Evolution Petroleum Corporation (NYSE:EPM) began as a secondary recovery player. The company has never operated anything, but instead depends upon partners to operate any project in which the company has a participation interest. The initial EPM acquisitions that I covered in the past were mature prospects that were essentially no growth or slow growth ideas that generated cash. Management then reinvested from time to time to grow production.

But that is beginning to change as the company now acquires prospects with some upside potential. That will move the company into (probably) the unconventional business that most investors associate with the oil and gas business. The base business of secondary recovery will still provide cash flow to grow the business.

Acquisition Announcement

This is now the third EPM acquisition that has acreage with some upside production potential with unconventional production. So far, management has not agreed (for example) for any new wells to be drilled on the North Dakota acreage because it has not made good economic sense to do so. The Pedevco Corp. (PED) project will have new production.

Now management has announced another acquisition of mature production with acreage that can be drilled for more production.

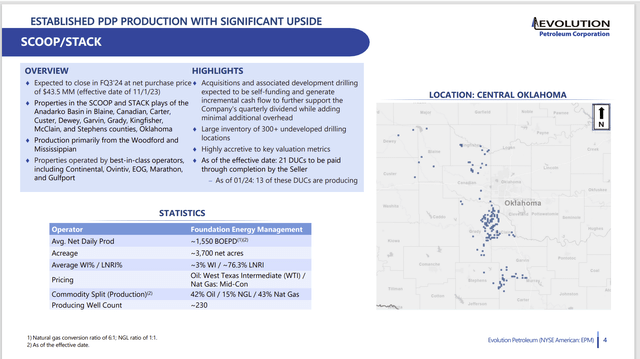

Evolution Petroleum Corporate Presentation Of The Latest Acquisition In Oklahoma (Evolution Petroleum January 2024, Corporate Presentation)

As is noted above, the properties feature well known operators. There are varying interests throughout the whole transaction. It is likely the largest acquisition the company has made since the investments to get the first project (Delhi) going.

The company is now large enough that the debt acquired should not be a major burden. In fact, this management does not like to use any more debt than it can quickly pay off. Usually that means being debt-free again within one year.

Unlike most acquisitions I cover, this is an area that not many buyers are interested in. The production is clearly older and has a low decline curve. But that production also has higher production costs because each well produces (on average) less than 10 BOED.

So far, the acreage acquired with the mature production has not been deemed to be commercial or sufficiently profitable. But this is likely to change as the company continues to grow. The purchases have sharply increased the company production and cash flow while maintaining one of the best debt ratios in the industry (usually mostly no debt). It does appear that management is looking to branch into unconventional production.

This company has a habit of purchasing properties before commodity prices go up. Timing is, of course, uncertain, as sometimes it takes a year or so. But investors can take this acquisition as a sign that at least one group of insiders sees higher commodity prices ahead. It should also be noted that there is a risk that insiders are wrong, and a downturn occurs.

Preexisting Operations

Evolution has long wanted to diversify away from the original Delhi project. That makes good business sense as the company grows. Originally, the Delhi project took a fair amount of attention and cash. Now, with Exxon Mobil (XOM) as the operator, there is a little less attention needed.

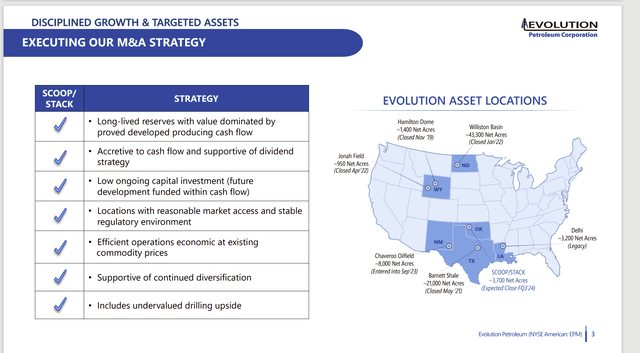

Evolution Petroleum Map Of Operations (Evolution Petroleum Corporate Presentation January 2023)

Evolution now actually has a majority of production outside of the original Delhi project. Acquisitions are becoming a steady business after a slow start.

In the future, I would not be surprised to see the company acquire an interest in some acreage that has unconventional or possibly conventional as its main objective. The lower breakeven point of these types of projects would benefit the company during commodity price downturns.

Secondary Recovery Business

As a purchaser of mature production that is well past the sharp decline curves of new production, this company has an easy job maintaining production (or rather its operating partners do). There is not that need to keep drilling and drilling as there is in the unconventional business. The whole cost structure may be unfamiliar to most investors.

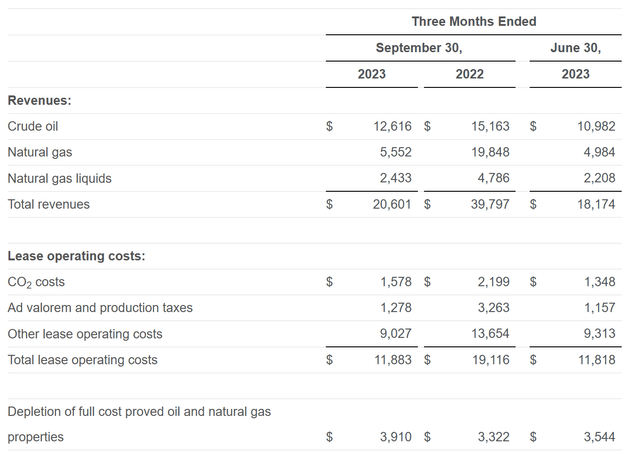

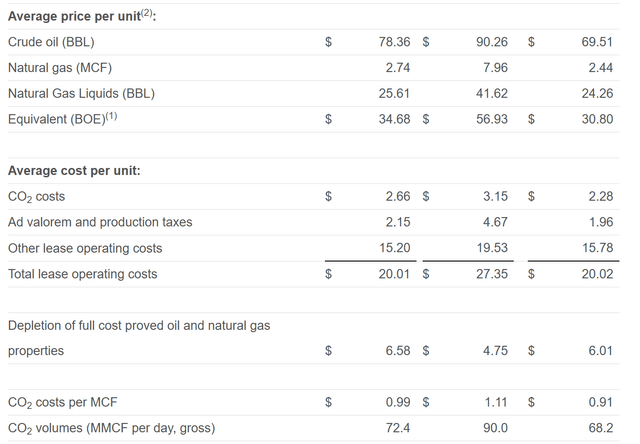

Evolution Petroleum Summary Of Revenues and Costs (Evolution Petroleum First Quarter 2023, Earnings Press Release) Evolution Petroleum Summary Of Per Unit Costs (Evolution Petroleum Earnings Press Release First Quarter 2024)

Probably the biggest difference between unconventional, conventional, and this type of business is the far lower depletion cost. That is because the profitable production is mostly gone. What is left is higher cost production and the structure needed to produce the oil has some age on it. So there will likely be higher maintenance costs as well.

Note that the total lease operating costs are “sky-high” when compared to the usual oil and gas business most investors spend their time looking for. Even though oil prices were reasonable, the combination of those costs and lower natural gas prices sharply decreased profitability from the previous fiscal year when natural gas prices were far higher.

To some extent, the lower depletion cost makes up for the higher lease operating costs. But the overall situation demands a very strong balance sheet with little to no debt “just in case.”

Note that the company pays for carbon dioxide. As has been mentioned throughout the industry, this type of operation is applying for the ability to be able to use tax credits for storing carbon dioxide. Should that happen, profitability could increase significantly for the secondary recovery projects as it counts as permanent carbon dioxide disposal or storage.

Summary

Evolution Petroleum has long been a specialist in an area with far less competition than most investors would believe to exist in the usual parts of the oil and gas business. The result has been the ability to grow by acquiring positions in several of these mature projects without having a lot of competitors bid up the price.

The downside of this strategy is that if the management ever wanted to sell their interest in these projects, they would run into the same lack of buyers that benefitted them when they purchased these projects.

For the time being, management evaluates the operator and only invests in projects that have a quality operator. Management’s track record is good. But there is always the risk of a future mistake or of a good operator going bad.

Still, shareholders benefit from the low personnel count of a management that essentially “cashes checks” while looking for more acquisitions. There is some oversight of the projects to be done. But it is nothing like actually operating these leases. The administrative part of this strategy is atypically low.

Shareholders should expect Evolution Petroleum Corporation management to continue to grow by acquisition with an eventual shift to more unconventional and conventional projects as the company grows in size. Management has found a great way for a small company to avoid a lot of competition while generating the cash needed to continue to grow.

That makes this company a very strong buy on the long-term strategy of continuing to grow along the lines noted above.

The debt-free balance sheet that will be low debt when the latest deal closes is a feature that reduces a lot of financial and business risk. Low and no debt companies frequently get all the chances they need to succeed. Whereas higher debt companies have far less flexibility and often have to succeed now (without second chances).

Management has some experience at growing and selling companies. But there are also key people whose loss would be a serious blow to the future of the company. One of the risks of investing in smaller companies is the potential loss of key personnel.

Altogether, though, Evolution Petroleum Corporation is one very profitable small company whose lower-than-expected risk makes the company suitable for a wide variety of investors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here