Thesis

Earlier in May, I covered Cognizant Technology Solutions Corporation (NASDAQ:CTSH), where I outlined the near-term challenges being faced by the company. In this article, I will discuss the company’s recent performance and the outlook going forward. The newly appointed CEO, Ravi Kumar, has outlined key goals aimed at decreasing employee turnover and enhancing the company’s competitiveness in managing comprehensive end-to-end transformation initiatives. These objectives have the potential to foster more predictable revenue growth. Cognizant’s strong performance in the third quarter, marked by a 16% increase in bookings, suggests that CEO Ravi Kumar’s efforts to revitalize the company are yielding positive results. Nevertheless, the company is contending with substantial attrition rates and wage pressures, which curtail its capacity for short-term margin improvement. Hence, I remain cautious for now and maintain my hold rating on the stock for now.

Post-3Q Review and Outlook

Cognizant’s strong performance in the third quarter, with a 16% increase in bookings, indicates that CEO Ravi Kumar’s efforts to turn the company around are making progress. Although the company has adjusted its full-year revenue guidance to be slightly lower, ranging from a 0.7% decrease to flat, instead of the previous estimate of a 1-1% decrease, this adjustment is mainly due to short-term challenges in its most significant market, North America (which accounts for 73% of its sales and declined by 0.6% in the third quarter), and its largest customer segment, financial services (which makes up 30% of its business and saw a 4% decline). However, the management is optimistic about achieving the higher end of the operating margin target and has increased its share repurchase goal, indicating confidence in the company’s recovery. I believe Cognizant is well-positioned to experience revenue growth once there is a rebound in discretionary spending, although the level of employee turnover remains uncertain.

Lower Penetration in the European Market May Hinder Growth

In the recent past, North America has experienced the most immediate pressure when it comes to discretionary IT spending, particularly in the financial services and technology sectors, where companies have been exercising caution. Notably, North America represents 74% of Cognizant’s total sales. On the other hand, European and UK enterprises have demonstrated more resilience to these spending constraints, but Cognizant’s relatively limited presence in these markets has amplified the challenges it faces in terms of revenue growth.

In terms of industry exposure, Cognizant generates 31% of its sales from the financial services sector and 16% of its revenue from the Technology, Media, and Telecommunications sector. Moreover, Cognizant has a significantly higher share of its revenue, 30%, coming from the health and public services sector compared to other major IT services companies. This sector presents more potential for long-term growth, given its relatively lower maturity in terms of digital transformation.

However, Cognizant’s limited presence in the European IT services market could hinder its revenue growth prospects in the medium term, as European businesses are expected to have more room for increased spending compared to their US counterparts. On the flip side, Cognizant’s significant involvement with healthcare clients presents an opportunity for growth, considering that this sector has not yet fully embraced digital transformation.

Cognizant has struggled to expand its revenue in Europe in recent years, partly due to disruptions in its supply chain that have slowed down its overall revenue growth. CEO Ravi Kumar appears to be addressing these challenges, although economic pressures may still constrain expansion opportunities in the short term. Nevertheless, the company may need to make targeted investments to enhance its presence in the European market. In the medium term, I believe there is greater potential for growth in Europe compared to the larger North American market.

Financial Outlook and Valuation

Cognizant’s strong position in the healthcare and life sciences market has the potential to boost its market share in the medium term. Healthcare is a relatively smaller industry vertical, but it tends to be more resilient to economic downturns compared to banking and technology spending. Additionally, healthcare has a longer runway for growth because many in the sector are slower to adopt new technologies. Once supply-side challenges are resolved, Cognizant could achieve high-single-digit annual growth in its healthcare segment.

However, in the near term, Cognizant’s revenue growth may face constraints due to macroeconomic uncertainty and the efforts of its new CEO to address supply-side bottlenecks. The financial services sector, which accounts for 33% of its total sales, could experience a slowdown due to pressures in the industry. Consulting services may also be impacted if companies reduce discretionary spending. Cognizant’s margins may face near-term pressures due to restructuring costs, and the company’s high attrition rate in the industry could pose a revenue risk if it has difficulty securing large-scale transformation projects due to a lack of available talent.

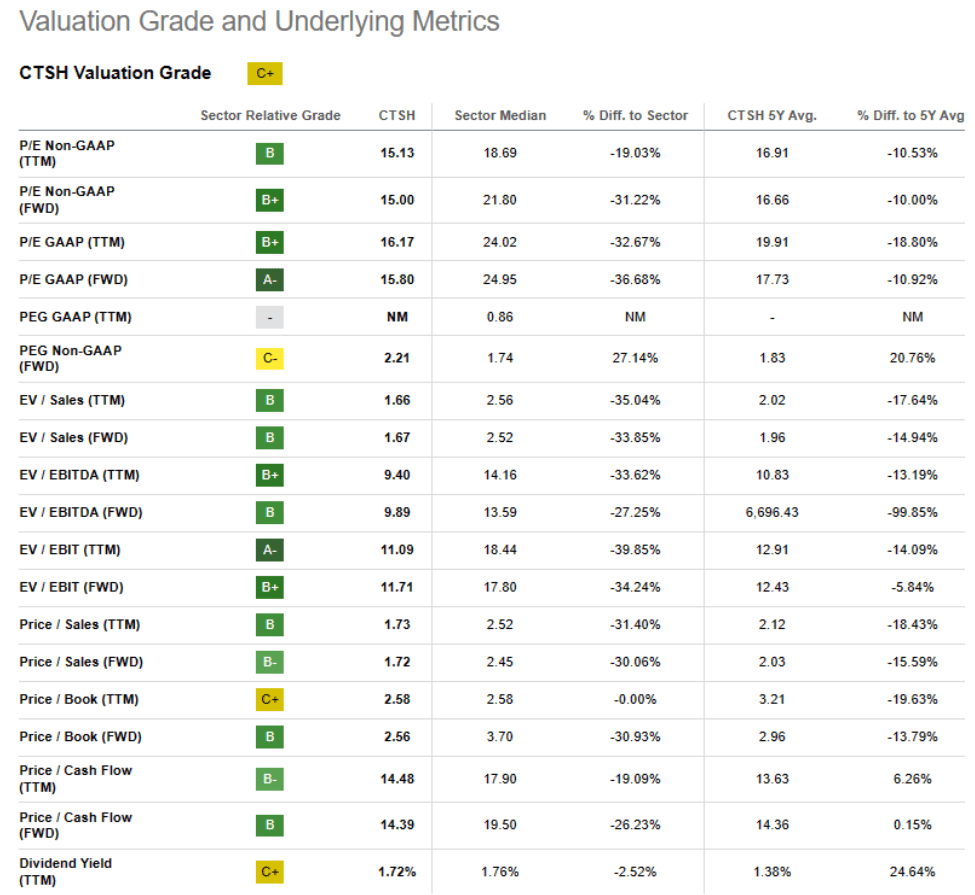

Cognizant is trading at a discount to peers, roughly around its two-year average forward PE. I believe CTSH stock discount is justified by the uncertainty surrounding the company’s growth trajectory and its above-average attrition rate as the company continues to execute a turnaround. In recent times, Cognizant has faced supply-side issues related to attrition in the IT sector. This has led to slower revenue growth compared to its peers. Given the current economic challenges, a sales recovery seems unlikely. However, the company has shown promising momentum with solid bookings. In the short term, there is a possibility of margin improvement as a result of ongoing restructuring efforts. I maintain my hold rating on the stock and will continue to observe IT spending going forward.

Seeking Alpha

Conclusion

Cognizant’s new CEO, Ravi Kumar, has set priorities focused on reducing employee turnover and positioning the company to be more competitive in handling comprehensive end-to-end transformation projects. These priorities have the potential to bring about more consistent and predictable revenue growth. However, the company is grappling with high attrition rates and wage pressures, which limit its short-term margin expansion potential. Given these challenges, I see the risk-reward balanced and assign a hold rating to the stock.

Read the full article here