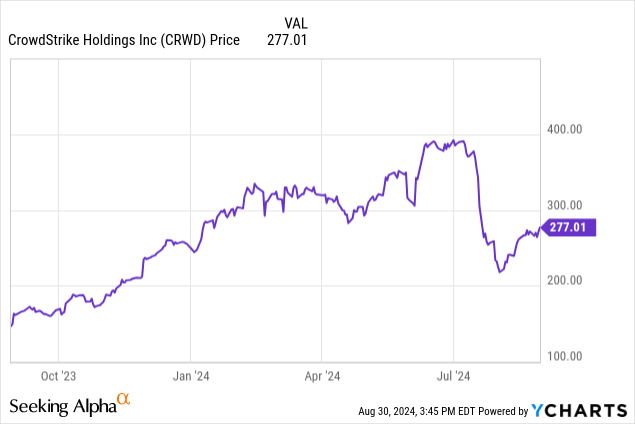

In my last analysis of CrowdStrike (NASDAQ:CRWD), I assessed the company following its faulty sensor update, which crashed 8.5M devices, leading to a ~30% stock decline. Since that analysis, it has increased by 2.62% in price, showing resilience after the fall. In Q2 results, it beat its top-line and bottom-line estimates. The company has announced a strategic partnership with Hewlett Packard Enterprises (HPE), and while lowering its full-year guidance due to the July crisis, I believe management is lowering near-term expectations strategically and could outperform long-term from its customer incentives.

CrowdStrike Q2 Earnings Analysis

The financial highlights of CrowdStrike’s Q2 2025 earnings include total revenue increasing by 32% YoY, subscription revenue increasing by 33% YoY and annual recurring revenue increasing by 32% YoY. Furthermore, its non-GAAP net income increased by 45% YoY, its operating cash flow increased by 33.5% YoY, and its free cash flow increased by 44% YoY. This reflects strong profitability for CrowdStrike, even in spite of its July operational crisis, which is important for investors because CrowdStrike only first reported net income in the fiscal period ending January 2024.

Not only were CrowdStrike’s financial results promising, but so were certain operational developments. For example, CrowdStrike’s partnership with Hewlett Packard and technology distributors to boost the adoption of its AI-native Falcon platform is notable. Management highlighted the HPE partnership during the Q2 earnings call, outlining that it is aimed at strategically enhancing security for AI innovations, including large language models, in collaboration with Nvidia (NVDA). This is a reason to be bullish, as AI workloads are increasingly sensitive and need full security, and integration of CrowdStrike’s Falcon cybersecurity platform with HPE’s GreenLake cloud and OpsRamp AIOps through the partnership creates a unified view of the attack surface security across AI infrastructure and applications. Management also mentioned that it has partnered with technology distributors such as Ingram Micro, M3Corp, and Tecnologia Especializada Asociada de México to accelerate the adoption of the Falcon platform across Latin America.

I think these new partnerships show the early signs of a strong reputational recovery for CrowdStrike. While the crisis in July was evidently devastating and unacceptable, improvements and second chances are often welcomed in business. I believe that the momentary setback could allow the company to engage with higher operational security moving forward. I think the HPE and Latin America partnerships are a strong indicator of recovery and continued forward advance from management, which is much needed at this time of uncertainty for the company.

During the Q2 earnings call, CEO George Kurtz mentioned that despite the crisis in July, it has emerged more resilient and customer-focused after the incident, and continues to close multi-million-dollar deals. The company has also introduced “customer commitment packages” to incentivize customers to continue using and expand their use of the company’s products. This is going to strain short-term revenue, which is a core reason why management has lowered its full-year revenue guidance, but this is likely going to be a strategic trade-off to secure long-term customer relationships and revenue stability. This proactive approach from management is another reason to be bullish; it is reconsolidating its position in the market and restoring confidence in its brand. Meanwhile, while management does this, the stock is still down 29.5% from its all-time high.

CrowdStrike Q2 Valuation Analysis

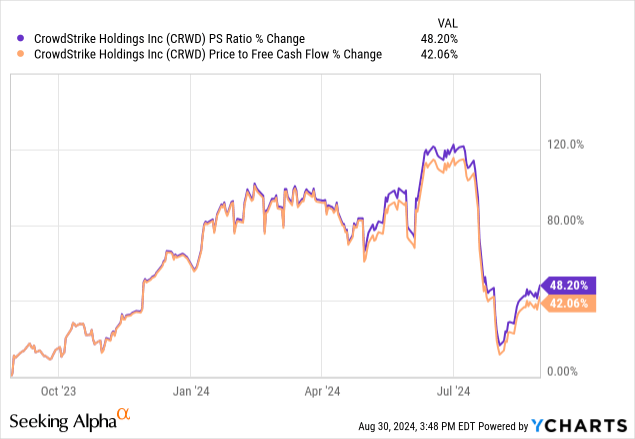

I maintain the thesis from my previous analysis following CrowdStrike’s Q2 results; we have a buying opportunity on our hands here for investors who are initiating their first position in the company. However, even following the crisis, CRWD stock is still selling at over a 40% increase in both PS and PFCF ratios compared to 12 months ago.

In my last analysis, I presented a 10-year price target based on a PS ratio. Based on feedback from readers, some of which, I believe, were correct, I am opting for a shorter-term price target and a valuation analysis, including a PS ratio and PFCF ratio analysis, this time around. I believe this to be more comprehensive.

CrowdStrike’s valuation discount is not significant on a valuation multiple basis compared to a year ago. Its valuation multiples have risen in tandem with its price growth, leading to it being constantly priced for perfection, and therefore, there is a momentary discount that has opened up based on a lapse in positive sentiment following the July crisis. However, the opportunity is heavily dependent on management’s ability to regain market trust and increase investor sentiment based on re-establishing its brand as reliable, which would support higher valuation multiples again. Q2 results indicated this is possible, and a proactive approach has been outlined, but for sentiment to return to where it was prior to the crisis, it could take years.

Instead, I believe we are going to see its valuation multiples and price rise slower than historically against its earnings and revenue growth, at least until management has cleared the investing public’s perception of the crisis.

Currently, CrowdStrike has a PFCF ratio of 65. This is much lower than its median since its IPO of 86.5. In addition, its PS ratio of 19 is also much lower than its median since its IPO of 25.6.

| Company | PS Ratio | PFCF Ratio |

| CrowdStrike | 18.5 | 65 |

| Palo Alto Networks (PANW) | 14.25 | 42 |

| Fortinet (FTNT) | 10.5 | 37.5 |

| Zscaler (ZS) | 14.5 | 53.5 |

Based on the above table, it is evident that CrowdStrike is also not selling at a discount to its peers following its operational crisis. This is another reason for investors to be cautious of allocating to CrowdStrike, and it makes the investment a Buy by my analysis, not a Strong Buy. There is not enough of a contraction or enough fear from investors to make this a time to be greedy with an outsized allocation.

Seeking Alpha

That being said, CrowdStrike has a higher valuation than its peers due to its higher growth rates. The Falcon platform’s cloud-native architecture is arguably the most critical factor that distinguishes CrowdStrike. Falcon is widely regarded as one of the most advanced cybersecurity platforms available today, specifically in areas of endpoint protection, threat intelligence, and real-time response. As it is considered a benchmark in the industry, the July crisis alone won’t eradicate this established position.

| Company | FWD Revenue Growth 5Y Avg. | FWD EPS Diluted Growth 5Y Avg. |

| CrowdStrike | 50.17% | 73% |

| Palo Alto Networks | 21.85% | 22.13% |

| Fortinet | 20.70% | 24.08% |

| Zscaler | 41.05% | 52.88% |

In my opinion, CrowdStrike stock is likely to be trading at a PS ratio of 19 in 12 months if management can continue to reconsolidate its reputation with partnerships and long-term revenue strategies. The current PS ratio of 18.5 seems too low considering its historical valuation multiples, and I have seen enough evidence of management strengthening the business following the July crisis for it to seem probable to me that the valuation multiples will expand again from here.

While its high SBC could be a risk to overall investor sentiment, indirectly affecting the PS ratio, I believe a small increase from 18.5 to 19 in the PS ratio over the next 12 months is likely because I do not see evidence that the July crisis will substantially affect its SBC program thus far.

The current revenue estimate for January 2026 of $4.81B is likely to be priced into the stock early, and therefore, I have a 1-year market cap target of $91.39B. This indicates growth of nearly 40% from the current market cap of $66.11B. Primarily, this is a result of the fact that management is still on track to deliver strong fundamental growth as a leader in the high-growth cybersecurity market.

Seeking Alpha

CrowdStrike Q2 Risk Analysis

There is a chance that future revenue for CrowdStrike comes in considerably lower than currently expected, even with management’s downgrade in full-year revenue. Management is currently expecting a $30M impact on subscription revenue for each remaining fiscal quarter of FY25 due to customer incentives, which I outlined above, related to the incident. This is a short-term loss for long-term gain strategy, but management could also face further compensation requests, legal challenges and other customer commitment packages to retain and develop its clients long-term.

CrowdStrike’s reputation in the market could also never be fully regained in a worst-case scenario. Even though this one crisis is likely recoverable, any further incidents are likely to be devastating and potentially a final blow. In addition, even if management does not encounter any other large-scale incidents, there is the unfortunate reality of a large-scale event like July’s outage remaining in the back of customers’ and investors’ minds indefinitely. This is why I believe it is so important for management to focus on turning this moment of weakness into a long-term strength. There is the potential that it will become known for its future state-of-the-art reliability, with the July 2024 outage the core historical catalyst that caused the company to up its operational performance and discipline to avoid any further major crises.

In a bear-case outcome, its PS ratio could contract down to 17, and its FY26 revenue could come in lower than estimated, for the sake of example, at $4.7B. This would be based on the issues mentioned above with reputational re-consolidation and potential lawsuits and compensation deals that management has to structure, as well as any minor crises that occur that further affect reputational stability. In this outcome, the FY26 market cap would be $79.9B, which is a 21% growth from the current market cap of $66.11B. This is still a strong return and another reason why my rating is a Buy.

Of course, in the worst-case scenario where we have another crisis on the level of the July outage, we would be looking at a significant contraction and potentially irreversible loss of capital if investing now. However, I see this as very unlikely, and so it is only a negligible consideration in my risk analysis, considering how alert management will now be in safeguarding its reputation and making sure that nothing goes awry in the near future.

Conclusion

In my opinion, management has proven quite resilient and strategic following the July crisis. While this event was obviously unacceptable, it is showing the correct kind of operational strategy to recover, and I believe that the present valuation allows new investors to still capitalize on the high-growth cybersecurity market, of which CrowdStrike is a market leader. I am bullish on CRWD stock, and while it is unfortunate for those who bought the shares pre-crisis, alpha for new investors in the company is still a high probability, as even in a likely bear-case outcome, CRWD stock would likely still return 20% market cap growth in 12 months, based on my analysis and estimates in conjunction with the Wall Street consensus.

Read the full article here