KBC Group (OTCPK:KBCSY) offers a high-dividend yield that is sustainable over the medium to long term, being the most attractive feature of its investment case.

As I’ve covered in a previous article, KBC is in my opinion one of the European banks with better business fundamentals, being quite attractive for long-term investors due to its quality profile and high-dividend yield.

Despite that, its share price has been relatively week in recent months, thus in this article I do an update regarding its recent financial performance and update its investment case, to see if it remains an interesting quality and income play within the European banking sector or not.

Earnings Analysis

While KBC has strong fundamentals and good levels of profitability throughout the economic cycle, KBC is not among the European banks more geared to interest rates and this is a key reason why its recent growth has not been particularly impressive and its share price has underperformed its peers in recent months.

Indeed, as shown in the next graph, KBC (white line) is up by some 8% over the last year, while the European banking sector is up by close to 24% over the same timeframe.

Share performance (Bloomberg)

Given that KBC has a bancassurance business model, having both banking and insurance as core businesses, its revenue mix is more diversified than compared to other European banks, with net interest income having a lower weight than usual for other retail-focused banks.

Indeed, during the first nine months of 2023, its NII amounted to €4.1 billion, representing only 48% of total revenues. This is among the lowest levels for banks that are mainly focused on retail and commercial banking, while banks more exposed to rates generate between 75-80% of total revenues from NII.

Moreover, a large part of its loans are set on fixed rates, while in Southern countries most loans are based on floating rates, making KBC less geared to rising rates. This backdrop explains why despite a steep rising interest rate environment over the past eighteen months in Europe, KBC’s NII increased by only 9.8% YoY, during the first nine months of 2023.

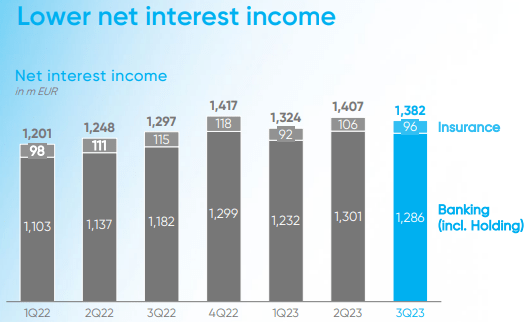

While this NII growth is not particularly impressive on the back of rising rates in recent quarters, more worrisome was its quarterly decline in Q3. Its NII in the last quarter was €1.38 billion, down by 1.8% YoY, due to higher deposit costs in Belgium. This happened because the Belgium government issued a retail bond in September that was very successful, leading to some deposits outflows in the banking system, and put pressure on banks to increase remuneration in time deposits.

This was a headwind for NII growth in Belgium in Q3, and is likely to also put pressure on the bank’s NII in Q4. Furthermore, the European Central Bank has stopped its hiking pace last September and is likely to maintain its key rate unchanged for some time, while the market is currently expecting cuts by Q3 2024. This means that KBC’s NII likely has reached its peak in Q2 2023 and going forward is probable that NII will be a headwind for revenue growth. For the full year, KBC has lowered its guidance to about €5.4 billion (from €5.6 billion previously), showing the negative pressure on NII is also expected to continue in Q4.

NII (KBC)

Also showing that KBC’s exposure to rates is somewhat limited, its net interest margin did not improve much during this rising interest rate environment, given that NIM was 2.04% in Q3 2023 (vs. 1.90% in Q1 2022), which can now turn into a positive factor if rates start to decline in Europe, anticipating potential central bank cuts in the second half of 2024.

Regarding other main revenue sources, fees and commissions (+4.8% YoY) and revenue from insurance (+10.8% YoY) reported strong growth during 9M 2023, being an important support for overall revenue growth (+13.8% YoY), to €8.55 billion in 9M 2023.

Regarding costs, despite the inflationary environment the bank was able to report contained cost growth over the past few quarters, even though staff and IT expenses have increased in recent months. In 9M 2023, KBC’s total expenses were €3.5 billion, up by 7.3% YoY, which was a lower increased than revenue growth and led to positive jaws in the period.

However, its cost-to-income ratio did not improve as much compared to European banks with higher leverage to rates, improving to 48% in the first nine months of 2023 (vs. 49% in 2022), while the most efficient banks in Europe are now reporting cost-to-income ratios below 40%. Nevertheless, in a potential period of lower rates ahead its cost-to-income ratio is expected to be more resilient, which may be a positive factor if the interest rate environment changes considerably over the next twelve to eighteen months.

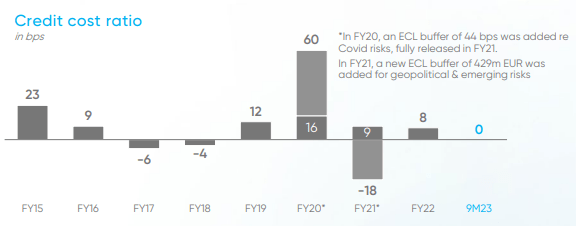

Regarding credit quality, this is one of the bank’s main strongest factors, as KBC has been able to report very low levels of credit losses throughout the past few years. As shown in the next graph, its cost of risk ratio has been quite low over the past nine years, with the only exception being 2020 when it made an increase in provisions that were partially reversed in the following year. In 9M 2023, its credit losses were near zero, which is a very good outcome considering higher interest rates, the cost of living crisis, inflationary pressures, and slower economic growth in Europe.

Cost risk (KBC)

While credit quality has been quite resilient and credit losses were extremely low during the last couple of years, a ‘normalization’ of credit losses to levels more in-line with the historical norm is expected ahead, which means higher provisions are likely in 2024. Nevertheless, this is not expected to increase much beyond 20-30 bps on an annual basis, thus the negative impact on the bank’s bottom-line is likely to be manageable.

Due to higher revenue, contained cost growth, and superior credit quality, KBC’s net profit increased to €2.7 billion in the first nine months of 2023, up by 30% YoY. Its return on equity (ROE) ratio was 17% in this period (vs. 13% in 2022), a level that is within the most profitable banks in Europe.

Regarding its capital position, KBC’s CET1 ratio was 14.6% at the end of last September, down on a quarterly basis due to its ongoing share buyback program and higher risk-weighted assets due to some model changes. This ratio is still quite good, even though it’s lower than it was at the end of 2022 (15.4%), and is comfortably above its capital requirement of 10.9%.

However, the bank’s medium-term target is to have a capital ratio of about 15%, thus KBC may decide to lower its future share buyback programs or may even totally suspend it, to build up a little bit its capital ratio in the near future.

For 2024, KBC’s guidance is not particularly impressive given that it expects NII to be flat in the year at about €5.4 billion, impacted by higher deposit costs and outflows following the Belgian State Note, plus higher taxes will also a negative impact on its profitability. According to analysts’ estimates, this will lead to revenues of nearly €11 billion in 2024, slightly ahead 2023 revenues, while its net profit is expected to decline to about €2.9 billion (-12% YoY).

This means that KBC’s growth in the short term is likely quite muted, thus its investment case is highly geared to income, as the bank continues to offer a high-dividend yield. Indeed, its last annual dividend was €4 per share, and is expected to grow to €4.40 per share related to 2023 earnings.

This is expected to represent a dividend payout ratio of about 52%, which is in-line with its dividend policy, and at its current share price leads to a forward dividend yield of 8.30%. This is quite attractive to income investors, given that its dividend is clearly sustainable and is likely to maintain a growing path in the coming years, supported by strong business fundamentals and an excess capital position.

Conclusion

KBC offers a very high-dividend yield that is sustainable over the medium to long term, being the most attractive feature of its investment case. Regarding its operational performance it can be considered mixed in recent quarters, and I don’t see many catalysts for a re-rating of its shares in the near term.

Its valuation has been on a downward trend in recent months, as this seems to be justified by revenue headwinds, which are not expected to subside in the short term. Therefore, I see KBC’s current valuation of close to book value as fair, being income the main reason to hold its shares right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here