Enel Chile S.A. (NYSE:ENIC) is an electricity utility company whose subsidiaries and affiliates generate, transmit, and distribute electricity in Chile. Over the past decade, the company has made a significant shift towards the energy transition, which includes the closure of its coal plants and a shift towards renewable energy sources. Currently, approximately 76% of its energy generation comes from renewable sources.

The Chilean company is under the control of Italy’s Enel SpA (OTCPK:ENLAY), which holds roughly 64% of the company’s shares. This ownership structure emphasizes the company’s commitment to delivering value to its shareholders through dividends. This forms the basis of my thesis regarding Enel Chile.

In 2023, the company entered the final phase of its renewable energy integration plan. This phase involves expanding its portfolio, maintaining its balance sheet at optimal levels, gradually reducing capital expenditures (CapEx), and providing guidance to increase the progressive payout to more than 50% over the next two years. I believe that the company is well-positioned to be a reliable income stock for a dividend-focused portfolio.

Furthermore, considering that the company’s valuation multiples are currently more discounted than those of other renewable energy-focused peers, I see the potential for Enel Chile’s stock to increase in value from its current level.

Enel Chile’s Strategy and Financial Overview

Enel Chile’s strategic pillar is integrating a sustainable energy portfolio, facilitating the energy transformation in Chile. The energy transition is a medium- and long-term process that commenced over a decade ago and is now yielding positive results. Enel Chile aims to drive a fair and sustainable transition, fostering a cleaner energy matrix, promoting electric transportation, and enhancing energy efficiency.

Enel Chile’s strategy consists of several key phases, starting with establishing the renewable energy business integration between 2016 and 2018, followed by an accelerated decarbonization phase from 2019 to 2022. The company is currently focused on sustainable growth in renewables to reduce the risks and volatility in its portfolio, strengthening its balance sheet for potential future opportunities.

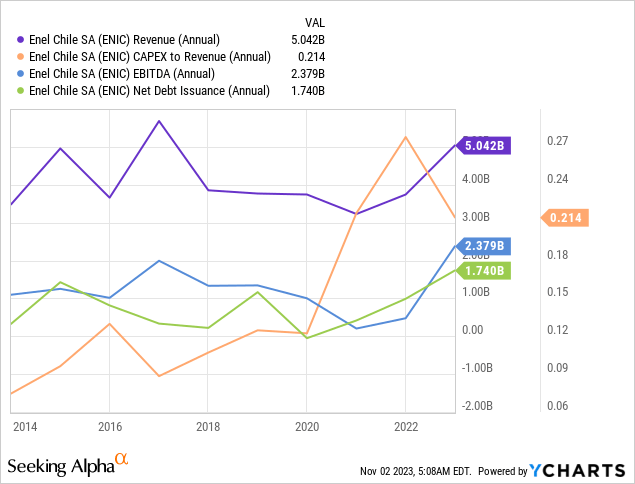

Over the past decade, Enel Chile has faced revenue challenges, primarily during the phase-out of coal. However, in the last two years, the company has shown improvement while maintaining continuous investment spending. The previous year, in particular, presented challenges for the company, mainly due to a combination of factors affecting spot prices and the broader macroeconomic and commodities landscape.

Notably, despite recent years of declining revenues and EBITDA, the company has successfully executed its growth plans while keeping its debt relatively stable.

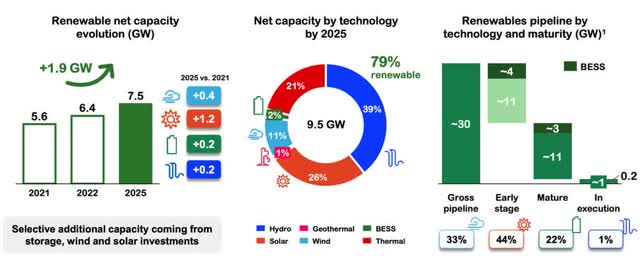

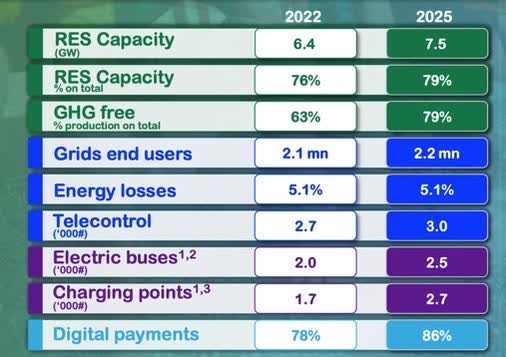

Enel Chile had 8.5 GW of net installed capacity as of the first half of this year, serving approximately 2.1 million end users, with renewable energy contributing to about 76% of its total net installed capacity. The company’s goal for 2025 is to achieve a net capacity growth of 1.9 GW, representing a 79% increase in its net installed capacity.

Enel Chile’s presentation

The company’s additional strategies revolve around maximizing customer value through electrification. Enel Chile’s commercial strategy is geared towards expanding its presence in other deregulated market sectors, which currently constitute 34% of its portfolio. The company aims to increase this to 44% by 2025. Additionally, there is a focus on enhancing geographical diversification to mitigate price fluctuations. Enel is also actively supporting the electrification of electric buses, public lighting, e-homes, and more energy-efficient and environmentally friendly industrial processes.

Consequently, the company’s plans are primarily driven by the expansion of renewable energy capacity, the development of its electricity distribution network, and advancements in promoting electrification for buses and charging infrastructure.

Enel Chile Investor’s Presentation

The Dividend Projection and Valuation

Simultaneously with its efforts to solidify the growth of its renewables business, the company maintains its dedication to delivering value to its shareholders. As per the company’s policy, a minimum payout of 50% is anticipated. It’s worth noting that, being a subsidiary of Enel, there is a strong commitment to consistently providing dividends.

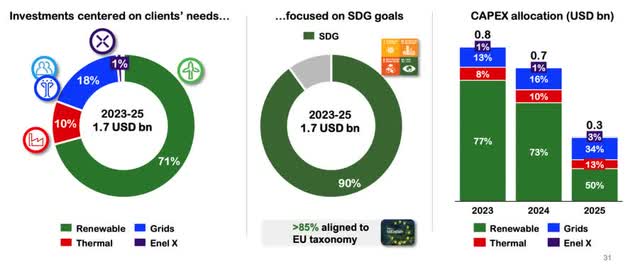

However, this payout ratio will be contingent on Enel Chile’s investment plans to enhance its renewables portfolio. According to the company’s roadmap for 2023, the firm is expected to allocate $0.8 billion in CAPEX, decreasing to $0.7 billion in 2024 and further reducing to $0.3 billion in 2025, as investments in renewables are anticipated to decrease significantly.

Enel Chile’s presentation

Moreover, Enel Chile is aiming for an integrated EBITDA growth of 41% by 2025, with a more conservative scenario targeting 30%. In this pursuit, the pro forma EBITDA margin is expected to rise from 14% to 25%. However, in the most recent quarter, Q2 2023, the company witnessed a 42% year-on-year decline in EBITDA, primarily due to temporary increases in production costs.

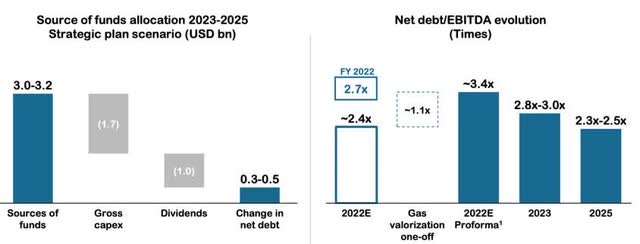

The company does not anticipate challenges in generating sufficient cash for financing its investments and distributing dividends. Out of the $3 billion allocated to the company’s funding sources, $1.7 billion will be allocated to CapEx, and an additional $1 billion will be designated for dividend distribution. This allocation should result in a net debt change of $300 million to $500 million. While the company’s leverage is expected to increase from 2.7x to 3x this year, the company is targeting a leverage ratio of 2.3x to 2.5x by 2025.

Enel Chile’s presentation

Regarding net profit, a significant recovery in the next two years is not anticipated. Enel Chile expects an increase from $0.3 billion in 2022 to around $0.4 billion by 2025. Although this represents a 38% growth, it is not a substantial increase over the specified time frame.

Enel Chile’s presentation

Given the share price of $3.02 on November 1st and adopting conservative payout assumptions in line with the company’s guidance of at least 50%, it aligns with its projected net profit of $561.7 million. This net profit represents an estimated annual EPS drop of 38%, per the sole analyst providing earnings estimates.

Based on this data, I calculate an annual dividend per share of 20 cents, which equates to a yield of 6.7%. Considering my pursuit of a robust ROI of 6% for dividend-paying stocks in the utilities sector, I find Enel Chile moderately attractive at the current price. I estimate a fair price of $3.39 per share, allowing for a 10% potential room for the stock to appreciate. This makes it a sensible choice for investment, primarily for its dividend.

Company’s data, table compiled by the author

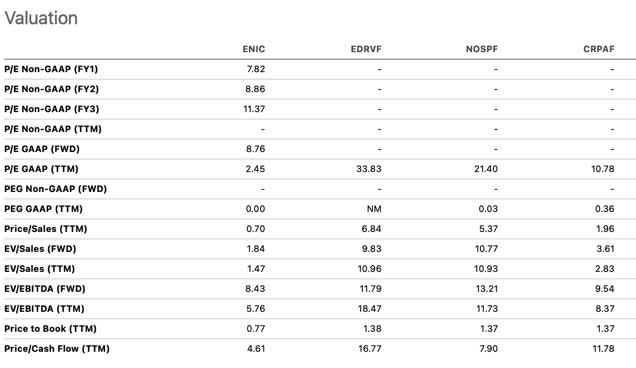

When examining the valuation multiples at which Enel Chile currently trades, it becomes evident that the company trades at a discount compared to other Latin American firms focusing on renewables. Enel Chile’s forward EV/EBITDA ratio, which stands at 8.43 times, is notably lower than that of EDP Renováveis (OTCPK:EDRVF), which is involved in wind and solar energy projects in countries such as Brazil, Mexico, and Colombia. It also compares favorably to France’s Neoen (OTC:NOSPF), which operates in Latin America with an emphasis on solar and wind energy, and Spain’s Corporación Acciona Energías Renovables (OTCPK:CRPAF).

Seeking Alpha

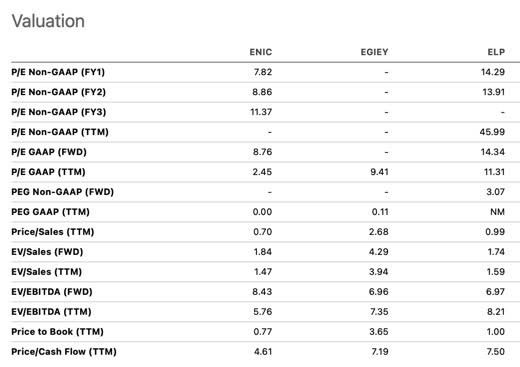

When comparing Enel Chile with other Latin American utilities that have interests in both renewable and non-renewable energies and have a similar market value, particularly in Brazil, such as Engie Brasil (OTCPK:EGIEY) and Copel (ELP), Enel Chile stands out as being traded at a significant EV/EBITDA premium.

Seeking Alpha

Conclusion

Despite recent challenges associated with a challenging macroeconomic environment that has impacted spot prices in recent quarters, Enel Chile has, on the whole, effectively implemented its energy transition strategy. This has been accomplished through a well-structured and clearly defined plan. The company has now progressed into the sustainable growth phase of its renewables strategy, primarily focusing on strengthening its balance sheet and delivering value to shareholders through dividend payments.

However, it’s essential to acknowledge the risks associated with this execution. These risks include hydrological challenges, as reduced hydroelectric power generation may lead to increased use of thermoelectric plants, potentially impacting the company’s profit margins. Additionally, inflation could raise project costs, and regulatory risks are a concern since regulated customers accounted for 36% of the company’s GWh sold and 45% of its generation revenues last year.

In light of the company’s favorable valuation multiples compared to its industry peers and the prospect of Enel Chile nearing its 2023 adjusted EBITDA and net income targets, I believe that the company holds the potential to consistently deliver attractive dividends, possibly in the proximity of 7% in 2023. This trend may continue over the next few years. With an estimated target price of $3.39 per share, I consider Enel Chile’s stock price alluring concerning its dividend potential.

Read the full article here