Introduction

With a dividend yield of 0.1%, the HEICO Corporation (NYSE:HEI) is one of the worst stocks for income-oriented investors on the market. However, that’s where the bad news ends. Headquartered in Hollywood, Florida, the company is a total return star thanks to its efficient operations in the aerospace industry.

Not only is aerospace demand booming again, but HEI has perfected its job as a supplier of key parts in both commercial and defense aerospace.

The company has strong pricing power, high revenue growth, and a healthy balance sheet allowing it to use M&A to its advantage.

In this article, we’ll discuss all of this, starting with strength in the aerospace industry.

So, let’s dive into the details!

The Return Of Demand

Shortly after the pandemic, demand for narrow-body planes started, as regional traffic started to pick up rather quickly. Wide-body demand for long-haul flights remained sluggish as various nations around the globe stuck to COVID restrictions. The most prominent example is China, which isn’t just one of the biggest growth markets for aerospace demand but is also known for its zero-COVID policies.

Three years after the pandemic started, things are looking great again.

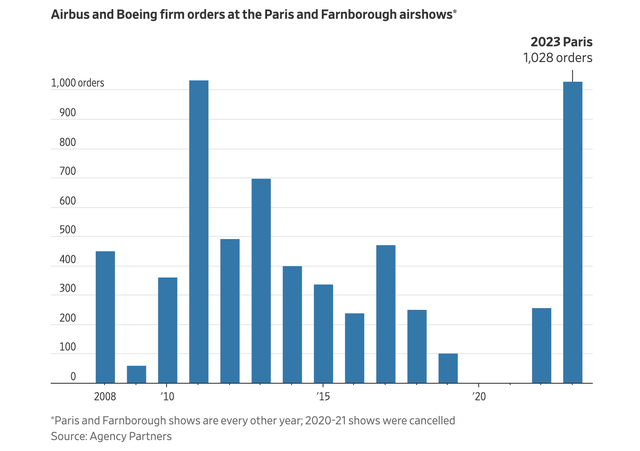

Wall Street Journal

As reported by the Wall Street Journal, following a period of halted air travel during the pandemic, airlines were caught off guard by the pent-up demand that surged once travel restrictions eased.

Airports faced overwhelming crowds last summer while airlines struggled to rehire staff and reactivate grounded planes.

Recent months have seen a shift from recovery to growth mode, with airlines like IndiGo placing record orders to expand their networks and cater to domestic and international travel.

So far this year, airlines and airplane lessors have ordered 1,429 Airbus and Boeing jets, including firm deals announced this week. That is already more than the combined full-year order haul of 1,377 in 2019. Confirmed orders at this year’s air show were the highest they have been since 2011, according to aerospace research firm Agency Partners.

Wall Street Journal

According to the article, Airbus (OTCPK:EADSF) and Boeing (BA), the world’s leading commercial jet manufacturers, have been struggling with supply shortages of engines, chips, and labor.

As a result of these headwinds and rising demand, both companies currently have substantial order backlogs, causing airlines to reserve planes well in advance, even if delivery is scheduled years later. The scarcity of resources has turned airplane orders into reservations for slots in the backlog.

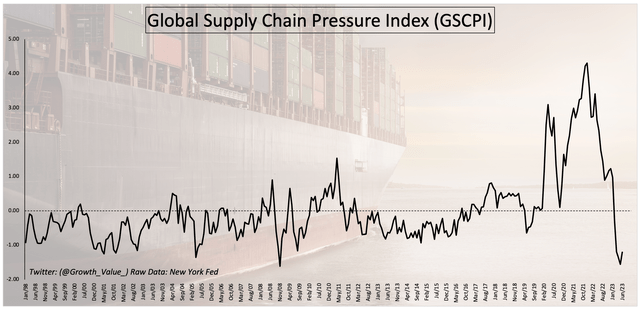

Leo Nelissen (Via Federal Reserve Bank of New York)

Furthermore, as supply chain issues are now easing at a rapid pace, it allows for higher production numbers down the road. This benefits suppliers like HEICO.

HEICO’s A Compounder

So, what’s HEICO?

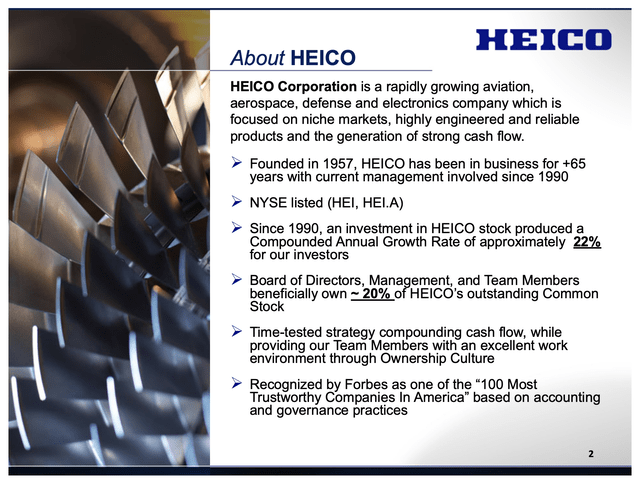

With a market cap of $21 billion, the company is a global leader in the manufacturing of FAA-approved jet engine and aircraft component replacement parts, as well as electronic equipment for various industries.

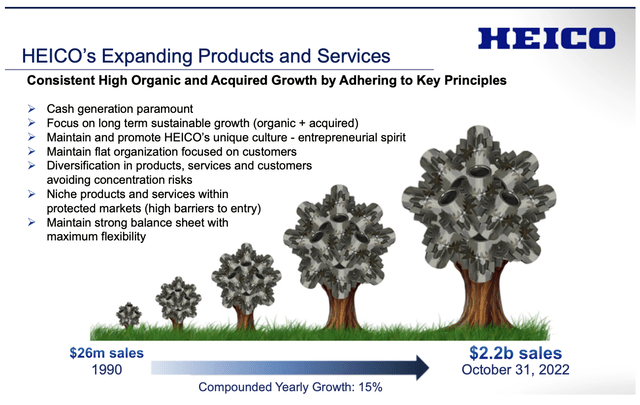

Established in 1957, the company has grown significantly through acquisitions, broadening its product offerings, and expanding its customer base.

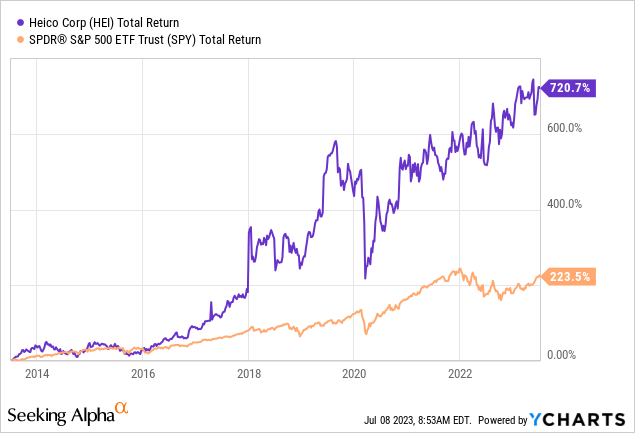

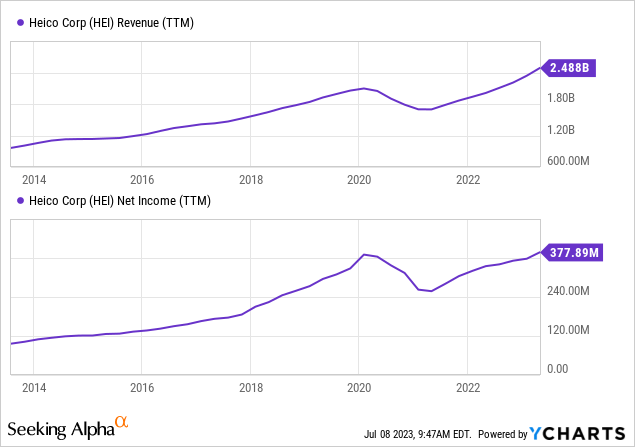

Over the past ten years, HEI shares have returned 720%, which includes a steep sell-off during the pandemic and two years of subdued orders. The S&P 500 has returned 224% during this period, which is impressive as well.

Since 1990, HEI shares have returned 22% per year, which is truly mind-blowing. Please note that the only difference between HEI and HEI.A is voting rights. Common stock has one vote per share. Class A shares have 1/10th vote per share.

HEICO Corp.

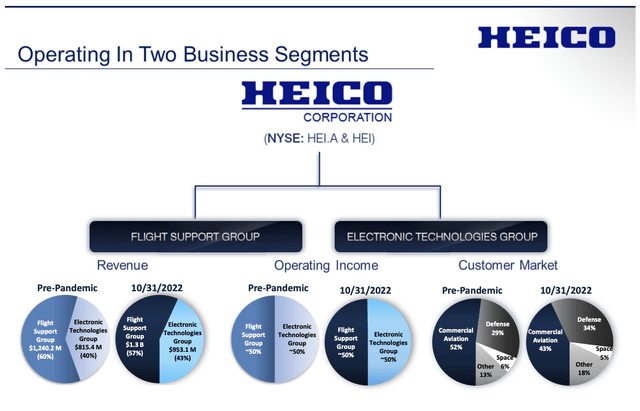

Having said that, HEICO has two main business segments.

-

Flight Support Group (“FSG”): Accounting for the majority of net sales, the FSG specializes in designing, manufacturing, and distributing jet engine and aircraft component replacement parts. This segment also provides repair, overhaul, and distribution services to domestic and foreign commercial air carriers, military and business aircraft operators, and others.

-

Electronic Technologies Group (“ETG”): This segment designs, manufactures, and sells various electronic, data, microwave, and electro-optical products. The customer base includes US and foreign military agencies, prime defense contractors, commercial and defense satellite manufacturers, and spacecraft manufacturers.

HEICO Corp.

Moreover, it has a strategy based on both organic and acquired growth. Over the past 30 years, the company has completed almost 100 acquisitions, enhancing its product offerings, technologies, and customer base. This has fueled annual revenue growth of 15% between 1990 and 2022.

HEICO Corp.

Now, it looks like this growth streak might continue.

HEICO Is, Once Again, Accelerating

As one can imagine, the fact that backlogs of OEMs like Boeing are filled while supply chain bottlenecks are easing offers tremendous opportunities for HEI and its peers.

Year-to-date, HEI shares are up 13%. The stock price is now 33% above its 52-week low, which is a truly impressive performance.

For example, HEICO achieved record results in the second quarter of its fiscal year 2023. This was driven primarily by record net sales within the Flight Support Group.

The company saw a continued rebound in demand for commercial aerospace products and services and contributions from recent acquisitions.

- Consolidated operating income and net sales for the second quarter improved by 28% compared to the same period in the prior year.

- These positive results reflect a 10% quarterly growth in consolidated organic net sales and the impact of recent acquisitions.

- Consolidated net income increased by 24% to $105.1 million, or $0.76 per diluted share, compared to $85 million, or $0.62 per diluted share, in the second quarter of 2022.

Furthermore, despite the elevated rate environment, HEICO made significant acquisition moves during the second quarter. In March, the company obtained an exclusive license and acquired key assets for the aircraft emergency locator transmitter product line from Honeywell International (HON).

The ELTs provide crucial emergency signals in the event of aircraft impact, enabling timely response from first responders. HEICO expects this acquisition to enhance its earnings in the year following the closing.

Additionally, HEICO announced the planned acquisition of Wencor Group for $1.9 billion in cash and $150 million in HEICO Class A common stock, totaling $2.1 billion. The deal is expected to be closed at the end of the fiscal quarter. It’s also the largest deal in the company’s history.

Based in Peachtree, Georgia, this company is a major commercial and military aircraft aftermarket company that offers factory-new FAA-approved aircraft replacement parts, value-added distribution of high-use commercial and military aftermarket parts, and aircraft and engine accessory component repair and overhaul services.

In this case, it’s important to note that HEI has a fantastic balance sheet, despite aggressive M&A in the past. As of April 30, the company has a total debt to shareholders’ equity ratio of 26.4%.

Net debt, which accounts for total debt minus cash and cash equivalents, was $627.5 million, resulting in a net debt-to-shareholders’ equity ratio of 21.9%.

The net debt-to-EBITDA ratio remained below 1x, as it came in at 0.4x. While this is up from less than 0.3x EBITDA in 2022, it’s an extremely healthy ratio providing the company with more room for M&A.

The company has a BBB credit rating.

Please note that I’m not spending much time discussing its dividend. While its five-year average annual dividend growth rate is 13.8%, its current yield is just 0.1%. The payout ratio is a mere 7%. The company’s focus will remain on M&A instead of shareholder returns. It’s bad news for income-oriented investors, but it should help the long-term total return.

Outlook & Valuation

Looking ahead to the remainder of the current fiscal year, HEICO anticipates net sales growth in both the Flight Support Group and the Electronic Technologies Group, driven by demand for the majority of their products.

However, the company expects continued inflationary pressures and supply chain disruptions stemming from the COVID-19 pandemic, which may result in higher material and labor costs. Despite these challenges, HEICO plans to continue its commitments to new product development, market penetration, and aggressive acquisition strategies while maintaining financial strength and flexibility.

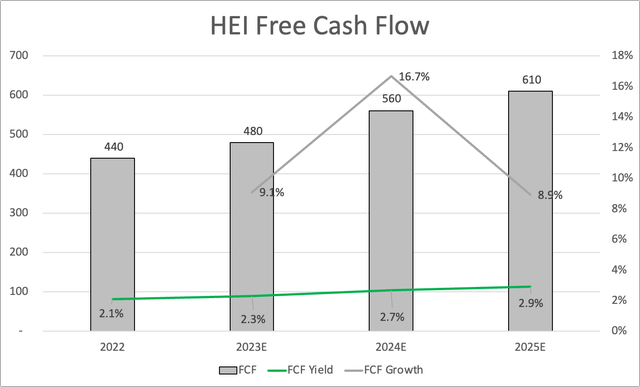

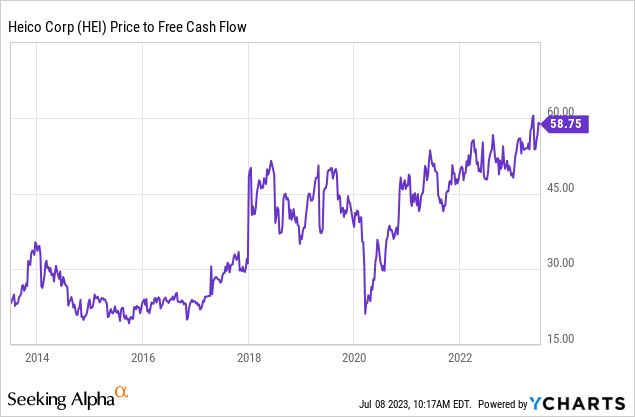

Looking at the chart below, we see that analysts expect free cash flow to accelerate after 2023. Next year, free cash flow is expected to rise by 17%. In 2025, FCF is expected to exceed $600 million.

Leo Nelissen

As a result, the company is now trading at 38x next year’s expected free cash flow. This isn’t extremely cheap, but it’s also not overvalued.

The current consensus target price is $182, which is 5% above the current price.

I agree with that.

Hence, I advise investors looking for an entry to buy on weakness.

The only reason why I do not own HEI is because I have close to 25% aerospace exposure already. If I add more high-growth compounders, I will likely start in other areas like healthcare, which I have covered a lot in recent weeks.

Takeaway

HEICO may not be an ideal stock for income-oriented investors with its low dividend yield of 0.1%. However, it shines as a total return star in the aerospace industry.

With the resurgence of aerospace demand and its expertise as a supplier of key parts, HEI is well-positioned for growth. The company boasts strong pricing power, high revenue growth, and a healthy balance sheet that supports its strategic mergers and acquisitions.

HEI’s market performance has been impressive, outperforming the S&P 500 over the past decade by a wide margin.

As supply chain issues ease and backlogs fill, HEI and its peers have ample opportunities.

Recent record results and the planned acquisition of Wencor Group demonstrate HEI’s growth trajectory.

While HEI is not a high-yield stock, HEI’s focus on M&A and long-term total return make it an attractive investment for those seeking growth in the aerospace sector.

Consider buying on weakness and look out for potential entry points.

Read the full article here