Investment Thesis

Our current investment thesis is:

- COKE is performing extremely well, utilizing the success of the brands it bottles to consistently grow revenue YoY.

- Margins have also been improving, as scale and operational excellence drives incremental improvements.

- Compared to its Coca-cola bottler peers and the soft drink industry as a whole, COKE performs respectably well. When factoring in its valuation, COKE is undervalued in our view.

Company Description

Coca-Cola Consolidated, Inc. (NASDAQ:COKE) is a beverage manufacturing and distribution company based in the United States. The company primarily produces and markets non-alcoholic beverages, focusing on products from The Coca-Cola Company.

Its product portfolio includes sparkling beverages, still beverages (such as energy drinks, bottled water, coffee, tea, juices, and sports drinks), and post-mix products for fountain retailers. Coca-Cola Consolidated also distributes beverages for other brands like Dr. Pepper and Monster Energy.

Similar to other bottlers, the company’s largest shareholder is the Coca-Cola Company (KO), which owns c.30% of the business.

Share Price

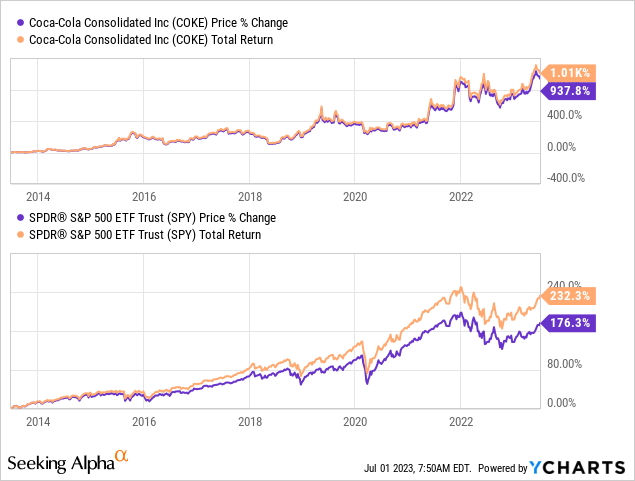

COKE’s share price has performed incredibly well in the last decade, significantly outperforming the wider market. This has been driven by a large and consistent increase in the company’s size, while also improving its economics, contributing to highly accretive returns.

Financial Analysis

COKE financials analysis (Capital IQ)

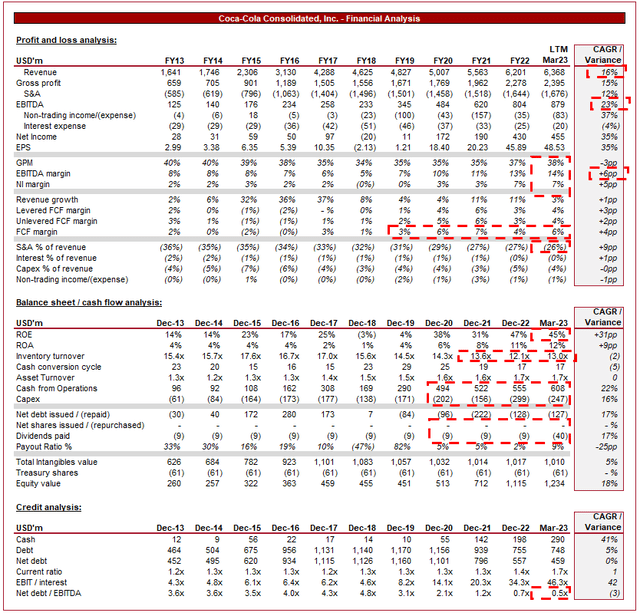

Presented above is COKE’s financial performance for the last decade.

Revenue & Commercial Factors

COKE’s revenue has grown at a CAGR of 16% during the last 10 years, with only 1 fiscal year of growth below 4%. This is a reflection of strong organic growth, as well as an expansion of its markets, allowing the business to reach an increased number of consumers.

Business Model and Competitive Positioning

Similar to our coverage of other Coca-Cola bottlers, it’s worth briefly discussing the relationship. COKE operates under long-term bottling agreements with The Coca-Cola Company, allowing it to leverage the iconic brand’s reputation and portfolio of beverages across a geographical area. Coca-Cola’s largest bottlers are Coca-Cola FEMSA (KOF), Coca-Cola Europacific Partners PLC (CCEP), and Coca-Cola HBC AG (OTCPK:CCHBF). Coca-Cola benefits from this bottling chain by reducing its fixed costs and capex requirements. This allows the company to focus on its core competencies and expansion.

COKE’s business model revolves around manufacturing, marketing, and distributing Coca-Cola (and other) products to a network of retail channels, including grocery stores, convenience stores, restaurants, and vending machines. The company benefits heavily from the diversification of its product offering, not only in the soda industry between brands but also various segments in the wider beverage industry (such as Energy drinks, tea, water, etc). The benefit of this is reduced exposure to any single brand or segment, allowing COKE to enjoy trends while protecting the downside if a segment slows.

Given the nature of the service, the company focuses on efficient production, supply chain management, and customer service to ensure the timely delivery of beverages and maximize customer satisfaction. This is critical to its ability to maintain its high standing with Coca-Cola, as well as continue to expand its clients.

COKE’s strategic focus on specific regions allows for a concentrated market presence and a deep understanding of local consumer preferences and trends. This allows Management to perfectly tailor its focus to maximize market penetration, as well as support Coca-Cola with new products entering its market.

COKE’s commercial profile is highly attractive. The business has a monopolistic position in its geographies, allowing the business to focus on efficiency and operational improvement. Improved performance will come from new products, and so the long-term prospects of this are based on the belief that Coca-Cola will continue to innovate and develop products customers want.

Beverage Industry

Rising health consciousness has led to increased demand for healthier beverage options, including low-sugar and low-calorie alternatives. This has been a longstanding trend, and many have suggested it will spell the end of Coca-cola’s dominance. These ideas have always been overblown, as Coca-Cola has shown its ability to successfully innovate to create sugar-free products. We believe there is scope for increased growth through the creation of new beverages that satisfy this demand.

In the near term, there is a concern with these use of Aspartame, an artificial sweetener. It is believed that this will imminently be ruled a carcinogen. This has the potential to disrupt COKE’s supply chain as there is a scramble by Coca-Cola to substitute the ingredient.

Consumers are increasingly concerned about the environmental impact of packaging and the carbon footprint of the beverage industry, driving the need for sustainable practices and packaging solutions. COKE has developed well in this regard, with expectations from Coca-Cola Co to do so. This has the potential to increase costs but has, importantly, not materially impact margins.

Margins

COKE’s margin progression has been impressive in the last 10 years, with its EBITDA-M increasing to 14%.

This rapid margin improvement is a reflection of its improving commercial position, allowing the business to price in excess of cost, as well as improve efficiencies and scale, driving significant cost benefits. Margin improvement has run into LTM, implying further improvement is possible in the coming years.

Inflationary pressures on bottling are having an impact, but thus far, COKE has been in a position to offset this impact sufficiently to enhance its returns.

Balance Sheet & Cash Flows

COKE is conservatively financed, with a ND/EBITDA ratio of 0.5x and a current ratio of 1.7x. For this reason, we are not overly concerned about solvency or the ability to finance future growth.

Capex is currently 4% of revenue, a large amount but a reflection of the financial investment required for a business of this nature. Despite this, the company has a FCF-M of 6%, a healthy level.

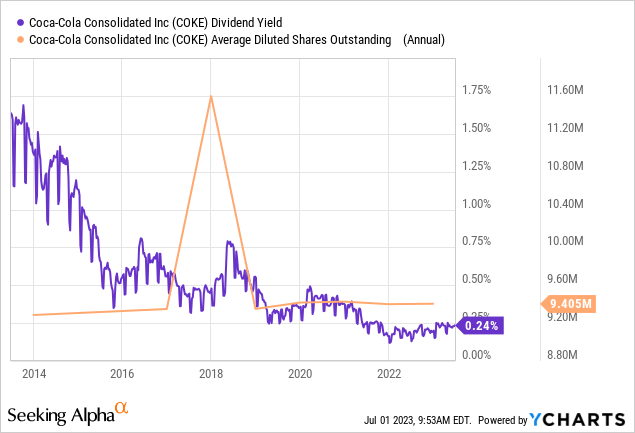

Distributions to shareholders have been non-existent to any material level, likely due to the high Capex relative to CFO and a desire to deleverage. With the improved FCF conversion in recent years, the potential to improve distributions is there, and the company is now accumulating cash.

Industry Analysis

Soft Drinks Industry (Seeking Alpha)

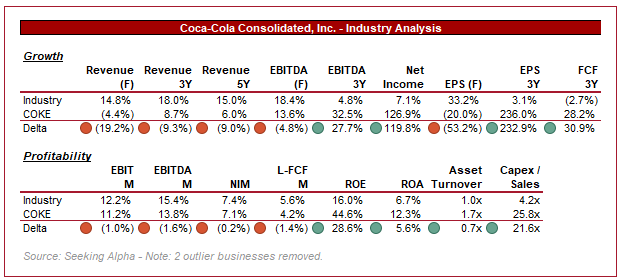

Presented above is a comparison of COKE’s growth and profitability to the average of the Soft Drinks industry, as defined by Seeking Alpha (12 companies).

COKE performs relatively well in our view when contextualized. Margin improvement in recent years has allowed the business to improve its profitability growth, as well as close the gap on a profitability basis to the industry.

Growth is a key area of weakness, but this is a reflection of its nature. The majority of its brands are mature, and the company is a bottler rather than a brand owner, restricting its direct comparability.

Peer Analysis

Coca-Cola bottlers (Seeking Alpha)

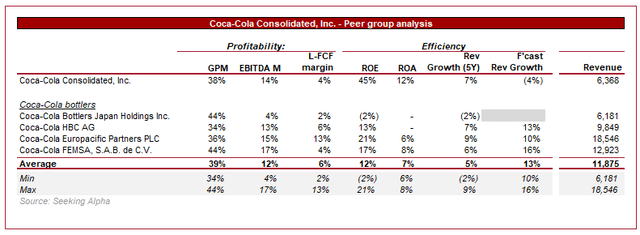

Presented above is a comparison of COKE to a cohort of Coca-Cola bottlers. COKE is one of the smaller bottlers in the group.

On a profitability basis, COKE is marginally above average, only due to the weakness of the Japanese business. This deficit to the larger business is likely partially due to scale. Growth is comparable.

Valuation

Valuation (Capital IQ)

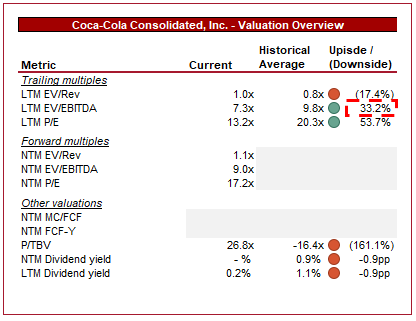

COKE is currently trading at 7x LTM EBITDA. This is a discount to its historical average. Given the improvement in profitability, this reflects an improvement in profitability at a rate faster than its price action. Our view is that a premium valuation to its historical average would be warranted given the margin improvement.

Peer valuation (Capital IQ)

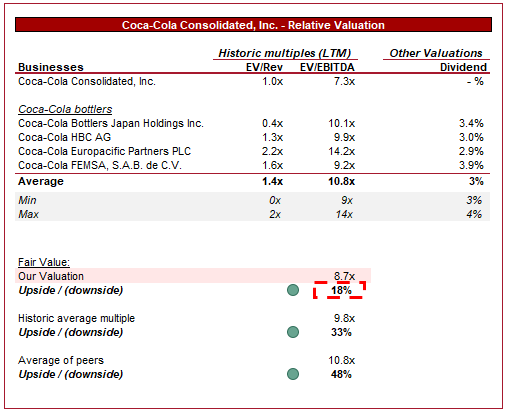

Further, if we compare COKE to its bottler peers, the company is trading at a large discount (48%). Given its smaller scale, lower profitability, and poor distributions, we have applied a 20% discount. Based on this, we compute a target upside of 18%.

Management

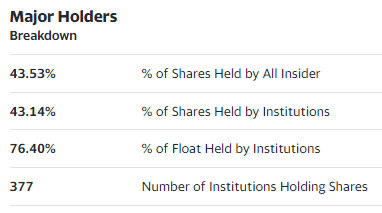

COKE’s Management owns a large number of shares, with c.44% of shares held by insiders. This is generally a good indication of aligning motivations, as compensation is the same as shareholders.

Insider ownership (Yahoo Finance)

Interestingly, control is also held by insiders, with Mr. Harrison III (Chairman and CEO) controlling 71% of the voting power through Class B shares (Source: Annual accounts). Although we like ownership, control is slightly different. This gives Mr. Harrison unchallenged control over the business, representing a risk to shareholders.

Key Risks With Our Thesis

The risk to our current thesis, in addition to the Management structure, is the lack of analyst coverage. It is incredibly unusual for a business of this size to lack analyst coverage, and we have been unable to figure out why. Analysts provide invaluable support to financial markets by holding Management to account on a regular basis, providing research and insight into the progress and performance of a business.

Final Thoughts

COKE has been on a fantastic growth trajectory. Our expectation is that the business will continue to perform well, as its monopolistic position and world-class brands (that it bottles) continue to generate strong returns. Upside will be supported by the scope for margin improvement and increased distributions.

Relative to the soft drinks industry and its bottler peers, COKE looks strong. We see upside at its current valuation, although remain cautious given its Management structure and lack of analyst coverage.

Read the full article here