Enterprise Financial Services (NASDAQ:EFSC) is a regional bank that I’ve been invested in since the regional banking crisis. The bank offers a fixed rate non-cumulative preferred share (NASDAQ:EFSCP) that was recently sold off after the release of the company’s third quarter earnings report. Now, the bank’s preferred share is yielding 9% and after reviewing their earnings, I decided to double my holdings.

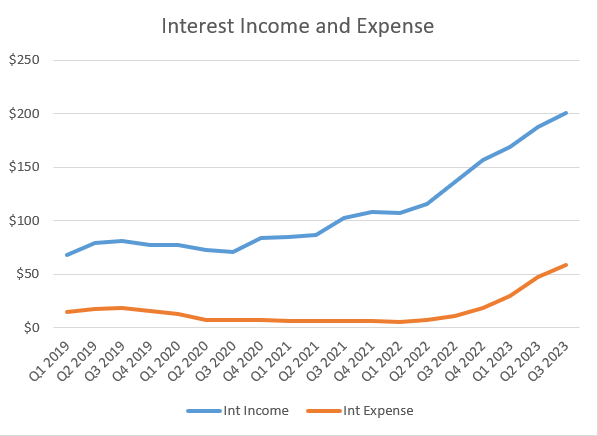

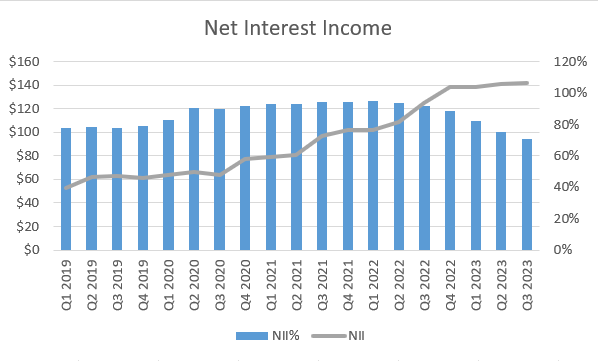

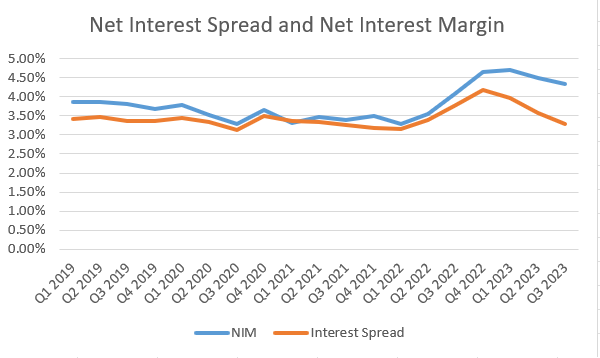

Like all banks, Enterprise Financial has seen its interest income and interest expenses grow since the Federal Reserve raised interest rates. Where Enterprise Financial is bucking the trend is that its net interest income (interest income less interest expense) is continuing to grow and is more than double what it was prior to the pandemic. A growing net interest income in this environment is very helpful considering banks are experiencing growing noninterest expenses (such as overhead and compensation costs). The bank’s net interest margin also remains above its pre-pandemic levels, showing that the bank’s asset portfolio is not bogged down by low interest, pandemic era loans.

Company Financials Company Financials Company Financials

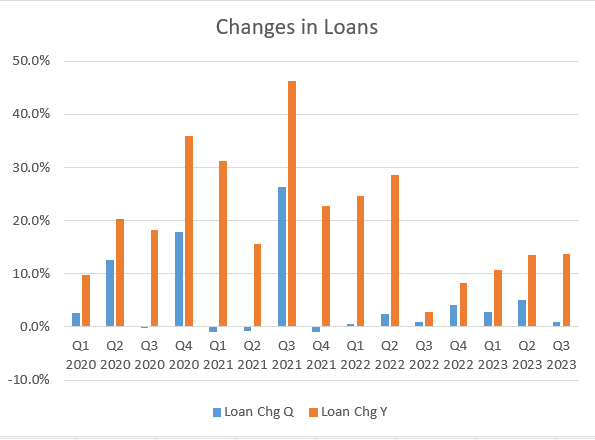

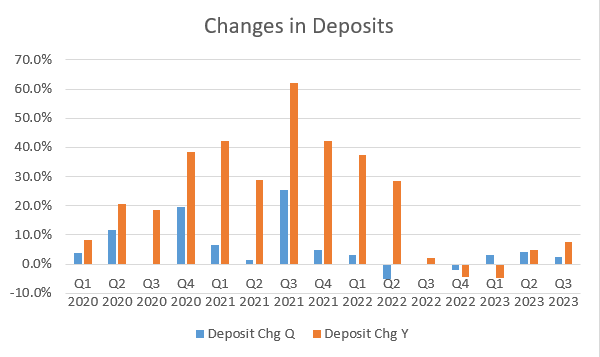

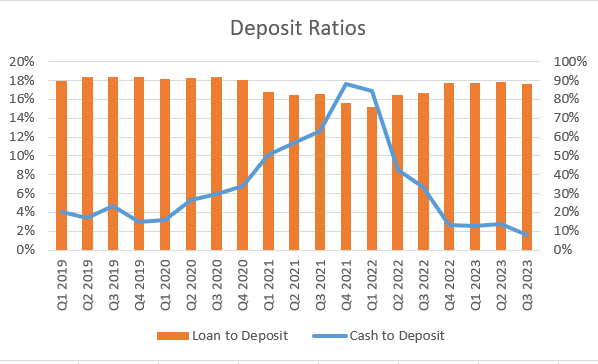

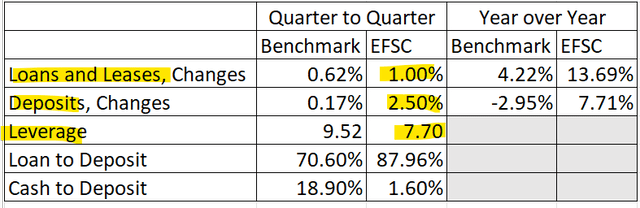

With the industry facing a tough haul of finding deposits and growing loans, Enterprise Financial is incrementally doing both. The bank has modestly grown its deposits for three consecutive quarters. Deposit growth has enabled the bank to continue growing its lending. It is important to note that the bank saw a build in cash after PPP forgiveness that it deployed into loans and caused its loan-to-deposit ratio to rise and its cash balance to become nimble.

Company Financials Company Financials Company Financials

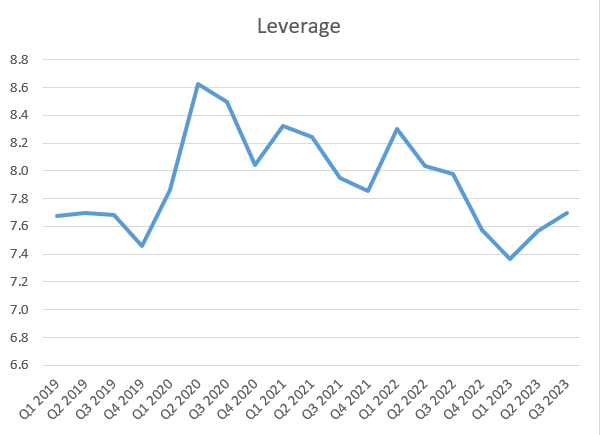

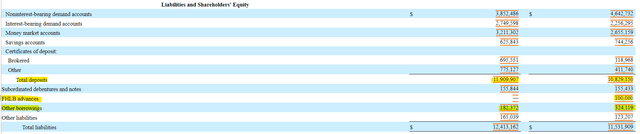

Should Enterprise Financial need to access additional liquidity, investors would be pleased to know that the bank has a modest leverage ratio of under 8 to 1. The bank has also transformed its leverage by taking its increased deposits and using them to pay off its debts to the Federal Home Loan Bank (FHLB) and reduced its other borrowings by $140 million. The bank’s leverage ratio is well below the industry benchmark, giving it plenty of room on the balance sheet for additional borrowings (including deposit growth) should it need to tap into its available credit lines.

Company Financials SEC 10-Q Company Financials

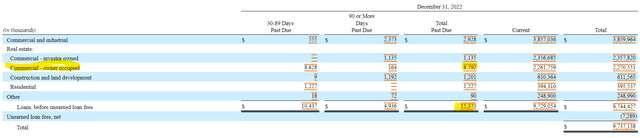

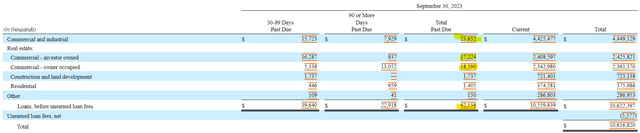

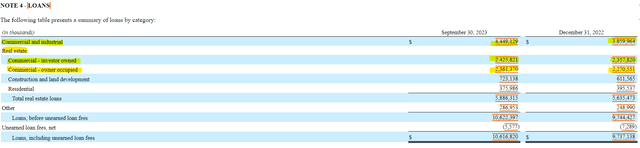

Enterprise Financial’s success is not without concerns, which are weighing down the price of both common and preferred shares. The bank has seen its past due loans jump fourfold since the end of last year. Currently, past due loans account for approximately 0.5% of its total loans. The other concern is commercial real estate, which accounts for a little less than half of the bank’s loan portfolio but has a higher delinquency rate than other types of loans. While the peak of delinquencies has not been reached yet, it is still manageable for the bank and has yet to dent its net interest income.

SEC 10-Q SEC 10-Q SEC 10-Q

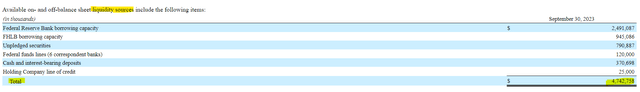

Another concern for Enterprise Financial is the number of uninsured deposits. While the number of uninsured deposits has dropped $2.5 billion since the end of last year, the balance remains rather elevated at $3.4 billion, or 29% of all deposits. Fortunately, the bank has multiple sources of additional liquidity. The bank has the ability to borrow over $4.5 billion, which sufficiently covers its uninsured deposits.

SEC 10-Q SEC 10-Q

Enterprise Financial Services is suffering from being a small player among banks. The bank is heavily weighted with commercial real estate loans and has seen an increase in past due balances, but net interest income continues to grow. The bank’s leverage ratio is very modest, and it continues to attract depositors. The bank’s flexibility will allow it to persevere against its challenges and allow preferred shareholders to collect a sizable income.

Read the full article here