Things are going pretty well these days for Halliburton (NYSE:HAL), a company dedicated to providing completion and production services, as well as drilling and evaluation services, to the energy sector, not only in the US, but across the globe. High energy prices that have been driven by robust demand, cuts from OPEC, and geopolitical issues, have created a great opportunity for shareholders of the business to experience strong cash flows. Shares of the company look cheap at this time and it’s likely that the near term picture for the company will remain positive. Even analysts are forecasting good times ahead, with revenue and profits per share both expected to continue growing when the company reports financial results for the final quarter of its 2024 fiscal year. Given these factors, the company seems to be a solid ‘buy’ candidate at this time.

Things are going well

The last article that I wrote about Halliburton came out in July of 2022. In that article, I was performing an earnings review leading up to the second quarter earnings release for the 2022 fiscal year for the business. Leading up to that point, the market had been worried about the firm, as well as others like it, since energy prices were pulling back from their highs and concerns of a potential recession were mounting. Fast forward to today, and we never did see that recession. It is true that energy prices have taken a rather significant decline from where they were previously. But even with this, the stock was cheap enough to warrant some rather meaningful upside. Although the S&P 500 experienced more, with a gain of 23.1% since the publication of that article, the 19.3% rise seen by Halliburton is nothing to scoff at.

Author – SEC EDGAR Data

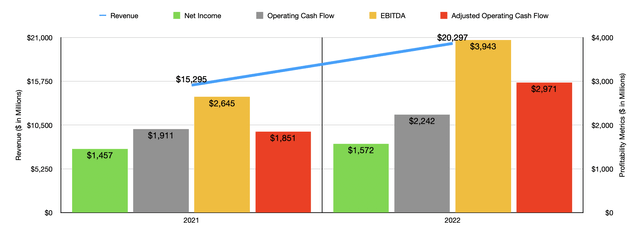

To understand just why the stock has moved up this much, we need only look at recent fundamental data. Briefly, we will touch on the 2022 results relative to 2021. But most of our efforts should be dedicated to the 2023 fiscal year given that more updated data is more relevant. Revenue for 2022 came in strong at $20.30 billion. That’s a whopping 32.7% above the $15.30 billion generated for 2021. Both of the companies operating segments performed well during this time. But the Completion and Production segment fared the best. Sales for it skyrocketed 37.7%, primarily driven by higher utilization rates and pricing for pressure pumping services, as well as additional completion tool sales and increased artificial lift activity in the markets in which the company operates. Higher well intervention services in North America and the eastern hemisphere also played a role. Meanwhile, the Drilling and Evaluation segment of the company reported a 26.6% increase in revenue thanks to higher drilling related services in most markets for the business, as well as increased wire line activity and testing services across the globe.

With the increase in revenue came higher profits. Net income rose only marginally from $1.46 billion to $1.57 billion. Operating cash flow increased from $1.91 billion to $2.24 billion. But if you adjust for changes in working capital, you get an increase of 60.5% from $1.85 billion to $2.97 billion. Also on the rise was EBITDA. Based on the data provided, it managed to jump from $2.65 billion to $3.94 billion. That’s a gain of 49.1% year over year.

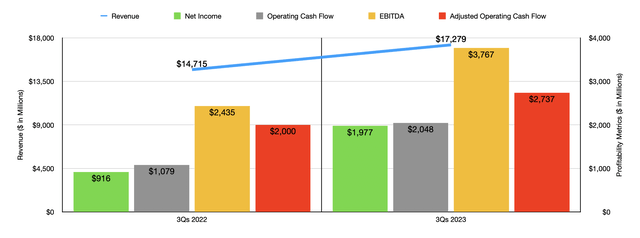

After such a robust year and considering what has transpired with the oil and gas industry, it wouldn’t be surprising to see fundamental performance weaken. But that is not what has happened. For the first nine months of 2023, revenue for Halliburton totaled $17.28 billion. That’s 17.4% above the $14.72 billion reported the same time one year earlier. Once again, it was the Completion and Production segment that led the way with a gain of 23.5% year over year. By comparison, the Drilling and Evaluation segment reported a much more modest 9.4% rise in revenue. The same factors that led to the growth in 2022 relative to 2021 also played a role for the first nine months of 2023 relative to the same time one year earlier.

Author – SEC EDGAR Data

With the rise in sales came continued profit growth. Net income more than doubled from $916 million to $1.98 billion. Operating cash flow nearly doubled from $1.08 billion to $2.05 billion. On an adjusted basis, the growth was a bit less impressive, with the metric climbing 36.9% from $2 billion to $2.74 billion. And lastly, EBITDA for the enterprise grew from $2.44 billion to $3.77 billion.

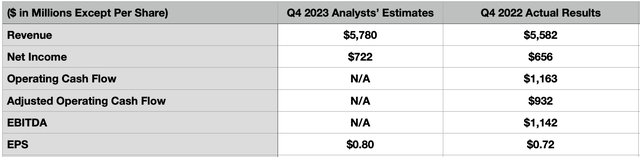

The exciting thing for shareholders is that, before the market opens on January 23, the management team at the business is expected to announce financial results covering the final quarter of the 2023 fiscal year. This will give investors an opportunity to reevaluate the company to see whether the picture is improving, getting worse, or staying the same. If analysts are correct, then the end result should be positive. Revenue, for instance, is expected to come in at about $5.78 billion. That would be 3.5% above the $5.58 billion generated in the same quarter of the 2022 fiscal year. While this sounds disappointing compared to how the company performed for the rest of the year, consider that revenue growth in the third quarter on its own was only 8.3% compared to the same time one year earlier. Both segments expanded, but at a much slower pace, because of lower simulation activity in North America and a reduction in project management activity in Saudi Arabia.

Author

Earnings per share, meanwhile, are forecasted to come in at about $0.80. That would represent a decent increase over the $0.72 per share reported the same time of 2022. That would translate to net profits climbing from $656 million to roughly $722 million. Analysts have not provided guidance for other profitability metrics. But in the table above, you can see what the most important metrics were for the company for the final quarter of the 2022 fiscal year. At the end of the day, it’s all about cash flow.

Author – SEC EDGAR Data

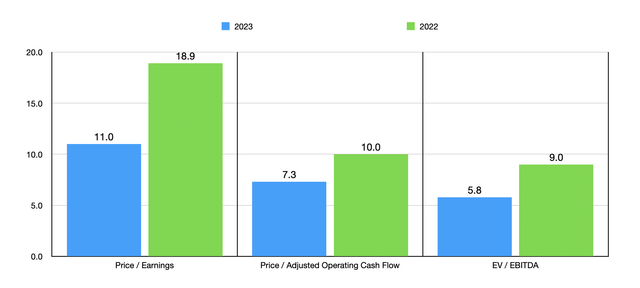

If analysts are correct about the final quarter of the year, then the company should generate total profits of about $2.70 billion. If we annualize results seen for the other profitability metrics, we should anticipate adjusted operating cash flow of about $4.07 billion and EBITDA of $6.10 billion. Taking these figures, I was then able to value the company as shown in the chart above. I then compared the financial metrics to five similar firms as shown in the table below. When it comes to both the price to earnings approach and the EV to EBITDA approach, I found that only one of the five businesses was cheaper than Halliburton. And when it comes to the price to operating cash flow approach, our prospect ended up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Halliburton | 11.0 | 7.3 | 5.8 |

| Baker Hughes Co (BKR) | 18.6 | 10.4 | 9.1 |

| Tenaris S.A. (TS) | 5.2 | 14.3 | 3.1 |

| NOV Inc. (NOV) | 15.5 | 30.7 | 8.7 |

| Schlumberger (SLB) | 16.8 | 13.4 | 10.5 |

| ChampionX Corp (CHX) | 17.5 | 9.4 | 7.8 |

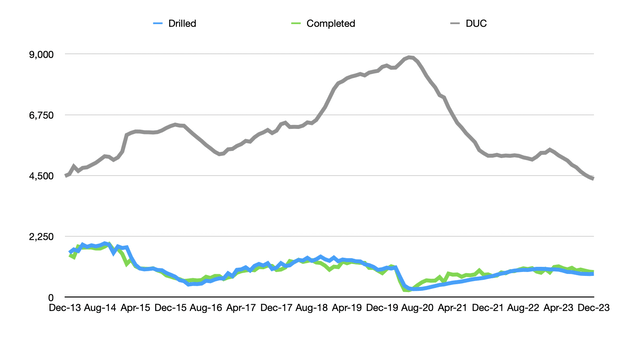

Regardless of the near-term picture, I fully expect that the long-term outlook for Halliburton will be positive. As I covered in a prior article, at least as far as the US market is concerned, the number of drilled but uncompleted wells have now fallen to a more-than 10-year low. The total number as of December of last year was 4,374. By comparison, the high point was the 8,874 wells that were drilled but uncompleted as of June of 2020. The fact of the matter is that, in order to save costs, oil and gas exploration and production companies in the US have worked away at their inventory in order to pump out as much oil and gas as possible while prices have been elevated. This has been great for cash flows. But as the number of wells completed have outpaced the number drilled, it has reduced DUC inventories. And at some point, additional wells will need to be drilled again in rather large quantities. The good news is that Halliburton wins either way. While the Completion and Production segment has outperformed the Drilling and Evaluation segment up to this point, that picture could change in the not-too-distant future. And with roughly 45% of the company’s revenue coming from North America, it’s a prime prospect to benefit.

Author – EIA Data

Takeaway

Although I do not have any intention of owning shares of Halliburton at this time, the company does seem to me to be a rather attractive prospect. Shares are cheap and the business has some attractive opportunities that lie ahead. All combined, this makes it a solid ‘buy’ candidate in my book, leaving me with no choice but to keep it rated as such at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here