At a Glance

Intra-Cellular Therapies (NASDAQ:ITCI) presents a compelling narrative that intertwines robust financial growth with significant clinical potential, predominantly anchored around its flagship product, Caplyta. My previous analysis of the company recognized this trajectory, noting its reliance on Caplyta and the risks therein. Since then, financials have strengthened, evidenced by the remarkable YOY revenue increase and improved control over net losses, moving the firm strategically towards profitability. Clinically, Caplyta has maintained its success in treating schizophrenia and bipolar depression, and its anticipated expansion into the Major Depressive Disorder [MDD] market positions it as a versatile and potent candidate in mental health therapeutics. The ongoing clinical trials for MDD, crucial to broadening Caplyta’s market reach, have progressed positively. This blend of stronger financial fundamentals since my last analysis and the promising clinical prospects underscores a potential growth story for Intra-Cellular Therapies. Investors, while cognizant of the inherent risks in the biotech sector, particularly regarding product approvals and market adoption, should closely monitor these developments, as they are likely to significantly influence the company’s market trajectory and investment appeal.

Q3 Earnings

To begin my analysis, looking at Intra-Cellular Therapies most recent earnings report, the key highlights are the significant revenue growth and reduced net loss. YOY for the three-month period ending September 30, 2023, total revenues surged to $126.2M from $71.9M, primarily driven by a 75% increase in Caplyta’s net product sales, reaching $125.8M. This growth reflects Caplyta’s strong market uptake, with total prescriptions rising 71%. Operating expenses saw a rise, notably in selling, general, and administrative costs, from $88.4M to $105.2M, indicating increased investment in marketing and expansion efforts. Despite this, the net loss narrowed to $24.3M from $53.5M, showing improved operational efficiency. The weighted average number of common shares increased marginally to 96.1M from 94.5M, suggesting minimal share dilution.

Financial Health

Turning to Intra-Cellular Therapies’ balance sheet, their liquid assets, comprising of cash and cash equivalents ($99.4M), and investment securities ($393.6M), total approximately $493M. The current ratio, calculated as total current assets ($702.4M) divided by total current liabilities ($103.1M), stands at about 6.8, indicating a strong short-term financial health. However, comparing assets to debts reveals a total liability of $117M, a significant figure but manageable considering their current assets.

Over the past nine months, the net cash used in operating activities was $122.1M, indicating a monthly cash burn of approximately $13.6M. Given their liquid assets, the cash runway is estimated to be roughly 36 months. This calculation assumes a consistent burn rate, which is an important caveat as past performance does not guarantee future outcomes.

Considering these factors, the odds of Intra-Cellular Therapies requiring additional financing within the next twelve months seem low. Their current ratio is robust, and they have a relatively long cash runway, suggesting sufficient liquidity to support near-term operations without immediate fundraising needs. However, this assessment must be regularly revisited in light of operational performance and market conditions.

Market Sentiment

According to Seeking Alpha data, Intra-Cellular Therapies exhibits a mixed picture of market dynamics and corporate actions. The market capitalization of $5.14 billion, coupled with a high institutional ownership of 88.42%, reflects market confidence. This is supported by the significant growth in Caplyta sales and the potential expansion into the MDD market, which is reflected in the optimistic revenue projections with an expected increase to $948M by 2025. However, the stock momentum shows a relative underperformance compared to SPY over most timeframes, indicating market hesitancy or sector-specific challenges. The short interest of 3.36%, with 3.16 million shares short, is relatively modest, suggesting limited bearish sentiment among investors.

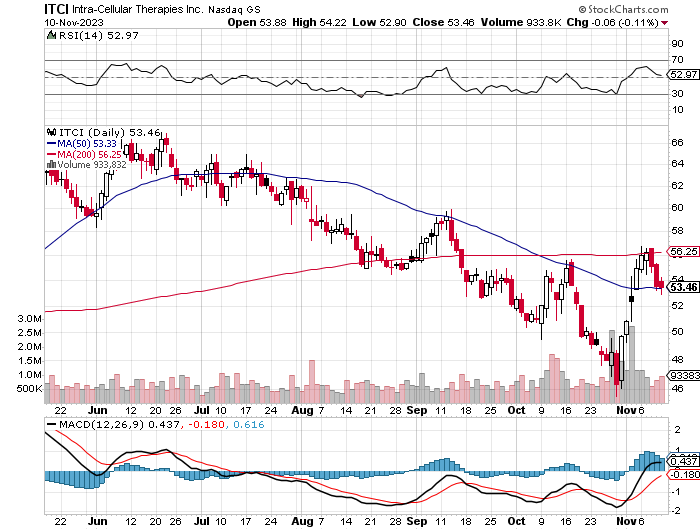

StockCharts.com

Institutional movements, especially the increased positions (9,823,340 shares) versus decreased positions (9,134,121 shares), indicate a balanced but slightly positive institutional perspective. Notable institutions like FMR, Vanguard, and BlackRock hold significant positions, though there’s a mix of increased and decreased holdings, showing varied institutional confidence.

Insider trades reveal a concerning trend with a net negative activity over both the past three (-141,943 shares) and twelve (-602,665 shares) months. This trend could signal caution from insiders regarding the company’s short-term prospects.

Why Caplyta Could Revolutionize Depression Treatment

Lumateperone, under the brand Caplyta, has already demonstrated a strong market presence in the treatment of schizophrenia and bipolar depression, indicating its acceptance and efficacy within these domains. This success forms a solid foundation for its potential expansion into treating MDD, a field where it not only promises to fulfill unmet needs but also exhibits characteristics that logically suggest its success.

The rationale for lumateperone’s potential success in MDD lies in several key aspects:

-

Unique Pharmacological Profile: Lumateperone’s mechanism of action is distinctively broad, targeting serotonin, dopamine, and glutamate pathways. This multifaceted approach is particularly relevant in MDD, a condition often characterized by complex and varied symptoms that may not be adequately addressed by medications focusing solely on serotonin and/or norepinephrine. By modulating multiple neurotransmitter systems, lumateperone has the potential to address a wider range of depressive symptoms, making it a compelling option for MDD treatment.

-

Addressing Unmet Needs in MDD: Many patients with MDD do not achieve full remission with existing antidepressants, and others are deterred by their side effects. Lumateperone’s favorable side effect profile, evidenced in its current indications, positions it as a potentially more tolerable option for MDD patients, which is crucial for long-term treatment adherence and effectiveness.

-

Adjunctive Therapy Strategy: The exploration of lumateperone as an adjunctive therapy to standard antidepressants is a strategic move. This approach capitalizes on the idea that combining treatments with different mechanisms can enhance efficacy, especially in patients who have an inadequate response to monotherapy. Given lumateperone’s unique action, it could synergize well with existing antidepressants, offering a more comprehensive treatment approach.

-

Proven Market Success: The commercial success of Caplyta in treating schizophrenia and bipolar depression already demonstrates market confidence in its efficacy and tolerability. This established track record provides a firm basis for its acceptance in the MDD market, especially among healthcare providers familiar with its use in other mental health conditions.

-

Ongoing Clinical Trials and Regulatory Pathway: The commitment of Intra-Cellular Therapies to extensive Phase 3 trials for MDD underscores the potential they see in lumateperone for this indication. Positive outcomes from these trials are likely to lead to regulatory approval, further supporting its market potential in MDD.

In summary, lumateperone’s innovative pharmacological profile, its potential to meet the unmet needs of MDD patients, its strategic use as an adjunctive therapy, along with its proven market success in other mental health conditions, form a logical and compelling argument for its likely success in treating MDD. The anticipation of positive clinical trial outcomes and subsequent regulatory approvals only strengthen this argument, positioning lumateperone as a potentially significant player in the MDD treatment landscape.

My Analysis & Recommendation

In conclusion, Intra-Cellular Therapies exhibits a strong financial position and significant clinical promise, particularly highlighted by the raised 2023 Caplyta net product sales guidance to $460 – $470 million. This upward revision underscores Caplyta’s successful market uptake in treating schizophrenia and bipolar depression and its potential in MDD. The company’s effective cost control and reducing net losses are indicative of a strategic path towards enhanced profitability.

Investors should closely monitor the ongoing clinical trials for MDD, as approval in this domain could substantially broaden Caplyta’s market scope. Regulatory updates, healthcare professionals’ receptivity to Caplyta in MDD, and the competitive dynamics within the MDD treatment landscape are crucial factors to watch in the coming months.

Investment strategies should involve a vigilant approach, with a focus on the company’s financial health, market position, and the evolving landscape of MDD treatments. While the biotech sector is known for its volatility, particularly for companies reliant on product approvals and market adoption, a balanced portfolio approach can help mitigate these risks.

Taking into account the raised guidance, strong financial fundamentals, and Caplyta’s clinical potential, along with the inherent risks in the biotech sector, I assign a confidence score of 80/100 and maintain a “Buy.” This reflects a positive outlook based on Intra-Cellular Therapies’ current trajectory and the prospective market expansion, tempered by an understanding of the sector’s uncertainties and competitive challenges.

Risks to Thesis

In assessing the investment recommendation for Intra-Cellular Therapies, several key risks and potential oversights emerge that may contradict the “Buy” recommendation:

-

Clinical Trial Risks: The assumption of Caplyta’s success in MDD trials might be overly optimistic. The failure or suboptimal results in these trials could significantly impact the company’s valuation and future revenue projections.

-

Market Penetration Challenges: The potential of Caplyta in MDD, while promising, may face challenges in market penetration due to established competitors and potential new entrants in the MDD market. The assumption of seamless market adoption could be an overestimation.

-

Regulatory Hurdles: The regulatory path for new indications is often unpredictable. Delays or unexpected regulatory requirements could impact the drug’s time to market and overall financial projections.

-

Reimbursement and Pricing Pressures: The healthcare industry is increasingly facing pressures on drug pricing and reimbursement policies. These factors could affect Caplyta’s profitability and market share, particularly in the MDD segment.

-

Operational Efficiency Overestimation: While the company has shown improved operational efficiency, this trend needs to be consistently maintained. Any unforeseen increase in operational costs could adversely affect the financial health.

-

Market and Economic Conditions: The broader market and economic conditions, including potential shifts in healthcare policy and investor sentiment in biotech stocks, could impact ITCI’s performance, independent of the company’s intrinsic value.

In light of these considerations, while the company exhibits strong potential, a more cautious approach might be warranted, with a readiness to reevaluate the position should any of these risk factors materialize significantly.

Read the full article here