Shares of Federal Realty (NYSE:FRT) have not been immune from the impact of rising rates on the real estate sector with its shares down by about 14% over the past year. This comes despite the fact that FRT has raised its dividend 56 consecutive years—the longest such streak in the industry. Given that track record, I certainly cannot criticize any investor for continuing to hold shares, but perhaps in part due to its stellar track record, FRT trades at a premium valuation, which likely limits upside and makes shares less attractive going forward.

Seeking Alpha

In the company’s third quarter, Federal generated $1.65 in funds from operations (FFO), which beat estimates by $0.03 as revenue rose 5% from last year. Alongside these results, it has tightened guidance towards the top end of its previous range, at $6.50-$6.58 from $6.46-$6.58. At the midpoint, this represents 3% growth from last year.

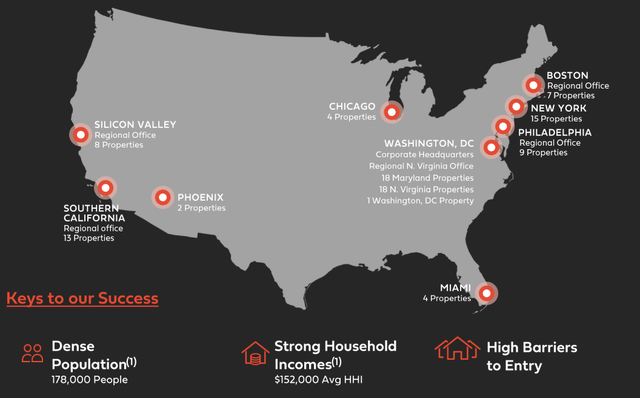

Federal Realty primarily focuses on retail shopping centers, owning 102 open-air properties. It operates in the primary suburbs of America’s largest metropolitan areas. This gives the company exposure to relative dense populations with high incomes. That helps to provide some insulation to recession as higher-end consumers are more likely to stay employed and have excess savings during downturns.

Federal Realty

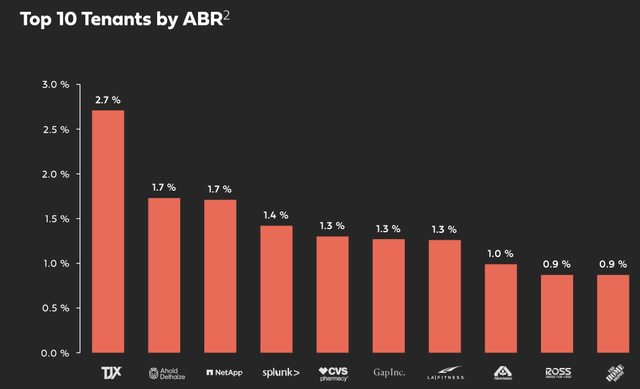

While it operates across several markets, Washington DC suburbs are its primary focus with 32% of its rents coming from this area. With the federal government an anchor employer, it also has less cyclical exposure, and it is home to some of the highest-earning counties in America. FRT has a premiere real estate footprint, which is why it has been such a steady dividend grower. This strong footprint has also made its properties very attractive to retailers who want stores in high-earning areas with dense foot-traffic. As such, FRT maintains a diverse base of leading retailers

Federal Realty

As of Q3, FRTs real estate was 92.3% occupied and 94% leased with a 100bp headwind from Bed Bath and Beyond’s liquidation. It is already beginning to reoccupy these spaces with $17 million of potential rent upside next year as these are filled. While results are taking a modest hit currently from this drop in occupancy, replacing Bed Bath will be a medium term positive for two reasons. First, in the quarter, FRT leased 553,000 square feet at an 11% gain to prior leases, across all properties. As it re-leases empty BBBY space, it should see superior cash rents. Further, as the company struggled, Bed Bath became a weight on centers.

Anchors typically pay substantially less (often just half as much) rent per square foot as small stores. This is because anchors are supposed to provide value to the center by driving foot traffic, which then causes shoppers to go into other stores, thereby supporting the business of smaller stores. However, as Bed Bath declined and brought in less and less foot traffic, these centers become less attractive to all other retailers. Replacing them with better-performing retailers like TJX (TJX) should provide a halo effect that boosts the entire center.

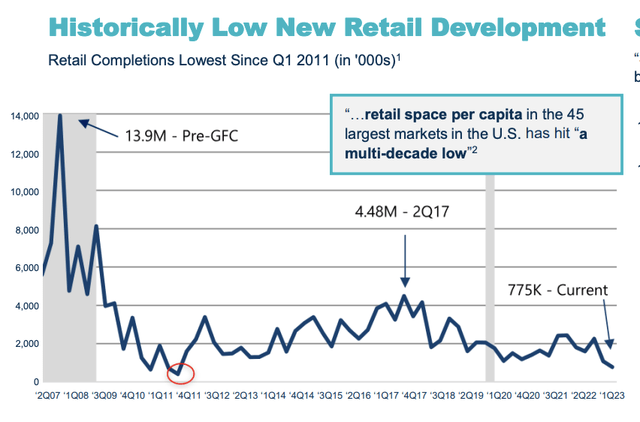

While BBBY reduced occupancy, we did see strength in more lucrative small shops, which are 90.7% leased, up 80bp from last year. This speaks to strong demand for FRT’s space, given their prime locations. Additionally, there has been virtually no new construction of new retail space—it is down 80% from 2017. In legacy cities, there is even less available space, making new construction difficult. This tight supply is helping to support prices. Because of favorable mix shift and strong re-leasing gains, comparable property income rose 3.8% from last year.

Kimco

While FRT is primarily a retail REIT, it does have some other exposures as several of its properties are “mixed-use. These are centers where there is retail on the first floor and apartments or office space above retail space. This has been a particularly popular format to attract younger renters in suburban areas who want to be in the suburbs but also have walkable amenities.

FRT has 3,100 residential units, and they are 97.8% leased, a strong level indicative of the desirability of its properties. Multifamily rentals account for 13% of the business. In the near-term, a surge in supply has caused apartment rents to turn negative. As such, we may see results slow here in the next year. However, over the longer term, I do view this exposure favorably, given the structural shortage of housing, which I have discussed when analyzing apartment REITs.

On the flip side, FRT also has some office space, which accounts for about 10% of base rent. Given hybrid and remote working, office space does face significant secular challenges, though suburban office may be better positioned than central business districts, given shorter commute times, and more exposure to customer-facing services, like medical care and financial advisors. Still, this exposure does pose some longer-term risks. In the near term though, I have limited concerns,

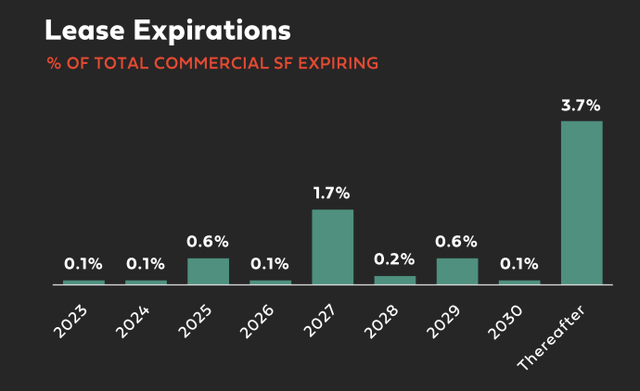

This is because its office space is 96% leased for 7 years on average. Office leases tend to be long-dated, so even if space is under-utilized by customers, they have to keep paying rent every month. Less than 10% of its office space renews over the next three years, which accounts for less than 1% of total FRT square footage. If this unit shows declines, it will be extremely gradually with the first major risk point in 2027.

Federal Realty

Essentially, office will be quite stable over the next year or two while residential may show some weakness, and then beyond that, I would expect to see strength in residential while office shows some weakness. Given these exposures are similarly sized, they likely broadly offset and should be fairly stable in aggregate.

Given higher interest rates, FRT has said it is looking at “modest” levels of asset sales as ways to access capital for redevelopment activity rather than borrow. These two units could be sources of capital, either via outright sales or joint venture activities. Higher rates are a headwind for most business, but FRT is fairly well positioned given its solid investment grade balance sheet. Interest expense rose by 20% to $42 million as debt rose by $120 million. FRT has 6x net debt to EBITDA with a mid-5x leverage ratio next year as it retains free cash flow.

Currently, FRT has a $4.36 dividend for a 4.71% yield with a 1.5x coverage ratio. This is a solid coverage level, which should allow FRT to grow its dividend alongside growth in FFO. Next year, assuming broadly flat residential rents, I would expect property growth to be 3-4% with a modest headwind from interest rates for about 3% FFO growth. Shares trade at about 14x FFO vs about 11x for Kimco (KIM) and Brixmor (BRX). Given its history and assets, I understand why FRT has commanded a premium valuation. But given the valuation, its medium term-return potential (dividend yield + dividend growth) is around 7-8% vs 9-11% for KIM and BRX, which likely limits its upside. Given the tight supply in retail space and strong re-leasing environment, I would rotate out of FRT into KIM or BRX.

While it looks relatively expensive, I do not see clear downside, absent a very significant recession or further shock up in rates, and I expect FRT to continue with modest dividend increases. As such, I view shares as a “hold,” not a short. It is a good company that simply has a full valuation, creating better opportunity for investors elsewhere.

Read the full article here