The Global X Genomics & Biotechnology ETF (NASDAQ:GNOM) offers exposure to companies innovating in the field of genomic science covering techniques such as gene editing, DNA sequencing, and genetic therapy. The attraction here is an expectation that genomics will revolutionize medicine through tailored treatments that target identified proteins that cause underlying disorders.

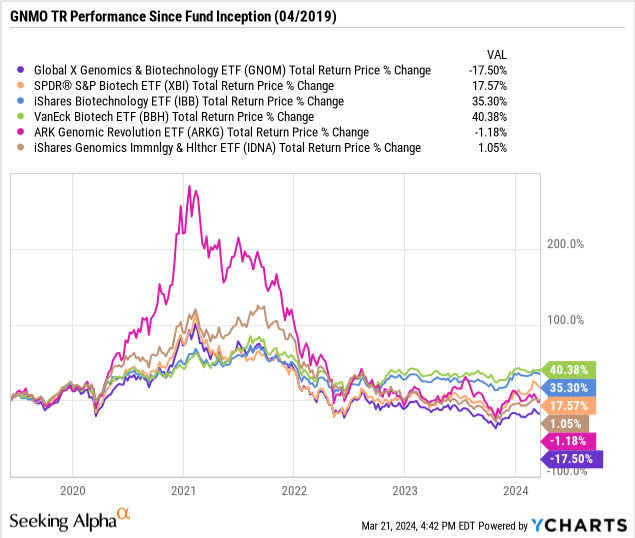

At the same time, while significant advancements in genomics have been made in recent years, the broader theme has failed to translate into major gains for related stocks. Indeed, GNMO has lost value since the fund’s inception date in 2019, underperforming a peer group of Biotech ETFs.

In our view, Genomics remains a technology of the future that is still missing its breakout moment or blockbuster application to kickstart investing momentum in this side of biotech. Certain companies in the group have a stronger outlook than others, but we expect the GNMO ETF to remain volatile.

What’s Next For GNMO?

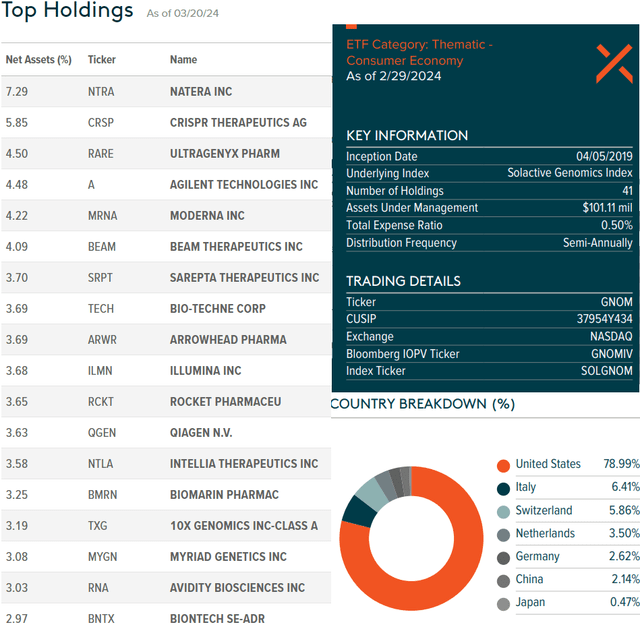

GNMO is intended to track the “Solactive Genomics Index”. According to the methodology, U.S. and foreign stocks classified as in the healthcare sector and generating at least 50% of their revenue from genomics or biotechnology are eligible for inclusion. There is also a $200 million minimum market capitalization requirement.

Companies are screened through an algorithm that identifies connections to the field of genomics and related activities from online publications and financial filings, assigning each stock a score based on its relevancy.

From this group, the 40 highest-ranking companies are determined as the final index constituents and GNMO holdings. The weightings are based on each stock’s free float market capitalization with a max weight of 4% for any individual stock and 0.3% minimum. Adjustments are made over a semi-annual rebalancing schedule.

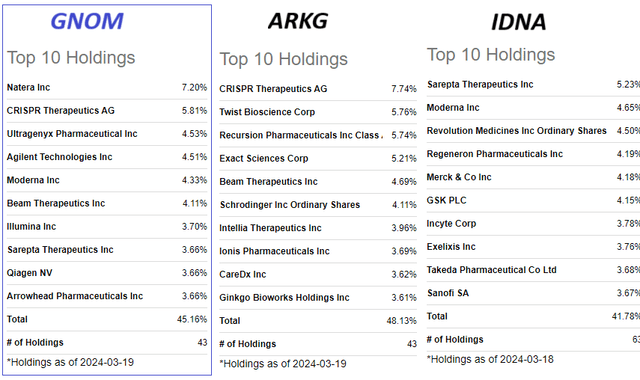

Going through the GNMO portfolio, top holdings include names like Natera Inc (NTRA), CRISPR Therapeutics Ag (CRSP), Ultragenyx Pharmaceuticals (RARE), Agilent Technologies Inc (A), and Moderna Inc (MRNA).

The takeaway here is that from leaders that could be considered a “pure-play” on genomics such as CRSP, the fund has a broader exposure to some more diversified biotechs consistent with the fund name. There is also a global profile with around 21% of companies based outside the U.S.

source: Global X

GNOM Performance

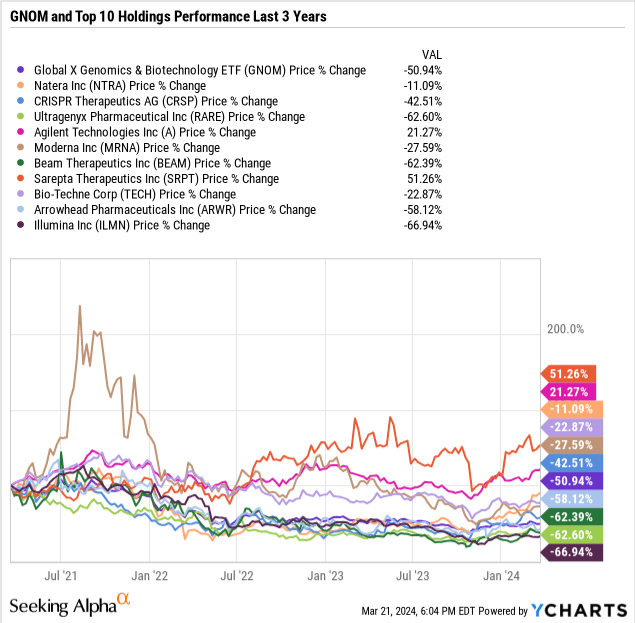

We mentioned the poor historical performance of GNOM which has lost around half its value over the last three years. This considers that 2021 represented a cycle peak in valuations for many of the underlying names, with several stocks performing worse than the ETF.

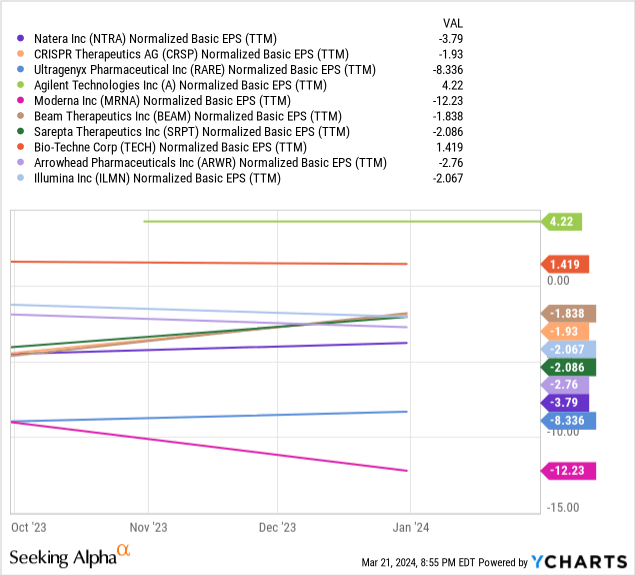

Generally, companies have thus far failed to live up to their most optimistic expectations while earnings over the period have disappointed. Out of the current top ten holdings in GNOM, eight are not currently profitable which has added to their volatility. In many cases, companies focusing on genomics are still in the early stages of attempting to commercialize a sustainable platform.

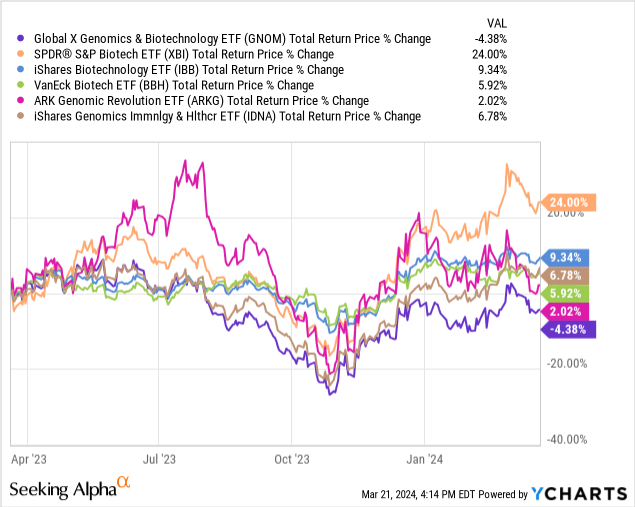

The other dynamic that GNOM has also underperformed Biotech industry benchmarks such as the SPDR S&P Biotech ETF (XBI), iShares Biotechnology ETF (IBB), or Van Eck Biotech ETF (BBH).

Over the past year, a period of otherwise strong stock market performance, GNOM is down -4% compared to a 24% gain in XBI or even the alternative iShares Genomics Immunology & Healthcare ETF (IDNA) that follows a similar strategy, with a 7% gain over the period. Larger biotech names not included in GNOM are typically more mature with a diversified portfolio of products on the market.

We can also bring up the actively managed ARK Genomic Revolution ETF (ARKG) as another option for investors in this segment that has fared modestly better than GNOM historically.

While all of these funds take a different direction in approaching the industry, GNOM and ARKG have some overlap in the same top holdings. We’d say IDNA is more balanced with more traditional large-cap healthcare names. Regarding their expense ratio, GNOM’s charging 0.5% expense ratio is close to IDNA at 0.47% while slightly lower than ARKG at 0.75%.

The point here is not to suggest one fund is “better” or worse than another, but simply to attempt to understand why GNOM has lagged the group. Our takeaway is that GNOM is a good attempt at a passive pure-play on genomics while ARKG appears capable of generating more value through more refined security selection.

Seeking Alpha

What’s Next For GNOM?

As we see it, Genomics remains a technology that is still missing its breakout headline capable of driving a wave of bullish optimism into the segment.

Here we draw parallels to what was observed with “artificial intelligence” which for the better half of the past decade was more or less just another buzzword until the emergence of the latest generation of language learning models and generative AI that crossed over into the mainstream in early 2023.

By this measure, Genomics is still waiting for its “ChatGPT” moment that will validate the transformative potential of this side of medicine.

Whether that occurs sooner rather than later or a few years down the line, there’s a good chance one of the top GNOM stocks like CRISPR Therapeutics or Ultragenyx Pharmaceutical will be well-positioned for its next growth stage. We’ve previously covered Agilent Technologies (A) which will likely be at ground zero of the genomics revolution on the side of specialized instrumentation and also see Twist Bioscience Corp (TWST) as an interesting name in the segment.

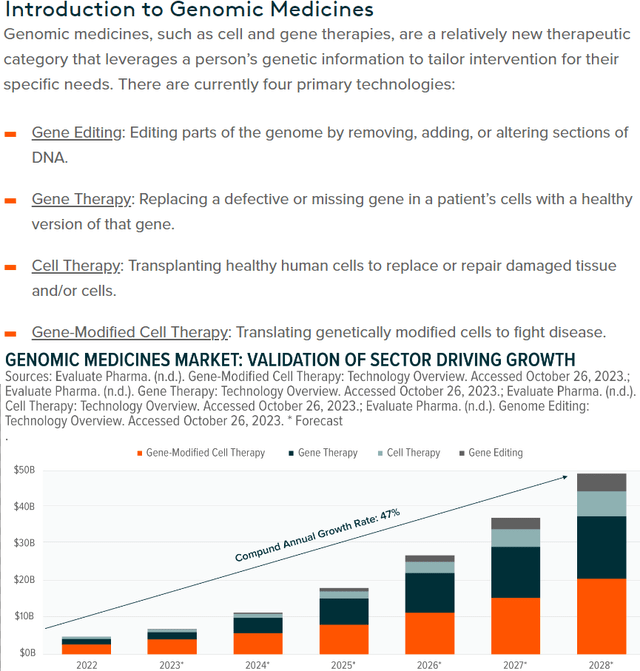

According to Global X, the Genomics medicine market across all technologies is expected to see 47% compound annual growth to $50 billion by 2028 from just $5 billion in 2022.

A large part of that considers declining costs on the side of manufacturing that can open the door for the scale necessary to reach the mass market. The report suggests the pace of FDA-approved genomic medicines has gained speed in recent years which is driving innovation and adoption.

source: company IR

Final Thoughts

Overall, GNOM performs as intended by at least covering all the bases of Genomics, including the smaller companies that may or may not succeed. The fund itself is speculative but could work in the context of a tactical allocation in a more diversified portfolio. We rate the fund as a hold, implying a neutral view over the next year from the current level.

From the price chart, the good news is that the fund is well off the 2023 lows, benefiting from the broader market rally. Holding the $10.50 area of technical support should keep bullish momentum in control ahead of what would be a long climb to reclaim highs from 2022 and 2021.

On the downside, we’d expect GNOM and biotech stocks to be exposed to shifting macro conditions impacting growth expectations. There is also a risk in the regulatory environment toward genomics worth being aware of. Monitoring points include updates from leading genomics companies and the pipeline of breakthrough genetic therapies.

Seeking Alpha

Read the full article here