Introduction and Investment Thesis

GitLab (NASDAQ:GTLB) is the pioneer of The DevSecOps (a portmanteau of “development,” “security,” and “operations”) platform that enables its customers to develop, secure, and operate software in a single application. In 2023, the stock performed at par with the Nasdaq 100. While the company delivered revenue growth of 33% in Q3 FY24, driven by a stronger growth rate in its $100K+ customers and deeper adoption of its “Ultimate” pricing tier, as well as improving its overall profitability, I believe that the stock is trading at a valuation where it’s future growth is fully priced in. Along with that, I also believe that the company may continue to see dampened effects from longer sales cycles in the SMB space as macroeconomic uncertainties persist as well as rising competitive pressures from larger players such as Microsoft (MSFT), Amazon (AMZN), and Google (GOOG) as they bring their own development tools to the market.

Given the above, I would rate GitLab a Hold at the moment.

About GitLab

GitLab has pioneered The DevSecOps Platform, a single application that brings together development, operations, IT, security, and business teams to deliver desired business outcomes through efficient software development from planning to production to security.

They have a three-tiered subscription-based pricing structure. They offer a free tier to encourage broad-based adoption by organizations and teams of all sizes to use the DevSecOps platform. They also offer two paid subscription tiers, with a monthly list price of $29 for Premium and $99 for Ultimate, which are more relevant to managers, directors, and executives.

As of March 2023, GitLab has 30M registered users, and more than 50% of the Fortune 100 companies are GitLab customers. As of Q3 FY24, they had 8100 customers with Annual Recurring Revenue (ARR) of at least $5000, which grew by 26% on a YoY basis. Customers with at least $5000 in ARR represent 95% of their total ARR, as per their latest earnings report.

The good: Strong revenue growth, Increasing adoption & Improving profitability

GitLab beat expectations on both the top and bottom lines by 5.6% and 1000%, respectively, as of the Q3 FY24 earnings report. Revenue grew 33% to $150M, while non-GAAP operating margin saw significant improvement from -19% in Q3 FY23 to 3% in Q3 FY24. The growth rate in revenue was spearheaded by customers contributing $100K or more in revenue, which grew 37% YoY. At the same time, GitLab continues to see strong adoption of their Ultimate Tier, which now represents over 50% of ARR booking as of Q3 FY24, as per their CFO, Brian Robins.

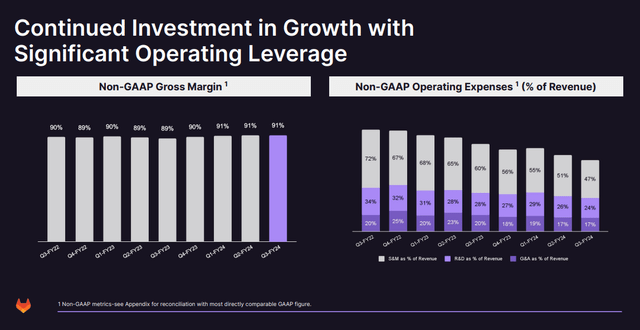

Meanwhile, the expansion in non-GAAP operating margin was accomplished by streamlining operating expenses YoY, especially Sales & Marketing that dropped from 60% of Revenue in Q3 FY23 to 47% of Revenue in Q3 FY24. Meanwhile, R&D Spend as a percentage of Total Revenue also fell 4% points YoY. While this showcases that the management is reprioritizing its overall profitability, the decline in R&D spend relative to revenue could spell trouble down the line as competitive forces are fierce, in my opinion.

Q3 FY24 Earnings Slide

In addition, GitLab saw its Remaining Performance Obligations (RPO) grow 40% YoY, compared to 34% last year. RPO is a good forward-looking metric to assess the growth trajectory of the company. In GitLab’s case, this is driven by an improvement in overall customer adoption, as its Net Revenue Retention Rate (NRR) grew 128% in Q3 FY24 compared to 124% in the last quarter.

Shifting gears to FY24 guidance, management expects revenue in the range of $573–$574 million, which translates to a YoY growth rate of 35%. It expects to produce a non-GAAP operating loss of -$9.5M, representing a growth of 90% YoY, with an expansion in the margin from -21% to -1.6%.

While the company operates in a large TAM of $40B, as outlined in their latest earnings call investor presentation, coupled with an improved focus on increasing profitability, I believe that the stock’s valuation is fully priced and offers no upside amidst an environment where macroeconomic uncertainties could escalate and competitive threats strengthen.

The bad: Lengthening sales cycle, Increasing competitive & an Unattractive valuation

Macroeconomic uncertainties may continue to lengthen the sales cycle

As per their latest earnings call, management noted that their overall sales cycle has lengthened. This is driven by the mid-market and the SMB segment, where customers are cautious about spending amid uncertain macroeconomic conditions. While the company has navigated the environment well to deliver strong revenue growth as the enterprise segment has stabilized, weakness in the SMB market could spell trouble for GitLab’s revenue trajectory.

The longer interest rates remain high, the greater the risk of debt defaults, as more and more companies will need to refinance their debts at higher interest rates. I believe that the full impact of the tightening cycle on the SMB market is yet to be fully realized, and as a result, spending is going to be muted in this target market until there is further clarity around the timing of interest rate easing plans.

Growing competition may dampen GitLab’s growth prospects

Perhaps the strongest threat, GitLab faces is from the extremely competitive DevOps industry that it operates in. There are many constituents in the DevOps software market that battle for market share, some of which benefit from having years of experience and resources at hand. One of GitLab’s biggest competitors, GitHub, was acquired by Microsoft in 2018 to bring Microsoft’s own development tools to market. There are also niche products from Google Cloud Platform and others such as AWS and JetBrains that focus more on features such as Cloud Development, Continuous Integration and Continuous Delivery/Deployment (CI/CD) and Artifact Registry.

Moreover, as AI became ubiquitous in the world of software, DevOps platforms such as GitLab were suddenly faced with the risk of getting disrupted if they were unable to keep up with the pace of innovation. For example, last year, Microsoft’s GitHub announced the launch of AI-enabled features such as GitHub Copilot, which helps programmers suggest code completion, ensuring higher workforce productivity. If GitLab does not keep up with the pace of innovation, I believe it may face the risk of losing market share.

GitLab’s valuation provides no upside

Taking consensus expectations for FY25 revenue and earnings expectations into consideration, the stock is trading at a forward price-to-earnings multiple of 195 and a forward price-to-sales multiple of 14.

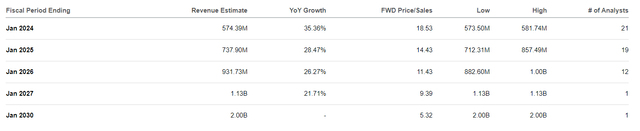

As the company management has not provided a long-term operating model for revenue and operating income targets, I will base my valuation of GitLab on my revenue growth estimate, which I believe should grow in the mid-20’s range over the next 3 years as the company continues to drive adoption for its Ultimate tier over the coming years amongst its Enterprise segment. As a result, I believe the company should be able to generate approximately $1.12B in revenue by FY27. This is also in line with consensus estimates, as per Seeking Alpha.

Seeking Alpha Consensus Estimates for Revenue Growth

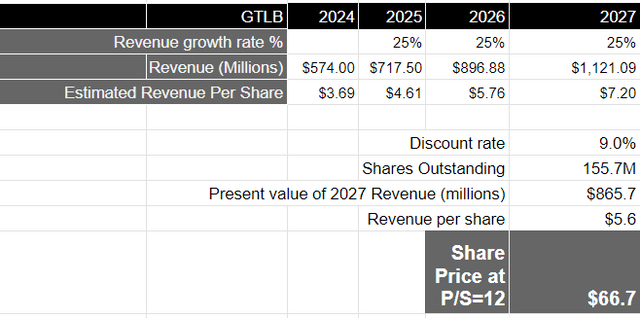

This translates to a present value of $865B in revenue when discounted at 9.0%, or a revenue per share of $5.6. Taking the S&P 500 as a proxy, where its companies grow their revenues at an average rate of 4.8% with a price-to-sales ratio of 2.19, that would mean that GitLab should be trading at 5.5–6x the forward price-to-sales ratio of the S&P 500 when linearly extrapolating GitLab’s revenue growth rate. That would translate to a forward price-to-sales ratio for GitLab of 12, which would mean that its stock should be trading at approximately $66. The stock is currently trading 3% over that, which would imply that the expected future growth of the company is fully priced into the stock price, which leaves little to no upside from current levels.

Author’s Valuation Model

Conclusions

While the company is operating in a large TAM with management showing commitment to driving profitable growth, the macro headwinds coupled with the overall competitive landscape pose a threat to GitLab’s long-term growth trajectory. Most importantly, its valuation is not providing an attractive entry point given its projected growth rate over a 3-year investment horizon to justify the risk-reward. Over the coming quarters, I will be monitoring the overall trend in growth rate of its $100K+ customers and its penetration in its Ultimate Tier to assess my thesis. But for now, I will be staying on the sidelines.

Read the full article here