Back in March, I took JAKKS Pacific (NASDAQ:JAKK) to “Strong Buy” saying that its long-term story was intact and that the stock had been thrown into the deep discount bargain bin. I followed up in May saying that the stock was still grossly undervalued. With the stock nearly doubling since my upgrade to “Strong Buy,” let’s take a closer look at the name.

Company Profile

As a quick refresher, JAKK designs, produces, and distributes both its own branded and private label toys, as well as licensed toys from the likes of brands such as Disney (DIS) and Nickelodeon. The company sells its toys primarily through the retail channel, with Walmart (WMT) and Target (TGT) being its two largest customers at over 25% of its sales each.

Q3 Earnings

For Q3, JAKK saw its revenue decline -4.1% to $309.7 million. That handily topped analyst estimates calling for sales of $283.3 million.

By category, Dolls, Role-Play/Dress Up was down -26.9% to $139.2 million, while Outdoor/Seasonal Toys saw revenue dip -2.2% to $13.1 million. Action Play & Collectibles climbed 42.5% to $93.7 million, while Costumes jumped 19.4% to $63.7 million.

North American revenue dropped -3.9% to $256.4 million, while International sales fell -5.3% to $53.4 million. Latin America was once again a standout, seeing sales soar over 61.2% to $15.3 million.

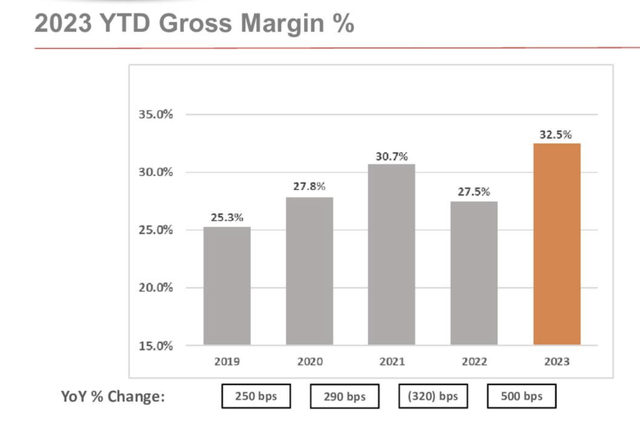

Gross margins soared 600 basis point to 34.5%. Sequentially, gross margins rose 380 basis points.

Company Presentation

G&A expenses, meanwhile, were 15% higher to $33.8 million.

Adjusted EPS came in at $4.75, up from $3.80 a year ago. Analysts were expecting adjusted EPS of $3.38.

Adjusted EBITDA rose 13% to $67.1 million from $59.3 million a year ago.

Inventory was down -37% year over year to $68.8 million. Inventory turnover fell to 31 days sales of inventory from 44 DSI a year ago.

The company ended the quarter with $96.3 million in cash and zero debt.

As is common practice, JAKK did not offer formal guidance.

Discussing the current environment of its Q3 earnings call, CEO Stephen Berman said:

“Switching now to talking about what we’re seeing at retail. On the toy side, it’s been the case all year and continued this past quarter when we look at our own data and syndicated data. We see that the toy portion of our business continues to perform better than the overall industry in the US. The same has been true with some of our European markets where we also see syndicated data. Certainly, some of the great content from our studio partners is helping to drive people to the register this year, much as it did last year. But broadly, we’ve been pleased with how the total portfolio is performing this year as we said last quarter. That being said, in Q3, we did see retail slowing. Retail sales at our top three US accounts were down low-single digits year to date and down high-single digits in the quarter. Separately at the end of the quarter, retail inventory at the same accounts were down over 20% versus prior year, delivering on their goals to finish the calendar year at lower-owned inventory levels. As we work through this transitional year at retail, we’ve managed to stay in-stock across all of our key product segments and are set up well to fulfill demand in Q4.”

The company also announced a multiyear worldwide relationship with Authentic Brands Group, which owns brands such as such as Roxy, Quiksilver, Element, Forever 21, Juicy Couture, and Sports Illustrated. JAKK will start off with a rollout of branded skateboards for Quicksilver and Elements in the fall of 2024. It will also look to roll out roller and in-line skates and beach accessories, as well as a line of dolls “infused with fashion elements from Forever 21, Juicy Couture, Prince, Sports Illustrated, and Roxy.” The company said the spring-summer nature of the business will help balance out its traditional Halloween/holiday seasonality.

JAKK also announced that it will create a new toy product line around The Simpsons that will debut in the fall of 2024. In addition, it entered into a new agreement with Sega to support its Sonic Hedgehog 3 feature film set to release in December of 2024.

This was a nice quarter from JAKK, highlighted by its strong margin expansion. The company benefited from lower freight costs like many companies have, but gross margin improvement has been a big priority for the firm, and its year-to-date gross margins of 32.5% are its best in more than a decade.

The company has also done a great job of building out its costume business, which really shown through in the quarter. Its Action Play & Collectibles business has also been on fire, and has doubled since 2021.

Now there has been some retail slowing given some pressure on the consumer, but both channel inventory and its own inventory are in really good shape, showing how well the company is being managed.

Looking ahead, the licensing deal with ABG looks like it has the potential to be a strong one for JAKK’s Outdoor business over time, while The Simpson deal should have a nice impact next year and help continue the momentum of its Action Play & Collectibles business.

Valuation

JAKK trades 2.5x the 2023 consensus EBITDA of $86.3 million and 2.8x the 2024 consensus of $76.3 million.

It trades at a forward PE of 5.2x the 2023 consensus of $5.31. Based on 2024 analyst estimates of $4.78, it trades at 5.7x.

JAKK is projected to see its revenue decline -9% in 2023 after a 23% increase in 2022. Revenue is projected to grow 3% in 2024.

Comparatively, fellow toymaker Hasbro (HAS) trades at 8.9x 2024 EBITDA of $1.12B and an over 11x PE based on 2024 estimates. Mattel (MAT) trades at 8.8x 2024 EBITDA of $1.03 billion and a PE of 13.2x based on 2024 estimates. Both are projected to generate low to mid-single digit revenue growth, similar to JAKK.

I see no reason that JAKK should trade at such a huge discount to HAS and MAT given the turnaround at the company. At a 6x EV/EBITDA multiple, JAKK is a $50 stock, which is still a substantial discount to its peers.

Conclusion

Despite nearly doubling since I upgraded the stock to “Strong Buy,” JAKK still remains incredibly cheap, as investors continue to not give the company credit for the turnaround that CFO John Kimble has helped orchestrate. The company has greatly improved its margin profile and its inventory position has been extremely well managed, both what it holds as well as in the channel.

At the same time, the company has been nicely growing its Action Play & Collectibles and Costume segments, while it just made a big licensing deal to help out its more struggling Outdoor segment. While the consumer and macro environment is a risk, overall, I really like what I’m see with JAKK. I continue to rate the stock a “Strong Buy” and think it has upside to over $50.

Read the full article here