This article was first posted in Outperforming the Market.

indie Semiconductor (NASDAQ:INDI) has had a good year to date performance thus far given the continued progress we have seen in its business.

For those who missed out on the deep dive into indie, I would highly recommend you read the deep dive before continuing with the article. This is one of the most extensive deep dive research into indie as I delve deep into the fundamentals and investment case of the company.

I often get asked by members of Outperforming the Market what they should do with their indie positions given that the indie position in The Barbell Portfolio has returned 64% since we sent the buy trigger alert.

In this article, I aim to highlight the key investment thesis for indie, including the strong competitive advantages of the company, high barriers to entry, its research and development strategy, the competitive and industry landscape and valuation of the company.

I have written other articles on indie, which can be found here.

Let’s dive right into indie’s competitive advantages.

Competitive advantages and barriers to entry

I will focus the next section on what makes indie unique as a player in the highly competitive semiconductor industry and what are the barriers that enable it to sustain these advantages as well as what strategy it is taking to further increase this advantage.

The company’s main competitive advantages are its differentiated product portfolio offering differentiated solutions to customers, and its underlying intellectual property portfolio, with its underlying engineering and design experience contributing to these advantages. Some of the many patents under indie can be found here, including power management in a seamlessly integrated microcontroller chip and switchable FMCW/PMCW radar transceiver, amongst others.

In addition, there are high barriers to entry in the segments that indie is operating in, because of the high regulatory scrutiny and safety requirements of the automotive industry. As such, to operate in the industry, industry players need to have high quality and safety standards and also meet high reliability standards.

One example is the relatively new LiDAR system-on-a-chip (“SOC”) called Surya, which indie launched last year. Surya was a breakthrough LiDAR SOC which consumes significantly lower power and is significantly more cost effective than current designs. This is done through combining the best-in-class laser and sensing technologies from TeraXion, as well as innovative high-speed analog, mixed signal, ESP and software technologies developed by indie’s team. This makes Surya an unrivalled, highly integrated, high performance LiDAR solution, and puts indie at the forefront of developing disruptive LiDAR-based solutions for next generation ADAS applications. The company has since been working closely with about 6 partners on its Surya SOC product and plans ultimately to convert these pipeline opportunities into substantial revenues.

Another competitive advantage that indie has is its highly competent and quality management team with a wealth of experience and expertise in the industry. The company is still largely led by co-founders that have been around since inception and the management team is well balanced with people with strong technological know-how and expertise, as well as people with experience in managing the operations, strategy and financials of a growing company.

Lastly, I would argue that the strong customer and partner relationships indie has is a competitive advantage as it allows them to win large scale projects from large customers despite having other larger competitors operating in the segment. indie has a strong track record of engaging and communicating actively with its partners and customers. On top of this, indie also brings unique designs to customers that enable them to achieve a wide range of objectives and increase the value proposition of indie’s products through providing cost savings, improvement in performance, amongst others. As a result of these strong relationships as well as a differentiated product portfolio, indie has been able to be relatively successful in winning over new customers and programs. As highlighted earlier, more than 10 Tier 1 automotive supplies like Apt (APTV) through more than 10 years of building a trusted relationship with these partners.

Will these competitive advantages be sustained? I think so given indie’s solid research and development strategy.

R&D strategy

All these intellectual property and innovative products do not come by accident.

By having a focus on research and development in the business, as well as spending significant time and money into research and development activities, this enables indie to continue to design and develop products that meets the increasing performance requirements of its customers. This is also perhaps what makes indie attractive to its customers despite its relative smaller size.

I think that indie recognizes that their future success depends on its success in its research and development efforts, more specifically, to design and develop new products that customers need quickly and to introduce differentiated products into the market.

indie stated in its 2021 annual report that their goal is to “to continually improve both our existing portfolio, while simultaneously introducing new solutions in order to create value for our customers. To outpace market growth, we invest in opportunities that will help extend our product reach, with an emphasis on the industry’s fastest growing segments”.

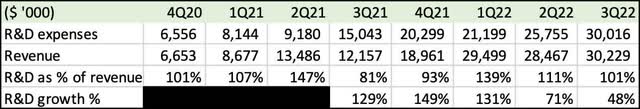

For indie, the early days will require a balance of the resources allocated to research and development and its profitability goal. As I will explain later, indie is rarer focused on its profitability targets, but I like that the company is also cognizant of the fact that if it does not have a strong focus on research and development as well as a key goal to churn out a differentiated product portfolio, it may not compete meaningfully with the other competitors out there. As such, the figure below shows their research and development spend as a percentage of its total revenues, with 120% of revenues in 2021 spent on research and development, and 97% of revenues in 2020 spent on research and development respectively.

R&D spend of indie since listing (Author generated)

The way I look at indie’s research and development spend, I look at it as an essential spend for it to make its way up the league of large players in the field. At the same time, as the business scales up, the percentage of revenue spent on research and development will trend down. Lastly, this is one of the levers management can take to reduce costs and improve profitability if there are signs that there is less need for research and development spend and greater need for profitability.

Competitive and industry landscape

In this part of the deep dive, the analysis will have a focus on the industry landscape and opportunities available to indie as well as potential threats there may be to indie. The first part will talk more about the industry landscape and market opportunity, while the second part of the section will be more on competition that indie faces today.

Semiconductor industry and opportunities

As a result of content expansion in segments like mobile, computing and consumer electronics, this has resulted in a strong growth in semiconductor companies across the industry. However, not all markets within the semiconductor industry will continue to grow at the same pace as it did in the past. Specifically, markets like mobile are starting to reach saturation.

That said, one of the fastest growing segments within the semiconductor industry in the next decade is likely to be the automotive sector. According to Allied Market research, as of 2020, the global automotive semiconductor market was valued at $38 billion, and this is expected to grow at a CAGR of 11% to $114 billion by 2030.

In terms of market opportunity in the automotive market for semiconductor companies like indie, the strong growth in the global automotive semiconductor market will be driven not only by growing global automotive volumes, but also the higher levels of semiconductor content needed in these very vehicles for the vehicles of tomorrow, compared to the vehicles of the past. This is primarily driven by higher safety standards, increasing demand for better user experience, electrification of vehicles and the growing ADAS applications that we see in the automotive sector today.

I will touch on some of these trends below:

Firstly, the rapid adoption of electric vehicles will drive a new wave of higher content vehicles. Deloitte expects that the number of electric vehicles will grow at a 29% CAGR, from 2.5 million in 2020 to more than 31 million in 2030. This would mean that more than a third of new cars produced will be electric vehicles by then. This rapid rise in adoption of electric vehicles is further supported by a new string of legislation in Europe and the United States to encourage increasing adoption of electric vehicles. On the consumer front, there is also a greater acceptance of electric vehicles today compared to 5 years ago when more people were more apprehensive about the infrastructure and the difficulties of buying an electric vehicle.

Electric vehicles are an important opportunity set because of this: Electric vehicles have more than twice the semiconductor content compared to the traditional internal combustion engine vehicles. In addition, when we compare proportion of the costs of semiconductors to the total cost of the vehicle, the internal combustion engine vehicle will have about 2% of costs from semiconductors but this is expected to increase to 6% of the total cost of the vehicle for an electric vehicle. Clearly, the electric vehicle does require more semiconductor content, and this contributes to more of the cost of a vehicle than before. Some examples of the electric vehicle components that require semiconductors include the battery, the inverter, the charger, the central processor, amongst many others.

Secondly, while ADAS adoption is not as often talked about, there is a trend of moving towards autonomous vehicles and I think that eventually, global ADAS volumes will grow significantly.

For ADAS applications, the increasing semiconductor content comes from the radars, ultra-sonic sensors, cameras, amongst others that will contribute to the increasing semiconductor content for automotive applications.

According to Straits Research, global ADAS market is expected to grow from $13 billion to $58 billion, growing at a CAGR of 18% from 2020 to 2030. As a result, we can expect ADAS volumes to grow in the next decade as I would expect increasing consumer acceptance as well as improving regulations to help improve adoption of ADAS across the world.

As we see increasing adoption of higher autonomy L4 and full autonomy L5, we are first likely to see increasing market share in L2 and L3 applications first. We can expect that by 2024, ADAS penetration could reach 79% of global car shipments, with the L2 category taking up 60% market share in 2024 as it has lower costs and higher safety criteria, while L4 market share will likely reach 24% by 2030 due to its use in more luxury automotive and robotaxis.

Last but not least, there is also increasing semiconductor content as a result of consumers requiring a better user experience. The trend towards a digital cockpit with interaction screens will need more processing power in the vehicle, while there is also a trend towards an increasingly connected car, with things like smart car access and NFC technologies that enable better connection of the vehicles and other external devices.

Growing need for an alternative automotive supply chain

There are 2 drivers that in my view are subtle ones that makes significant difference for indie. The first is the global shortage of semiconductors in the automotive space and the second is the increasing demand for alternative suppliers to the current incumbents to boost the resilience of the automotive supply chain by increasing localization.

The reasons for the shortage of semiconductors for the automotive industry are many, but there are 3 main reasons driving this. The first is the increasing adoption of electric vehicles which has higher semiconductor content per vehicle, which results in insufficient capacity for the growing electric vehicle demand. The second is the rising geopolitical tensions between the United States and China, resulting in globalization taking a step back. Given that both the United States and China play specific roles in the automotive semiconductor space, this increasing fragmentation has further worsened the shortage of semiconductors available for the automotive sector. Lastly, and the most evident of them all, the covid pandemic has caused a disruption to global supply chains that further aggravated this global shortage of automotive semiconductors.

Also, automotive manufacturers and Tier 1 suppliers are looking to expand their network of supply chain to further increase resilience. The theme of increasing localization comes up here as players are starting to realize the importance of diversification in the automotive supply chain as a key strategy going forward.

Competition

The semiconductor industry is highly competitive, especially that of automotive applications like high-performance analog, digital and mixed signal semiconductors.

The top 3 largest players in the automotive semiconductor industry are Infineon (OTCQX:IFNNY), Renesas (OTCPK:RNECF) and NXP (NXP). The largest player is Infineon, with market share shrinking slightly from 13.2% to 12.7% from 2020 to 2021. NXP on the other hand, grew market share in the period from 10.9% to 11.8% and Renesas maintained market share during the period at 8.4% of the market. Infineon is a German company with 44% of its revenues derived from the automotive sector, and a cash position of Euro 3.9 billion in its balance sheet as of 3Q22. Renesas is a Japanese company that has about 50% of its revenues coming from automotive semiconductors and as such, is not a pure play automotive semiconductor player. Lastly NXP is a Dutch company and similarly, has about 50% of revenues from the automotive end market, with $3.8 billion in cash on its balance sheet as of 3Q22. These major players have exposure to markets like the industrial, power and mobile markets respectively.

As a result, one of the key differentiating factors for indie is that it can stay as a pure play automotive semiconductor company. With the automotive semiconductor market poised for higher growth in the longer term, this means that indie will have a higher market growth opportunity than its peers due to its concentration in the automotive markets. Of course, the risk to this would be the concentration to one particular sector as a weakness in the automotive sector will certainly have a larger impact to indie than to its peers.

The other difference is the financial resources these larger competitors have compared to indie. Infineon generated Euro 1.6 billion and NXP generated $863 million in free cash flows in the past 3 months for the recent quarter, while having a large cash balance in its balance sheet as highlighted above.

Ultimately, I look at the difference in growth profiles for indie and the current incumbents and find the stronger growth profile leveraging the automotive trends supported by a differentiated and innovative product portfolio an attractive setup for indie compared to its larger peers. While they may have larger number of resources, they are growing much slower, with NXP expected to grow at mid-single digits in the next few years while Infineon is expected to grow at mid-single digit to low double-digit growth in the next few years. Furthermore, with the recent consolidation of the semiconductor industry, as well as the stronger growth profile of indie, I like the company’s position in the fast-growing automotive semiconductor segment and with its focus there, I think that it will continue to outpace competitors that are trying to juggle different end markets.

How will indie compete?

The key thing for indie is that it needs to maintain a strong portfolio of innovative and differentiated products by utilizing the technical and design experience of its teams. This will lead to many other opportunities, including increasing demand for its products from new and existing customers, as well as growing list of Tier 1 automotive suppliers that include indie on their approved vendor list. This will enable indie to outperform the overall market and compete with its larger competitors who may not be as nimble and adapt to meet the needs of customers as quickly as indie.

Valuation

indie is poised for strong growth in the future as its strategic backlog was $4.3 billion. On top of that, the company is focused on its profitability goal by the end of 2023.

I reiterate my intrinsic value for indie, which is based on a 5-year discounted cash flow model, and the key assumptions, as well as the summary of the financials of indie, can be found here.

My 1-year price target for indie is $17.74. My 1-year price target is based on a 40x 2024 P/E assumption. I think that this valuation multiple is justified given the strong topline growth, increasing profitability and growing momentum in the business.

Conclusion

indie has strong competitive advantages, including its differentiated product portfolio, competent and quality management team, and strong customer relationships.

The company continues to strengthen its advantage by spending on research and development, bringing the best and differentiated products to the market.

In addition, the company is poised to benefit from the faster growth rate in the automotive semiconductor space. indie is able to compete with other players in the market given its innovative and differentiated product portfolio.

My 1-year price target for indie is $17.74, which represents 88% upside potential from current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here