Co-authored with Treading Softly.

When we talk about investing for income, one frequent question we get asked is, “what about taxes?”

Often we like to remind investors that we don’t allow taxes to determine what is a good investment. Simply put, we can’t determine what everybody’s taxation situation is going to be because those situations are uniquely personal for each person.

What we can show is that a high yield, even with taxes removed, is often providing more income than a low yield that is tax friendly. So when we do an after-tax comparison using an estimation of a tax bracket, we find that taxes really don’t make that much of a difference unless you’re willing to accept less money under the fear and guise that it needs to be more tax-friendly. It is a fact of life that those who are successful end up paying more taxes. It’s just par for the course.

Today, however, I want to present two investments that are tax-friendly but also high-yield, allowing you not to sacrifice income in the name of tax-friendliness. We’re going to let you eat your cake and have it too.

Let’s dive in!

Pick #1: NEP – Yield 5.9%

Since its IPO in 2014, NextEra Energy Partners, LP (NEP) has hiked its dividend every quarter. NEP is a “yieldco” which invests in green energy projects. NextEra Energy, Inc. (NEE) accounts for the bulk of the projects that NEP buys, through its subsidiary NextEra Energy Resources or NEER. NEER takes on the construction costs and risks, and NEP buys the infrastructure once it is operating. This provides NEER with free capital to start more construction while NEP sells the electricity generated to NEE.

The entire purpose of NEP’s existence is to provide upfront capital in exchange for a long-term income stream. What a coincidence! I have capital, and I’m interested in owning a long-term income stream!

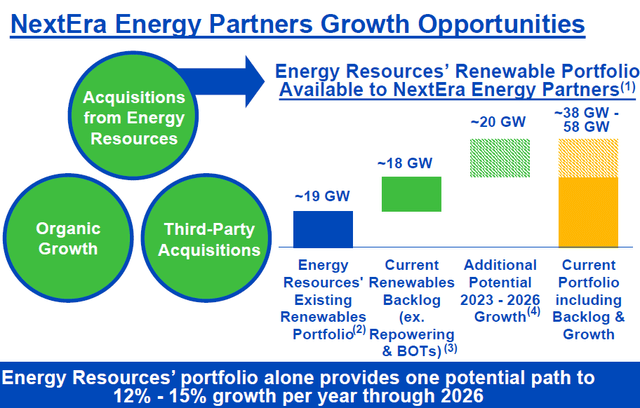

Since NEER is a related company, NEP management has a lot of visibility on NEP’s growth trajectory. Through 2026, NEP expects to double or even triple the size of its portfolio. Source.

NEP May 2023 Presentation

As the portfolio grows, so too will the distribution to shareholders. NEP continues to guide for 12-15% annual growth in its per/share distribution. Historically, management has been quite accurate in these types of forward projections.

Of course, not everything can be controlled or predicted. There are always variables that are outside of management’s control. One of those that happened recently is the increasing cost of capital. Rising interest rates and a declining share price changed the dynamics for NEP. A higher cost of capital makes it less attractive and less profitable to issue equity in order to buy new assets.

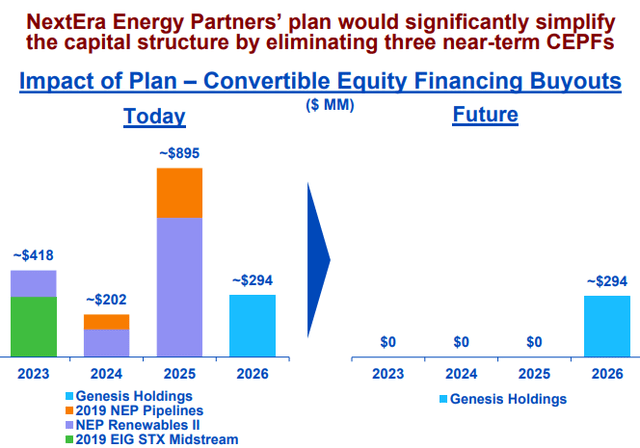

NEP has the additional complication of having used convertible equity financing to invest in several projects. That’s a move that was appealing when the common equity was trading at $70-$80/share, but is much less appealing at $60/share. With approximately $1.5 billion in convertible equity financing coming due, NEP’s growth trajectory was at risk through too much dilution.

Management came through with a plan that protects existing shareholders and allows NEP to buy out the convertible equity that is due through 2025, avoiding dilution of existing shareholders at poor prices.

NEP May 2023 Presentation

To achieve this plan, NEP is selling all of its gas pipelines, and NEE is waiving its Incentive Distribution Rights (“IDR”) through 2026, a savings of $157 million per year for NEP that largely offsets the loss of earnings from the pipelines.

As a result of this move, NEP will become 100% green energy, possibly making it more appealing to certain investment funds that prioritize ESG. At HDO, we are agnostic; we will invest in gas, oil, coal, tobacco, alcohol, etc. But, there are certain investors, like the Church of England pension fund, that make investment decisions based on non-monetary reasons. We’ll buy your oil at a discount, and when NEP goes all green, if you offer a high enough price, we’ll sell you ours.

In the meantime, NEP will continue rewarding us with a steadily increasing flow of green dollars. The suspension of NEE’s IDR ensures that we won’t be too diluted, and we can expect our dividend growth trend to continue. As our cash flow grows even higher, the price the Church of England will need to offer us in 3-5 years will be much higher.

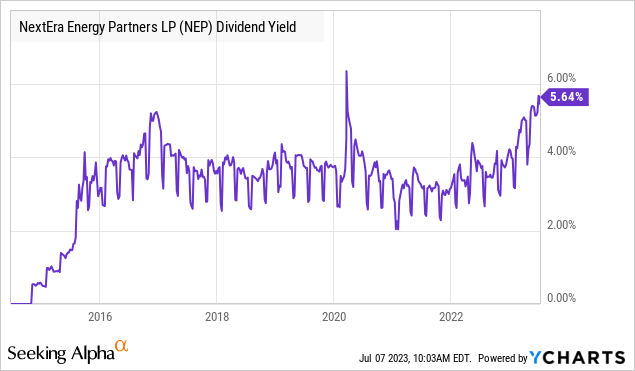

NEP is a great option for investors looking for long-term dividend growth. Starting at 5.5%, 12-15% dividend growth develops a very respectable dividend yield sooner rather than later. In 3-5 years, we can measure the price against our cash flow and decide if the gains are large enough to realize or keep holding indefinitely. When you are being paid to wait, you have the option to decide whether or not to sell.

How much upside can we expect? Well, historically, NEP has frequently traded at a yield of 3.5% or lower.

At 3.5%, that is certainly a yield that no longer meets HDO’s goals, so we would likely be sellers. With today’s dividend, that would imply a price of $96/share. At the low end of management’s projections of a $5.11 annualized dividend in 2026, a 3.5% yield would imply a price of $146.

So I will just sit here, collecting my income and watching it grow while I wait for the Church of England or some other ESG-focused investor to offer me double my investment.

Pick #2: GHI – Yield 9.2%

Greystone Housing Impact Investors LP (GHI) is a unique partnership that has two core segments.

GHI invests in “mortgage revenue bonds,” which are originated by state housing agencies to encourage the construction of apartments with an affordable living component. These bonds are secured by real estate on a first-lien basis.

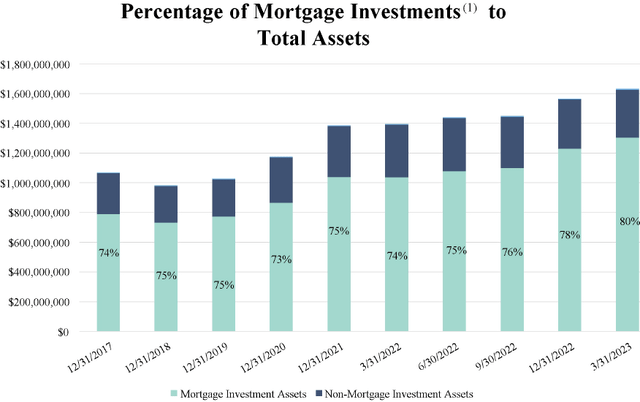

These mortgage investments make up approximately 80% of GHI’s portfolio. Source.

GHI Q1 2023 Presentation

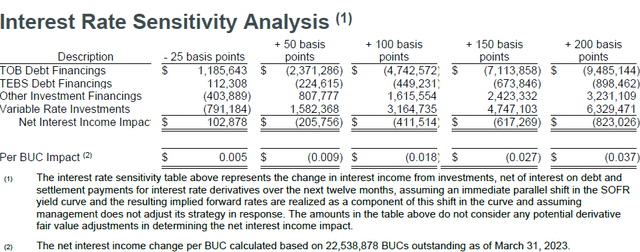

These mortgages are a “spread” investment, GHI profits from the difference between the interest paid by the borrowers and GHI’s own cost of capital. Rising interest rates have been a headwind to this business, as it increased the costs that GHI has to pay on its own debt. However, with hedging, the impact is very slight. Even a 200 bps increase from March 31st rates would only reduce earnings by $0.037/unit for an entire year.

GHI Q1 2023 Presentation

The current high-interest environment is likely a big part of why GHI shares are trading at a lower price this year. When interest rates start declining, this headwind will turn into a slight tailwind for earnings and an even larger tailwind for valuation.

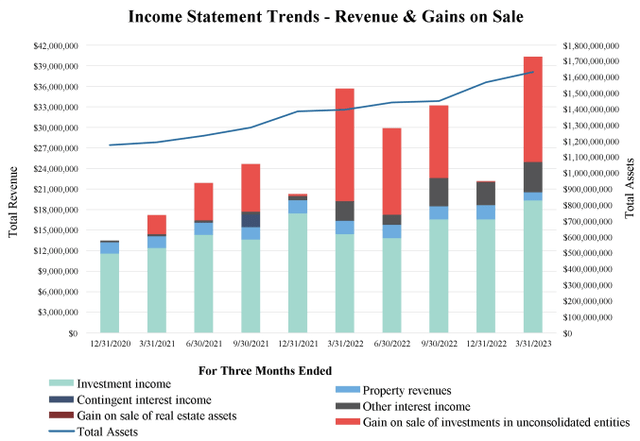

The second portion of GHI’s business is their “Vantage” joint venture. The JV has a business plan of developing new apartment buildings, leasing them up, and then selling them to investors. The large gains on sale result in lumpiness for GHI’s earnings.

Below, you can see the variance in the red bar. These are the gains on sale from GHI’s Vantage properties.

GHI Q1 2023 Presentation

GHI is off to a great start for 2023, with two sales in Q1. Thanks to these Vantage sales, GHI generated $0.81 in CAD (cash available for distribution) in Q1, compared to a distribution of $0.37/quarter. GHI aims to distribute 100% of CAD, providing us with a lot of confidence in the sustainability of the current dividend.

The opportunity to grab shares of GHI with a yield over 9% is a fantastic buying opportunity. Note that GHI does issue a K-1 at tax time since it is a partnership. Additionally, the portion of GHI’s distribution that is attributable to its mortgage bonds is tax-exempt for Federal Income tax purposes. The percentage can vary from year to year, but a portion of your dividend will be tax-exempt, making GHI a very tax-efficient investment for taxable accounts.

Conclusion

With NEP and GHI, we are able to invest in two solid companies that are growing but also provide outstanding income. NEP primarily pays return of capital, which defers taxation until the day you sell your investment. GHI invests in federal tax-free mortgage bonds allowing you to get income while helping lower-income individuals have housing and not have to pay federal tax on it.

I’ll be the first to tell you that I don’t know a single person who enjoys paying taxes. While I pay what’s required of me, I don’t desire to pay extra. On the other hand, I am not willing to sacrifice excellent income and accept less money coming into my account because I’m afraid of paying more in taxes. At the end of the day, if I pay more taxes and I end up with more after-tax income, then we’re both winners – myself and the government. Those who accept less income out of the fear and desire to pay fewer taxes will be the same as somebody cutting themselves, hoping they get the blood on the other person – hurting yourself to try and hurt someone else benefits no one.

That’s why I have designed my entire investment philosophy to focus on generating strong, sustainable recurring income. We’re not foolheartedly running into the market, hoping to find income at any location. We are carefully crafting excellent income portfolios to generate the most income possible while maintaining strict risk tolerance. That way, when you retire, you can sit back and enjoy time with your family; you can go on a long walk or even hike the Appalachian Trail, never once having to worry about where your money’s coming from or who’s going to pay your taxes – the market’s handling that for you. Enjoy the pleasures of life while you’re retired! Don’t be a slave to where your money is going to come from. Money is a terrible master but an excellent servant. You make it your servant when you’re an income investor.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here