Warren Buffett, arguably the greatest investor of all time has famously said:

It’s far better to buy a wonderful company a fair price than a fair company at a wonderful price

Costco Wholesale Corporation (NASDAQ:COST) is a wonderful company currently trading at a fair price. COST was previously a holding of Berkshire Hathaway, but Berkshire exited its position in Q3 2020. COST remains a large personal holding of Charlie Munger, the legendary investor who is Vice Chairman of Berkshire.

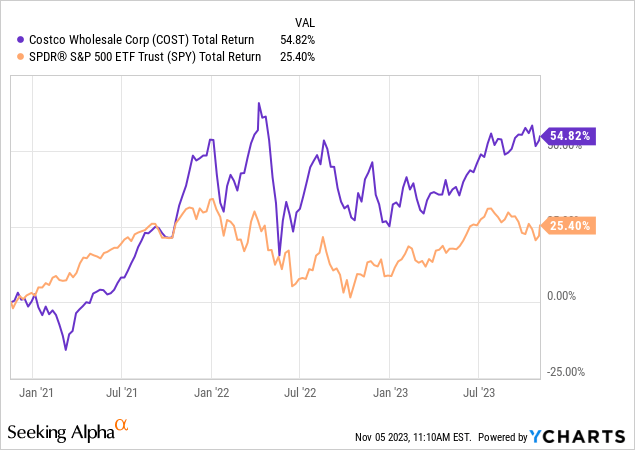

Since Berkshire’s decision to sell was revealed in November 2020, COST shares have delivered a total return of 54.8% compared to a return of 25.4% delivered by the S&P 500.

Company Overview

COST is an operator of membership warehouses across the globe. The company carries a relatively limited assortment of goods (4,000 SKUs per warehouse which is significantly less than other retailers) and sells items in bulk for very low prices.

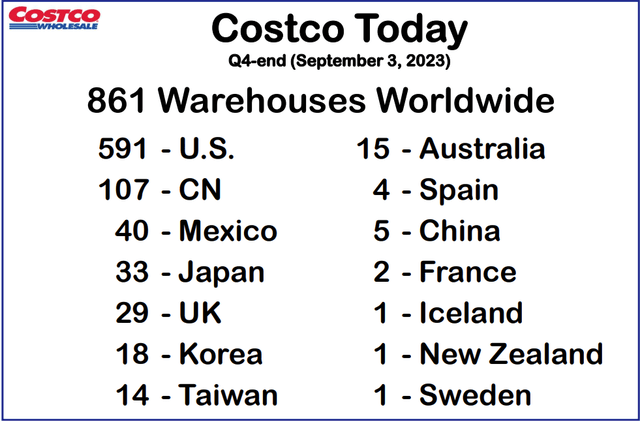

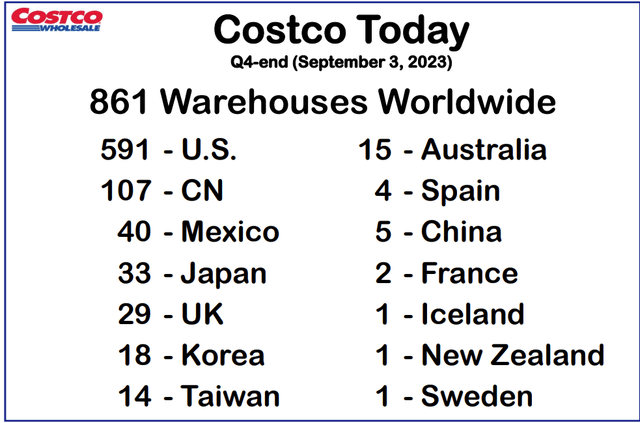

The company is the 3rd largest global retailer and its largest market is the U.S. which accounts for ~69% of total locations and ~73% of total revenue. Canada is the company’s next largest market accounting for 12.4% of total locations.

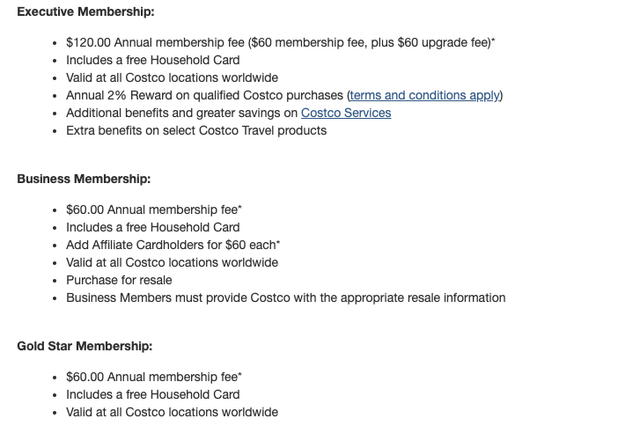

COST has three membership options, Executive, Business, and Gold Star which carry varying benefits. Membership fees account for ~1.8% of total revenue.

Costco Website

COST Investor Presentation

Strong Competitive Moat

Despite operating in the highly competitive retail industry, COST has been able to create a wide moat. The primary three drivers of COST’s competitive moat and scale, efficiency, and its membership program.

As the 3rd largest retailer in the world, COST is able to leverage its scale to achieve cost advantages with suppliers relative to smaller retailers. Additionally, COST’s scale has allowed the company to build a large private label business as the company has a large enough customer base to support its own private label brands.

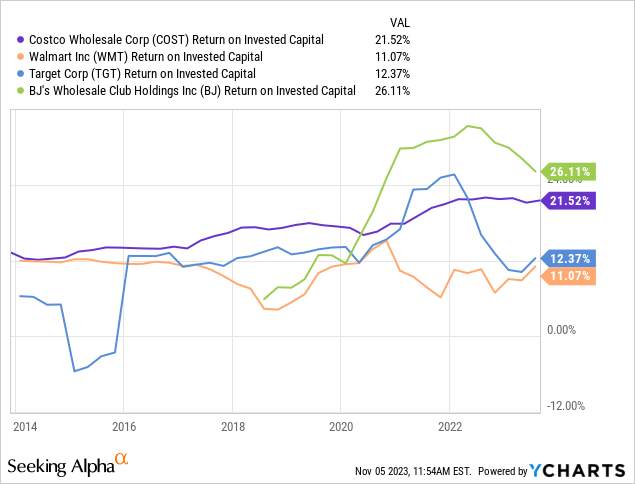

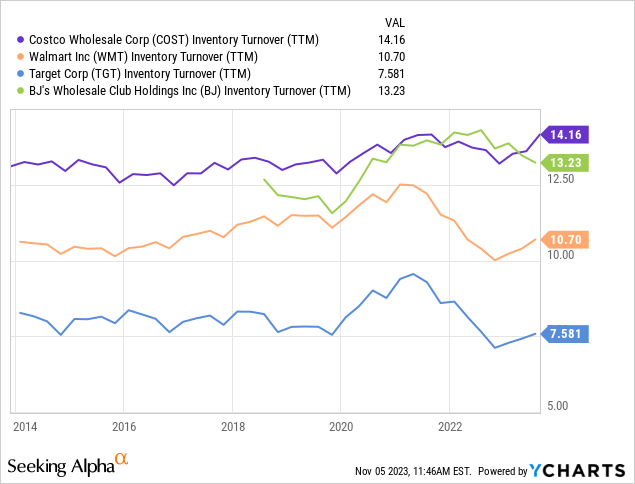

COST is more efficient than traditional retailers such as Walmart (WMT) or Target (TGT) because it uses its warehouse stores as retail and storage spaces in one. This means that goods are distributed directly to the retail chain with less handling and store time, which results in reduced costs. Additionally, COST offers only a limited amount of SKUs (~4,000 compared to 100,000+ for Wal Mart.) The result is that each item that COST sells is rigorously vetted and sold in very high quantities. Evidence of COST’s efficiency can be seen in its higher inventory turnover ratio compared to traditional retailers such as Walmart or Target.

COST’s membership base currently includes 71 million households and 127.9 million total cardholders. The renewal rate is ~92.7% (U.S. and Canada). In total, COST generates ~4.6 billion in membership fees each year. Comparably, net income for FY 2023 came in at $6.29 billion. Thus, membership fees (which have no direct related costs) represent the bulk of COST’s net income. Membership fees also incentivize consumers to shop at COST vs other places in order to get value for their membership. Another key benefit of the membership-based business model is it helps COST limit shrink due to theft as it is better able to control who enters its stores. This is a major competitive advantage compared to other retailers such as Target and CVS which have been struggling to control increases in theft.

Wide Moat Has Led to Strong Historical Financial Performance

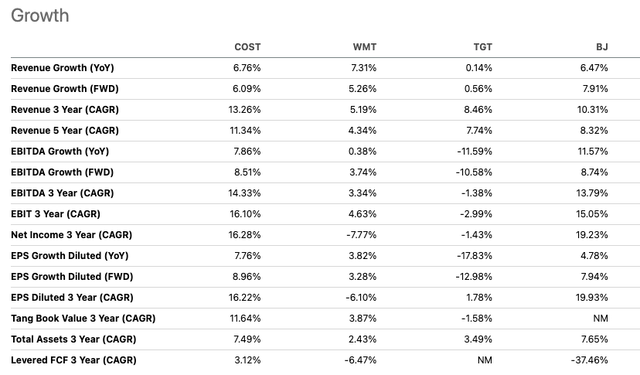

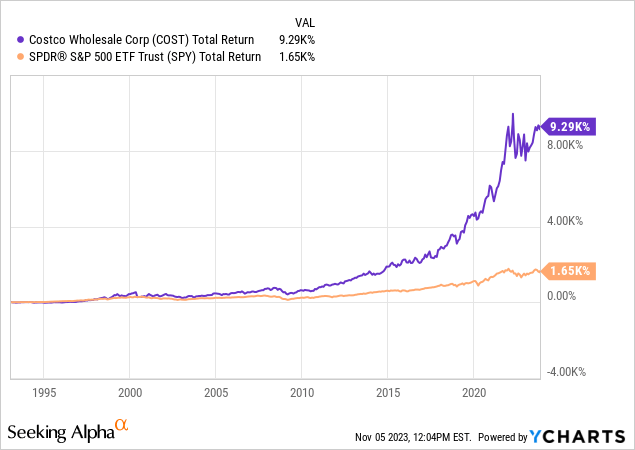

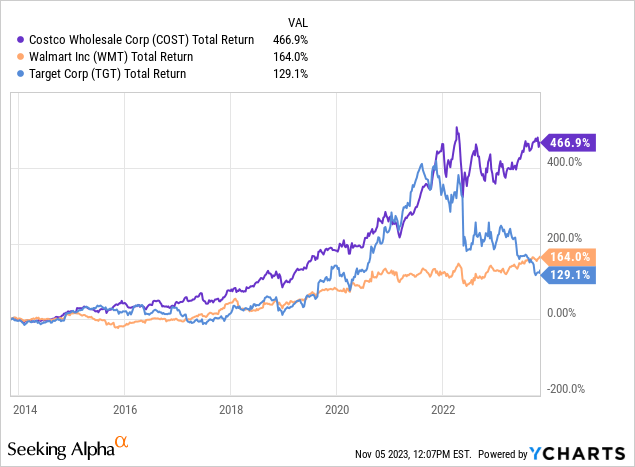

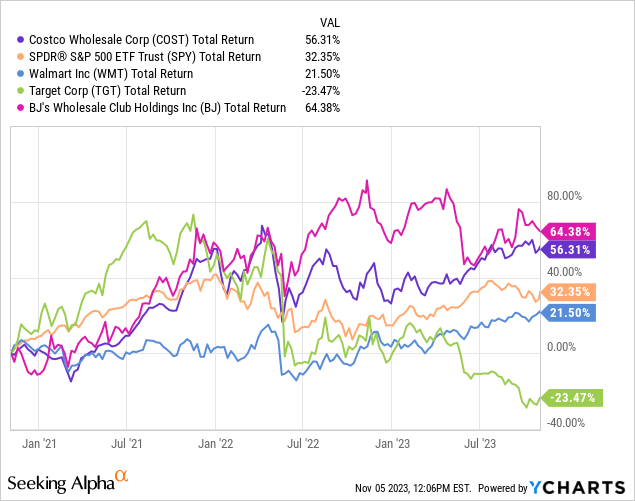

As shown by the charts below, COST has significantly outperformed the S&P 500 over both long periods as well as more recent periods. This relative outperformance is particularly impressive given the highly competitive industry in which COST operates. Additionally, COST has significantly outperformed traditional competitors such as Target and Walmart.

This outperformance has been driven by strong financial results. COST has delivered a best in class 5 year revenue CAGR of 11.3% compared to 5.2% for Walmart and 8.5% for Target. Moreover, COST has delivered a net income CAGR of 16.3% over the past 3 years compared to 4.6% for Walmart and -3% for Target.

Seeking Alpha

International Growth Opportunity

One of the most exciting things about COST as an investment opportunity is the potential for international growth. As shown below, the company already has significant operations outside the U.S. and thus has proven that it can operate in foreign markets. That is not something that can be said for most large retailers.

Moreover, COST is in the very early innings in regards to growth potential in emerging market countries such as China and has yet to enter other markets such as India. Given COST’s strong history of succeeding outside the U.S., I am confident the company will find ways to grow its international business which will serve as a key driver of earnings growth going forward.

COST Investor Presentation

Dividend Grower

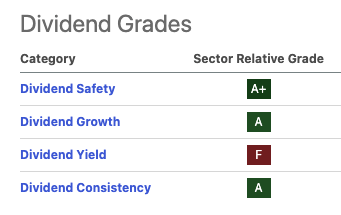

While COST has a dividend yield of just 0.7% today, the company has been a long-term dividend growth stock.

COST initiated its regular dividend at $0.40 (annually) in 2004 and has since grown to a level of $4.08 today. This represents a CAGR of 13% and I expect that growth rate to continue going forward.

As shown below, COST has also received very strong dividend growth and safety ratings from Seeking Alpha quant scores.

Seeking Alpha

Valuation

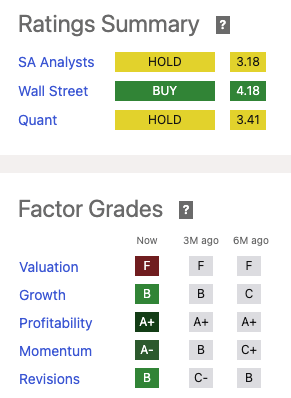

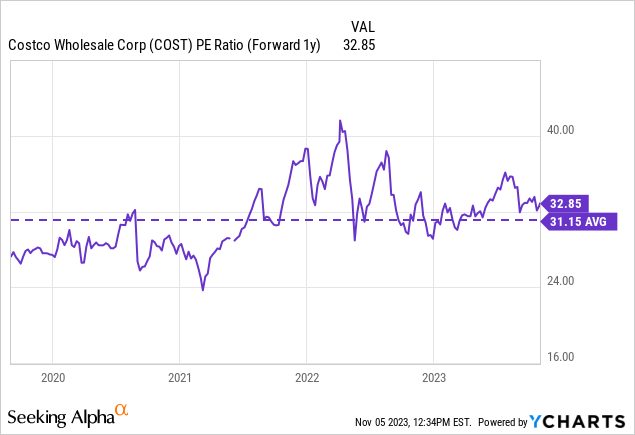

The market is clearly aware of the strength of COST’s business and, for this reason, the company trades at a high valuation. COST receives a Seeking Alpha factor grade of F for valuation. Moreover, many of the hold recommendations on COST by Seeking Alpha analysts are driven by concerns related to valuation. However, COST shares have fallen by ~7% from all-time highs reached in early 2022. COST’s forward P/E ratio (based on FY 2025 earnings estimates) has fallen from ~41 down to 32 suggesting the move lower has been driven by changes in valuation as opposed to changes in the growth outlook for the company. On a forward P/E basis, COST is trading close to its historical average over the past few years.

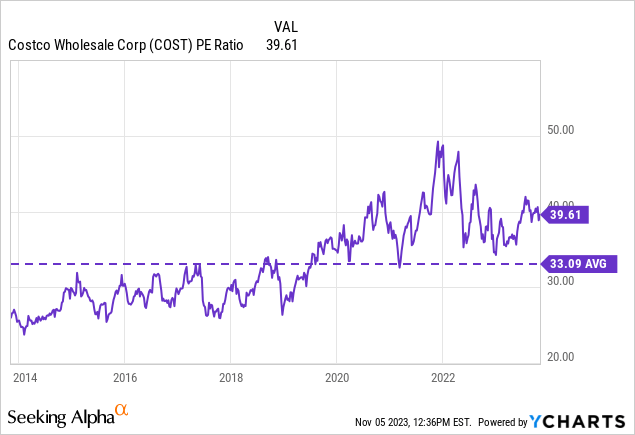

On a trailing basis, COST trades at a P/E ratio of 39.6x which is somewhat above its 10-year historical average of 33x but down from a level approaching 50x in early 2022.

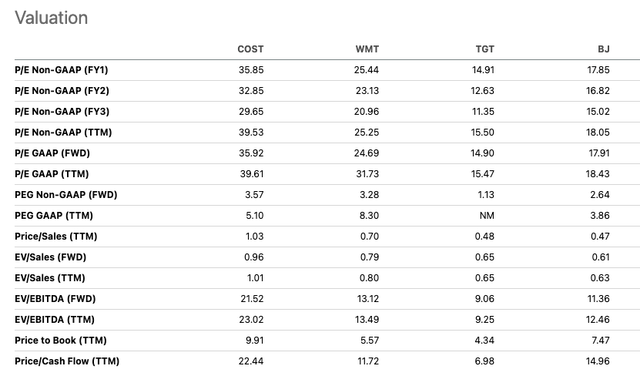

On a relative basis, COST trades at 35.8x FY 2024 forecast earnings. Comparably, the S&P 500 trades closer to 17.4x 2024 consensus earnings. While COST is trading at a significant premium, this has been the case historically given the strength of COST’s business model and ability to grow at above market rates.

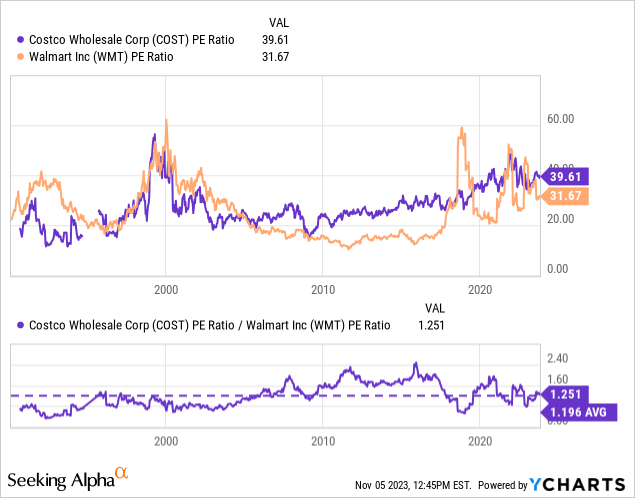

COST also trades at a significant premium to peers. However, I believe this premium valuation is well deserved given COST’s ability to generate significantly higher growth rates historically. Given its scale, significant wholesale business, and international operations WMT is arguably COST’s closest comp. As shown by the chart below, COST has historically traded at a trailing P/E ratio that is ~1.19x Walmart’s. Currently, COST is trading at 1.25x Walmart’s suggesting COST is trading roughly in line in terms of relative valuation.

Seeking Alpha

Seeking Alpha

Risks to My View

The biggest risk in my view is that COST fails to deliver strong growth in the years ahead. A number of factors could lead to this such as an operational stumble with its existing business or challenges with the international growth opportunity due to cultural distance in major growth markets. However, given the company’s strong history I do not expect this to be the case.

Another risk in my view is that COST valuation resets somewhat lower over the medium term. While I believe COST is trading at a fair valuation, it is certainly possible that the stock re-rates lower in the event of a broad market sell-off. I would view any such decline as temporary in nature and a potential buying opportunity.

Conclusion

COST is a wonderful business due to a wide moat and significant international growth opportunities. COST has been a large personal holding for Berkshire Hathaway Vice Chairman Charlie Munger and he continues to be bullish on the stock.

Investors are well aware of the strength of COST’s business and thus COST is not cheap given that it trades at ~36x forward earnings. However, this valuation is reasonable relative to COST’s own historical valuation range and represents a decline from higher valuations experienced in early 2022. Moreover, COST is also trading close to its historical relative valuation premium to its closest competitor Walmart.

I believe that COST will be able to achieve high earnings growth over the next few years and I believe the stock is a buy at current levels. I would consider upgrading the stock to a strong buy in the event the share price moves significantly lower from here.

Read the full article here