Investment Thesis

Estée Lauder (NYSE:EL) is the dominant player within the beauty and cosmetics industry.

Their huge portfolio of highly admired brands generates a wide economic moat for the firm, which has historically allowed the firm to earn outsized returns on their invested capital.

Poor fiscal performance in FY23 and Q1 FY24 has resulted in a massive 60% YTD selloff that has sent shares to new 5Y lows.

Still, The Value Corner’s intrinsic value calculation suggests that only a potential 16% undervaluation is present in shares.

Therefore, I rate Estée Lauder a Hold at present time and believe short-term macroeconomic pressures may place further downward pressure on shares.

Company Background

Estée Lauder is one of the most established names in premium beauty and makeup products. The firm’s luxurious image combined with a highly diversified portfolio of brands enables Estée Lauder to target multiple different market segments with their products.

The company operates over 20 different brands, with a heavy focus resting on the premium-end of the beauty and cosmetics markets. Estée Lauder has tailored many of their brands to cater for certain geographic markets specifically such as China and Southeast Asia in a bid to capitalize on the significant growth expected in the cosmetics markets these regions harbor.

Current President and CEO Fabrizio Freda is leading the company through some of its tougher times with recent pronounced decreases in total sales and margins, in my opinion placing some doubt over his ability to lead Estée Lauder forward.

While I do believe that more could have been done to avoid the significant drop in sales witnessed as the macroeconomic environment has become increasingly bearish, I believe the main reason for this decline was out of Freda’s hands.

Therefore, and given his extensive history with the firm, I believe Freda is still a good choice for CEO and believe his premiumization strategy will permit Estée Lauder to earn outsize returns on their invested capital. While this may expose the firm to more cyclicality, I believe the overall benefits will outweigh any volatility concerns.

Economic Moat -In Depth Analysis

Estée Lauder has a wide economic that is built primarily upon the strength their reputable and luxurious brand identities earn the company from the perspective of pricing power.

The firm operates 22 different brands of skin care, makeup, fragrance and haircare products with iconic names such as Tom Form, Aveda, Clinique, La Mer, Estée Lauder and Mac all being operated by the company.

EL FY23 10K

Estée Lauder has taken care to spread their brands across the entire beauty industry in a bid to enable monetization of a maximum variety and volume of consumers.

The curation of unique brand identities that target a wide breadth of customers has allowed Estée Lauder to create tangible footholds within each distinct market segment and product category. I believe this significant diversification of revenue streams is beneficial to Estée Lauder and allows the firm to adapt product offerings quickly to match market demand.

Estee Lauder Homepage

While brand identities can be costly to maintain, I believe the established nature of many of the firm’s product lines means relatively less investment in advertising is required to market these brands compared to a brand-new entrant.

Given the mature yet relevant nature of these brands, I see this massive portfolio of brands as already generating significant moatiness for the firm.

Tomford.com | Fragrances

Furthermore, given the overall focus on the premium market and the boutique images of brands such as Tom Ford and La Mer, Estée Lauder has succeeded in achieving significant levels of pricing power among consumers.

The strong brand identities and premium products allow Estée Lauder to avoid competing with its competitors on price. Instead, Estée Lauder can focus on more abstract qualities such as perceived ingredients quality, image and reputation to differentiate their products.

For any retail business, pricing power is fundamentally what allows most companies to earn excess returns on their invested capital. Given that the cosmetics and beauty industries undoubtedly operate as consumer discretionary markets, Estée Lauder’s strength in pricing and brand identity are what generate moatiness for the firm in my view.

I believe Estée Lauder has a good mix of brands and product lines that cater to both the upper, middle and lower ends of the beauty market. Their brands also cater to both an older generation of customer as well as a younger, more progressive crowd.

The overall diversity of their brands combined with the heavy focus on the luxury segment of the market should allow the firm to develop their pricing power even further, which, if successfully achieved, will allow Estée Lauder to continue earning outsized returns even as competition increases within the industry.

Financial Situation

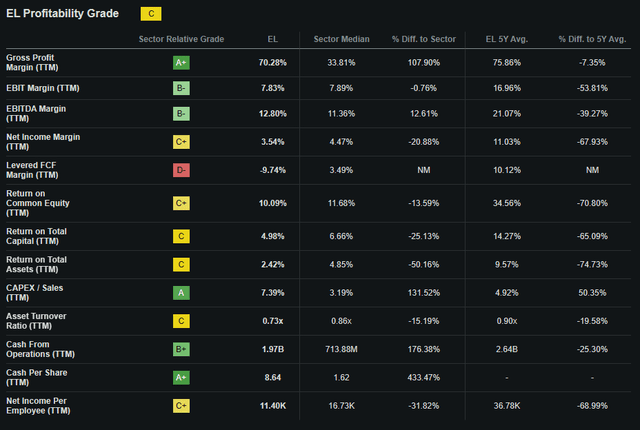

Estée Lauder has historically been an absolute profitability powerhouse when it comes to their fiscal performance.

The firm has 5Y average (as measured from FY19-FY23) gross, operating and net margins of 75.44%, 16.54% and 10.90%. Gross margins often act as an efficient yardstick to quickly measure the overall profitability present within a company’s core business model.

The very healthy 75.44% margin illustrates just how much pricing power Estée Lauder ultimately holds, with their operating and net margins still very impressive too.

Estée Lauder has a 5Y (same period) ROA, ROE and ROIC of 9.88x, 34.17x and 15.69x respectively. The high ROIC illustrates how Estée Lauder’s pricing power and wide economic moat allows the company to earn excess returns on their invested capital and sets the firm apart from the majority of their smaller competitors.

Considering these basic operational performance metrics, we can see that Estée Lauder is a market leading firm that effectively and efficiently generates excess returns on their invested capital and operates on healthy gross margins.

However, FY23 was much more difficult for Estée Lauder with some uncharacteristically lackluster results raising the firm’s overall ability to target consumers accurately into question.

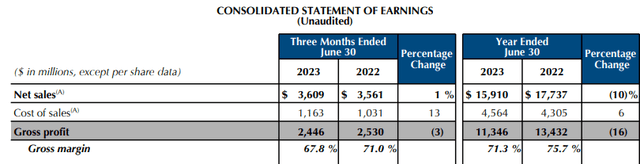

EL FY23 Q4 & Full Year Report

Full-year 2023 results saw Estée Lauder experience a 10% YoY decline in overall net sales, while the firm’s COGS increased 6% YoY. This saw the firm’s gross profits decline by 16% YoY and their gross margin contract 4.4% to 71.3%.

This decline in revenues and core profitability was due to the very slow recovery of the Chinese and southeast Asian travel industry, with Estée Lauder relying heavily on travel retail sales for a large portion of sales in these regions.

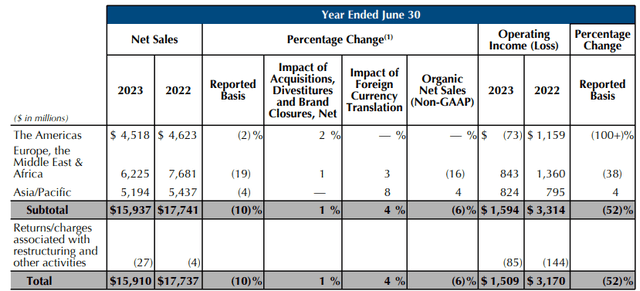

EL FY23 Q4 & Full Year Report

The firm’s EMEA and Asia/Pacific geographic regions were particularly challenged during FY23 due to a slow easing in COVID-19 travel restrictions, hindering the volume of tourists purchasing products through travel retail channels.

While the firm’s Americas region showed significant resilience despite an increasingly inflationary and high-interest rate environment placing pressure on the disposable income of consumers, it is undeniable that flatline results were still disappointing to see from Estée Lauder.

The rise in pricing levels within the firm’s supply networks combined with a drop in intercompany royalty income also resulted in a significant contraction in operating income across Estée Lauder’s EMEA and Americas segments, with an operating loss being recorded for the first time in over a decade by the Americas segment.

Estée Lauder’s robust brands and economic moat helped the firm avoid an even greater drop in net sales, however the firm’s reliance on intercompany royalties means the decline in travel retail revenues has hurt their operating margin substantially.

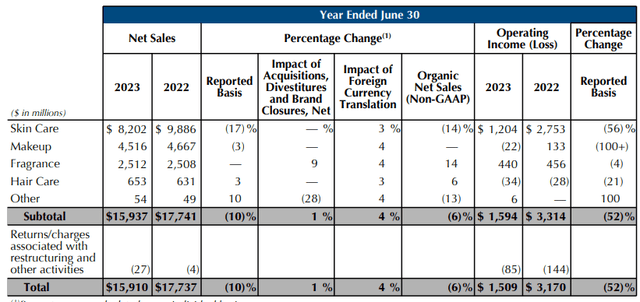

EL FY23 Q4 & Full Year Report

The firm’s skin care and makeup product categories were hit the hardest during FY23, with the segments seeing a 17% and 3% drop in net sales respectively. These two segments are particularly popular within the firm’s Asia travel retail business, which means these weaker sales figures were largely to be expected.

Despite this fundamental weakness, many of Estée Lauder’s key brands witnessed strong growth in FY23, suggesting the firm is still well-equipped at targeting new and changing consumer tastes accurately.

The firm’s The Ordinary brand saw strong double-digit growth within the skin care segment, while MAC cosmetic sales saw double-digit growth in FY23, thanks to a variety of new and successful product launches.

The late-2023 acquisition of Tom Ford has allowed Estée Lauder to significantly benefit from the brands popular image, with strong double-digit sales being seen across the firm’s geographic regions.

I believe this acquisition has provided Estée Lauder with increased exposure to the rapidly growing fragrance marketplace, and see Tom Ford being a great source of growth and revenue moving into the future.

FY23 was a year characterized by underperformance and lack luster sales results. Unfortunately for Estée Lauder, their most recent Q1 results did little to improve the outlook for the firm.

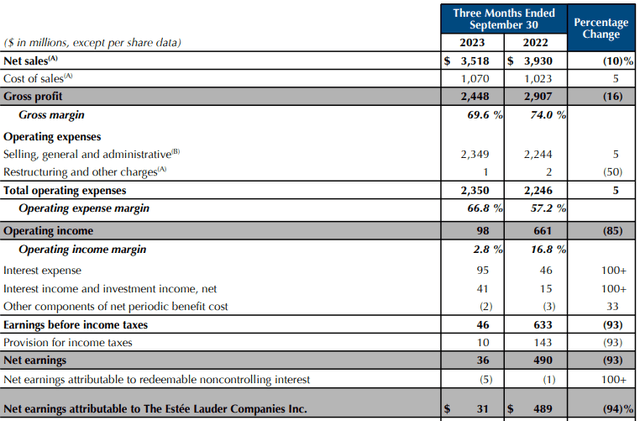

EL FY24 Q1 Report

Q1 saw Estée Lauder’s drop in sales continue YoY, with net sales falling another 10% YoY. Considering how weak the firm’s Q1 FY23 results were, these new FY24 results suggest the fundamental macroeconomic pressures present on Estée Lauder’s core consumers are huge.

Weakness in travel retail driven by retailers cutting inventory levels to match decreased levels of consumer demand significantly harmed Estée Lauder’s EMEA and Asia geographic regions. Simultaneously, the firm faced continuing levels of price inflation in their supply chains, which resulted in a further degradation of gross margins from 74.0% in FY23 Q1 to just 69.6% this past quarter.

The significant decline in tourism originating from southeast Asian markets has also been to blame for the drop in travel retail sales, as the global economic slowdown has hit these regions particularly hard.

Interestingly, many of Estée Lauder’s more mature markets such as the U.S., U.K. and countries such as France and Ireland saw strong sales in Q1 with increased levels of consumer demand for iconic brands such as Tom Ford, MAC and Estée Lauder driving the growth.

I believe that the overall weakness currently present within Estée Lauder’s business is almost entirely due to an incredibly difficult macroeconomic environment, placing substantial pressures on the firm’s core clientele and sales channels.

The fundamentally premium nature of the majority of brands sold by Estée Lauder will expose the firm to more cyclicality in sales than more main-stream oriented competitors. While this will mean that recessionary periods may cause significant deteriorations in net sales and growth, I believe the strategy will yield the firm an overall increased gross and net margin in the long term.

Seeking Alpha | EL | Profitability

Seeking Alpha’s Quant calculates a “C” profitability rating for Estée Lauder, which I believe to be a relatively accurate representation of the mixed bag of results currently being generated by the firm.

While Estée Lauder’s income may have fallen significantly, the firm’s balance sheet continues to be in excellent shape.

The firm has $8.59B in total current assets, while total current liabilities amount to just $5.91B. This reasonable short-term liquidity leaves the firm with quick ratio of 0.85x and an excellent current ratio of 1.45x.

Estée Lauder also has $3.1B in cash and equivalents at its disposal, which is very welcoming to see and illustrates the conservative fiscal management strategy being pursued by management.

Total assets for the firm amount to $22.7B, with total liabilities just $16.48B. This leaves the firm with an excellent debt/equity ratio of 0.72x.

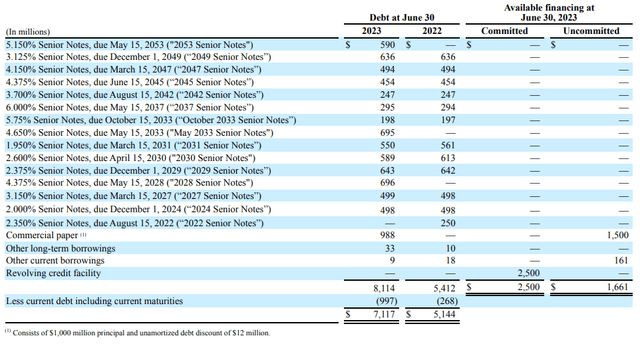

EL FY23 Q4 & Full Year Report

At the end of FY23, Estée Lauder had $7.2B in long-term debt. While this is a relatively large sum of debt considering the firm’s overall balance sheet, the firm has consistently been paying off any arising maturities.

Furthermore, a look at the staggering of this debt reveals that the vast majority of notes are due post-2029, which will allow Estée Lauder to effectively undertake their turnaround objectives without the hinderance of massive debt payments on their FCF.

Moody’s credit ratings agency affirmed an excellent A1 LT Issuer credit rating for Estée Lauder and affirmed a Prime-1 rating for their domestic commercial paper. The outlook remains stable.

Moody’s classifies “A1” credit ratings as being of “high investment grade” and classifies “Prime-1” short-term debt ratings as being of the “highest quality”.

Considering Estée Lauder as a whole, one can clearly see that we are dealing with a historically successful, profitable and stable company that is currently facing a flurry of macroeconomic headwinds and challenges.

While the firm’s core business model remains intact, these macroeconomic headwinds are still going to impact Estée Lauder’s bottom-line until at least H2 of FY24. Luckily, the overall conservative fiscal management pursued by the firm’s management should allow Estée Lauder to weather the storm and regain its footing once the recessionary macroeconomic environment subsides.

Furthermore, the company has managed the debt they have carefully and their debt maturity schedule means the firm’s near-term debt obligations should not place excessive additional pressures on the firm’s net margins.

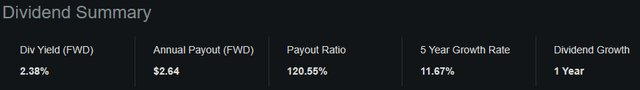

Seeking Alpha | EL | Dividend

Estée Lauder pays a dividend which while not amazing is still quite a good opportunity for shareholders to benefit from.

With a FWD dividend yield of 2.38%, a FWD annual payout of $2.64 and a 5Y growth rate of 11.67%, Estée Lauder’s dividend is quite healthy if not superbly impressive.

Some investors are beginning to show concerns that Estée Lauder may cut or eliminate their dividend in FY24 due to the difficult macroeconomic environment and the pressures this may place on their profitability.

However, I am not so concerned and believe that even if they were to cut the dividend, it would be grown or reinstated quickly once their returns improve.

Valuation

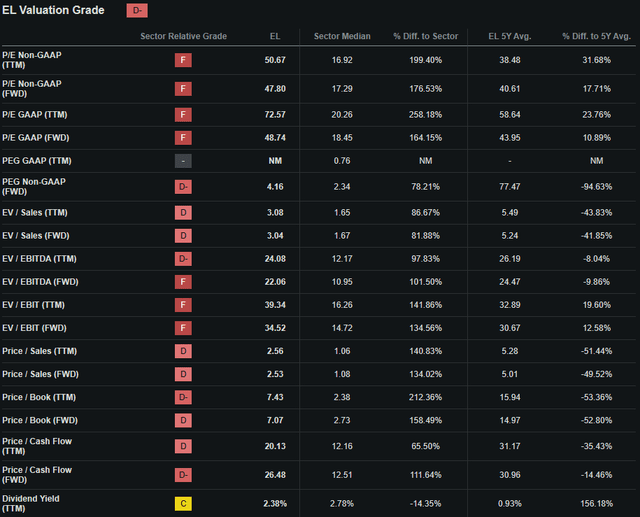

Seeking Alpha | EL | Valuation

Seeking Alpha’s Quant assigns Estée Lauder with a “D-” Valuation grade. I believe this is an excessively pessimistic representation of the value present within Estée Lauder stock, even despite the poor performance shown in FY23 and projected for the rest of FY24.

The firm currently trades at a P/E GAAP FWD ratio of 48.74x. This represents an 11% increase in the firm’s P/E ratio compared to their running 5Y average.

Estée Lauder’s P/CF FWD of 26.48x is quite elevated but still 15% lower than their 5Y running average. Their FWD EV/EBITDA of 22.06x is also representative of this in my opinion, especially when considering the firm’s EV/Sales FWD is 3.08x.

Considering these basic relative valuation metric, Estée Lauder certainly appears to be moderately overvalued compared to both its peers and the firm’s historic averages. Of course, recessionary and cyclical declines can often lead to P/E compression, with elevated figures being witnessed as a result of a sudden change in the profitability present within a firm.

Nonetheless, the relatively overvalued picture in comparison to industry peers could suggest an overvaluation was present or is present in Estée Lauder shares.

Seeking Alpha | EL | Summary Chart

From an absolute perspective, Estée Lauder shares are trading at a huge discount relative to previous valuations, with current share prices of around $110.96 representing a five-year low for the stock.

When compared to the 59% growth seen in the S&P 500 tracking SPY index over the past five years, Estée Lauder has been soundly outperformed by the U.S. market index as a whole by over 82%.

While Estée Lauder shares outperformed the U.S. market significantly for a majority of the past five years, the recent selloff due to worsening fiscal results and a bleak FY24 outlook has resulted in a massive degradation in market capitalization.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison allow for a basic understanding of the value present in Estée Lauder shares to be obtained, a quantitative approach to valuing the stock is essential.

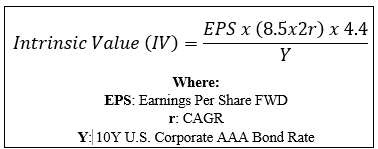

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using Estée Lauder’s current share price of $110.96, an estimated 2025 EPS of $4.44, a realistic “r” value of 0.13 (13%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.61x, I derive a base-case IV of $131.40. This represents a modest 16% undervaluation in the firm.

When using a more pessimistic CAGR value for r of 0.10 (10%) to reflect a scenario where a globally spanning recession causes Estée Lauder’s turnaround plans to stagnate, shares are still valued at around $108.50 representing a fair valuation in shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that while Estée Lauder is trading at a massive discount relative to previous valuations, shares are either modestly undervalued or fairly valued at present time.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. The uncertainty regarding the future direction of both the U.S. and global markets as a whole means predicting the direction for most stocks from a qualitative side is essentially impossible.

A raft of conflicting signals and economic indicators has clouded the outlook, which may in and of itself result in a slight slowdown in consumer spending.

Tax harvesting could see Estée Lauder shares decline further, as a less than stellar 2023 may lead some investors to cut the firm from their portfolio as the year winds to a close. Ultimately, I do not believe there is much upside potential in shares in the short-term.

In the long-term (2-10 years), I see Estée Lauder continuing to dominate the beauty industry thanks to their wide range of market leading brands continuing to earn the firm massive revenues and solid low double-digit growth.

Risks Facing Estée Lauder

Estée Lauder faces some tangible risks, primarily arising from their exposure to a cyclical consumer discretionary market environment.

Fundamentally, the demand for Estée Lauder’s mostly premium range of products correlates with the amount of disposable income consumers have and are willing to spend on the firm’s products. Recessionary, inflationary and higher-interest rate environments act to eventually decrease the ability and willingness of consumers to spend their income on discretionary, non-essential products.

Considering Estée Lauder’s overall transition to focus more on the luxury-end of the market, the firm’s revenues will become even more tied to overall macroeconomic performance, especially in times of contractionary monetary or fiscal policy.

While I do believe this strategy will ultimately strengthen the firm’s key brands and reputation among consumers, a real risk of comprised profitability and returns during times of economic hardship is highly likely.

Estée Lauder also must deal with constantly changing consumer tastes and preferences, along with the continuous emergence of new competitors within the beauty industry. The rapidly evolving consumer landscape means Estée Lauder must continue to innovate and develop their brand identities to ensure their reputations do not stagnate among consumers.

I believe the firm will continue to develop their own brands accordingly and further enhance their core portfolio of brands through strategic acquisitions of popular competitors.

While failed execution, poor brand development or a stagnating image could lead to a decrease in profitability, I believe Estée Lauder has an acute understanding of how to maintain popularity thanks to their decades of industry experience.

From an ESG perspective, Estée Lauder faces no particular risks or concerns in my view.

I believe the overall lack of material environmental, societal or governance concerns would make Estée Lauder a suitable pick for a more ESG conscious investor.

Of course, opinions may vary, and I implore you to conduct your own ESG and sustainability research before investing in the firm if these matters are of concern to you.

Summary

I believe Estée Lauder is the dominant beauty and cosmetics industry leader. Their massive portfolio of iconic brands, acute and conservative fiscal management along with a historic ability to continue growing revenues at a rapid pace have allowed the firm to strengthen their competitive position within the market.

Poor performance in FY23 and in Q1 FY24 has largely been due to a fundamentally weakened consumer environment as a result of the bearish macro pressure currently bearing down on economies across the globe.

While the recent 60% YTD selloff in shares has resulted in shares becoming very cheap from an absolute perspective, The Value Corner’s intrinsic value calculation suggests a modest 16% undervaluation is present at best.

Considering this mixed bag of fiscal indicators along with the uncertainty surrounding the timeframe in which Estée Lauder will begin to grow revenues again, I cannot advocate building a position in the firm.

Therefore, I issue a Hold rating at present time.

Read the full article here