Global manufacturing business conditions worsened for a fifteenth successive month in November, according to the latest JPMorgan Global Manufacturing Purchasing Managers’ Index™ (PMI™) compiled by S&P Global. The headline PMI – a composite index based on five survey variables – registered 49.3, up from 48.8 in October but remaining below the 50.0 no change level to merely indicate a moderation in the pace of decline.

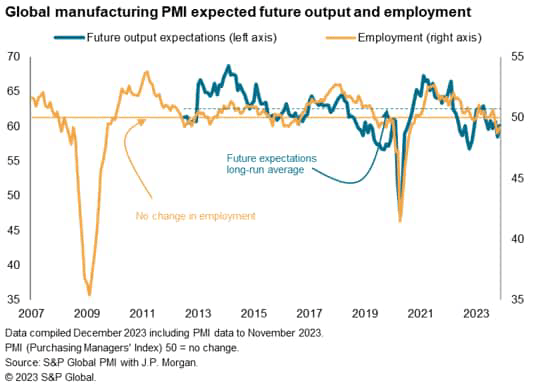

Production continued to edge lower in response to a further deterioration in order books. The latter also contributed to a further month of subdued confidence about the outlook, prompting producers to cut employment for a third month running. This represents one of the worst global job market performances since the global financial crisis.

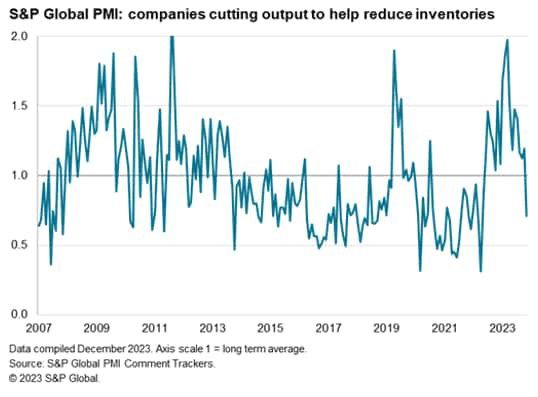

Firms also continued to cut back their input buying, though November saw some easing in the recent drag on output from cost-cutting related inventory reduction policies, which will potentially provide some support to production in the months ahead if sustained.

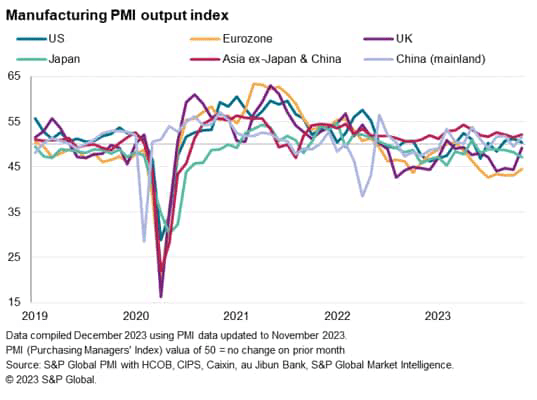

Europe continued to see the steepest downturn, with output also falling in Japan, though production returned to growth in mainland China and showed signs of stabilising in the UK. Modest growth was again meanwhile recorded in North America, including in the US. By far the strongest performance, however, was recorded once again in India.

Global factory output edges lower again in November amid further demand fall

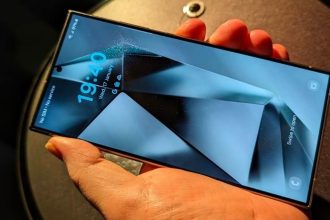

Global manufacturing output fell for a sixth consecutive month in November, according to the latest PMI surveys compiled by S&P Global and sponsored by JP Morgan, though the decline signalled by the survey’s production index was only very marginal and the weakest seen during the recent downturn.

Output has only risen globally in just four of the past 16 months, reflecting a post-pandemic shift in spending from goods to services and subdued spending amid higher prices and increased interest rates, but recent months have seen only very modest declines.

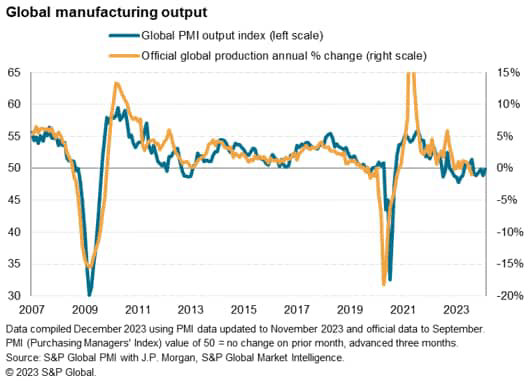

A key factor preventing a steeper decline in production has been the fulfilment of backlogs of orders, accumulated during the pandemic-related supply shortages. Such shortages have eased considerably during 2023, facilitating higher output. Backlogs of work have consequently now fallen for 17 consecutive months.

A growing concern among manufacturers, however, has been a continual decline in inflows of new orders over the past 17 months, which means order books are becoming increasingly depleted.

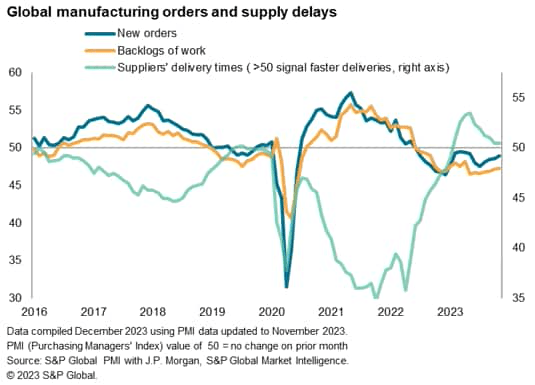

Global trade flows remain especially weak, with new export orders for goods falling globally for a twenty-first straight month in November, representing the worst spell for exports since the global financial crisis barring only the initial pandemic lockdowns. While the rate of decline in exports moderated to the slowest for seven months in November, the rate of contraction remained marked by historical standards.

Gloomy prospects drive job losses and cost-cutting

The sustained downturn in demand signalled by the survey contributed to a further gloomy outlook for the year ahead among manufacturers. Although business expectations lifted from October’s recent low, the level remained well below the survey’s long-run average.

This downbeat mood led to a third successive month of falling employment in the manufacturing sector worldwide, as firms sought to adjust operating capacity lower in line with demand. Although the pace of job losses eased slightly in November, the past three months have seen the average payroll reduction exceeded since 2009 only by that recorded the early pandemic months.

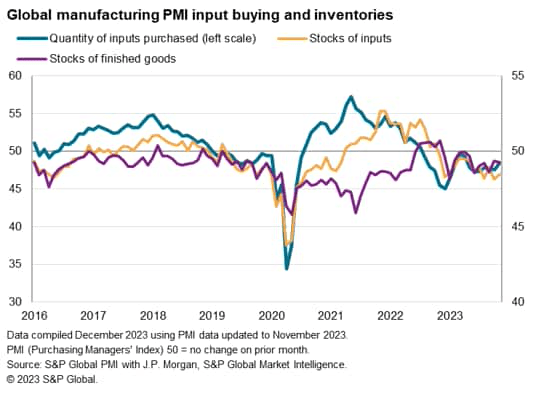

Similarly, manufacturers continued to focus on reducing their purchases of inputs, and ensured further cost savings through the running-down of inventories of both inputs and finished goods.

Inventory cycle turning

There are some glimmers of better news, however, notably through the survey data on inventories, especially those of inputs and raw materials. Although still declining, manufacturers’ purchasing of inputs fell at the slowest rate for seven months in November.

At the same time, analysis of anecdotal evidence collected in survey responses (which powers our PMI Comment Tracker dataset) shows a marked fall in the number of companies globally that are cutting output deliberately in order to reduce inventories.

As such, the data therefore hint at a shift away from inventory reduction policies and an easing in the accompanying drag on global manufacturing production, which appears to have helped lift some of the survey gauges in November.

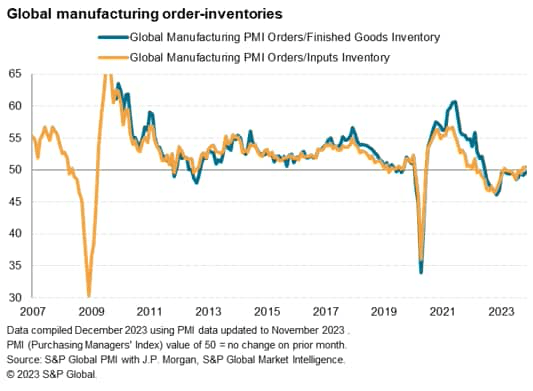

A shift to the inventory cycle becoming more supportive to growth is likewise hinted at by the survey’s order-to-inventory ratio, especially in terms of orders relative to inventories of inputs. However, it is clear that any such inventory-led growth stimulus remains very modest, reflecting the fact that, although inventories of inputs are becoming more depleted compared to the high levels accumulated during the pandemic, the need to replenish stock remains low amid the ongoing downturn in final demand.

Eurozone continues to report sharpest decline

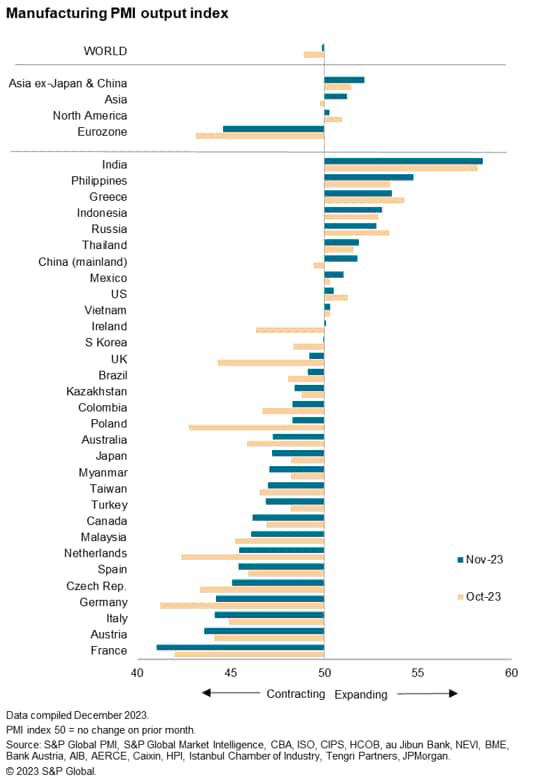

Drilling down geographically, only 11 economies monitored by the S&P Global PMI surveys reported higher manufacturing output in November while 20 reported lower production.

By broad region, the eurozone once again reported by far the sharpest downturn while Asia returned to growth after briefly slipping into contraction in October. North American production continued to grow marginally.

In more detail, the seven fastest-contracting manufacturing economies were all found in Europe, with France replacing Germany as the worst performer. The UK notably saw a near-stabilisation of production, and output in mainland China revived after slipping into contraction in October. Downturns meanwhile eased in South Korea and Taiwan, but deepened in Japan.

In terms of the best performers, the strongest output gain continued to be recorded in India, where an ongoing production boom far outpaced all other economies covered by the S&P Global PMI surveys, followed by the Philippines, Greece and Indonesia.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here