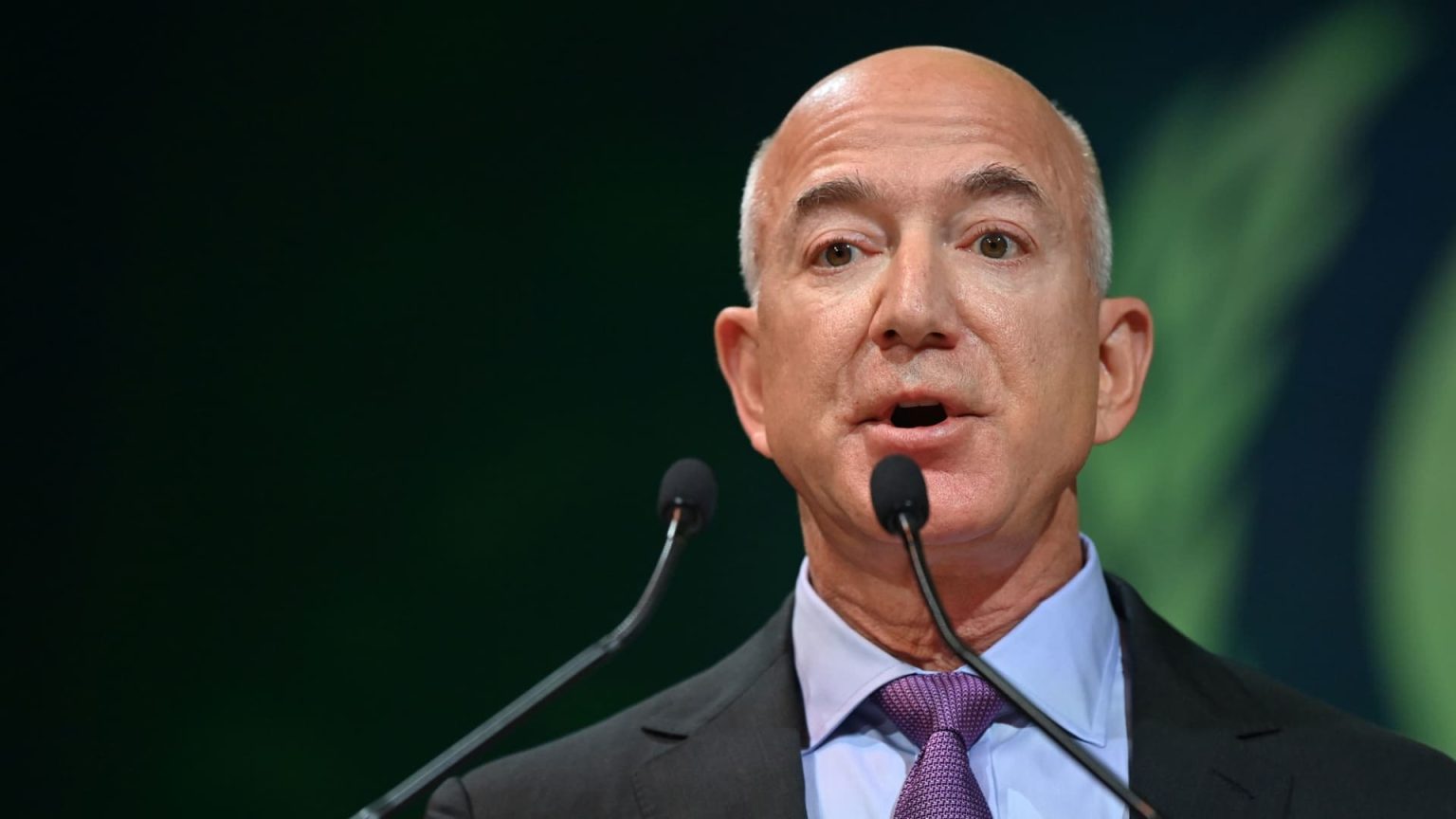

Don’t buy the Amazon (AMZN) selloff — yet. Jim Cramer said Tuesday he wants more clarity around why Amazon founder Jeff Bezos is aggressively selling shares. “I don’t think anyone wants to be on the other side of Jeff Bezos selling,” he added. The tech mogul on Tuesday could offload as many as 8 million to 10 million Amazon shares worth over $1 billion, according to CNBC’s David Faber . While those are big numbers, more than 53 million shares of Amazon have traded hands as of late Tuesday afternoon. It’s one of the most active stocks in the market, showing it can absorb selling even from a major player like Bezos. Tuesday’s expected sales would follow the Amazon executive chairman’s sale of over 1.67 million shares worth around $240 million last week, according to federal government securities filings . Amazon shares were down more than 3% at their session lows just above $141 each before paring nearly half of those losses as speculation around Bezos’ selling reverberated through the market. Bezos is third on the Bloomberg Billionaires list, with a net worth of more than $170 billion. He still owns about a 10% stake in Amazon. AMZN YTD mountain Amazon (AMZN) year-to-date performance “When you have this kind of gigantic wave of selling from the largest shareholder, who owns a lot of stock, people are going to be very skittish about buying,” Jim said. “I am trying to drill down on when Amazon is right” to buy, he explained. “I don’t think it’s right yet to tell you if you don’t own any shares that you should buy some here.” Last week’s transactions were marked as “contributions to non-profit organizations,” according to filings. A representative for Bezos didn’t immediately respond to CNBC’s request for comment. Tuesday’s decline in Amazon shares follows an impressive rally of nearly 15% in the past month following better-than-expected third-quarter results in late October. The stock has soared more than 70% in 2023. The Investing Club remains committed to Amazon in the long term even as we wait for more information about Bezos’ transactions. Fundamentally, Amazon stands to benefit from continued improvement in e-commerce profitability ahead of the holiday shopping season — along with strong growth prospects for its cloud business. (Jim Cramer’s Charitable Trust is long AMZN. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Don’t buy the Amazon (AMZN) selloff — yet.

Read the full article here