On September 2, 2021, special purpose acquisition company Digital World Acquisition Corp. (NASDAQ:DWAC) held its initial public offering. The following month, the SPAC announced it was merging with Trump Media & Technology Group (TMTG), a recently-formed company centered around former President Donald Trump.

The merger was a financial sensation: DWAC soared on the news, and against an IPO price of $10 the stock twice topped out just shy of $100 (in October 2021 and again the following March). It proved a political event as well: TMTG since has launched Truth Social, a social media app targeting Trump supporters and conservatives more broadly.

But, more than two years after the merger was announced, so far the tie-up has been full of sound and fury, but signifying little. DWAC and TMTG haven’t yet actually merged. Truth Social’s impact and usage appears relatively minimal. TMTG’s streaming efforts — which the company initially argued would drive the lion’s share of shareholder value — appear non-existent.

Back below $16, DWAC stock certainly is cheaper, and there is a path to finally completing the long-awaited merger. But valuation isn’t the problem here: rather, it’s almost everything else.

Big Losses And A Going Concern Warning

For now, TMTG is centered around its social media platform, Truth Social. In an amended proxy statement filed with the U.S. Securities and Exchange Commission this week, DWAC for the first time disclosed TMTG’s financial figures. They aren’t impressive, even if some of the coverage around the disclosures admittedly seems overblown.

In the first half of 2023, TMTG generated revenue of just $2.3 million. Operating loss was $7.6 million. And even those numbers are an improvement from full-year 2022, during which time TMTG generated revenue of only $1.4 million, and an operating loss of $23.3 million.

To be fair, it’s still early. TMTG attributes the revenue it did generate to “early-stage testing of a nascent advertising initiative”, suggesting it hasn’t really ramped up its advertising plans. (The experience on the app itself suggests as much.) The company isn’t even selling the ads itself: Rumble (RUM) is selling most of the inventory at a 30% commission, while a smaller, private company also is an agent for TMTG (at a 10% rate). Nor is the company putting any real capital behind revenue generation: sales and marketing expense in the first half of 2023 was just $644,500.

Meanwhile, as reported in a number of outlets, the proxy statement did include a so-called “going concern” disclosure for TMTG. Technically speaking, that disclosure is correct, and required: TMTG is funding itself through repeated, small, issuances of convertible stock. And so, as the disclosure states, right now the company does not have enough cash to cover twelve months’ worth of losses.

But the company also has access to the needed cash assuming a merger with DWAC actually is completed. And if it isn’t, DWAC stock is going back to ~$11 (the SPAC’s trust account currently has $10.69 per share in cash, which would be available to any DWAC shareholder who chose to redeem). Either way, TMTG’s precarious balance sheet doesn’t really matter to DWAC shareholders (and any balance sheet problems can be resolved relatively easily, as funding to this point suggests). The news is perhaps not as bad as some headlines might suggest.

Truth Social Still Looks Disappointing

All that said, this is a company with an enterprise value, pro forma for the merger, of $2.5 billion. And there certainly isn’t much from Truth Social results to this point to support that kind of valuation. A big part of the optimism toward DWAC and TMTG was that Donald Trump’s popularity with his base would create built-in revenue and user growth.

Yet revenue doesn’t actually seems like it’s growing. Q2 revenue increased less than 7% against the first-half print. All of the revenue generated in 2022 occurred in the second half; there was no disclosure of when the ad program began, but even so it’s not as if there’s any kind of hockey stick growth here.

Meanwhile, one metric was notable in its absence from the S-4: users. MAUs (monthly active users) and DAUs (daily active users) are common figures cited by social media companies, yet TMTG doesn’t cite any firm numbers on users. The company does say that users increased in the first half of 2023 against the 1H 2022 level, but Truth wasn’t launched on Apple (AAPL) devices until April 2022, with the Android version not available until October.

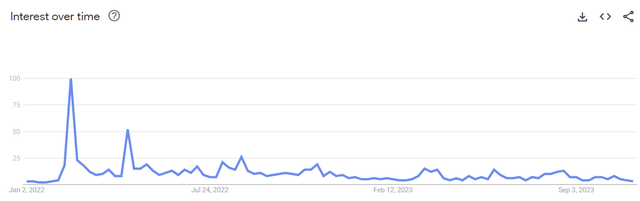

The third-party data we have does suggest some weakness. Google searches for Truth Social are at the lows:

Google Trends

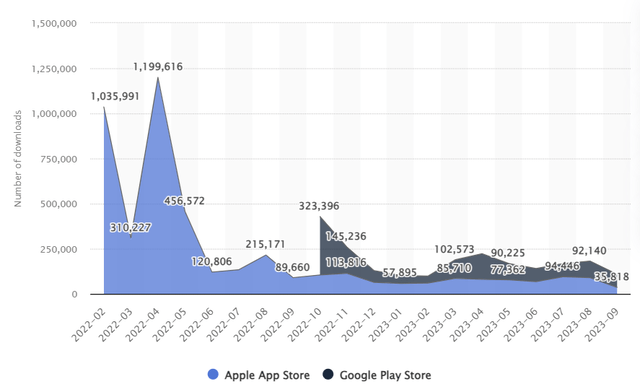

The same is true of app downloads — and the web app is down as of this writing:

Statista

Again, it’s early. But, in the S-4, DWAC itself cites the “high rate of failure” for social media companies. It’s an exceptionally difficult business in which to grab a toehold, because network effects mean that users tend to go where users already are. Network effects are precisely why Meta Platforms (META) founder Mark Zuckerberg famously called “a clown car that fell into a gold mine”; even that company’s haphazard management as a public company still left it with a buyout worth over $40 billion.

To this point, Truth Social hasn’t shown any real evidence that it can get over the proverbial hump and start to benefit from network effects, rather than be held back by them. That doesn’t mean the platform can’t get there eventually, but the slow start has to at least undercut some of the optimism that greeted its launch last year.

Even the Digital World board is probably disappointed: the company wrote in this week’s proxy that in October 2021 “the Digital World Board believed that TMTG’s brand recognition and President Trump’s strong social media following would well position the company to gain market share and expand its user base at an accelerated pace.” That doesn’t appear to be what has happened in the two years since.

A Shift Away From Streaming

As I wrote last year, one of the strange aspects of trading in DWAC last year was that seemingly every investor focused solely on Truth Social, even though DWAC itself was telling them not to.

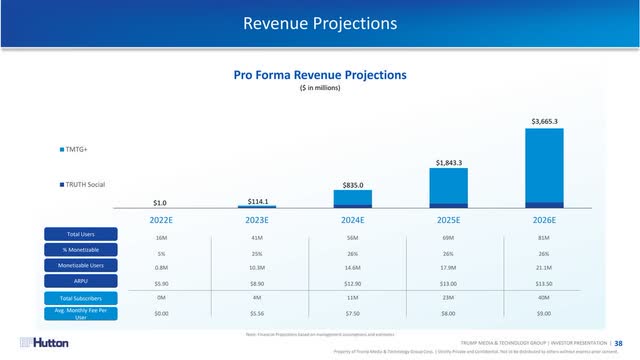

In an investor presentation from November 2021, the SPAC’s own projections clearly showed that streaming video, not social media, was going to be the key revenue driver:

DWAC investor presentation, November 2021

In the 2026 estimate, Truth Social is the small, dark blue line; at the time, a streaming platform called TMTG+ was projected to generate the overwhelming majority of revenue.

Over at Truth yesterday, TMTG chief executive officer Devin Nunes posted a letter to The Hollywood Reporter alleging defamatory statements in coverage of the proxy statement. One of the supposedly defamatory statements was a claim that the proxy doesn’t mention a streaming service, except in a discussion of layoffs at TMTG.

At the risk of incurring Nunes’s wrath, my interpretation was much the same. The proxy (see p. F-7 and F-32) says that on March 1, TMTG “eliminated several positions” and that the layoff “most significantly impacted TMTG’s streaming video on demand (“SVOD) and infrastructure teams”. Elsewhere, DWAC cites a meeting with TMTG in early August of this year to discuss, among other topics, “the evolution of TMTG’s business operations and future plans since October 2021”. The “evolution” of those plans almost by definition has to include a change to the outlook for the streaming business, since the efforts around Truth Social continue.

Those discussions aside, the concept of streaming video is referenced only obliquely. TMTG+ is mentioned just once, in a list of trademarks. And, notably, the company’s growth strategy on page 231 has three pillars, none of which directly references streaming video. The first is to grow Truth Social. The third, interestingly, is to pursue acquisitions and/or partnerships, particularly with “an increasing number of entrepreneurs catering to conservatives.”

It’s the second pillar, however, that seems to confirm TMTG’s move away from grandiose streaming plans, and is worth quoting in full:

Organically and/or in partnership with third parties, TMTG intends to develop one or more additional cutting-edge products and/or services to complement the Truth Social platform. TMTG has conducted extensive technological due diligence regarding, and begun testing, a particular technology that it aims to acquire and incorporate into its product offerings and/or services as soon as practicable.

There’s no sign in the proxy of what this “particular technology” is. But the idea of a growth strategy built around Truth Social is, unequivocally, a departure from the projections given two years earlier. (In the proxy, DWAC does say that those projections are no longer valid.)

This move is logical. TMTG simply doesn’t, and likely won’t, have the capital to execute on a grand streaming strategy. The PIPE (private investment in public equity) that was supposed to raise $1 billion along the SPAC merger is being unwound. DWAC had previously disclosed that nearly half the PIPE had been canceled; in multiple sections of the proxy, the SPAC writes that “Digital World expects to continue to seek the termination of or significantly reduce such PIPE commitments.” Given the PIPE covered preferred stock which converted into common stock at $33.60, one would assume all committed investors will be happy to move on. Pro forma for the merger, with no redemptions of DWAC stock, TMTG will only have $255 million in cash.

Warrant exercises could bring in another $171 million, but even that combined figure is nowhere nearly enough to match TMTG’s prior, grandiose, plans. Netflix (NFLX) spent nearly $17 billion on content in 2022; Disney is cutting its budget to just $25 billion next year. Both companies were cited as comparables for TMTG when the merger was announced two years ago.

But even if the move is logical, it does remove some of the blue-sky optimism surrounding what TMTG was supposed to be. Two years ago, the company was taking on “Big Tech” by trying to create a “Big Tech” business of its own. Now, TMTG will be centered on Truth Social, a venture capital-type effort, and an unnamed technological advance — which the company itself says will “complement” Truth Social. That means Truth Social has to carry the weight in terms of revenue and valuation, and at least right now it isn’t doing so.

Trump Gets Control

One of the interesting disclosures from the proxy is that there was a significant dispute between TMTG and DWAC over the merger agreement. (This analysis is not legal advice, simply my layman’s reading, focused on the ” Timeline of the Business Combination Post-IPO Negotiations ” section starting on p. 183.) DWAC argued that extensions to its liquidation date extended the merger agreement; TMTG believed that the merger agreement expired on December 31, 2022. The proxy details a months-long conversation between the two companies, which turned into a negotiation, which TMTG clearly won.

In return for keeping the merger intact — and for extending a license agreement with Donald Trump, which expired on June 30, and which Trump has “verbally affirmed” (p. 187) he will maintain through the merger process — TMTG gained concessions. The company will get six of seven board seats in the post-merger company. 40 million earnout shares were previously granted to TMTG shareholders in three tranches: 15 million if the stock traded at a volume-weighted average price of $15 for 20 of 30 days; another 15 million if VWAP was $20, and 10 million more at $30. The targets were pulled down to $12.50, $15, and $17.50, obviously a much lower bar to clear.

But perhaps the most interesting, and most consequential, change is that Donald Trump will now control the post-merger business. Trump personally will be issued super-voting Class B shares which will give him roughly 55% voting power after the merger.

Given Trump’s importance to the business going forward, this doesn’t necessarily seem like a bad thing for shareholders. Trump’s agreement with Truth Social is not that restrictive: he can post anything on any social media site (most notably Twitter) as long as he posts the same thing on Truth Social six hours earlier. Political communication is excepted, and that loophole could be huge in a presidential campaign and particularly if Trump once again enters the Oval Office.

But with voting control and a substantial stake in TMTG, the letter of the agreement may be less important than Trump’s financial and personal interest in the business. Given that DWAC shareholders are betting on the former president, it would seem that, at least for them, the closer his ties to the business, the better.

Trademarks and Management

Even so, it’s difficult to get too excited with the information presented. Truth Social hasn’t really made a dent in the social media space. The plans beyond the platform are vague and not particularly compelling.

Overall, there’s a sense here of a company that’s not particularly well-managed. The proxy (see p.113) discloses that TMTG applied for trademarks for “Truth Social” and other terms — and received “non-final rejections” from the U.S. Patent and Trademark Office for use in social media or streaming video. In the European Union and Sweden, there have been “bad faith registrations” of the company’s trademark. Presumably other parties beat Truth Social to the trademarks of its own brands, which is what happens when a company doesn’t get its legal efforts in order before a launch.

Not coincidentally, TMTG is led by Devin Nunes, whose professional experience consists of being a dairy farmer and a politician. The proxy gives previously undisclosed information on other key executives, who lack experience in major companies. The chief financial officer last led Town Sports International through bankruptcy, and before that was a Wall Street analyst. The chief operating officer came from Parler. It’s possible the team will be successful, but for now that team looks at best unproven.

And to this point, that team hasn’t done the job all that well. It bears repeating: DWAC itself admits how difficult breaking into the social media sphere is. Yet TMTG has not had a coherent or well-executed strategy for taking on that task. The Apple launch was haphazard and full of glitches; it took months to add Android (at which point the buzz around Truth Social had faded) and now the web app is unavailable.

Trump himself was slow to use the platform (and, given his pull and financial interest in TMTG, surprisingly quiet in terms of exhorting shareholders to vote to extend the merger deadline, which nearly left DWAC facing liquidation). The company faces potential trademark infringement issues. Advertising revenue growth has been disappointing, and the quality of ads on the platform is not particularly impressive (though, to be fair, at this point Twitter is hardly any better).

Solely as an investment, there’s just not that much to like, and a lot of very real question marks.

What Is DWAC Worth?

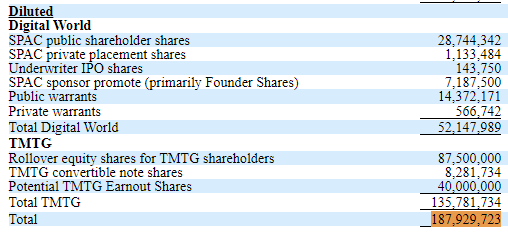

As noted, pro forma for the merger TMTG still has an enterprise value of about $2.5 billion. On a fully-diluted basis, there will be 187.9 million shares outstanding:

DWAC/TMTG proxy statement, November 2023

Tuesday’s close of $15.62 thus suggests a pro forma market capitalization of $2.93 billion; less cash (including cash from warrant exercises, which at $11.50 are in the money and thus included in the table above) of $426 million puts enterprise value at $2.51 billion.

Whether that’s a realistic valuation obviously is up for debate. TMTG is essentially a startup; the company is less than three years old. There perhaps is the potential for a conservative-focused social media platform, though such platforms already exist in Gab, Parler, and Gettr.

But while there is potential here, two-plus years after TMTG’s founding there honestly seems little reason for optimism. The company hasn’t gained substantial market share even within the conservative ecosystem. Revenue is minimal. The cash raised in the merger can certainly support operations, but it’s not as if the post-merger TMTG will be so flush as to spend aggressively. Between 2010 and 2012, Twitter burned $215 million in cash as it ramped revenue from $28 million to $317 million. TMTG will have to spend a good chunk of its war chest to drive much lower revenue growth.

It’s difficult, at this point, to project that this company will have the ability to drive its own exponential growth. One obvious advantage that Twitter had in the early 2010s was a lack of competition; Truth Social is playing on a very different field. And while, as Zuckerberg’s biting comment suggests, Twitter management had its own missteps, clearly TMTG itself is off to a rocky start. In this environment, and with existing competition, the performance so far hardly seems to support a valuation well past two billion dollars.

Read the full article here