Overview

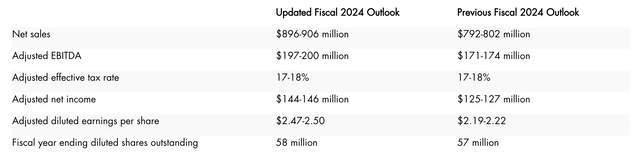

e.l.f. Beauty (NYSE:ELF) reported impressive earnings for the quarter ending in September 2023. The cosmetics company exceeded expectations with a 76% increase in sales, leading to nearly triple profits in the second quarter. The company’s net income for the quarter was $33.3 million, or 58 cents per share, compared to $11.7 million, or 21 cents per share, in the same period last year. This represents a significant growth of 184% in net income. Additionally, e.l.f. Beauty reported revenue of $215.5 million, surpassing estimates by approximately 29%. These exceptional results have led to a positive outlook for the company, with an increased full-year net sales expectation of 55% to 57%, amounting to $896 million to $906 million

e.l.f. Beauty

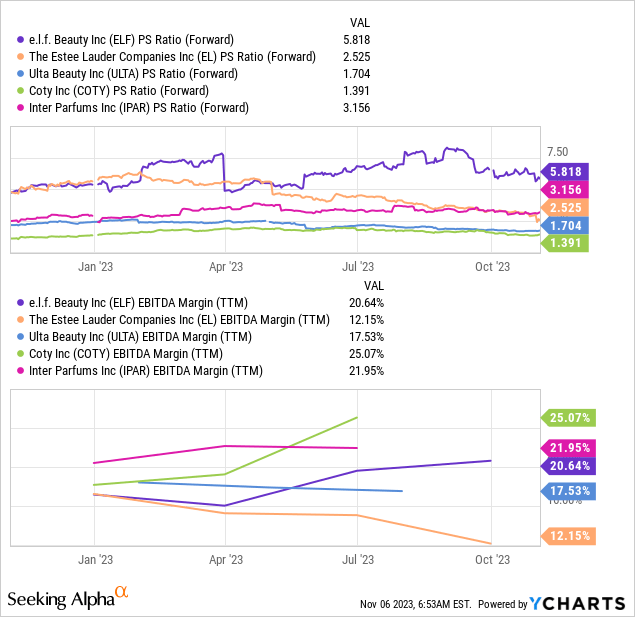

As a result of its strong growth, e.l.f. Beauty outperformed its competitors Ulta Beauty (ULTA) and Coty (COTY) by wide margins, with a surge of nearly 100% year over year. The company’s shares have experienced remarkable growth over the past few years, now up over 1000% from its Covid lows, as shorts were squeezed. Nevertheless, in accordance with its share price, e.l.f.‘s valuation has significantly expanded, pricing in high expectations going forward.

Lofty Valuation

e.l.f.’s valuation has expanded substantially over the past few years, from just under 2x Price to Sales (P/S), to over 7x. This is mainly due to its acceleration of growth in recent quarters, as revenue growth picked up speed in recent quarters. Moreover, as demonstrated in its latest Q3 earnings, e.l.f. also reported growing underlying profits, pointing toward sustainable revenue growth.

e.l.f. Beauty

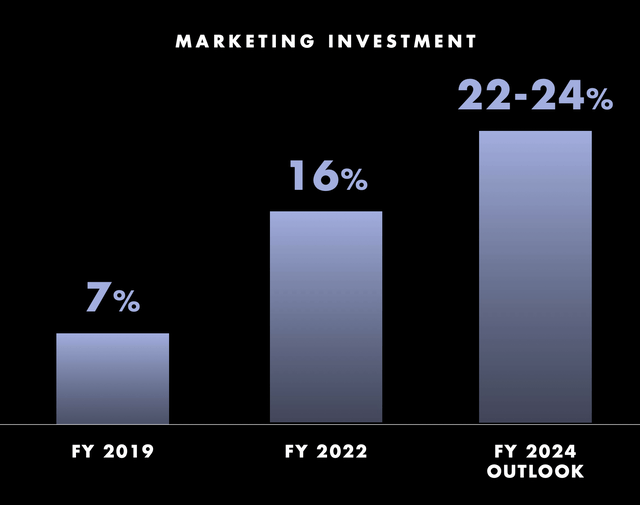

However, it is crucial to note that while its revenue growth accelerated significantly in recent years, so did its marketing spending. Since beauty brands heavily rely on overall brand awareness to grow their overall market share, it is no surprise that e.l.f. is spending heavily on marketing. Here, its marketing spending has increased over threefold from 2019 in order to also grow its digital channel, which grew a staggering 75% last quarter.

| Company | Employees | Market Cap. | Market Cap./ Employee |

| e.l.f. | 339 | $5.2B | 15.3M |

| Ulta Beauty | 53.000 | $19B | 359.000 |

| Estée Lauder Companies (EL) | 62.000 | $40B | 645.000 |

| Coty | 11.300 | $8.3B | 734.000 |

However, the question is how sustainable inorganic growth is, especially in the long term. As demonstrated in the table above, e.l.f. currently has just 339 employees, which translates into a value of $15.3 million per employee, which could be interpreted positively at first, demonstrating a highly efficient business. However, to me, it appears that its low headcount is a representation of its high reliance on inorganic growth and hardly scalable business model. One may remember how Nu Skin (NUS) rose to popularity in 2013, growing revenues and earnings by over 50% annually. However, given the competitive landscape and low differentiation of the beauty and cosmetic industry, the company could not scale further and eventually saw its earnings decline rapidly. Shares are still trading some 80% lower from its all-time highs in 2013, although its valuation was even lower, at a P/E ratio of just 17x and at a P/S ratio of 2x.

e.l.f. Cosmetics is known for offering affordable makeup and skincare products, making it a popular choice among budget-conscious consumers. The brand has particularly found favor with younger shoppers who often discover its products through social media. A prime example of e.l.f.’s affordability is its latest release of lip oils, priced at just $8. In comparison, a similar lip oil serum from Estée Lauder, a high-end competitor, retails for a significantly higher price of $36. While focusing on budget-conscious consumers is certainly the right strategy to drive growth, especially in times of high inflation, the lower-price segment usually attracts more competition, which could eventually drive down margins. Again, my main worry here, is how sustainable e.l.f’s growth strategy is over the long-term.

Takeaways

e.l.f. has got its marketing right – after all, it is quickly becoming the favorite beauty brand for Gen Z due to its aggressive and clever marketing approach.

While e.l.f. Beauty’s recent revenue and earnings growth are impressive, the long-term sustainability of this trajectory is questionable given the competitive landscape dominated by giants like Estée Lauder and Ulta. Considering the potential challenges in maintaining market share and the company’s lofty valuation, I remain skeptical about recommending e.l.f. at its current price.

Read the full article here