It is quite rare for me to find a company where the end result is me sitting on the fence between rating it a “buy” and a “strong buy.” But one company that I have come across that forces me to straddle those two ratings is Financial Institutions, Inc. (NASDAQ:FISI), a very small bank with a market capitalization of $263.4 million as of this writing. Although the company is not perfect, it is trading at very low multiples, both relative to earnings and book value. At the end of the day, I did decide to settle with a “buy” rating. But if we see two changes come through the pipeline, that picture could change for the better.

A very attractive bank

According to the management team at Financial Institutions, the bank is a rather small player with 49 branches spread across the 14 contiguous upstate New York counties and additional loan production offices in the Mid-Atlantic and central New York regions of the state. Although this is the physical footprint of the bank, some of its locations fall under different names than others. And this is because the company’s operations are really split between five different subsidiaries. The first of these is Five Star Bank, which operates 48 full-service banking offices and which provides a wide array of deposit services and loan products for its customers.

But there are other operations that the institution has. Another one of its subsidiaries is SDN Insurance Agency, LLC. As its name suggests, this is an insurance agency and it sells, on behalf of the company, personal insurance lines such as automobile, homeowners insurance, boat insurance, landlord insurance, and other offerings. It even provides certain financial services products such as life and disability insurance, Medicare supplements, annuities, mutual funds, and more. Its Courier Capital, LLC subsidiary operates as an SEC-registered investment advisor and wealth management firm that offers up investment counseling, retirement plan services, and other similar activities to its customers. HNP Capital, LLC is another SEC-registered investment advisory and wealth management firm that provides the same kind of services as Courier Capital does.

Next in line, we have Corn Hill Innovation Labs, LLC. This was actually set up back in 2021 to manage a joint venture that the company has with Alloy Labs Alliance to launch an open network for peer-to-peer payments for consumers and small businesses. And finally, there is Five Star REIT, Inc. This is a small REIT that holds residential mortgages and commercial real estate loans on behalf of the company.

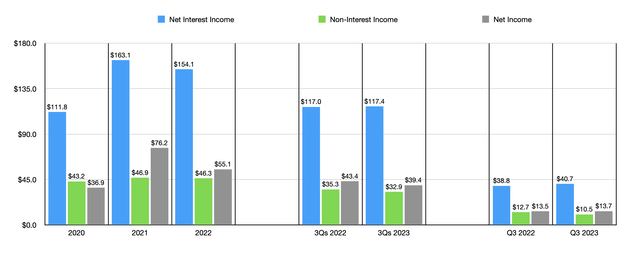

Author – SEC EDGAR Data

Over the past few years, the financial picture for Financial Institutions has been a bit lumpy. As you can see in the chart above, net interest income jumped from $111.8 million in 2020 to $163.1 million in 2021. But then, in 2022, it pulled back slightly to $154.1 million. A similar trend can be seen by looking at both non-interest income and net profits for the company. But in the case of net profits, the movements higher and lower were more severe. This year, we are seeing a bit of weakness. While net interest income in the first half of the year managed to come in higher than it was last year, both non-interest income and net profits decreased compared to the same time last year.

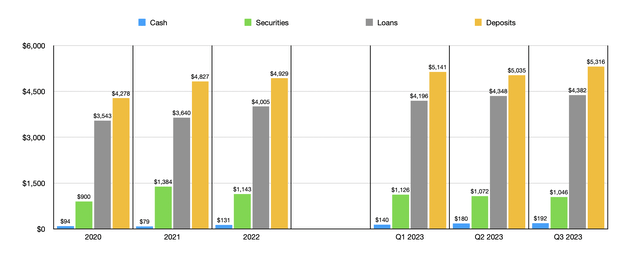

Author – SEC EDGAR Data

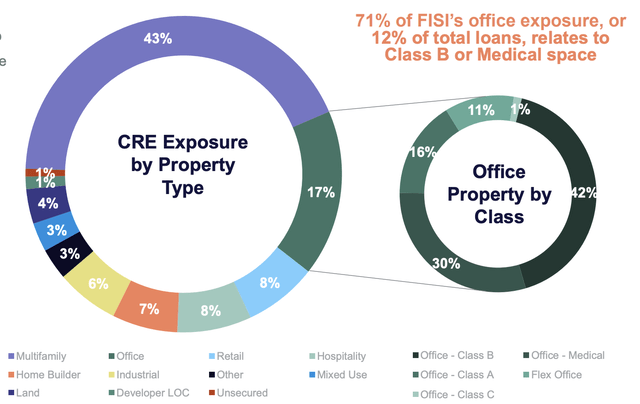

Despite this volatility, the overall trajectory for the bank from an asset perspective has remained positive. The value of loans that it has, for instance, grew from $3.54 billion in 2020 to $4.01 billion in 2022. We have seen continued upside so far this year, with the value of loans climbing further to $4.38 billion by the end of the third quarter. I do understand that one area that investors are worried about involves exposure to office properties. The good news on this front is that 17% of the company’s commercial real estate loans, by value, fall under the office category. But as a percentage of total loans, this drops to 6.8%. While not the lowest that I have seen, it is quite low as far as exposure goes.

Author – SEC EDGAR Data

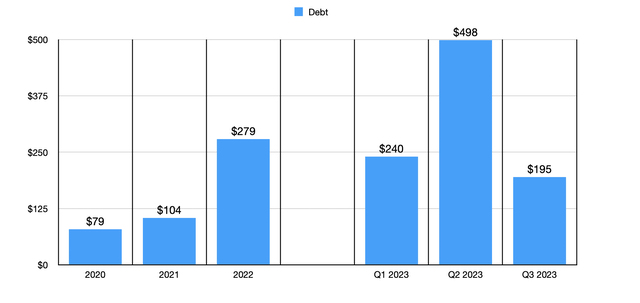

There are some other metrics that should be paid attention to. The first of these would be the value of securities. These have actually jumped quite a bit from one random point to another. For instance, after rising from $900.1 million in 2020 to $1.38 billion in 2021, the value dropped to $1.14 billion last year. By the end of the most recent quarter, they had fallen further to $1.05 billion. Meanwhile, the value of cash on the company’s books has largely risen over time, growing from $93.9 million in 2020 to $192.1 million today. And this occurred at a time when debt first rose and then subsequently fell. In 2020, debt totaled $78.9 million. This peaked at $498.4 million in the second quarter of this year before falling precipitously to $194.5 million by the end of the third quarter.

Author – SEC EDGAR Data

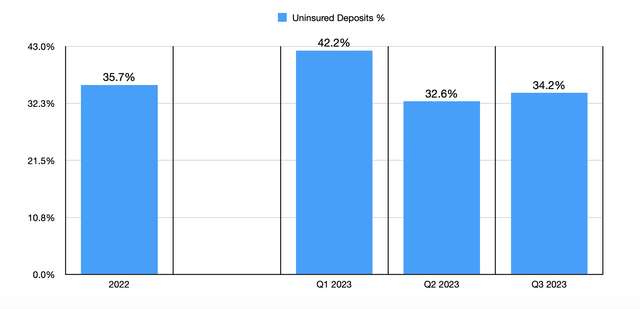

The overall growth in the value of loans that the institution has experienced has only been made possible by a growth in deposits. These expanded from $4.28 billion in 2020 to $4.93 billion in 2022. Even though there were concerns about a banking crisis, we only saw a modest drop from $5.14 billion in the first quarter of this year to $5.03 billion in the second. But this was short-lived, with the value of deposits hitting an all-time high for the bank of $5.33 billion by the end of the third quarter. Perhaps the only negative on this front is that 34.2% of the company’s deposits, by value, are classified as uninsured. This is a bit higher than the 30% maximum that I prefer to see. But it is fairly close so as to justify a bit of wiggle room.

Author – SEC EDGAR Data

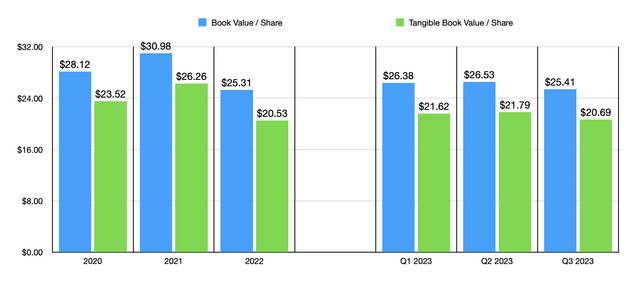

In terms of valuing the bank, the process is fairly straightforward. On a price-to-earnings basis, shares are trading at a multiple of 4.8. This is actually lower than almost any of the other banks that I have seen this year. Many of them fall in the 6 to 9 range, With some even higher than that. The other way is to compare the price of the stock to its book value per share. Right now, shares are trading at a 33.9% discount to book value and at an 18.8% discount to tangible book value. Both of these are very attractive and they suggest that risk for shareholders is not terribly significant.

Author – SEC EDGAR Data

Takeaway

Based on the data provided, I would argue that while Financial Institutions have a less than perfect track record, it is an appealing prospect to consider. Shares are cheap in multiple ways and management has resumed growth of deposits. This is all excellent to see. In fact, shares are so cheap that I was very close to rating the company a “strong buy.” But for as long as uninsured deposit exposure remains above 30% and until the company can demonstrate consistent revenue and profit growth, I would argue that a very solid “buy” rating makes a bit more sense right now.

Read the full article here