Synopsis

La-Z-Boy Incorporated (NYSE:LZB) is the leading global manufacturer of reclining chairs and the second-largest distributor of furniture in the U.S. According to a KeyBanc consumer survey, it is also a leading brand for interest in new furniture purchases. However, the outlook for the furniture industry has been rather weak due to a housing shortage and lingering inflation. In the midst of the chaos in the housing market, LZB is focusing on solidifying their business by gaining more market share and strengthening their operating margins. In addition, my relative valuation has brought me to a target share price of $36.98 with a 12% upside potential. Therefore, I am recommending a buy rating.

Historical Financial Analysis

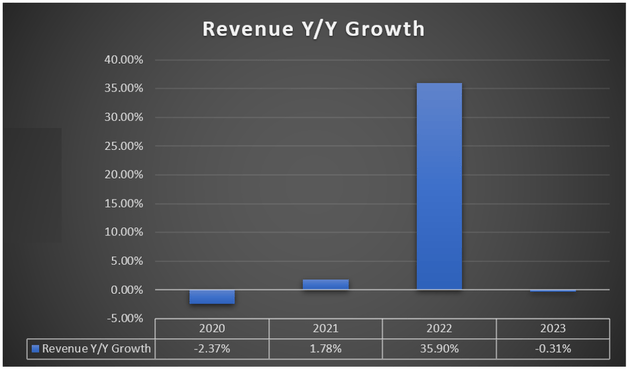

Author’s Chart

In FY22, year-over-year revenue growth increased significantly, hitting 35.90%. Sales have increased by $622.6 million from FY21. As retail and manufacturing businesses reopened post-pandemic, LZB saw a significant increase in orders. Pent-up demand during closures led to a surge in orders, indicating a robust surge in consumer interest in their product once restrictions were lifted. This increased demand driven by the impact of the pandemic resulted in a relative decrease in volume delivered in FY23, therefore leading to a decrease of ~0.3%.

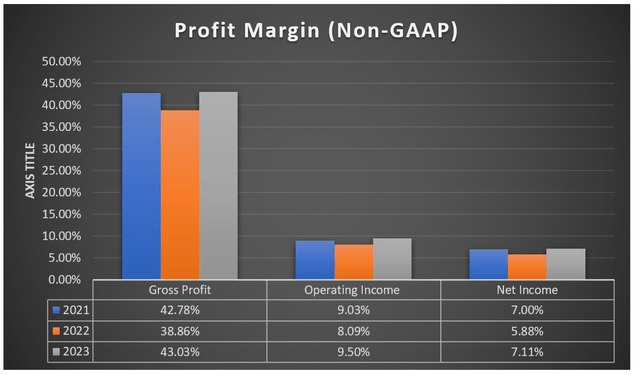

Author’s Chart

Moving on to margin, there is an overall slight increase in LZB’s annual margins. Gross margin has improved by ~4.1% as a result of higher sales volume in the retail segment, which has a stronger gross margin than the Wholesale segment. Pricing and surcharge actions to combat inflationary cost pressures that were executed in prior years were realized in FY23, driving up gross margin.

This inflationary pressure on raw materials and freight costs was driven by pandemic-related challenges in the global supply chain. Therefore, LZB took action on pricing and surcharges to counter the rising costs. Despite the reduction in costs in FY23, global supply challenges that persisted in the first half of FY23 partially offset LZB’s robust profit margin. In addition, SG&A for the full year has increased by 2.7%. This is primarily due to the higher volume of sales in the Retail segment, which has a higher marketing expenditure to drive sales. A robust top-line result in FY23 has resulted in an all-time high in non-GAAP operating income at 9.5%, increasing by ~1.4% from FY22. Its net income margin has increased overall by 1.23%, reaching 7.11%.

For 3Q23, sales have fallen by 13% as compared to 3Q22 sales, which have benefited due to high pandemic-related backlog fulfillment. This quarter’s results have been heavily impacted by winter weather. This has slowed production, causing delivery delays, temporary closure of production facilities, and softening store traffic. LZB has maintained a strong balance sheet and financial position, with $333 million in cash and no external debt.

Revenue Segment

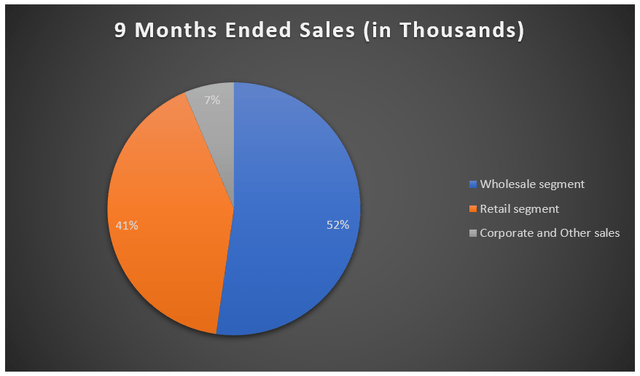

LZB’s business can be segregated into three different segments: Wholesale, Retail and Corporate & Others segments. The wholesale segment can be further segregated into 3 segments: its largest operating segment La-Z-Boy, its England subsidiary, and case goods brands [American Drew, Kincaid, and Hammary]. The retail segment comprises 171 stores, selling furniture and case goods to end consumers.

Author’s Chart

Stagnant Housing Market

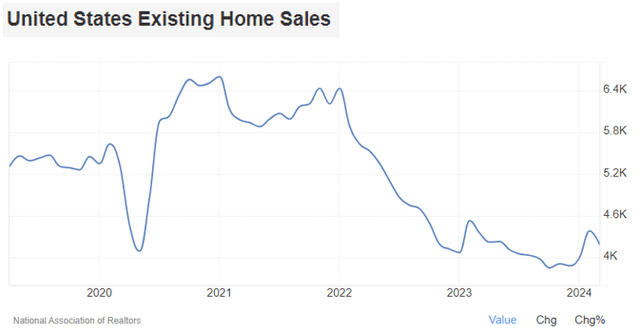

Trading Economics

Existing and new housing activities have a strong influence on this industry’s overall growth. During FY21 and the start of FY22, more discretionary expenditure was directed towards home furniture, which led to a boost in demand. In 2022 and 2023, existing home sales have plunged as the Fed started raising the interest rate in 2022 to combat inflation, which in turn has put a strain on the housing market.

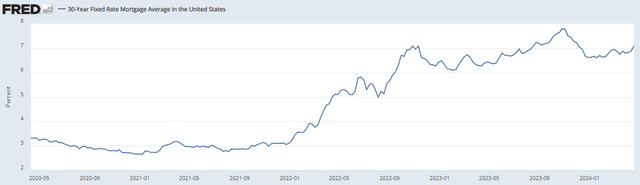

The Fed’s inaction on the interest rate has stalled U.S. existing home sales for some time. Since then, the Fed has kept interest rates stable because it lacks confidence in inflation control. The 30-year fixed-rate mortgage has remained high, currently averaging around 6%. Aside from cooling off the mortgage rate, an increase in home inventories would also ease rising home prices.

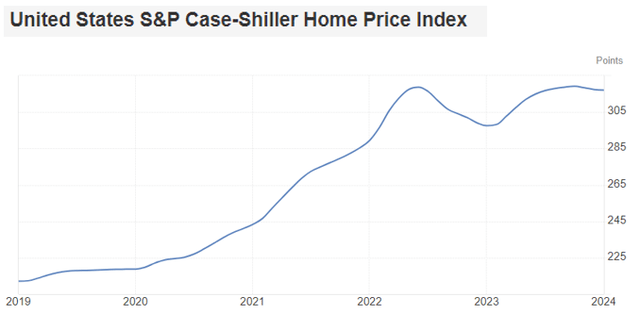

Based on the S&P Case-Shiller Home Price Index, prices have cooled down slightly at the start of 2024, despite the fact that they have generally been rising for quite a while. Existing homeowners with relatively low mortgage rates may be reluctant to move because refinancing at the current higher rates would be expensive. This reluctance contributes to a lower number of homes available for sale, and thus, a low supply of homes would drive up the prices of existing and new homes. This in turn impacts the home furniture industry until homebuyers are more certain of where interest rates are headed.

Trading Economics

Trading Economics

LZB Prepares and Anticipates for Normalization of Furniture industry

LZB management has been anticipating a return to what they consider a normalization of furniture demand in the latter half of FY25, driven by favorable demographics and a potential easing of interest rates. They are looking on the positive side, where a persistent structural housing shortage may support long-term demand for furniture as housing inventories pick up. Additionally, an interest rate cooldown could return demand to a normalized level.

In response to these conditions, they are focusing on solidifying their business for the long run by gaining market share, growing revenue, and strengthening operating margins, which is in line with their Century Vision Growth strategy. This included acquisitions and store openings. They have already acquired six independent stores this quarter and will add two more in the following quarter. This brings to a total of 11 stores acquired for FY24. These acquisitions of independent stores are crucial to LZB’s profitability, optimizing retail operations by integrating them into existing operations and leveraging its vertical integration and wholesale-retail margin.

Acquiring independent stores also ensures a uniform brand experience across its retail network. By controlling more of the retail process with these acquisitions, it supports LZB’s vertically integrated model, which is a significant competitive advantage because they can deliver furniture with strong speed-to-market.

Valuation

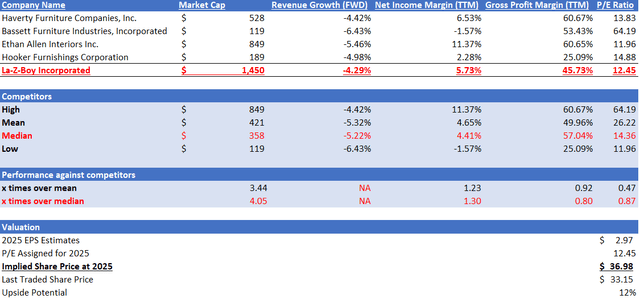

Author’s Valuation

LZB is the second-largest manufacturer in the United States and has the highest market cap among its peers at $1.45 billion. Its products are in the mid-to-upper price range, above budget but below luxury, specializing in residential furniture for the living room, bedroom, and dining room. I will be comparing LZB with its peers in the competitive home furniture industry.

All the firms have displayed a negative forward revenue growth rate, indicating a softening outlook. Among its peers, LZB still performs better, with an expected decline of about 1% lower than its peers’ median. LZB has a slightly weaker TTM gross profit margin but has outperformed its TTM net income margin. It has a TTM gross profit margin of 45.73%, 0.80x of peers’ median of 57.04%. With a 5.73% TTM net income margin, it is 1.30x the peers’ median of 4.41%.

Currently, LZB’s forward P/E ratio is at 12.45x, trading slightly lower than peers’ median of 14.36x. LZB’s 5-year average forward P/E stands at 13.13x. Given LZB’s outperformance, I would argue that LZB should at least be trading at peers’ P/E. However, given the current concerning housing situation, I would assign a lower P/E of 12.45x to remain conservative in my valuation. The 2025 market revenue estimate is $2.07 billion, and the EPS estimate is $2.97. Given the current macro headwinds discussed, these estimates are reasonable. By applying my target P/E of 12.45x to its 2025 EPS estimate, my 2025 target price is $36.98, a 12% upside potential.

Risk & Conclusion

LZB expects monetary policy easing to kick in and ultimately return to normalized demand in the furniture industry. The furniture industry is especially sensitive to cyclical changes in the economy because LZB’s goods are considered discretionary purchases. Prolonged inflation and a high-interest rate would continue to impact overall demand. Housing would still be unaffordable with the high mortgage, resulting in lesser demand for home furnishings.

LZB has also anticipated a potential price increase for core materials, which could be countered by passing costs on to customers. However, they may not be able to fully mitigate the impact of inflationary pressures on costs, which would, in turn, affect operating profits. In response to the macro headwinds, they are expanding their brand reach by growing their network by opening new stores and acquiring them. Additionally, my relative valuation has shown that LZB outperformed its peers, with a strong net income margin and a relatively better forward revenue outlook. Therefore, I am recommending a buy rating.

Read the full article here