stocks could experience a near-term selloff due to the massive Bitcoin spot ETF runup. If this happens then that would make CLSK shares even more attractive in my opinion.

CleanSpark Q3 2023 Business Update

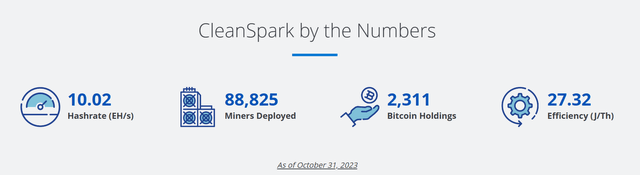

CleanSpark achieved some key milestones in Q3 2023 as the company plans to expand its Bitcoin mining hash rate to 16 EH/s over the next few quarters. The company hit record revenue of $45.5 million (Up 47% YoY) while tripling its hash rate year over year to 9 EH/s.

Net losses were $14.2 million in Q3 2023 compared to $29.3 million in Q3 2023, which means CleanSpark should become profitable again as early as Q2 2024 due to the upcoming Bitcoin halving event.

CleanSpark finished Q3 2023 with 1,200 BTC on its balance sheet and $90 million in cash on hand.

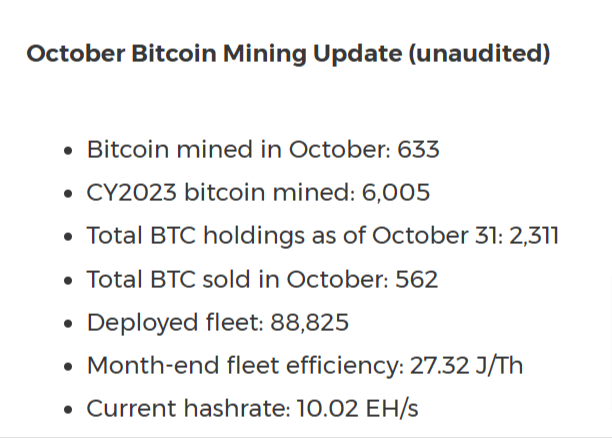

What’s interesting is that CleanSpark, along with most BTC miners, provides monthly updates on its mining operations.

As of October 31st 2023, CleanSpark mined 633 BTC on October 2023 and increased its BTC stack to 2,311. The company surpassed the 10 EH/s milestone with almost 89,000 operational Bitcoin miners deployed.

CLSK October 2023 Update (cleanspark.com)

These are impressive numbers considering CleanSpark shares trade under $5 as I write this at a sub $1 billion market cap.

Why I’m Bullish on CleanSpark Stock

Investors misunderstand the potential of the Bitcoin mining industry because it’s a relatively small sector that doesn’t have a lot of invested capital.

Marathon Digital (MARA) is the largest publicly traded Bitcoin mining company with a $2 billion market cap. It’s understandable that small-cap companies get ignored by larger, more profitable companies such as Nvidia (NVDA) or Tesla (TSLA).

However, that’s exactly why I’m bullish on companies such as CleanSpark due to its massive upside potential at a relatively low valuation.

CleanSpark mined 633 BTC in October at around 10 EH/s. If the company scales production to 16 EH/s then I expect mining production to increase around 60% to ~1,000 BTC mined per month.

At current Bitcoin prices, CleanSpark could generate around $37,000,000 million in monthly revenue or just over $100 million per quarter.

Many Bitcoin experts predict the price of Bitcoin to skyrocket after the April 2024 Bitcoin halving due to a supply shock when the amount of mineable BTC per block decreases from 6.25 to 3.125 every 10 minutes.

That’s where things could get interesting for CleanSpark if Bitcoin price soars over the next 12 to 24 months.

The April 2024 Bitcoin Halving Catalyst

The Bitcoin Halving event is the most important catalyst for Bitcoin’s price because it occurs once every 4 years and cuts the amount of daily released Bitcoin in half.

The current BTC block reward is 6.25 but BTC miners like CleanSpark will receive 3.125 BTC per block after April 2024.

While I expect CleanSpark to mine fewer BTC moving forward, the company will benefit from higher BTC prices along with transaction fees and Ordinal fees.

For example, someone paid over $3 million (83.65 BTC) in transaction fees to send 128 BTC on November 23rd, 2023. The miner, AntPool, received the 83 BTC block reward for processing the transaction.

This is a good example of how higher transaction fees will offset the decreasing BTC block reward for CleanSpark and other miners in the future.

I previously mentioned that CleanSpark could scale to ~3,000 BTC mined per quarter in the near future, which would translate into ~$100 million in quarterly revenue at Bitcoin’s current price levels.

My Bitcoin Price prediction for 2025 is around $370,000 per coin, which is around 10x from current price levels.

Assuming CleanSpark’s BTC production remains steady over the next two years, the company could generate as much as $1 billion per quarter in mining revenue.

CleanSpark’s 2025 annual revenue could approach $4 billion annually during the peak of the bull market, which makes CLSK stock look extremely cheap at current price levels.

Using CLSK’s current Price-to-sales ratio of 2.65, I’m projecting a future market cap of around $8 to $10 billion at the height of the crypto bull run in the Summer of 2025.

That would send CLSK shares to around $48 to $60 if my prediction comes true.

Risk Factors

- Decreasing Bitcoin Prices: Crypto mining stocks are positively correlated to Bitcoin prices, which means a BTC price crash would hurt CLSK shares in the near term.

- Lack of Capital to Fund Hashrate Growth: CleanSpark finished Q3 2023 with $125 million in cash on hand and may need to conserve some capital just in case Bitcoin’s price crashes over the next few months.

- Selling Bitcoin to Fund Growth: CleanSpark sells ~88% of its monthly mined BTC to cover expenses but that could increase if the company wants to grow its hash rate faster.

- Rising Short Interest: CLSK’s short interest is ~8% but that number could increase if short sellers bet heavily against the stock. I don’t think this is a major risk since short sellers have lost a ton of money betting against Bitcoin and crypto stocks in 2023 due to Bitcoin’s 125% YTD gains.

My Gameplan for CLSK Stock

I’m long CLSK shares and will continue buying the stock leading up to the April 2024 Bitcoin halving.

My goal is to accumulate shares and then sell covered calls to pay myself a small “dividend” while I wait for the bull run to start after the April 2024 halving.

Right now, the Daily RSI chart for CLSK is around 62 while the weekly RSI chart is just 58. Long-term resistance is around $7.50 while support sits around $3.40.

CLSK Daily RSI Chart (cleanspark.com)

CLSK Weekly RSI Chart (cleanspark.com)

CLSK stock may dip in the next few weeks but should continue rising over the next few quarters if crypto bulls continue to smash the buy button.

The crypto bull run won’t last forever and usually ends ~500 days after the Bitcoin halving event. That means CLSK shares could peak around September 2025.

If you’re looking for a relatively cheap crypto penny stock with lots of upside then CleanSpark is one of the best Bitcoin mining stocks in my opinion.

Read the full article here