Introduction

I’ve been busy researching healthcare stocks after coming to the conclusion that I want to make healthcare the second-largest sector in my portfolio. In addition to buying more of the stocks that I own, I’m considering adding two new companies. One of them could be ResMed Inc. (NYSE:RMD), a fascinating company that I have never publicly discussed.

While the company isn’t the perfect dividend stock due to its 0.8% yield and subdued dividend growth, the company is a fundamentally-driven wealth compounder.

It has top-tier products that cater to modern health issues. It also has a wide moat, a strong product ecosystem, and secular tailwinds providing high long-term growth.

In this article, I will elaborate on all of this and explain why the RMD ticker is now a part of my watchlist.

So, let’s get to it!

Buying A Fast-Growing Healthcare Segment

Whenever I buy companies, I want to buy assets that add value to the world – in addition to having a wide moat.

This includes healthcare, a sector that I expect to benefit from decades of strong tailwinds. Obesity, an aging population, and our fight against illnesses that were hard to treat for decades are reasons I’m such a big fan of healthcare.

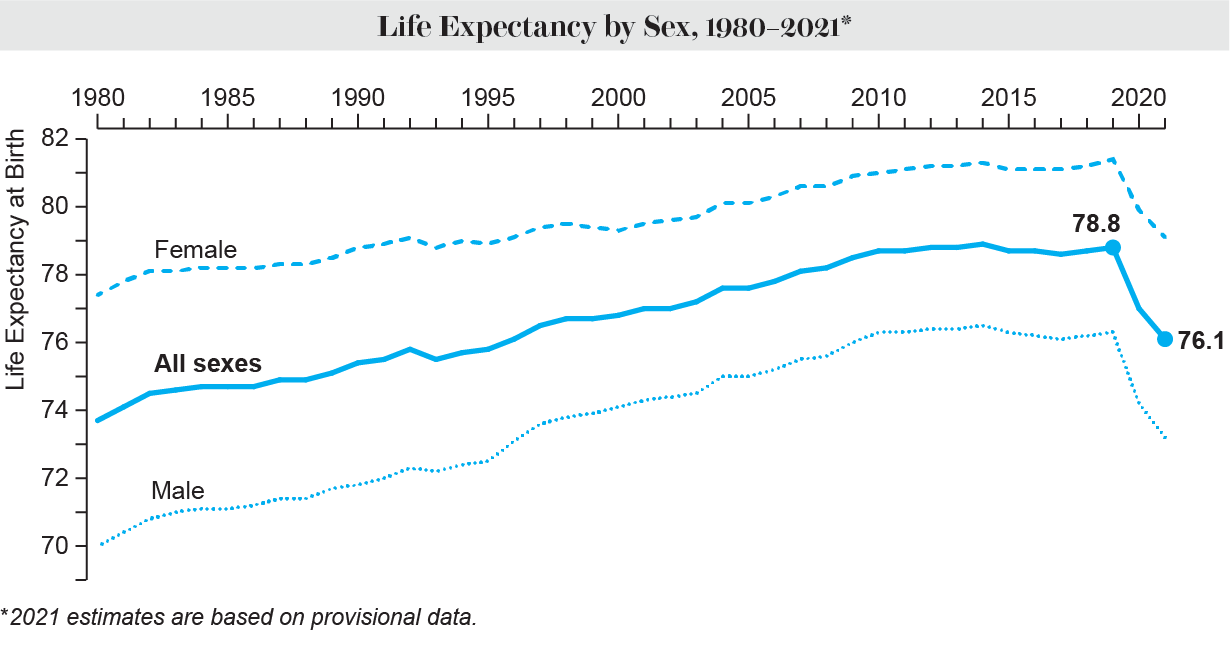

One chart I cannot stop thinking about is the one below, which shows that life expectancy in the United States has fallen off a cliff. Not only has this chart gone sideways between the Great Financial Crisis and 2019, but it has taken a huge plunge after the pandemic.

Scientific American

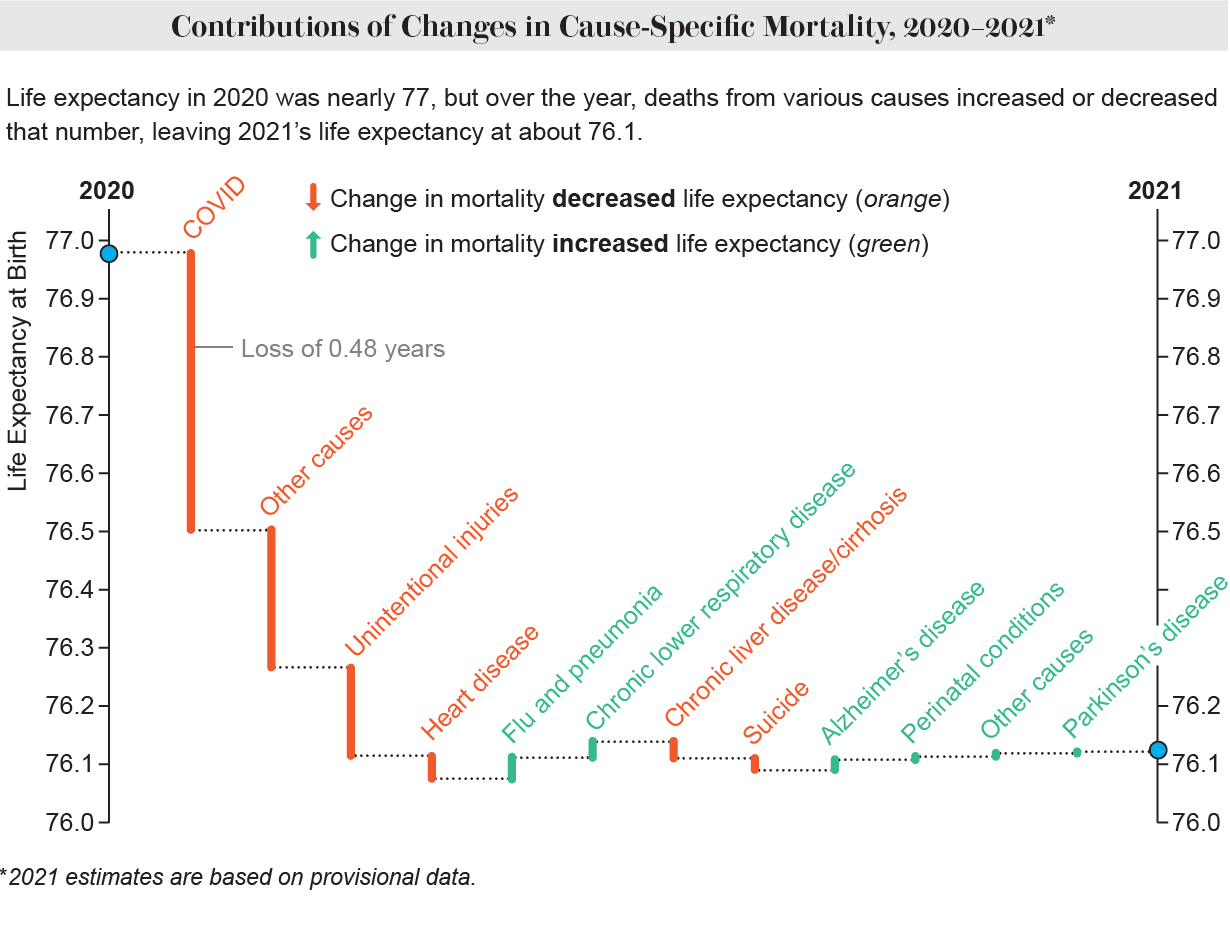

According to a report in Scientific American, this is mainly due to COVID, other causes, unintentional injuries, and heart disease.

Scientific American

What I found interesting is that issues like heart disease continue to pressure the average life expectancy. However, another major takeaway is that healthcare efforts in other areas are causing life expectancy to improve. This includes pneumonia, respiratory diseases, Alzheimer’s, and Parkinson’s.

This brings me to the star of this article.

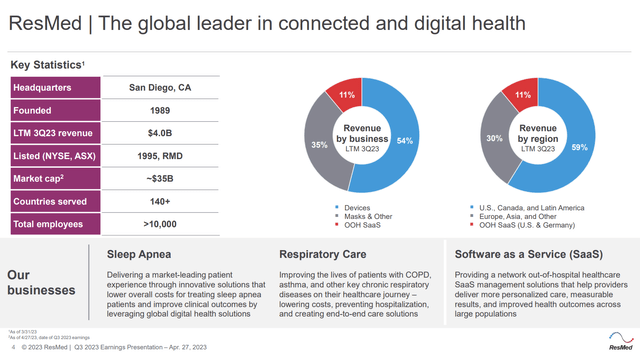

With a market cap of $32 billion, ResMed is one of the largest players in the Medical Instruments & Supplies industry.

The company is a global leader in digital health and cloud-connected medical devices. ResMed focuses on designing innovative solutions to treat and manage chronic diseases, such as sleep apnea, chronic obstructive pulmonary disease (“COPD”), and other respiratory disorders. This also explains the company’s name.

Essentially, the company’s products aim to improve the quality of life for patients, reduce the impact of chronic disease, and lower costs for consumers and healthcare systems. While this sounds a bit like an obvious sales pitch, these goals are very important and in high demand. Especially because demand for chronic disease is (unfortunately) rising, which often requires expensive treatments. Having tools to improve patients’ lives while reducing costs is the sweet spot in this industry.

ResMed Inc.

As the overview above shows, the company operates two (major) business segments:

- The Sleep and Respiratory Care segment focuses on the sleep and related respiratory care markets. It offers a range of products for the treatment of sleep apnea, including CPAP systems, masks, ventilation devices, diagnostic products, and dental devices. It also provides solutions for other respiratory disorders, such as COPD and asthma.

- The Software as a Service segment focuses on providing cloud-based software health applications and management software to support out-of-hospital care, including home medical equipment, home health, hospice, skilled nursing, and other healthcare services.

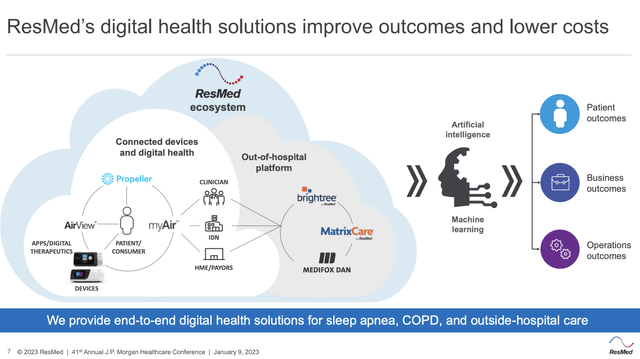

ResMed Inc.

Essentially, by enabling better patient care, improving clinical decision support, and driving interoperability, they aim to transform and significantly improve out-of-hospital healthcare.

With this in mind, the company has a business strategy based on six pillars:

-

Product Development and Innovation: The company is committed to ongoing innovation in sleep apnea and respiratory care products, introducing masks in AirFit and AirTouch ranges and therapy-based software solutions like AirView. RMD also acquired Curative Medical for a portfolio of sleep apnea products.

-

Digital Health Technology: RMD is focused on expanding cloud-based patient management platforms like AirView, U-Sleep, and myAir to improve patient outcomes and remote monitoring.

-

SaaS Solutions in Out-of-Hospital Care Settings: RMD aims to transform OOH healthcare with software solutions for various settings like HME, home health, hospice, skilled nursing, and more.

-

Geographic Presence: RMD sells its products in 140 nations and aims to use regions with fast growth to expand its footprint.

-

Increasing Public and Clinical Awareness: RMD is conducting promotional activities to raise awareness of sleep apnea, COPD, and related conditions.

-

New Clinical Applications: RMD is actively seeking new medical applications for the technology, exploring the association between OSA and stroke, heart failure, hypertension, and glucose intolerance. This includes partnering with prominent physicians for research.

Technically speaking, there are seven pillars of growth. However, I decided to leave out levering management experience, as that one is too obvious.

With that said, it needs to be said that although RMD does enjoy a wide moat in the current market, that moat could be challenged by competitors and new technologies. After all, ResMed’s products also compete with surgical procedures, nerve stimulation devices, and dental appliances designed to treat sleep apnea and other respiratory conditions.

The emergence of new procedures, devices, or therapies by competitors could cause ResMed’s products to become obsolete. I don’t expect that to happen, especially because of RMD’s aggressive M&A strategy, but it needs to be mentioned.

RMD’s Shareholder Benefits

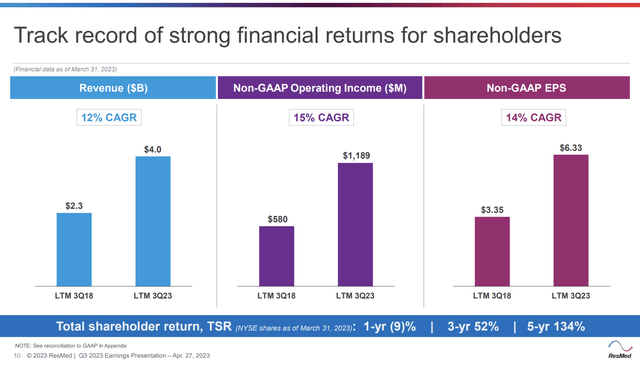

RMD’s numbers support the bull case. Over the past five years, the company has grown its revenues by 12% per year. Adjusted operating income has risen by 15% per year. Non-GAAP earnings per share have risen by 14% per year.

ResMed Inc.

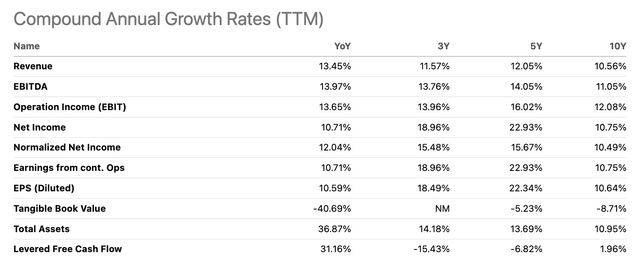

Using the Seeking Alpha table below, we see that the company has consistently grown its financials at elevated rates. For example, EBITDA has risen by 11.1% per year over the past ten years.

Seeking Alpha

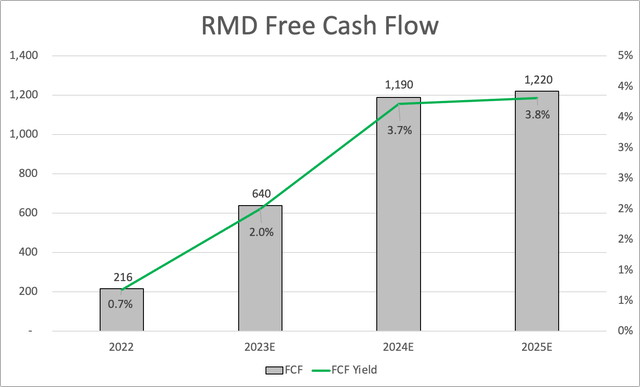

Furthermore, free cash flow is expected to take off in the years ahead.

In the 2024 fiscal year, free cash flow is expected to reach $1.2 billion, which translates to a 3.7% free cash flow yield.

Leo Nelissen

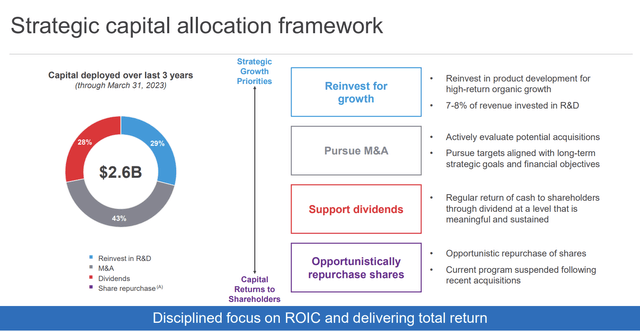

Most of the company’s cash will end up being spent on organic and acquired growth.

Over the past three years, roughly three-quarters of its cash was spent on R&D to support organic growth and mergers to add additional capabilities. The company expects to spend between 7% and 8% of its sales on R&D.

ResMed Inc.

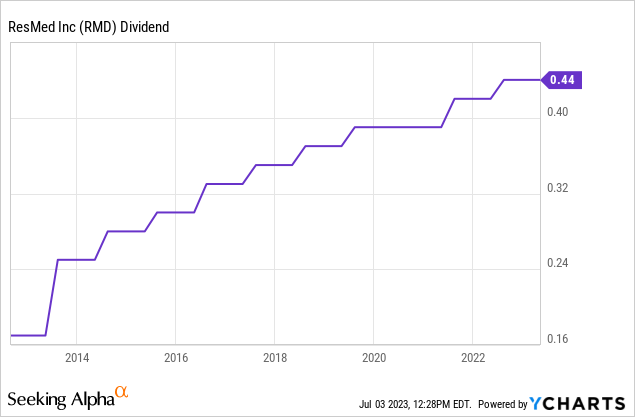

So, while RMD is a dividend growth stock, it’s not a dividend growth stock with a high yield or high growth.

Its 0.8% yield is backed by a 27% payout ratio. However, over the past five years, the average annual dividend growth was just 4.7%.

While RMD is the wrong stock for income-seeking investors, I don’t mind its low dividend growth rate, as I believe that RMD can generate much more value by focusing on growth.

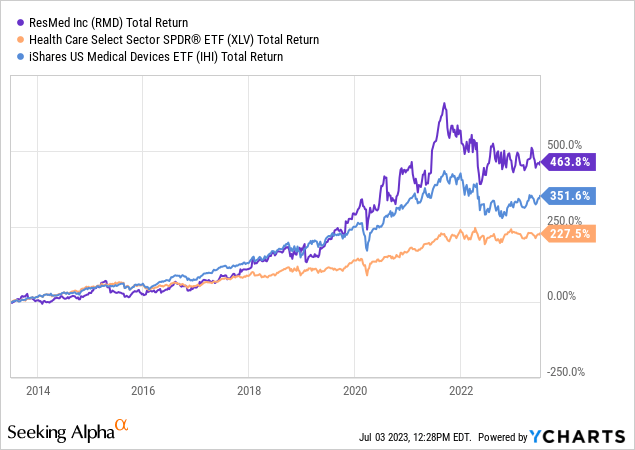

Over the past ten years, RMD shares have returned 464%, which crushes the market and its peers. I expect RMD to outperform its peers on a long-term basis, which makes up for the fact that investors do not get to enjoy a decent dividend yield. And, to be honest, almost all companies in this industry with a somewhat decent yield are lacking growth. This emerging industry is just too focused on growth to sacrifice (a lot of) cash on dividends – at least for the time being.

It also helps that the company has a very healthy balance sheet.

As of March 31, the company had $1.6 billion in gross debt and $1.4 billion in net debt, primarily related to the funding of the MEDIFOX DAN acquisition.

Next year, net debt is expected to be roughly zero.

During the quarter, the company reduced revolver debt by $215 million, leaving approximately $605 million available for drawdown under the revolver facility. Hence, the company maintains a solid liquidity position.

In other words, the company has an extremely healthy balance sheet and accelerating free cash flow, which allows it to quickly engage in new M&A projects.

Valuation

In 3Q23, the company did extremely well, which supports the longer-term trend.

Group revenue for the quarter reached $1.12 billion, reflecting a 29% increase compared to the prior-year quarter. When adjusted for constant currency, revenue grew by 31%. Revenue growth was driven by the improved availability of sleep devices and solid growth across the company’s broader product portfolio.

Additionally, the company recorded an incremental revenue of approximately $15 million from COVID-related demand during the quarter. It is expected that revenue from COVID-related demand will be negligible going forward.

Furthermore, ResMed saw a significant increase in SaaS revenue, which grew by 35% in the March quarter. This growth was attributed to the contribution from the aforementioned MEDIFOX DAN acquisition and continued strong performance from the HMV vertical. Excluding the MEDIFOX DAN acquisition, SaaS revenue still grew by 9% in the quarter.

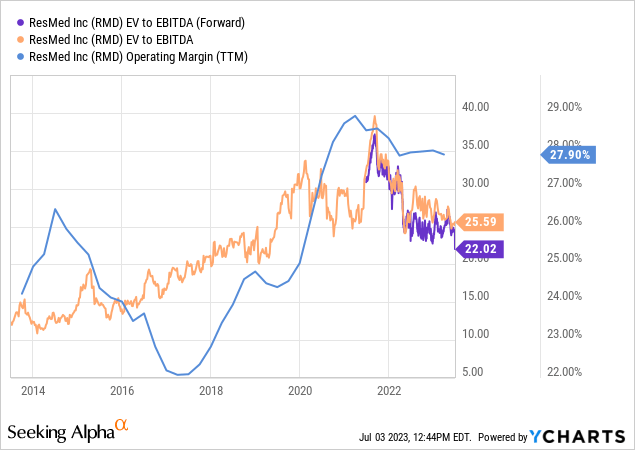

With that said, RMD is trading at 22x NTM EBITDA. This is the lowest number since 2019. Note that the company’s impressive stock price appreciation has been driven by a valuation expansion, which is the result of an increasingly efficient business model. That’s why I added operating margins to the chart below.

With that said, EBITDA is expected to grow by 11% in FY2024. In FY2025, EBITDA growth is expected to be 10%.

Unless the company runs into significant problems like a sudden industry disruptor, which it cannot acquire through M&A or a recession that gets so bad that healthcare spending falls, I believe that 22x EBITDA is justified.

The stock is currently trading at $215, which is 26% below the stock’s all-time high. The consensus price target is $260, 21% above the current price.

On May 23, UBS (UBS) initiated a buy rating with a $290 target.

I think that’s a fair target and believe that RMD will be a tremendous wealth compounder for many years – hopefully, decades.

Hence, I put the stock on my watchlist, as I believe it’s a suitable pick for my portfolio. I could add it along with Abbott (ABT) or another biotech player.

Needless to say, I’ll keep readers up-to-date.

Takeaway

ResMed stands out as a compelling compounder in the healthcare sector. Despite its modest dividend yield, the company’s focus on fundamentally-driven growth, top-tier products addressing modern health issues, and strong moat make it an appealing addition to my portfolio.

The healthcare industry is poised for long-term growth due to factors like an aging population and increasing health awareness. ResMed’s innovative solutions for chronic diseases, such as sleep apnea and respiratory disorders, are in high demand, making it a leader in digital health and cloud-connected medical devices.

While it faces competition and technological challenges, ResMed’s strategic pillars and aggressive M&A strategy position it well for continued success. With accelerating free cash flow and a healthy balance sheet, the company has ample resources for future expansion.

Trading at a reasonable valuation and with positive growth projections, I believe ResMed has the potential to be a wealth compounder for decades to come. Hence, I have added it to my watchlist alongside other strong players in the healthcare industry.

Pros & Cons

Pros:

- Wide moat and innovative product ecosystem.

- Benefits from long-term tailwinds and rising healthcare demand.

- Consistent financial performance and increasing free cash flow.

- Healthy balance sheet for potential M&A opportunities.

Cons:

- Subdued dividend growth and low yield.

- Competition and potential technological advancements.

Read the full article here