Article Thesis

Jackson Financial Inc. (NYSE:JXN) has delivered a very nice 150%+ return over the last year, and yet, its valuation is still very low. In this article, we will take a look at the company’s business model, opportunities, and whether Jackson Financial is a good investment at current prices.

Past Coverage

I have not covered Jackson Financial publicly on Seeking Alpha, but we have covered it at Cash Flow Club. I have covered Brighthouse Financial (BHF), a relatively similar company, here on Seeking Alpha in 2021.

Company Overview

Jackson Financial Inc. is an insurance company that is focused on providing annuities to its customers, mostly retail investors. Its offerings include retirement and savings products such as variable and index-linked annuities and lifetime income solutions. This may not sound very exciting, and whether its offerings are attractive to customers is up for debate. But for shareholders of Jackson Financial, these products can be excellent, as the company is generating appealing profits via these offerings.

While Jackson Financial’s track record as a publicly traded company is not very long, the company has a much longer history. Jackson Financial was spun off by Prudential plc (PUK), meaning its business operations have a much longer track record than the track record as a standalone company, which began in 2021.

Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B) has proven that insurance operations can be quite profitable, which is, at least partially because insurance companies can utilize the insurance float to generate investment income. My colleague at Cash Flow Club, Darren McCammon, has described this as using other people’s money, which is a very fitting term.

Of course, the underlying insurance operations themselves should also generate profits, meaning the profits that are generated by investing the insurance float are just icing on the cake.

These items are not unique to Jackson Financial, of course, as the company’s peers, including Brighthouse Financial, American International Group (AIG), Lincoln National (LNC) and so on are operating in a similar manner. One could thus argue that insurers, or annuity providers, can be attractive investments in general, at least as long as these companies are well-managed. Management mistakes, e.g., the ones that led to AIG’s issues during the bursting of the housing bubble, can turn insurance companies into poor investments. Also, when investors buy equities at a too-high valuation, total returns can be unappealing, even if the underlying business is performing well and management is making the right decisions — shareholders that bought Cisco (CSCO) at the top of the dot-com bubble will know this very well.

Jackson Financial seems like a well-managed insurance companies that is doing reasonably well operationally. GAAP results for annuity companies such as Jackson Financial can be perplexing, as Jackson Financial sometimes reports negative GAAP revenues. This is attributable to losses on derivatives that the company records during some quarters. Jackson Financial uses these derivatives to hedge its portfolio against interest rate movements and other macro items. In some quarters, these hedges add to its revenues, while they result in a revenue headwind in other quarters. The impact of the changes in the market value of JXN’s derivatives is a non-cash item, however, which is why Jackson Financial also reports a non-GAAP revenue number that is more telling when it comes to the performance of the underlying business. After all, ups and downs in the value of the derivatives on the company’s balance sheet that are used for hedging purposes don’t really tell a lot about the underlying business performance.

During the most recent quarter, GAAP revenues were negative — due to the aforementioned movements in Jackson Financial’s derivatives position. Non-GAAP revenues were appealing, however, as fee income was up 5% year-over-year, while net investment income was up 4% year-over-year. Sure, this isn’t Nvidia-like (NVDA) growth, but the valuation is quite low, meaning even a mid-single digit growth rate is far from bad.

Like almost every company, Jackson Financial also reports non-GAAP profits. These back out one-time and non-cash items as well, such as the movements in the derivatives position. On an adjusted basis, Jackson Financial earned $334 million during the most recent quarter, or a little more than $1.3 billion on an annualized basis. This was up 23% compared to the previous year’s period, as Jackson Financial benefitted from higher fee income, while operating leverage was working in the company’s favor as well.

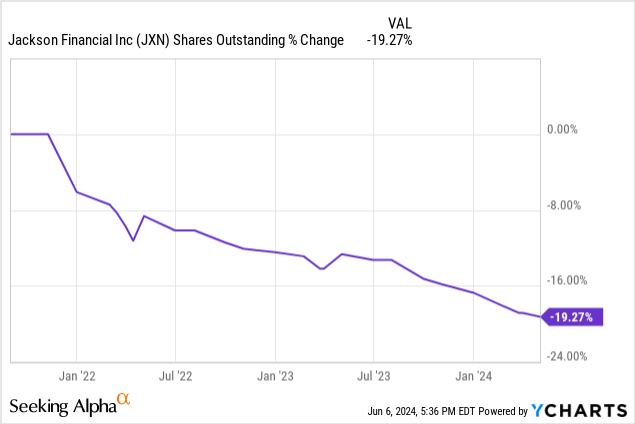

Earnings per share came in at $4.23 for the quarter, versus $3.15 during the previous year’s quarter. This was a 34% increase compared to the previous year’s period — a much stronger growth rate compared to the company-wide profit increase. This can be explained by Jackson Financial’s very shareholder-friendly strategy when it comes to returning cash to the company’s owners. The following chart shows Jackson Financial’s share count over the years:

Since Jackson Financial’s IPO around three years ago, the company has reduced its share count by almost 20%. This made each share’s portion of the overall earnings pie grow by around 25% over the last three years, giving a nice extra boost to Jackson Financial’s earnings per share growth.

But JXN’s buybacks do not only generate additional earnings per share growth, they are also highly beneficial for another metric: Jackson Financial’s book value. While book value is not necessarily a good metric to evaluate a tech company or a pharma company, companies from the financial industry have a high portion of liquid and easily valuable assets on their balance sheets, thus the book value of these companies is a relevant metric.

Jackson Financial’s book value stood at $124.42 at the end of the most recent quarter, up by around 3% compared to the previous quarter (Q4 of 2023). This was possible despite company-wide book value staying flat over that time frame, at $9.6 billion — the decline in JXN’s share count made each share’s book value grow at a double-digit annualized pace. With Jackson Financial trading for around $70 per share today, there is a clear discount compared to book value — buying back shares under these conditions results in a growing per-share book value.

Jackson Financial also reports an adjusted book value number, where preferred stock and Accumulated Other Comprehensive Income (Loss) are excluded. The Accumulated Other Comprehensive Income (Loss) can be either positive or negative, depending on where interest rates are. Currently, interest rates are relatively high, compared to the last couple of years, which has resulted in AOCI being negative. When AOCI is backed out, book value is thus higher, standing at $147.17 per share as of the end of the most recent quarter. While some may prefer to look at GAAP book value instead of the adjusted metric, a case can be made for adjusted book value to be the more telling number, as AOCI can distort the number upwards or downwards due to price swings in interest-rate sensitive assets — but when JXN owns treasuries, for example, and plans to hold them until they mature, short-term price swings in these treasuries are not significant for the company.

If one looks at adjusted book value, JXN currently trades at a little less than 0.5x book value today, which is quite cheap. Investors that prefer the GAAP number see a book value multiple of around 0.6, which is still far from high. This suggests that Jackson Financial will be able to drive substantial future book value growth if the company keeps buying back shares at a major discount to book value.

Is JXN A Good Investment?

Jackson Financial Inc. is quite profitable, the company is experiencing solid fee income growth thanks to strong index-linked annuity sales (which hit a record level during the most recent quarter). The shareholder-friendly capital allocation approach of buying back shares at a huge pace is attractive, too.

Jackson Financial offers a dividend yielding 3.8%, which is not ultra-high but which adds nicely to the company’s total return outlook. While buying JXN a year ago or half a year ago would have been even better, JXN does not look like a bad investment at all right here, trading at around 0.6x GAAP book value and at just below 0.5x adjusted book value.

Read the full article here