Introduction and investment thesis

CrowdStrike (NASDAQ:CRWD) continued to impress investors with its FY24 Q3 earnings, which showed that topline growth slowdown could be near a bottom. Cloud cost optimization efforts prevailed during the quarter resulting in more cautious expansion from existing customers and elongation of sales cycles. However, this has been offset by the continued success of emerging products, especially LogScale, Cloud Security and Identity Security, which could be joined by Falcon for IT in 2024.

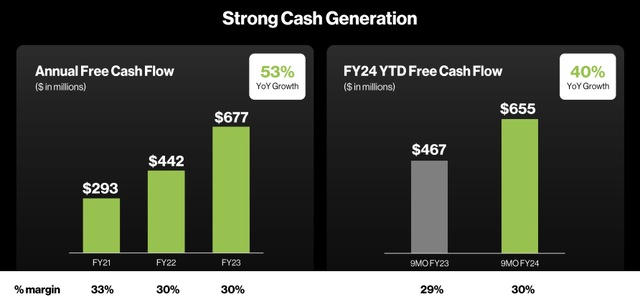

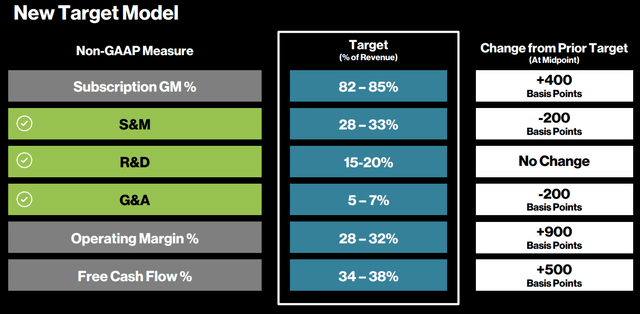

Meanwhile, Free Cash Flow generation hit a new a record with $239 million, resulting in a FCF margin of 30.4%. This has been driven by record non-GAAP subscription gross margin of 80%, and record GAAP and non-GAAP operating margin. Based on the company’s recent update of its target operating model FCF margin has further room to increase to the 34-38% range.

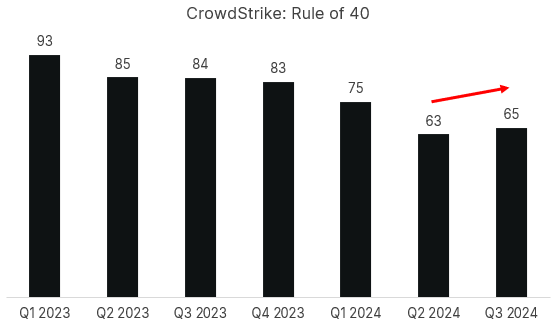

In the light of these trends, I believe CrowdStrike reached an important fundamental turning point in the Q3 quarter, which can be measured by its Rule of 40 metric. This is one of the most popular metrics in the SaaS space to determine the attractiveness of a company, aggregating topline growth and FCF generation ability. A number above 40 is considered attractive, but if we look at CrowdStrike we can see that the company is playing in another league. 34.9% yoy Annual Recurring Revenue (ARR) growth and 30.4% FCF margin in Q3 add up to ~65, which is an increase from ~63 in Q2 breaking the negative trend of recent quarters:

Created by author based on company fundamentals

Looking at current momentum and the new product announcements at Fal.Con back in September I believe this is not a one-time increase in the Rule of 40 metric, it’s rather the beginning of a new upward trend. Why I believe so, and what could be the most important risk factors to this thesis are the main themes of the upcoming paragraphs.

Beat-and-raise with a minor beauty flaw

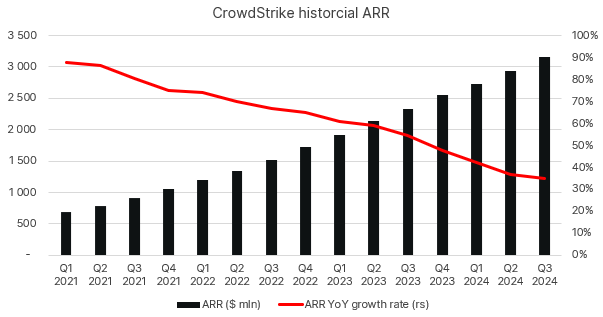

CrowdStrike surpassed the $3 billion ARR mark in its FY24 Q3 quarter with a closing ARR of $3.15 billion. This has been a yoy increase of 35%, which has been only slight decrease from 37% in the previous quarter:

Created by author based on company fundamentals

This means that the pace of topline growth slowdown seems to be decreasing, which can be attributed to the following factors in my opinion:

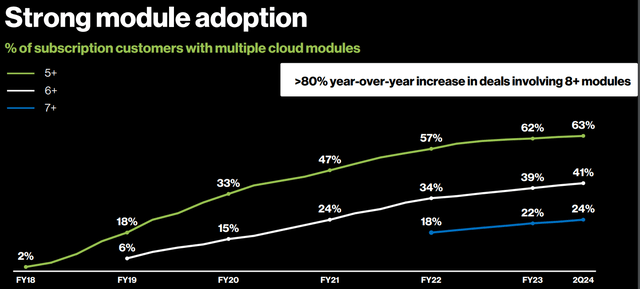

- CrowdStrike is the leading one-stop-shop cybersecurity platform on the market in times when 75% of organizations want to consolidate their security vendor. The company’s unique licensing program, Falcon Flex enables customers to easily gain access to all modules through a simple consumption-based model, which builds a frictionless way towards consolidation on the Falcon platform. Looking at module adoption rates from FY24 Q2 we can see that the process is working smoothly:

CrowdStrike Investor presentation at Fal.Con

63% of subscription customers use 5 or more modules, while the number of deals involving 8 or more modules increased 80% yoy in Q2. This trend has continued into Q3 as the same number increased by 78% yoy demonstrating the raison d’être of the consolidation narrative.

- Strong growth of emerging products, especially LogScale, Cloud Security and Identity Security. LogScale surpassed the $100 mln ARR this quarter, while the number of customers using Cloud Security increased 45% yoy. As I’ve covered these products in my previous article on the company (CrowdStrike: Stronger Than Ever) I don’t want to elaborate on them more, only remind investors that they should be an important engine of future growth:

CrowdStrike Investor presentation at Fal.Con

The adoption of LogScale and Identity Security is only in the early innings, while the Cloud Security business still managed to accelerate its growth in Q3 despite being in a more mature phase of adoption.

- Increasing adoption of Falcon Go, CrowdStrike’s tailored, easy-to-use cybersecurity solution for the SMB segment. The company introduced the solution on Amazon Business recently, which could further increased adoption rates in the upcoming quarters.

- Beside these main themes the strengthening ties with the federal government have also been an important contributor to ARR growth, which was evidenced by a record quarter for Q3.

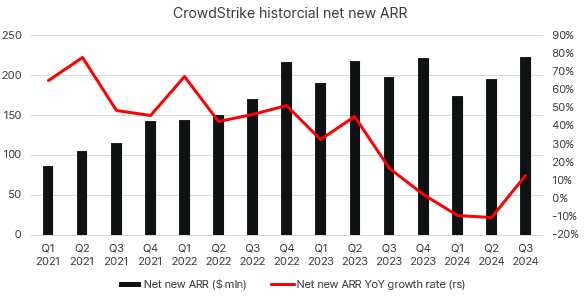

Thanks to these positive trends yoy net new ARR growth turned back to positive territory during the quarter signaling the beginning of possible topline growth reacceleration:

Created by author based on company fundamentals

Net new ARR came in at $223 million growing 13% yoy after two quarters of 9-10% decrease. Based on management’s guidance for flat to modestly up net new ARR for FY24 the implied guidance for Q4 should be around $240 mln. If this holds, it would result in ~$3.4 bln ending ARR for FY24, meaning a yoy growth rate of 33%. Although this would still mean a further gradual decline from 35% yoy growth in the Q3 quarter, if we factor in the usual conservatism of management, I believe topline growth reacceleration could already happen next quarter.

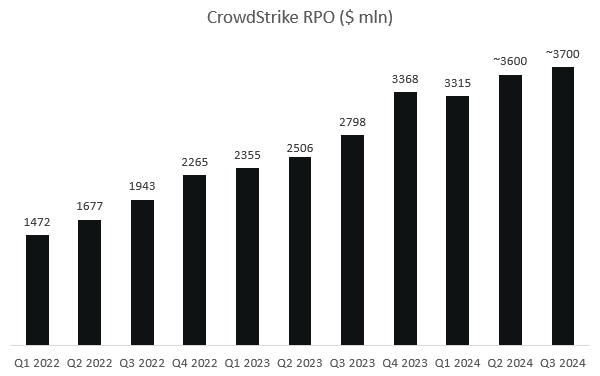

The most important risk factor against this thesis in the short run has been a weaker print in remaining performance obligations (RPO) for the Q3 quarter:

Created by author based on company fundamentals

As CrowdStrike does not publish exact figures for RPO from FY24 Q2 onwards there are only rounded figures available for the past two quarters, although they are still helpful for analyzing the big picture. Q2 was a strong quarter from an RPO perspective, but Q3 seems to be somewhat muted. In the light that some competitors, like Palo Alto Networks (PANW) posted disappointing billings forecasts for the year this could give some reason for concern.

Analysts tried to ask management about this topic on the Q3 earnings call, but there hasn’t been a direct answer to the question. What they shared, is that business trends in October have been strong, but they didn’t comment on trends observed during November. Nonetheless, Q4 guidance has been de-risked from this perspective as management assumed that there won’t be a typical budget flush that used to happen during this quarter. If we see a strong print in RPO in Q4, let’s say around $4 bln, it would mean that the budget flush happened anyway, which would provide a strong setup going into FY25. So, this will be a key metric to look out for.

Finally, another key element to look out for during FY25 will be the company’s recently revealed new module, Falcon for IT, which could open new dimensions for the company already next year. Falcon for IT is a major move from CrowdStrike to broaden its business scope outside of cybersecurity to the IT space in more general.

The core thinking behind this module is to utilize CrowdStrike’s existing technologies to help organizations manage their IT infrastructure. CrowdStrike has already proved in the field of cybersecurity that it has probably the best platform for collecting and analyzing data at scale, and taking automated actions based on this. This core feature of the platform extended by Charlotte AI could come handy in several general IT infrastructure related processes like asset inventory or assessing CPU or software utilization. This could make CrowdStrike a more direct competitor for Datadog (DDOG), Dynatrace (DT) or Elastic (ESTC) in the IT observability space, just like some of these players already ventured into the cybersecurity space.

Currently, CrowdStrike estimates a TAM of $8 billion for Falcon for IT for 2028, approximately half the size for its LogScale solution. LogScale managed to grow into a $100 million ARR business within 2 years, I believe Falcon for IT could achieve at least the same. Based on the Q3 earnings call the new module is already highly sought after by clients, even before its expected launch in Q1 next year:

“Well, coming out of Falcon, I would say that was the number one requested feedback item across all the great announcements that we had.” – George Kurtz, CEO and Co-Founder

I believe that the launch of Falcon for IT next year combined with the strong performance of already marketed emerging products could result in topline growth re-acceleration over the coming quarters. This should be further supported by improving trends in the cloud cost optimization cycle, which has been called out by hyperscalers like Microsoft (MSFT) or Amazon (AMZN) on their recent earnings calls.

Ambitious margin targets set after meeting previous ones

Besides encouraging future revenue growth prospects, FCF margin is the other side of the Rule of 40 coin, which needs to show a convincing upward trend. So far this year this has been accomplished as FCF generation grew 40% yoy in the first three quarters of FY24 by reaching $655 million YTD:

CrowdStrike FY24 Q3 earnings presentation

The real question is whether this trend continues into FY25? Well, based on the company’s recent updated operating target model it has significantly more room to go:

CrowdStrike Investor presentation at Fal.Con

CrowdStrike intends to achieve these goals in a 3–5-year time frame but looking at their previous goals we could’ve observed that they tend to reach these much sooner. The main drivers behind further margin improvement are increasing economies of scale and continued optimization of the company’s cost structure in the form of optimizing compute and storage or leveraging lower cost geographies.

Based on CrowdStrike’s execution over the past several years I believe they will meet or probably exceed the 34-38% FCF goals, which should be a further significant improvement from current ~30% levels.

Combining the strong topline growth prospects for FY25 and possibly further increasing FCF margin I think the current Rule of 65 metric of the company should extend further to 70+ territories soon. Even among SaaS companies this could be an exceptional performance which I believe is far from priced into the shares yet.

Valuation

Since the IPO of CrowdStrike back in June 2019 the valuation of the company’s shares has fluctuated in a wide range. Looking at the most basic, Price/Sales ratio it has reached its post-IPO high somewhat above 90 just to fall back below 15 during the Covid induced March 2020 stock market sell-off:

Seeking Alpha

Zooming into the past two years we could observe a significant meltdown of the multiple from ~30 to the 10-15 range:

Seeking Alpha

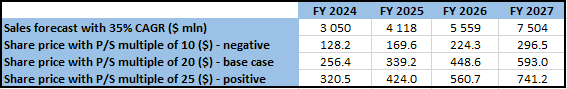

It’s important to note that no matter how bleak economic prospects got, and tech valuation multiples compressed, the P/S ratio of CRWD didn’t fall below 10. Based on this I will apply the multiple of 10 as the negative scenario in my simplified valuation framework.

I believe an average P/S multiple of 20 could be a realistic scenario for the upcoming years as inflation possibly continues to cool down, and interest rates decrease leaving space for valuation multiples to expand. Of course, this only holds if the above-mentioned improvements in fundamentals continue. Currently, shares of CrowdStrike trade at a multiple of 19, so they are valued around my base-case scenario.

Finally, I am assuming a P/S multiple of 25 as an optimistic scenario, where tech becomes the darling of investors again partly resulting from the transformational impact of AI on the sector. This, combined with decreasing interest rates could blow up valuations in the sector in my opinion leading to more aggressive levels like in the back half of 2022.

In the light of these scenarios my simplified valuation framework looks as follows, calculating with 2% annual shareholder dilution and a CAGR of 35% for sales:

Created by author based on own estimates

From the table above we can see that currently there is a small upside for shares in the case of the base case scenario, as they trade at $235 compared to $256 assuming a P/S multiple of 20. However, as we move further down the timeline, we can see that thanks to strong sales growth at the company a P/S multiple of 20 would result in a share price of $593 in 3 years’ time. This would mean an increase of ~150% within 3 years, which is very attractive in my opinion.

Looking at the negative scenario we can see that shares are priced very generously currently and could only catch up to their intrinsic value within 2 years. So, if inflation, and thus interest rates stay stubbornly high, and the fundamentals of the company would begin to deteriorate (e.g.: as a result of increasing competition) I believe investors would have to wait until the end of FY26 until shares become fairly valued.

Finally, in the case of an optimistic scenario the share price could increase almost 140% within two, and more than 200% within 3 years. If current tailwinds continue into FY25 and afterwards, and new products continue to be on fire I think this is also a possible scenario.

The conclusion from the above is, that shares seem fairly (or according to some analysts a bit aggressively) valued at current levels, but as we move into FY25 and beyond the fair share price could increase rapidly. Buying CrowdStrike shares now and hold them for the upcoming years seems an attractive investment opportunity in my opinion.

As a sidenote there could be more negative or positive scenarios than the ones presented above, so take these as a rough guideline for valuation.

Important risk factors that could lead to more negative scenarios in my opinion are the increasing competitive threat from Microsoft with its low-cost, bundled security solution, a potentially prolonged economic downturn resulting in continued cloud cost optimization efforts, higher inflation for longer combined with higher interest rates, or a possible large scale security breach by one or more CrowdStrike customers, which could undermine the trust in CrowdStrike’s Falcon platform.

Conclusion

In the current fragile economic environment if a SaaS company is able to operate at a Rule of 40 it’s a remarkable performance in my opinion. CrowdStrike closed its most recent quarter as a Rule of 65 company, which could increase above 70 in the upcoming year. If Rule of 40 is remarkable, I would call this stellar. Although the market began to price this in recently as shares surged almost 40% in the past month or so, there is still considerable upside for an investor who takes a longer-term perspective. I am not sure it’s a good strategy to sit and wait for a larger pullback as this opportunity may have passed for a while.

Read the full article here