Dear readers/followers,

I last wrote about Evotec (NASDAQ:EVO) back in April of this year, after a reader asked me to take a look at German company Evotec, which also has a dual listing on NASDAQ under the symbol EVO. The question was about undervaluation. Despite going in at a “BUY” rating, I myself was not ready to buy or invest at that particular time, which I made clear in the very third point of that article, where I established my basic thesis for the company. You can find that particular article here.

So, in this article, I’ll provide you with an update on Evotec SE. Since the time in April, when I made it clear that I haven’t particularly exposed my portfolio to healthcare or pharma for this year, I haven’t actually changed this approach that much. My current exposure to the sector is significantly lower than it was in 2021. I don’t view the sector as unattractive, but I view other sectors as generally more attractive than I do pharma/healthcare.

Evotec’s appeal is based on both the current macro, what else is available, and most importantly, its valuation and upside. And despite a double-digit decline since my last piece, and an undeniable potential upside in the “right” situation, there continues to be the question of contextual appeal.

Let’s look deeper here.

Evotec SE – Upside from drug discovery and development

Drug discovery and development is my least-invested subs-segment in the entire pharma and healthcare sector. The reasons for this come down to the volatility of the process and the resulting finances. It’s a space where you can make a lot of money, and I know investors who have made their fortunes from this sector, but I know many who have lost significant amounts of capital in the sector as well.

Unlike investing in market-leading portfolio companies like Bristol Myers (BMY), you’re betting on the company’s ability to execute strictly in the discovery cycle – going from the screening of small molecules, extracts, or natural products to identifying substances with desirable therapeutic effects, and through processes like reverse pharmacology and the like discover new potentials and candidates for clinical trials. The trials are some of the last steps in a drug discovery company.

It doesn’t take a Ph.D. to understand that this is a capital-intensive process, and this is where much of the risk comes from. Back in 2010, which is now over 13 years ago, the cost of discovery of each new molecular entity, or NCE, was on average $1.8B – but there was a massive spread here, with some as high as $5.5B. It’s fair to say though given the current body of research on the subject, that this is a heavily-argued area. (Source)

So how good is Evotec at doing just that?

It’s so-so. Average.

This is not me saying this from any sort of malicious position, these are financial facts from the peer average in the Drug manufacturer segment.

I’m talking about the fact that the company’s 27.44% gross margin is one of the worst in the industry – only 19% have worse GM’s in the sector. The company also enjoys negative gross, net, and FCF margins, as well as negative RoE, ROA, and ROIC. All of these very basic financial KPIs indicate to us a company that, at least for the time being, is not doing too well.

EVO comes in at a cash/debt of 1.05x, which is decent, but a debt/EBITDA that is subpar. The company’s business model specifics, for 2022A, do not look all that great.

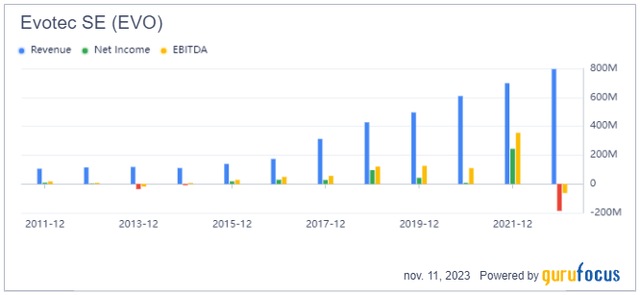

Putting some context into it, the problem for Evotec is relatively new. 2022 wasn’t a good year, but the company hasn’t had issues generating at least positive net income for some time.

Evotec revenue/net income (GuruFocus)

The company also still has plenty of cash on hand – it’s not in any sort of fundamental trouble, even if this last annual report marks it going deep into ROIC-negative to WACC territory.

The 9M23 results, which are the latest ones we have, go into some specifics. The company generated revenue growth at 14% 9M23 YoY, and EBITDA growth of 13%. Evotec claims continued good pipeline momentum, and the current action plan is on track, with a look back at the progress since 2009 as proof for the business. (Source: Evotec 9M23)

Evotec IR (Evotec IR)

And the company is certainly in no real fundamental danger, meaning bankruptcy or similar processes here. That is something I consider very unlikely at this time.

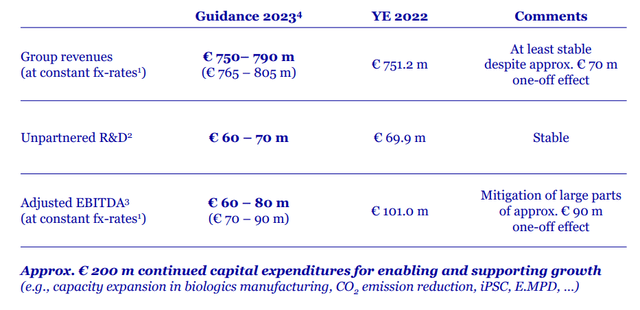

3Q23 was the first quarter in history where quarterly revenues exceeded €200M. That is a milestone. The company is ahead of its plan with a Sandoz-tech partnership. Equity is above 50%, versus an equity ratio of 31% in year-end 2022. The current indications for 2024E are good, and here’s both 2023E guidance as well as 2022 as a comparison.

Evotec IR (Evotec IR)

Evotec remains a company that’s working with the leading drug/pharma players in the entire market. We’re talking over a billion in booked revenues with over half of that already received upfront, and a milestone upside of €15B, with average royalty deals of 8-10%. This is based on over 140 product opportunities with the following partners.

Evotec IR (Evotec IR)

Again, saying that Evotec is a “bad” or “risky” company doesn’t really fly. The company may be riskier than other investments given what’s available today, but when it comes to drug research businesses, this is probably one of the best out there, that I would be open to investing in during the right position. That’s why I considered, and still consider the company to be a “BUY” here.

Evotec is a company in high demand, evidenced by the number of partnerships and sales volume, with an order book that’s already tripled and continues to grow compared to 2021. Evotec is, without a doubt, doing many things correctly. Its R&D is 18% faster (Source: Evotec IR) than the overall average market.

A few issues – the no-dividend is a bit of a deal breaker for me at times, but for Evotec given its business model and how its cash flow works, I can understand the company not paying one. Instead, the upside here continues to be based strictly on capital appreciation.

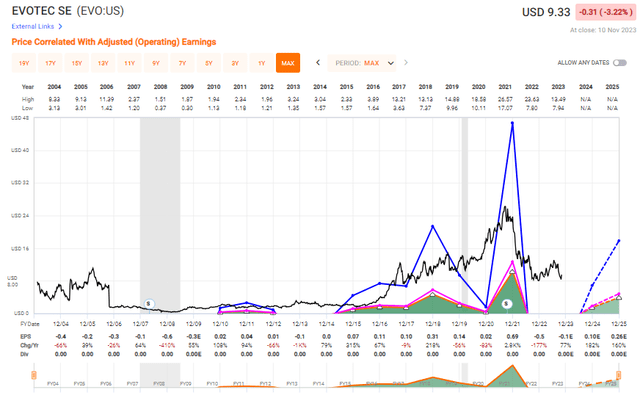

If you look even cursory at the company’s earnings, you’re presented with a pretty complex picture, which quickly makes it clear to you that evaluating this company using “standard” valuation processes is going to be a very tricky one.

Evotec valuation (F.A.S.T graphs)

I have been watching Evotec on the sidelines for new partnerships after it managed to extend its ongoing partnership with BMY, which was extended in March to encompass another 8 years. This is obviously a huge vote of confidence for this company.

However, one deal and one vote of confidence don’t necessarily give me enough of a reason to buy the company here. Evotec isn’t immune to input cost increases, inflation, labor, and other cost increases. We’ve yet to see in full how these materialize in this company’s business model, and what we can expect Evotec to do going forward. (Source: Evotec 9M23)

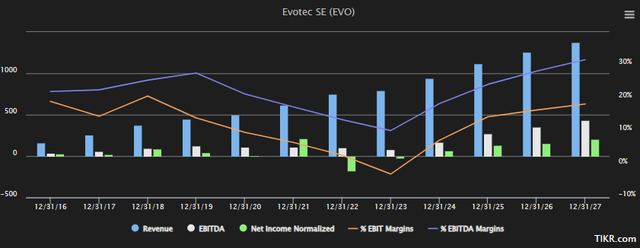

Estimates for the company are not necessarily positive, though the current estimates are for the company to turn the negative GAAP during 2024E, if not during 2023, which due to current projects and bookings will peak in 2025E, where we have an estimated GAAP profit of $1.14 per share (Source: S&P Global).

Other analysts point to declining margins and productivity as a reason to hold off on investing here – that is a valid view. However, I want to point out that every single estimate here, points to the company being in a trough, maybe until the end of this year, but will then see a higher upside.

Evotec Financial KPI’s forecast (S&P Global/TIKR.com)

If this turns out to even be remotely true, then this company will see a significant upside in terms of valuation as well.

Let’s revisit that crucial point – valuation.

Evotec – Upside continues to be high if normalization is in the books

In my last article, I called Evotec a “spec buy” with good quality. However, any sort of standard valuation approach does not work here. The company is trading hands at a current normalized P/E of negative 52x, with zero dividend yield, no real credit rating, a market cap of $3.4B and other issues. Instead, we have to look at the margins both historically and forward, and as I said in my previous article, you have to take a bit of a leap of faith here.

This is what it comes down to as my problem when investing in businesses like this. If we see a reversal to valuation levels that the company enjoys during good years, this would imply 100-200% RoR. Obviously, that’s a superb return. But timing and likelihood of this become very dicey when we’re lacking what we usually have – solid financial, forecastable KPIs.

Comps differ depending on what you look at. Some put EVT in the Life Science/Tech sector, which puts it alongside businesses like Lonza Group (OTCPK:LZAGY), Samsung Biologics, Eurofins Scientific (OTCPK:ERFSF), Syneos Health (SYNH), and others. But it can also be compared to generic drug manufacturers, which would include companies like Merck KGaA (OTCPK:MKGAF), Zoetis (ZTS), Takeda (TAK), Haleon (HLN), and others. My choice in this sector, which I actually invest in, is Merck KGaA – which I recently reviewed. It’s not a “small fish”, and I believe size equates to safety here.

I’ll be clear in saying Evotec is attractive. It also needs to be attractive in context to what else is available – and I would say that in this market, there are so many alternatives that are not just good, but also come at triple-digit potentials, much like Evotec.

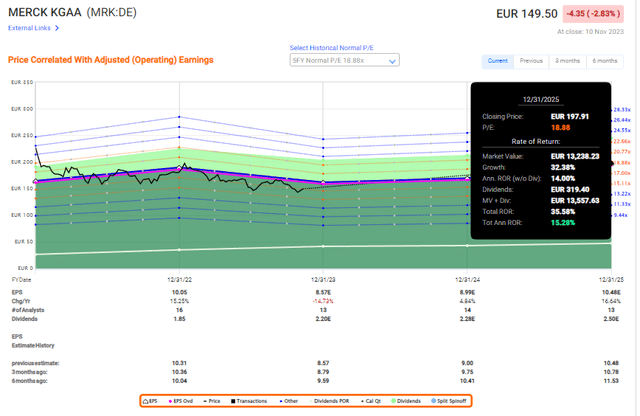

However, I believe that Merck is the current better investment, with the following conservative upside.

MRK upside (F.A.S.T graphs)

When I can buy A-rated drug/pharma companies with a discovery wing with a yield at this valuation and upside, or go the “risky” avenue, I elect to go Merck KGaA. You may be the risk-taking type with more appetite for this sort of up and down – then Evotec is a good pick because the upside potential here is massive.

But this is my current thesis on Evotec.

Thesis

- Evotec is an attractive company in the medical/drug discovery field. It has an attractive pipeline, decent fundamentals, and a growth rate not matched by many companies in either the sector or the market, having grown from less than €100M to potentially over €1.3B in this coming fiscal in terms of revenues, updated for November 2023.

- However, plays like this are risky – and my risk tolerance at this time is limited. I view it best to err on the side of safety and pick history and quality in these sectors, with predictability. For now, that is not Evotec.

- The company is a theoretically attractive speculative “BUY” with a price target of €25/share for the native – but that is as high as I am currently willing to go. For the Nasdaq ticker, as of November of 2023, that’s around $13.4/share.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Three out of five is not good enough for a conservative investment, but it’s good enough for a “spec buy” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here