A Quick Take On Integral Ad Science

Integral Ad Science Holding Corp. (NASDAQ:IAS) reported its Q3 2023 financial results on November 2, 2023, beating revenue but missing consensus earnings estimates.

The firm provides organizations with various online advertising monitoring and related technologies to maximize their brand management, control and performance across digital platforms.

I previously wrote about IAS with a Buy outlook on its growth potential from short-form video.

While IAS’ stock has pulled back in recent months in concert with a broader software market selloff, my investment thesis based on continued reasonably high growth and operating profitability remains intact.

Accordingly, I reiterate my Buy outlook on IAS at around $13.50 per share.

Integral Ad Science Overview And Market

New York-based Integral Ad has developed a cloud-based platform for independent measurement and verification of digital advertising units across various devices and environments.

The firm is led by Chief Executive Officer Lisa Utzschneider, who has been with IAS since January 2019 and was previously Chief Revenue Officer and SVP at Yahoo!

The company’s primary offerings include:

-

Viewability.

-

Ad Fraud.

-

Brand Safety & Suitability.

-

In Geo.

-

Contextual Targeting.

IAS has numerous offices in countries and targets medium and large advertisers and agencies through its direct sales and marketing efforts.

According to a 2023 market research report by Fortune Business Insights, the global media monitoring tools market was an estimated $3.96 billion in 2022 and is forecast to reach $13.4 billion in 2030.

This represents a forecast CAGR of 16.4% from 2023 to 2030.

The primary reasons for this expected growth are a continued transition of client advertising budgets toward digital channels, increasing demand for monitoring and verification capabilities.

Also, the COVID-19 pandemic increased demand for online advertising as businesses with a significant offline presence sought to diversify their revenue streams during the pandemic.

Major competitive or other industry participants include:

-

DoubleVerify.

-

Criteo.

-

Moat.

-

Comscore.

-

Adform.

-

NOBL Media.

-

Oracle.

-

HUMAN.

Integral Ad Science’s Recent Financial Trends

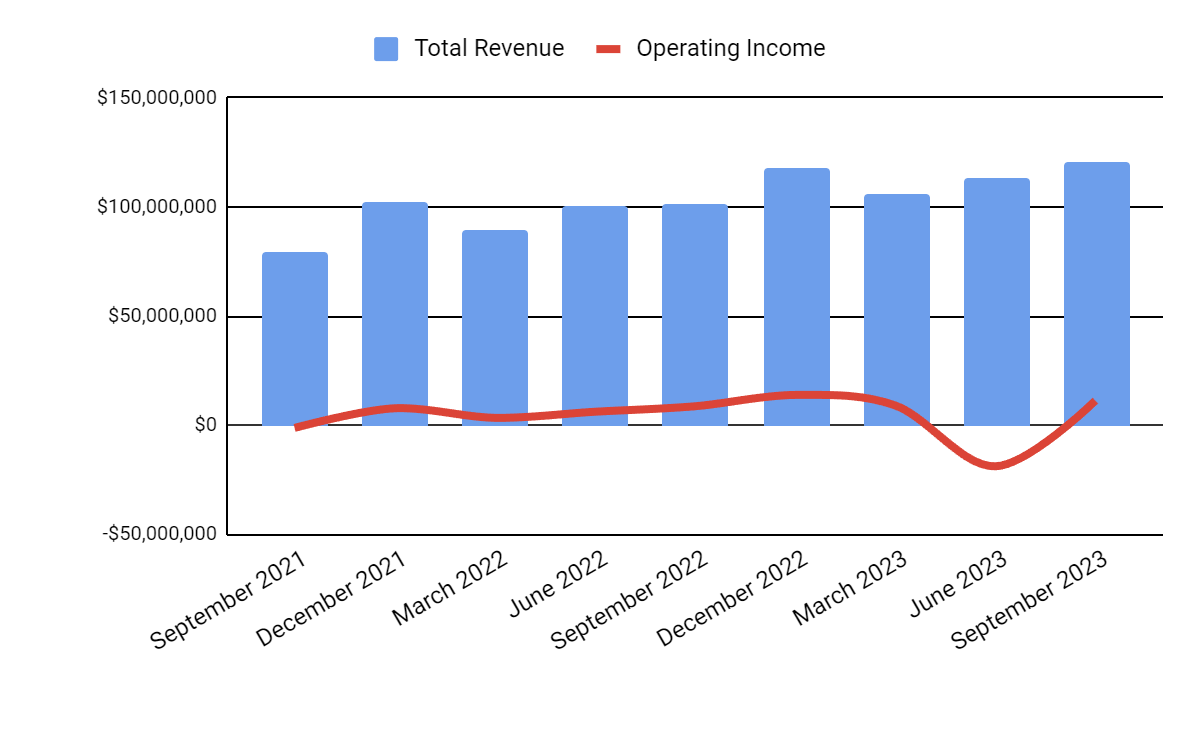

Total revenue by quarter (blue columns) has continued to rise; Operating income by quarter (red line) has rebounded well into positive territory sequentially:

Seeking Alpha

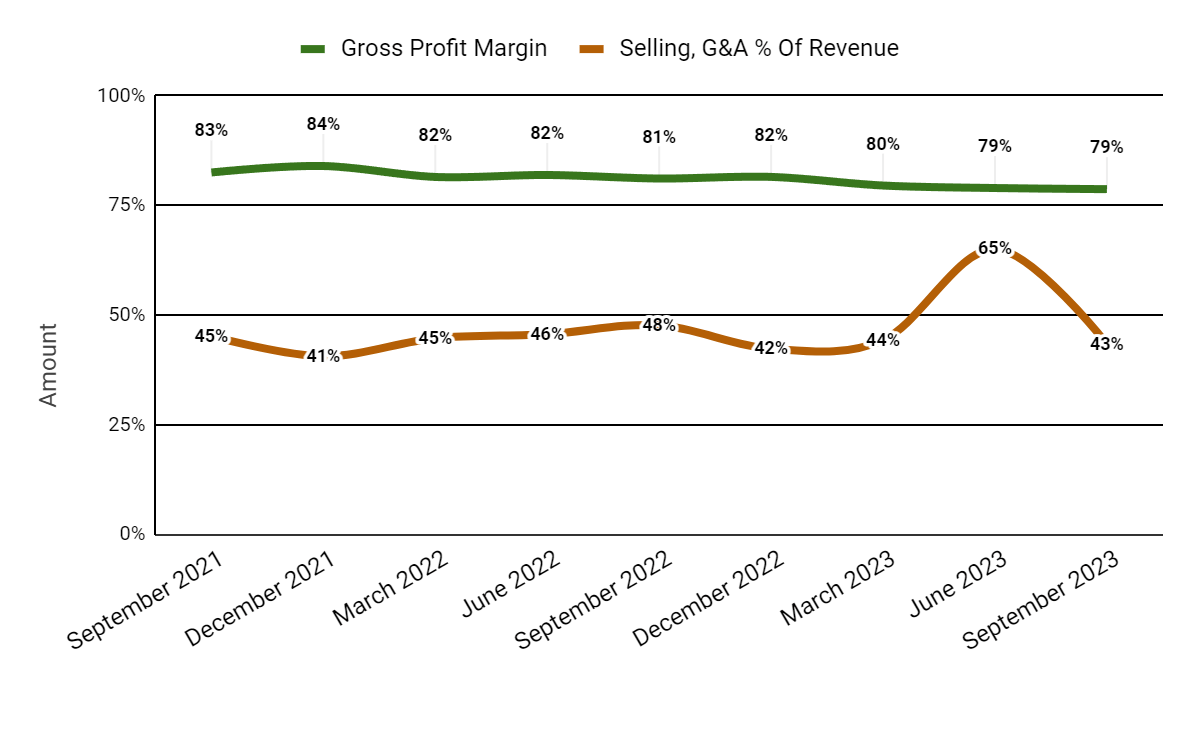

Gross profit margin by quarter (green line) has trended lower; Selling and G&A expenses as a percentage of total revenue by quarter (amber line) have been volatile in recent quarters:

Seeking Alpha

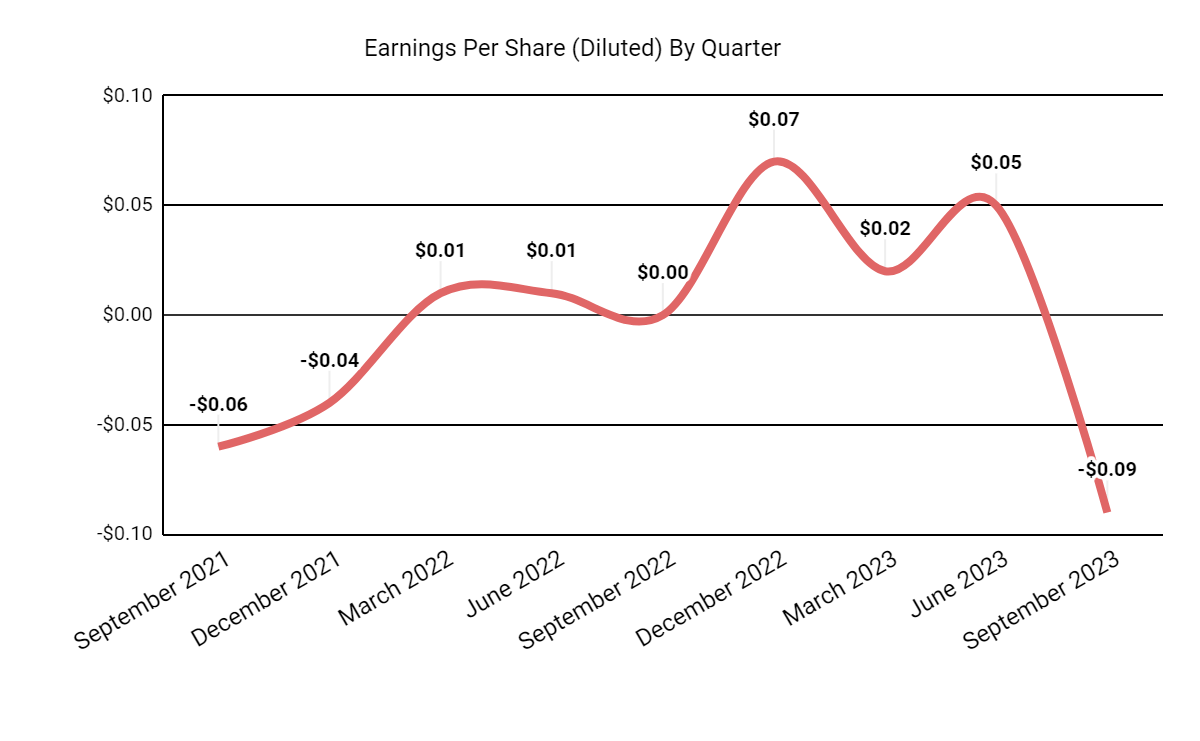

Earnings per share (Diluted) have dropped materially in the most recent quarter. This was due to the “timing of the company’s income tax provision related to stock-based compensation from the return target options expensed in the second quarter.”

Seeking Alpha

(All data in the above charts is GAAP).

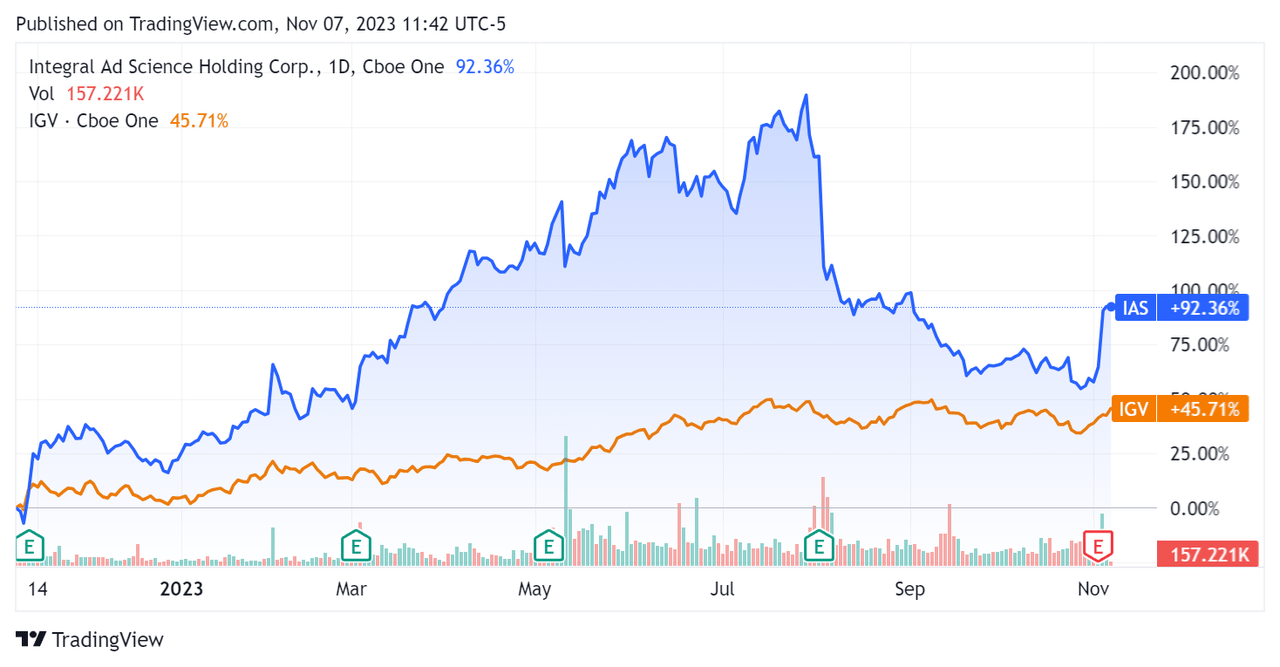

In the past 12 months, IAS’s stock price has risen 92.36% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 45.71%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $92.2 million in cash and equivalents and $173.6 million in total debt, all of which was long-term.

Over the trailing twelve months, free cash flow was an impressive $95.9 million, during which capital expenditures were $3.1 million. The company paid a hefty $77.3 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Integral Ad Science

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (Trailing Twelve Months) |

Amount |

|

Enterprise Value / Sales |

5.0 |

|

Enterprise Value / EBITDA |

41.0 |

|

Price / Sales |

4.7 |

|

Revenue Growth Rate |

16.3% |

|

Net Income Margin |

1.9% |

|

EBITDA % |

12.1% |

|

Market Capitalization |

$2,170,000,000 |

|

Enterprise Value |

$2,280,000,000 |

|

Operating Cash Flow |

$99,030,000 |

|

Earnings Per Share (Fully Diluted) |

$0.05 |

|

Forward EPS Estimate – 2024 |

$0.27 |

|

Free Cash Flow Per Share |

$0.43 |

|

SA Quant Score |

Hold – 2.91 |

(Source – Seeking Alpha)

IAS’s most recent unadjusted Rule of 40 calculation was 25.7% as of Q3 2023 results, so the firm’s results have deteriorated slightly sequentially, per the table below:

|

Rule of 40 Performance (Unadjusted) |

Q2 2023 |

Q3 2023 |

|

Revenue Growth % |

18.2% |

16.3% |

|

Operating Margin |

12.1% |

9.4% |

|

Total |

30.3% |

25.7% |

(Source – Seeking Alpha)

Commentary On Integral Ad Science

In its last earnings call (Source – Seeking Alpha), covering Q3 2023’s results, management’s prepared remarks highlighted the expanding inventory coverage of its TMQ system for the YouTube product suite.

As a result, the company has “seen strong customer adoption of TMQ in YouTube from clients including Dyson, Volvo and Kimberly-Clark.”

The firm also continues to push customer adoption of its TMQ system for TikTok, and ‘active measurement campaigns on TikTok have more than doubled year-to-date, and impressions have quadrupled.’

IAS is also moving forward on its partnership with X (FKA Twitter) and believes it was selected based on the sophistication of its TMQ system.

Total revenue for Q3 2023 rose by 18.8% year-over-year, while gross profit margin dropped by 2.4% due to further investment in its data infrastructure and higher hosting costs.

The net revenue retention rate rose to 116% from 115% in Q2 2023 due to “higher product adoption.”

Selling and G&A expenses as a percentage of revenue fell 4.3% YoY, indicating increasing efficiencies, while operating income rose 29.9% versus Q3 2023, a strong result.

Analysts asked leadership about competitive advantages, market outlook and expansion and AI/ML technology strategies.

Management said that feedback from large new customers indicates their interest in IAS’ product innovation, international footprint and high-touch service.

The firm is seeing double-digit growth for context control, especially in the wake of the recent Middle East violence.

As for AI/ML, management has an expectation of double-digit growth potential and margin expansion as these technologies play a core role in the firm’s offerings, such as the TMQ system.

The company’s financial position is strong, with ample liquidity, some long-term debt but very strong free cash flow.

IAS’ Rule of 40 performance has fallen somewhat sequentially due to both revenue growth decline and operating margin drop, so it is in need of further improvement.

Looking ahead, management raised its forward guidance, now expecting full-year revenue growth to be around 15.5% at the midpoint of the range.

If achieved, this would represent a significant decline in revenue growth rate versus 2022’s growth rate of 26.14% over 2021.

In the past twelve months, the firm’s EV/Sales valuation multiple has risen about 51% net, as the chart from Seeking Alpha shows below:

Seeking Alpha

Regarding valuation, the market is valuing IAS at an EV/Sales multiple of around 5.0x on TTM revenue growth rate of 16.3% against a median Meritech SaaS Index implied ARR growth rate of around 19% (Source).

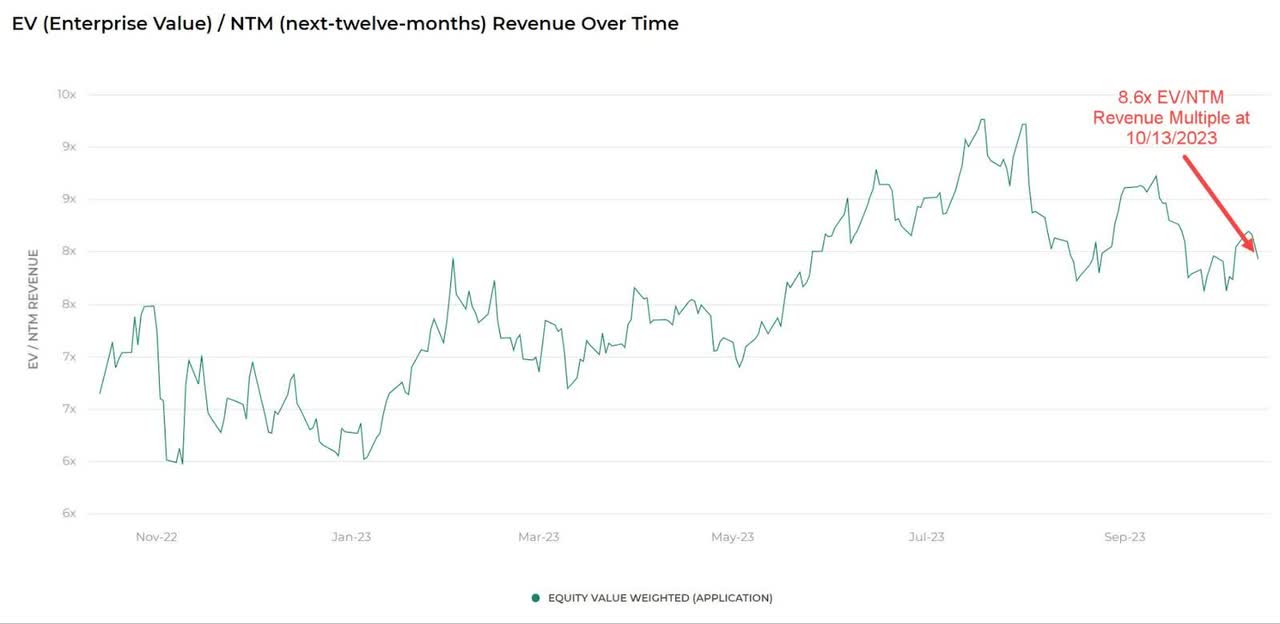

The Meritech Capital Index of publicly held SaaS application software companies showed an average forward EV/Revenue multiple of around 8.6x on October 13, 2023, as the chart shows here:

Meritech Capital

So, by comparison, IAS is currently valued by the market at a significant discount to the broader Meritech Capital SaaS Index, at least as of October 13, 2023.

While IAS stock has pulled back in recent months in concert with a broader software market selloff, my investment thesis based on continued reasonably high growth and operating profitability remains intact.

Accordingly, I reiterate my Bullish outlook on IAS at around $13.50 per share.

Read the full article here