Welcome to the February 2024 edition of the “junior” lithium miner news. We have categorized those lithium miners that are not in production as the juniors.

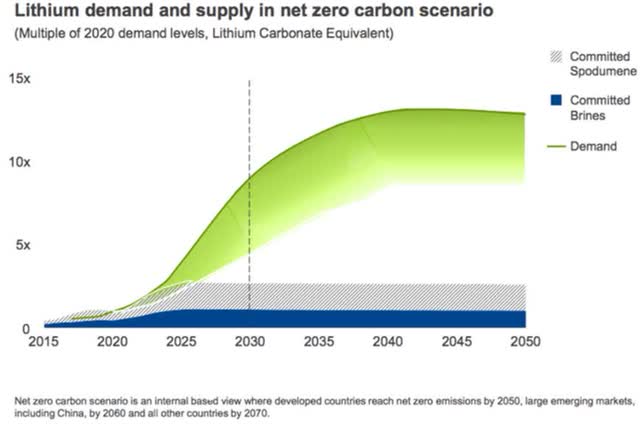

Note: Investors are reminded that many of the lithium juniors will most likely not be needed until the mid and late 2020’s to supply the potentially booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

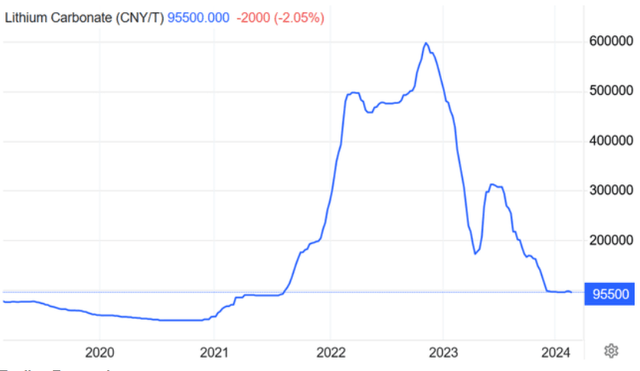

February saw lithium prices generally flat.

Lithium price news

Asian Metal reported during the past 30 days, the China delivered lithium carbonate (99.5% min.) spot price was down 0.59% and the China lithium hydroxide (56.5% min.) price was down 2.18%. The Lithium Iron Phosphate (3.9% min) price was flat (0.0% change). The Spodumene (6% min) price was flat (0.0% change) over the past 30 days.

Metal.com reported lithium spodumene concentrate Index (Li2O 5.5%-6.2%, excluding tax/insurance/freight) spot price of USD 910/t, as of Feb. 22, 2024.

China lithium carbonate spot price 5 year chart – CNY 95,500 (~USD 13,281) (source)

Trading Economics

Rio Tinto forecasts lithium emerging supply gap (chart from 2021) – 60 new mines the size of Jadar needed

Rio Tinto

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of February 2024” article. Highlights include:

- Fastmarkets – Battery materials market facing oversupply and macroeconomic headwinds in 2024. Forecast a tentatively balanced lithium market in 2024.

- Lithium-ion battery inventory levels approaching a critically low level (1x monthly demand) as of Jan. 2024.

- Germany invests €1 billion to counter China on raw materials.

- GM, LG Chem establish $19 billion battery supply deal.

- EU, US to align global minerals push against China’s supply grip.

- China’s battery and car makers have united as part of a government-led drive to commercialize solid-state batteries (& supply chain) by 2030.

- Albemarle forecasts 3.3mtpa of lithium carbon equivalent to be needed globally by 2030, a 10% cut from its previous forecast of 3.7mtpa.

- US moves to restore stockpiling ‘panic button’ in EV metals fight with China.

- China’s lithium carbonate futures jump on talk of environmental crackdown in Yichun, Jiangxi, China.

- Australia’s Pilbara Minerals sees signs of lithium slump ending.

Junior lithium miners company news

Liontown Resources [ASX:LTR] (OTCPK:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia.

On January 31, Liontown Resources announced:

Quarterly activities report for the period ended 31 December 2023…The Project reached 72 percent completion at quarter end…The Company’s cash balance was A$516.9 million as at 31 December 2023. Subsequent to the quarter the Company announced it had commenced discussions with its lending syndicate on a revised, smaller debt facility. A further funding update is expected by the end of the March 2024 quarter.

Upcoming catalysts include:

- Mid 2024: Commissioning with production set to begin mid 2024 at the Kathleen Valley Project.

- 2023-25: Study with Sumitomo Corporation to produce lithium hydroxide in Japan.

Wesfarmers [ASX:WES] (OTCPK:WFAFY) (took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV (“Covalent Lithium”) between Wesfarmers [ASX:WES] and SQM (SQM), located in Western Australia.

On February 15, the AFR reported:

Wesfarmers won’t make money off lithium at current prices…confirmed it will make lithium concentrate this half, but its foray into critical minerals will be unprofitable at current prices.

Upcoming catalysts include:

- H1, 2024 – Mt Holland spodumene production, ramp up to 380,000tpa.

- H1, 2025 – Kwinana LiOH refinery planned to begin and ramp to 45-50ktpa LiOH.

Eramet [FR:ERA] (OTCPK:ERMAY) (OTCPK:ERMAF)

Eramet is in a JV ‘Eramine Sudamerica’ (50.1% Eramet, 49.9% Tsingshan) which owns the Centenario-Ratones Lithium Project in Argentina. Eramet targets to start DLE production by Q2 2024.

On February 21, Eramet announced: “2023 results: Confirmation of solid fundamentals for the Group, in a very de-pressed price environment in 2023.” Highlights include:

- “Excellent intrinsic performance in second half (+€230m, for a total of +€153m over the year) leading to adjusted EBITDA at €772m in 2023, in a depressed price environment on a full-year basis (-€1,373m)…

- Net income, Group share positive at €109m, including the asset impairment related to SLN(*).

- Solid performance of restated Free Cash-Flow [FCF], at €78m in a context of growth capex, resulting in net debt of €614m, and adjusted leverage of 0.8x.

- Proposal of a dividend of €1.5 per share, in line with the Group’s capital allocation policy.

- Start of lithium production in Argentina this summer, with the achievement of full capacity confirmed by mid-2025…

- 2024 outlook set against the background of a continued very difficult macroeconomic context with low market price levels at the start of this year.

- Growth in volume targets in 2024:…Lithium carbonate produced at Centenario: between 5 and 7 kt-LCE.

- Financial performance in H1 2024 expected to be significantly below that of H2 2024 given the unfavorable seasonality but also market prices which should not rebound before the second part of the year.

- Ambitious and controlled capex plan, of around €700m to €750m financed by the Group in 2024, in order to support growth in activities and plan for the future.”

Upcoming catalysts include:

- Q2, 2024 – Start of lithium production in Argentina. Progress construction pics here.

POSCO [KRX:005490] (PKX)

POSCO owns the northern Sal de Vida (Hombre Muerto salar, Argentina) tenements.

No lithium news for the month.

Upcoming catalysts include:

- H1, 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Leo Lithium Limited [ASX:LLL] (OTCPK:LLLAF)

Leo Lithium is developing the Goulamina Lithium Project (50/50 JV with Ganfeng Lithium) in Mali with a total Resource of 211 Mt @ 1.37% Li2O.

No news for the month.

Upcoming catalysts include:

- ?Q2, 2024: Commissioning targeted to begin for Goulamina Lithium Project. The outcome of negotiations with the Mali Gov.

Atlas Lithium Corp. (ATLX)

On February 20, Atlas Lithium announced:

Atlas Lithium expands Anitta 3 pegmatite, provides representative cross-sections. Anitta 3 current cross sections reveal two ore bodies with individual true widths up to 42m and combined true widths of up to 52m in certain sections, and with mineralized lithium-bearing spodumene starting near the surface…

Upcoming catalysts include:

- Q4, 2024/Q1, 2025 – Production targeted to begin at the Das Neves Lithium Project in Brazil.

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF)

ioneer ltd. owns 50% (JV with Sibanye Stillwater) of its flagship Rhyolite Ridge Lithium-Boron Project in Nevada, USA.

On January 30, ioneer Ltd announced: “Quarterly activities report for the period ending 31 December 2023.” Highlights include:

Permitting

- “Key milestone achieved with completion by BLM of the administrative draft EIS.

- The draft EIS will be made available to the public once BLM management and cooperating agency reviews are complete.

- Commencement of the 45-day public comment period expected this quarter (Q1 2024).”

Project Advancement and Operational Readiness

- “Successful geotechnical drilling program completed on time and on budget.

- Drilling program completes coverage of the southern and southeastern sections of the South Basin and provides valuable information for the NEPA evaluation that will also feed into the updated resource and quarry design.

- Work continues on updates for resource/reserve, capital and operating cost estimates and financial model.

- Engineering design now at a mature stage requiring only minimal spend ahead of FID and commencement of construction.”

Growth Opportunities

- “Ioneer and Eco Pro expand existing partnership with MOU covering potential future development of the Rhyolite Ridge lithium clay resource (currently excluded from Project design and economics).”

On February 21, ioneer Ltd announced:

Interim condensed consolidated financial statements…The Group reported a consolidated comprehensive loss of $2.6m for the half year ending 31 December 2023 (2022: loss: $6.3m)…

Upcoming catalysts include:

- 2024 – Possible permitting approval. Commencement of construction of the Rhyolite Ridge Lithium-Boron Project.

Atlantic Lithium Limited [LSE:ALL] [ASX:A11] (OTCQX:ALLIF)

Atlantic Lithium is progressing its Ewoyaa JV Project in Ghana towards production. Piedmont Lithium has an effective 40.5% project earn-in share.

On January 31, Atlantic Lithium Limited announced:

Quarterly activities and cash flow report for the quarter ended 31 December 2023. Atlantic Lithium takes major stride towards production with grant of historic Mining Lease in respect of the Ewoyaa Lithium Project…Cash on hand at end of quarter was A$9.8m…Completion of Stage 1 of the Company’s competitive offtake partnering process to secure funding for a portion of the remaining 50% available feedstock from Ewoyaa to expedite the development of the Project…

On February 5, Atlantic Lithium Limited announced:

Multiple broad and high-grade drill intersections. Resource extension drilling. Results Ewoyaa Lithium Project, Ghana, West Africa. 83m at 1% Li2O from 36m returned at Dog-Leg target…

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

On February 20, Critical Elements Lithium Corp. announced:

Progress of the Rose project – New Government authorizations obtained…Jean-Sébastien Lavallée, Chief Executive Officer of the Corporation, stated: “We are grateful to the Ministère for their continued support as we move the Rose Project towards a final investment decision. Despite the current negative sentiment around lithium equities, management remains confident in the quality of the Rose Project, the investment appeal of Québec as it develops its battery supply chain ecosystem for the future, and the future global growth of quality lithium demand. Our highly experienced lithium industry management team is well-positioned to pivot to meet the challenges of today’s market and we are excited for the future of the Corporation.“

Upcoming catalysts include:

- H1, 2024 – Possible off-take or project financing announcements.

- 2025 – Target to commence production (assumes Project funding achieved soon)

Lithium Americas [TSX:LAC] (LAC)

Lithium Americas owns the North American assets (Thacker Pass, ~5.2% equity in GT1) from the LAC split.

No news for the month.

Upcoming catalysts:

- 2024 – Thacker Pass construction to progress. Waiting on a potential DOE ATVM Loan.

- H2, 2026 – Phase 1 (40,000tpa LCE) lithium clay production from Thacker Pass Nevada (full ramp to 80,000tpa by ?2028).

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On January 30, Vulcan Energy Resources announced: “Quarterly activities report for the period ending 31 December 2023.” Highlights include:

- “Positive results from Vulcan’s Bridging Engineering Study for Phase One, demonstrating the low operating cost and robust nature of the ZERO CARBON LITHIUM™ Project, by keeping target NPV materially the same, demonstrating the robustness of the Project despite volatile market conditions. The study delivered a reduction in CAPEX and OPEX despite the inflationary environment, with the same target production capacity, while also increasing project definition to a “Class II” estimate.

- Start of structured debt and project-level equity financing process, supported by BNP Paribas, following positive market sounding in 2023 from commercial banks, development banks, and government-backed export credit agencies. This included a A$200 million (~€120 million) non-binding Letter of Support from Export Finance Australia [EFA] during the Quarter, and indication of ECA support from Canada, Italy, and France during 2023.

- Positive decision by the Landau City Council in Germany to execute an agreement to allow Vulcan to begin construction of its integrated Geothermal and Lithium Extraction Plant (G-LEP) on the intended land located in the Landau region.

- Opening of Vulcan’s Lithium Extraction and Optimization Plant (LEOP) in Landau, Germany, attended by key investors, off-takers and politicians…

- Completion of Environmental and Social Impact Assessment (ESIA) for Phase One, an important third-party validation of Vulcan’s sustainability credentials, supporting the Company’s efforts to raise sustainable or “green” debt finance.”

On February 23, Vulcan Energy Resources announced: “European Investment Bank proposed €500m (~A$825m) financing for Zero Carbon Lithium™ Project.” Highlights include:

- “…EIB’s proposed financing could amount to up to €500m (~A$825m), pending completion of due diligence, credit approval and legal agreement, and subject to EIB’s governing bodies approval. It is expected to serve as a cornerstone to complement ongoing debt funding discussions with leading export credit agencies and international banks…

- Phase One of Vulcan’s ZERO CARBON LITHIUM™ Project (Project) is targeting the production of 24,000 tonnes per annum (tpa) of Lithium Hydroxide (LHM), equivalent to 500,000 Electric Vehicles. Vulcan will supply key auto and battery makers in the European supply chain, including its second-largest shareholder, Stellantis…”

Upcoming catalysts include:

- End 2026 – Target to commence commercial production at the Zero Carbon Lithium™ Project in Germany, then ramp to 40,000tpa.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina.

On January 31, Galan Lithium announced: “A$19.5 million equity raising to fund ongoing development of HMW Phase 1.” Highlights include:

- “Galan has received firm commitments to raise A$18 million at A$0.46 per share…

- Funds will be used for ongoing HMW Phase 1 development costs, exploration and resource work, corporate overheads and working capital.”

On January 31, Galan Lithium announced: “Quarterly activities report December 2023.” Highlights include:

Hombre Muerto West (HMW)

- “HMW Project is a low cost, tier one project that will produce a premium high grade lithium chloride (LiCl) concentrate of 6% Li, comparable to 13% Li 2O or 32% Lithium Carbonate Equivalent (LCE) in H1 2025.

- Operating cost of $US3,510/t LCE equates to a Li 2O equivalent operating cost of SC6 $US310/t-$US350/t; HMW in the 1st quartile of lithium industry’s cost curve.

- Pond 1 liner installation rapidly moving forward (50% completion).

- Buffer wall installed at 35% mark of Pond 1; filling ongoing.

- Evaporation process has commenced; the first major step of the long-term production schedule.

- Pond 2 earthworks construction progressing well (30% completion).

- Phase 1 Glencore production offtake due diligence ongoing; site visit completed.

- Phase 2 production offtake discussions advancing.

- On-site laboratory commissioned for ongoing Li assaying.

- Phase 2 EIA lodged with Catamarca Government.

- 9 production wells constructed (works ongoing); Phase 1 production only requires 6 wells.

- Galan’s robust 4 phase production strategy (up to 60ktpa LCE) provides an exceptional foundation for significant future economic upside.

- Current resource 6.6Mt LCE @ 880 mg/L Li (72% in Measured category); updated resource estimate due in Q1 2024.”

Greenbushes South

- “Further drill program planned for late Q1 or early Q2, 2024.”

Corporate:

- “Cash and investments at the end of quarter ≈A$19 million.

- A$19.5 million Equity Raising announced 31 January 2024.”

On February 9, Galan Lithium announced: “Share Purchase Plan offer…”

Upcoming catalysts include:

- Q1, 2024 – Updated resource estimate at Hombre Muerto West (HMW).

- H1, 2025 – Target to ramp to 5.4ktpa LCE of lithium chloride production. Phase 2 to follow and ramp to 21Ktpa LCE.

Latin Resources Ltd [ASX:LRS]

LRS’ flagship is the 100% owned Salinas Lithium Project in the pro-mining district of Minas Gerais, Brazil. The Salinas Lithium Project has a Mineral Resource Estimate of 70.3Mt @ 1.27% of Li2O at the Colina and Fog’s Block Deposits.

On January 30, Latin Resources Ltd announced:

NSW project update including Maverick Minerals spinout…Latin shareholders will retain an interest in the LFB projects through Latin’s 16.28% shareholding of Maverick.

On January 30, Latin Resources Ltd announced:

Quarterly activities report for the period ending 31 December 2023. 41% increase to the Colina Deposit Mineral Resource Estimate (“MRE”) to 63.5Mt @ 1.3% Li 2O (above a cut-off of 0.5% Li 2O), placing it amongst one of the largest scale Tier-One undeveloped lithium resources globally. …Latin held $51.8 million in cash and $2.3 million in investments at 31 December 2023. Latin completed a A$35.0 million raise through an institutional placement priced at A$0.25 per share.

On January 31, Latin Resources Ltd announced:

“New assays confirm Planalto discovery. 3rd discovery supports the potential of the Salinas Project to host a world class, tier one lithium mineral resource. Latin Resources achieves exploration success: Setting the stage for 2024’s milestones.”

Highlights include:

- “…Assays support the abundant coarse grained spodumene previously observed in SADD223 with 32.94m of significant intercepts (cumulative) encountered. Significant intercepts from SADD223 include: SADD223: 9.25m @ 1.21% Li2O from 395.29m. SADD223: 16.14m @ 1.29% Li 2O from 425.00m, including 7.14m @ 1.63% Li 2O from 434.00m

- Latin Resources submitted its Environmental Impact Assessment (“EIA”) and Environmental Impact Report (“EIR”) (collectively “EIA-RIMA”1) on 29 December 2023. Progress towards achievement of environmental permitting and mining licensing to enable a Final Investment Decision (“FID”) by Q4 2024 remains on track. Key Definitive Feasibility Study (“DFS”) contractors selected and mobilised with Worley Engineering appointed as engineering design team, and MinSol Engineering appointed as process engineers…

- Expression of Interest for offtake closed with firm bids received from Tier 1 mining companies, converters, battery manufacturers and metals trading houses.

- JORC Mineral Resource Estimate (“MRE”) update planned for the second quarter of 2024 along with the DFS.

- Further assays received for 25 diamond drill holes from the Colina Deposit, with high grade results continuing. Highlights as follows: SADD206: 17.84m @ 1.58% Li 2O from 260.15m…

Upcoming catalysts include:

- Mid 2024 – DFS due for the Salinas Lithium Project.

Standard Lithium [TSXV:SLI] (SLI)

On February 8, Standard Lithium announced: “Standard Lithium reports fiscal second quarter 2024 results, schedules investor update call.” Highlights include:

- “Released the results of the Company’s fully optimized and proven DLE Process. During a representative period of continuous operation the LiPRO™ LSS achieved an average lithium recovery of 96.1% and rejected, on average, over 99% of key contaminants including over 95% of boron.

- Concluded East Texas drilling program that yielded the highest-ever reported lithium brine values in North America. The Company identified a globally-significant lithium brine asset with confirmed lithium concentrations of up to 806 mg/L and an average grade of 644 mg/L from three newly drilled wells. In addition, the results included highly elevated concentrations of potassium and bromine, demonstrating the potential for significant upside.

- Secured lithium brine production rights on South West Arkansas (“SWA”) Project…

- Progressed the Company’s first commercial lithium project with the filing of Phase 1A’s Definitive Feasibility Study. The Phase 1A Project located in El Dorado, Arkansas is expected to initially produce 5,700 tonnes per annum (“tpa”) of battery-quality lithium carbonate over a 25-year operating life.

- Engaged Citi for strategic financing and partnerships for the development of the Phase 1A Project, as well as advancing the South West Arkansas Project and initiatives in East Texas. LANXESS communicated it’s plans to commercialize its role in the Phase 1A Project with agreements under negotiation for brine supply, site lease, and infrastructure services, key to defining the operational framework…

- Cash and equivalents and working capital of Ca$15.8 million and Ca$5.7 million, respectively, as of second fiscal quarter end, and in combination with the prudent and strategic use of our at-the-market offering program as a tool to fund any short term financing needs, are expected to sustain the Company through the 2024 fiscal year.”

Upcoming catalysts include:

- 2026 – Production targeted to begin at the LANXESS South Plant.

Global Lithium Resources [ASX:GL1] (OTCPK:GBLRF)

On January 31, Global Lithium Resources announced: “Quarterly report for the period ending 31 December 2023.” Highlights include:

- “Large-scale 60,000m Reverse Circulation [RC] and Diamond Drilling [DD] campaign completed at the Manna Lithium Project covering infill, extensional, metallurgical and geotechnical programs.

- Six drill rigs were utilized as part of the CY23 exploration campaign.

- Initial assays from the resource infill and expansion drilling program continue to deliver high-grade results at Manna including the best intercept to date of 26m @ 1.53% Li 2O.

- A further ~600m of mineralized strike added to the North-eastern extension.

- Complete assay results due Q1 CY24, to be included in Manna Definitive Feasibility Study [DFS].”…

DFS and Corporate

- “DFS and related metallurgical studies for the Manna Lithium Project are well advanced and expected to be complete during H1 CY24.

- Initial metallurgical test work at Manna has demonstrated excellent rougher flotation recovery of greater than 95% at 5.5% Li 2O or better and spodumene concentrate [SC] grade of >5.5% Li 2O.

- Native title mining agreement negotiations and overall approvals process on schedule.

- Perth-based corporate advisory firm Azure Capital (Azure) appointed financial advisor for Manna and is assisting in formalizing the Company’s funding strategy.”

Upcoming catalysts:

- H1, 2024 – DFS for the Manna Lithium Project (to include an updated MRE).

European Lithium Ltd [ASX:EUR] (OTCQB:EULIF)

On January 31, European Lithium Ltd announced: “Quarterly report quarter ended 31 December 2023.” Highlights include:

- “Work continues to cover the environmental impact assessment [EIA] determination procedure forming a fast-track-eligibility approval process covering the application of the final mining decree for the Wolfsberg Lithium Project (Wolfsberg Project). This essential work contributes towards operational readiness and construction of mine facilities.

- Internal studies continue to assess the technical and commercial impacts of relocating the hydroxide plant to Saudi Arabia, based on the DFS results for the Wolfsberg Project presented in December 2022 by lead consultant DRA Global (DRA)…

- The approved Zone 2 drilling program by the Mining Authority will commence in Q1/24 drilling contractor will be GEOPS.

- An exploration program has been developed for the future lithium targets in Styria, Austria, recently acquired from Richmond.

- EUR continues collaborating with a research group from the University of Graz to develop local lithium hydroxide production from recycled Lithium-Ion batteries.

- GREENPEG (EU-funded) supported infield and underground work continues. A fully GREENPEG funded comprehensive airborne geophysics program was completed during the quarter to assess a new airborne technology (via Helicopter) for its suitability in mineralization such as the Wolfsberg Project.

- E47/4144 located in the northwest of Western Australia continues to progress through the WA Mining Act regulatory application process.

- EUR advances towards completion of business combination with Sizzle Acquisition Corp. that at conclusion will own the Wolfsberg Project via a newly-formed company, ‘Critical Metals Corp’ which is expected to be listed on the NASDAQ.”

On February 19, European Lithium Ltd announced:

Request for voluntary suspension…The voluntary suspension is requested pending an announcement by the Company regarding an update on the potential investments from strategic parties…

On February 26 European Lithium announced: “Voluntary suspension extension.”

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On January 30, Savannah Resources announced: “Operation Influencer: Reassuring conclusions from Independent Legal Reviews…”

On January 30, Savannah Resources announced: “Continued progress on key project workstreams.” Highlights include:

Strategic Partnering Process:

- “The process is moving forward as expected, with good levels of interest sustained from groups located along the battery value chain.”

Definitive Feasibility Study (“DFS”):

- “Schedule: Savannah still expects to complete the DFS in H2 2024.

- Recent drilling and design work includes…All 9 of the planned hydrogeology boreholes have also been completed. Despite some delays in receiving assay results from third party laboratories, the Company still expects to begin publishing results from the drilling and updating the JORC Resource estimates on a deposit by deposit basis later this quarter. Savannah’s team and its consultants are continuing to develop final designs for the Project’s working areas, processing plant and infrastructure.”…

On February 9, Savannah Resources announced:

Update on Lawsuit involving APA and the Portuguese Ministry of Environment and Climate…

Upcoming catalysts include:

- H2, 2024 – DFS due to complete at the Barroso Lithium Project.

Patriot Battery Metals [TSX:PMET][ASX:PMT] (OTCQX:PMETF)

Patriot Battery Metals own the Corvette Lithium Project in James Bay, Quebec. Corvette has a Maiden resource of 109.2 Mt at 1.42% Li2O.

On January 31, Patriot Battery Metals announced: “Patriot approved to graduate to TSX on Thursday, February 1, 2024…”

On January 31, Patriot Battery Metals announced:

Patriot drills 26.1 m at 1.21% Li2O in step-out hole at the CV13 pegmatite, Quebec, Canada…Previously identified higher-grade zone has been extended to at least 200+ m strike length. The CV13 Pegmatite has been traced to a 2.3 km strike length, as defined by multiple outcrop exposures and drilling completed to date, and remains open along strike at both ends and to depth.

On February 6, Patriot Battery Metals announced:

Patriot extends strike of the CV5 pegmatite, drills 34.2 m at 1.06% Li2O in step-out hole and 11.6 m at 3.25% Li2O in infill hole, Quebec, Canada…”The CV5 Spodumene Pegmatite has now been traced over a 4.4 km strike length and remains open along strike at both ends and to depth – results of 2023 drill holes for an additional 2 km of prospective strike length remain to be reported…Strong grades continue to be returned over the western extension and outside of the June 2023 mineral resource estimate at CV5.

- 34.2 m at 1.06% Li2O, including 14.2 m at 1.83% Li2O (CV23-236).

- 27.7 m at 1.20% Li2O and 7.2 m at 1.27% Li2O (CV23-243).

- 10.2 m at 1.47% Li2O and 6.7 m at 2.27% Li2O (CV23-259).

- Strong infill drill results, including very high grades, returned outside of the Nova Zone.

- 89.5 m at 1.01% Li2O, 17.9 m at 1.31% Li2O, and 19.0 m at 2.56% Li2O, including 11.6 m at 3.25% Li2O (CV23-246).

- 37.2 m at 1.02% Li2O (CV23-251).

- Results for 35 holes at the CV13 Pegmatite, 42 holes at the CV5 Pegmatite, and 18 holes at the CV9 Pegmatite, from the 2023 drill program remain to be reported, and will be released to the market in accordance with the Company’s usual processes.

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On February 22, Frontier Lithium announced: “Frontier Lithium announces filing of third quarter financial statements and MD&A.” Highlights include:

- “Strong financial position with a cash balance of approximately $15.5 million.

- Received $2 million government funding via a grant from the Northern Ontario Heritage Fund Corporation to advance lithium chemicals research.

- Awarded contract to commence and complete a Definitive Feasibility Study (Phase I) that will advance development of the mine and mill at the PAK Project

- Exploration drilling further extended and proved the potential of the Bolt pegmatite, Pennock dyke and Spark deposit.”

Azure Minerals Limited [ASX:AZS] (OTCPK:AZRMF) – Takeover offer by SQM

On January 31, Azure Minerals Limited announced:

Corporate

- “Azure entered a binding Transaction Implementation Deed with Sociedad Química y Minera de Chile S.A. (“SQM”) and Hancock Prospecting Pty Ltd (“Hancock”) (together the “Joint Bidders”) under which it is proposed that the Joint Bidders (via SH Mining Pty Ltd (“BidCo”)) will acquire 100% of the shares in Azure by way of a scheme of arrangement for a cash amount of A$3.70 per Azure share (“Scheme Proposal”), or if the Scheme Proposal is not successful, by way of an off-market takeover offer for a cash amount of A$3.65 per Azure share (“Takeover Offer”) (together, the “Transaction”)…

- Transaction replaces the earlier SQM transaction (refer Azure’s ASX announcement dated 26 October 2023) which comprised a scheme proposal of A$3.52 cash per Azure share and a fallback takeover offer of A$3.50 cash per Azure share (“Original SQM Transaction”).”

Andover Project

- “Further broad zones of high-grade mineralization intersected in Target Area 1 (“TA1”) with world-class results from the AP0011 pegmatite, including: 165.2m @ 1.33% Li2O from 306.6m in ANDD0295 (True Width (“TW”): ~141.8m); and 135.2m @ 1.12% Li2O from 288.9m in ANDD0276 (TW: ~117.0m).

- Assays from drilling at Target Area 3 (“TA3”) confirmed consistently thick, high-grade lithium mineralization in the AP0003/AP0004 pegmatite: 37.0m @ 1.22% Li2O from 22.8m in ANDD0285 (TW: ~35.8m); 66.9m @ 1.18% Li2O from 41.0m in ANDD0289 (TW: ~35.7m); and 36.6m @ 1.16% Li2O from 15.5m in ANDD0292 (TW: ~36.5m).

- Whole of ore flotation produced marketable spodumene concentrate with a grade of 5.59% Li2O at a recovery of 82.37% with spodumene the dominant Li bearing mineral, containing approximately 95% of the total Lithium content. Mineralization is well suited to industry standard flotation processing.

- Drilling recommenced in early January 2024 with eight diamond rigs on site.

- Post period-end further assay results and visual observations of spodumene mineralisation1 received from AP0003/AP0004 pegmatites in TA3 extend strike to 1,700m and 700m down-dip. Highlights include: 90.8m @ 1.54% Li2O from 82.5m in ANDD0303 (TW: ~34.0m); 58.6m @ 1.57% Li2O from 57.7m in ANDD0306 (TW: ~33.1m); and 51.6m @ 1.04% Li2O from 255.1m in ANDD0322 (TW: ~36.9m)…

On February 13, Azure Minerals Limited announced:

More very impressive lithium intersections from Andover 112.9m @ 1.63% Li2O in ANRD0154. 152.3m @ 1.15% Li2O in ANDD0309. 112.0m @ 1.24% Li2O in ANDD0334. 106.1m @ 1.30% Li2O in ANRD0156. 125.2m @ 1.00% Li2O in ANRD0162. 112.1m @ 1.11% Li2O in ANDD0327…

On February 14, Azure Minerals Limited announced: “Transaction booklet lodged with ASIC…”

On February 16, Azure Minerals Limited announced: “ASIC relief in respect of the Transaction.”

Delta Lithium [ASX:DLI](formerly Red Dirt Metals)

On February 15, Delta Lithium announced: “Drilling update from Yinnetharra and Mt Ida.” Highlights include:

- Maiden Resource Estimate (MRE) of 25.7Mt @ 1% Li 2O reported in December 20231. This MRE is located within a 1.6km section of the 40km strike length of Delta’s prospective stratigraphy at the broader Yinnetharra Lithium Project. Drilling at the next target area (Jameson) is scheduled to commence in the current Quarter.

- The Mt Ida Lithium Project is located in the Goldfields region of Western Australia. Existing MRE of 14.6Mt @ 1.2% Li2O reported in October 20232. Additional Gold MRE of 3.1Mt @ 4.1 g/t Au for 412 koz reported in November 2023 3. Initial Open Pit Phase 1 is shovel ready with all environmental and mining permits in place.

- New drilling results include: Yinnetharra: 26m @ 1.7% Li 2O from 180m in YDRD033 at Malinda. 17m @ 1.4% Li 2O from 187m in YRRD274 at Malinda. 19m @ 1% Li 2O from 232m in YRRD286 at Malinda. Mt Ida: 27m @ 1.6% Li 2O from 575.3m in SSRD058 at Sister Sam. 20m @ 1.5% Li 2O from 79m in GCS0025 at Sister Sam. 3m @ 41g/t Au from 87m in MNGC087 at Meteor North. 2.4m @ 51.6g/t Au from 55.6m in AURD026 at Meteor North. 15m @ 6.17g/t Au from 42m in MNGC154 at Meteor North. 1m @ 113.6g/t Au from 86m in MNGC080 at Meteor North.”

Winsome Resources Limited [ASX:WR1] [FSE:4XJ] (OTCQB:WRSLF)

On January 29, Winsome Resources announced: “Quarterly report period ending 31 December 2023.” Highlights include:

Development & Exploration

- “Maiden Mineral Resource published for Adina of 59Mt at 1.12% Li2O.

- Over 28,000 meters of drilling in the December quarter with five active rigs at time of reporting.

- Adina Main Zone continues to expand along strike with assay results increasing strike length of mineralization defined by systematic drilling to 1,340m.

- High grade results from Adina Footwall Zone confirmed significant scope for continuity.

- Development studies continue to advance Adina in a responsible and collaborative manner, with project studies on track for completion in H2 2024.

- Quebec footprint expanded with acquisition of Jackpot Property.

- Significant pegmatite outcrop discovered during exploration at Tilly.”

Corporate

- “Raised A$34m at $2.38 per share, using Canadian Flow Through Shares.

- Winsome remains well funded to undertake current drilling plans and study work in 2024.”…

On February 6, Winsome Resources announced: “Near surface high grade drilling results provide positive indicators for development at Adina.” Highlights include:

- “Assay results from circa 4,700m of resource delineation drilling undertaken in Q4 2023 continue to demonstrate the thick, shallow, high-grade nature of mineralization at the large-scale Adina Lithium Deposit.

- The Adina Lithium Deposit includes a substantial zone of near surface mineralization (Main Zone) highlighting the potential for open pit mining with a low waste to ore strip ratio.

- Results from the Main Zone [MZ] include: 61.9m at 1.40% Li 2 O from 3.5m (AD-23-135, MZ). 52.8m at 1.46% Li 2 O from 19.0m (AD-23-129, MZ). 40.5m at 1.93% Li 2 O from 69.5m (AD-23-093, MZ). 27.1m at 1.72% Li 2 O from 52.2m (AD-23-123, MZ).

- New intersections in the Footwall Zone (FWZ) continue to return high grade results, enabling higher value zones of mineralization to be targeted in initial mining scenarios: 25.9m at 1.59% Li 2 O from 275.0m (AD-23-093, FWZ)…

- Regular receipt of assay results ensures update to Adina Inferred Mineral Resource Estimate of 59Mt at 1.12% Li 2 O on track for completion in H1 2024.

- Project studies are advancing and on track for completion in H2 2024.”

On February 20, Winsome Resources announced: “Exceptional metallurgical test work results from the Adina Lithium Project.” Highlights include:

- “…Test work demonstrates recoveries ranging from 66% to 82% producing a 6% Lithia (Li2O) concentrate using Heavy Liquid Separation (HLS).

- Results indicate the potential for a dense media separation (DMS) only processing route…

- Incorporating test work and ongoing metallurgical results, maiden project studies for Adina are on track for completion in the second half of 2024.

- Drilling currently underway to supply a further set of samples for a comprehensive metallurgical test work program planned for 2024.”

On February 22, Winsome Resources announced: “Winsome Resources Limited – Response to query letter…”

Lithium Ionic Corp. [TSXV:LTH] (OTCQB:LTHCF)

On February 6, Lithium Ionic Corp. announced:

Lithium Ionic extends Salinas pegmatites with intercepts of 1.22% Li2O over 16.7m and 1.51% Li2O over 11.9m; Discovers new high-grade zone grading 1.63% Li2O over 5.6m…

On February 12, Lithium Ionic Corp. announced: “Lithium Ionic publishes 2023 sustainability report.”

Wildcat Resources [ASX:WC8]

No significant news for the month.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCQX:EMHLF)(OTCQX:EMHXY)

On January 29, European Metals Holdings announced:

Extension granted to all Cinovec Exploration Licenses. European Metals Holdings Limited (ASX & AIM: EMH) (“European Metals” or the “Company”) is pleased to announce the granting of an extension to all four Cinovec Exploration Licences (“the licences”). These licenses fully cover all three granted Preliminary Mining Permits (“PMP’s”) comprising the Cinovec Project. All four licences have been extended until 31 December 2026…

On January 31, European Metals Holdings announced:

Quarterly activities report December 2023. The Company’s total cash is $5.7million as at 31 December 2023…

Upcoming catalysts include:

Century Lithium Corp. (TSXV:LCE) (OTCQX:CYDVF)(Formerly Cypress Development Corp.)

Century Lithium Corp. is focused on developing its Clayton Valley Lithium Project in west-central Nevada.

No news for the month.

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On February 12, Lake Resources NL announced: “Further drilling at flagship Kachi Project measures high lithium concentrations South of the planned wellfield.” Highlights include:

- “K25D44, the last drillhole associated with the 2023 drilling program was completed in December 2023 and is located south of the surface expression of the salar.

- Results show brines returning grades of 230 – 302 mg/L lithium over 407 metres (215 – 622 m) with an average of 257 mg/L.

- The best results are from 239 to 250 metres below ground surface (m bgs) averaging grades of 302 mg/L lithium…”

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 75% of its Manono Lithium & Tin Project in the DRC. The Project ownership is currently in dispute.

On January 31, AVZ Minerals announced: “Manono Project Mineral Resource increases 47% to 842Mt…grading 1.61% Li2O, 709ppm Sn and 37ppm Ta.”

On January 31, AVZ Minerals announced: “Activities report for thequarter ending 31 December 2023.” Highlights include:

- “AVZ’s securities remained in suspension during the December 2023 Quarter pending a resolution and clarity of the mining and exploration rights for the Manono Lithium and Tin Project (Manono Project).

- AVZ continued its strategy to facilitate the development of the Manono Project, including the affirmation of its legal rights to a 75% interest in Dathcom Mining SA (Dathcom), the entity holding legal rights to PR13359 comprising the Manono Project and its continuing pre-emptive rights over 15% of the 25% interest held by La Congolaise d’Exploitation Minière (Cominière)…”

Lithium Power International [ASX:LPI] (OTC:LTHHF) – Takeover offer by Codelco

LPI owns 100% of the Maricunga Lithium Brine Project in Chile.

On January 29, Lithium Power International announced: “Activity report for the quarter ended December 2023.” Highlights include:

- “LPI entered into a binding scheme implementation deed with Chilean mining company Codelco, pursuant to which it is proposed that a wholly-owned subsidiary of Codelco will acquire 100 percent of the share capital of LPI by way of a Scheme of Arrangement (“Scheme”).

- The terms of the Scheme stipulate that LPI shareholders will receive A$0.57 in cash per LPI share upon implementation of the Scheme, which is expected to occur on 23 February 2024 (assuming the Scheme is approved by the Court and other conditions to the Scheme are satisfied or waived).

- Subsequent to the Reporting Period, the resolution to approve the Scheme was passed by the requisite majorities of LPI shareholders at the Scheme meeting held on 23 January 2024.”

American Lithium Corp. [TSXV: LI] (AMLI)(acquired Plateau Energy Metals Inc.)

No news for the month.

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

On February 16, Wealth Minerals announced: “Wealth Minerals files technical report on SEDAR+ for the Kuska Project, Ollagüe, Chile…”

E3 Lithium Ltd. [TSXV:ETL] [FSE:OW3] (OTCQX:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has a M&I Resource of 16.0Mt.

On January 25, E3 Lithium Ltd. announced: “E3 Lithium discovers lithium concentrations as high as 87 mg/L in the Nisku Aquifer.”

On February 20, E3 Lithium Ltd. announced: “E3 Lithium provides update on technology selections for first commercial lithium.” Highlights include:

- “In determining the basis for its commercial design, E3 Lithium evaluated its proprietary Direct Lithium Extraction (DLE) technology along with four third-party DLE technologies, all demonstrating technical success for the extraction of lithium from the Company’s brines.

- Additionally, the Company evaluated the DLE technologies along with the downstream refining process and has selected the optimal combination that outlines the best technical and economic results, while de-risking E3 Lithium’s path to commercialization.

- E3 Lithium is proceeding with third-party DLE technology for its first commercial facility and will continue to pursue the development of its proprietary technology for subsequent commercial facilities.”

On February 21, E3 Lithium Ltd. announced: “E3 Lithium outlines 2024 corporate guidance and its plans to advance the Clearwater Project.” Highlights include:

- “…With the commercial viability of Direct Lithium Extraction Technology and E3 Lithium’s brines-to-battery flow sheet demonstrated in 2023, achieving the milestones set for 2024 marks a fundamental shift in E3 Lithium’s business and sets it on a clear and demonstrated pathway to commercial operations.”

Nevada Lithium Corp. [CSE:NVLH] (OTCQB:NVLHF)

Nevada Lithium has an arrangement to own 100% of the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

No significant news for the month.

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

No lithium related news.

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

No news for the month.

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Petalite Zone Resource of 6.28mt grading 1.37% Li2O, plus an Inferred Resource of 0.94mt at 1.3%. Avalon has a JV with SCR-Sibelco NV (“Sibelco”) (60% Sibelco: 40% Avalon) to develop their lithium assets.

On February 14, Avalon Advanced Materials announced: “Avalon appoints Scott Monteith as CEO and changes location for annual meeting of shareholders…”

Snow Lake Lithium (LITM)

On February 8, Snow Lake Lithium announced: “Snow Lake expands its lithium portfolio with mineral claims near Kenora, Ontario.” Highlights include:

- “302 single cell, unpatented mineral claims totaling over 6,000 hectares.

- The RFR Greenstone Belt is recommended as an exploration target by the Regional Resident Geologist for the Red Lake district due to muscovite-bearing granites and pegmatites with potential to host lithium mineralization.

- Option to acquire a 90% interest in the Muskrat Dam Project upon payment of CAD$50,000 in cash, issuing 500,000 common shares of Snow Lake, and issuing 2,000,000 warrants to purchase common shares of Snow Lake at a deemed price equal to US$1.50 per common share, with the warrants vesting upon a series of milestones being met by Snow Lake.

- Manco receiving a 2% NSR upon exercise of the option by Snow Lake.”

Green Technology Metals [ASX: GT1]

On January 30, Green Technology Metals announced: “Quarterly activities report for the quarter ended 31 December 2023.” Highlights include:

- “Preliminary Economic Assessment (PEA) delivered indicating robust economics.

- $14.8m Capital raising completed to put GT1 in strong financial position.

- Root Bay East showing significant potential as new stacked system.

- ‘Capital light’ look ahead currently being implemented given market conditions, focus on permitting and PEA optimization work streams.

- Strategy delivery on course to become the first Lithium concentrates and Chemical producer in Ontario…”

Corporate

- “Successful A$14.6m (C$13m) raised utilizing “flow-through shares” provisions under Canadian tax law.

- Flow-through shares to be placed at $0.37 per share representing 32% premium to GT1’s last trading price of $0.28c.

- Head of Corporate Development appointed.”

On February 22, Green Technology Metals announced: “2024 strategic update.” Highlights include:

- “Strategy to become the first lithium concentrates and chemicals business in Ontario on schedule.

- Operational review completed focused on optimizing expenditure and cash outlay onto critical path work streams in line with current market conditions.

- PEA optimization and DFS well advanced and progressing Seymour to construction readiness.

- Key permitting activities are well advanced for Seymour with a focus on the final Closure Plan submission and obtaining Overall Benefit Agreements.

- Application for multiple Canadian government initiative funding schemes ongoing, through the Critical Minerals Infrastructure Fund (CMIF) & Strategic Innovation Fund [SIF].

- Further offtake agreements and asset level investment discussions continue as part of the financing strategy for the Seymour Lithium project development.”

Lithium Energy Limited [ASX:LEL]

On February 21, Lithium Energy Limited announced: “Lanshen resin (DLE) testwork recovers 92% of lithium from Solaroz Brine.”

Argentina Lithium & Energy Corp. [TSXV: LIT] (OTCQB:PNXLF) (OTCQX:LILIF)

No news for the month.

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

No significant news for the month.

Neometals (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT]

On February 13, Neometals announced:

Spargos exploration update. Innovative battery materials recycler, Neometals Ltd (ASX: NMT & AIM: NMT) (“Neometals” or “the Company”), advises that its review of the lithium exploration potential over its 100% owned Spargos Project (“Spargos”) indicates a low potential for lithium-bearing pegmatites…Given the current market conditions for both nickel and lithium, further exploration activities have been placed on hold pending a strategic review of the Project…

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

On February 5, Nano One Materials announced: “Nano One provides shareholder update with key objectives for 2024.” Highlights include:

- “Commercialization plan on target and advancing with partners.

- One-Pot process targeting energy storage and EVs in North America and globally.

- Collaborative work with partners on track with NMC and LFP.

- Validation of LFP proceeding with multiple potential customers targeting offtake agreements.”

On February 21, Nano One Materials announced: “Nano One adds 4 more lithium battery manufacturing patents in Asia – Boosts total to 40.”

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), ACME Lithium Inc. [CSE:ACME] (OTCQX:ACLHF), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (OTCQB:AZLAF), Azimut Exploration [TSXV:AZM] (OTCQX:AZMTF), Bastion Minerals [ASX:BMO], Battery Age Minerals [ASX:BM8], Bradda Head Lithium Limited [LON:BHL] (OTCQB:BHLIF), Brunswick Exploration [TSXV:BRW] (OTCQB:BRWXF), Bryah Resources Ltd [ASX:BYH], Carnaby Resources Ltd [ASX:CNB], Champion Electric Metals Inc. [CSE:LTHM] [FSE:1QB0] (OTCQB:CHELF), Charger Metals [ASX:CHR], CleanTech Lithium [AIM:CTL] (OTCQX:CTLHF), Compass Minerals International (CMP), Consolidated Lithium Metals Inc. [TSXV:CLM], Cosmos Exploration [ASX:C1X], Critical Resources [ASX:CRR], Cygnus Metals [ASX:CY5], Dixie Gold [TSXV:DG], Electric Royalties [TSXV:ELEC], Foremost Lithium Resources & Technology [CSE:FAT] (OTCPK:FRRSF), Future Battery Minerals [ASX:FBM], Greentech Metals [ASX:GRE], Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), Grounded Lithium [TSXV:GRD] (OTCQB:GRDAF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formely Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], Infinity Stone Ventures (CSE:GEMS)(OTCQB:GEMSF), International Battery Metals [CSE: IBAT] (OTCPK:IBATF), International Lithium Corp. [TSXV:ILC] [FSE: IAH] (OTCQB:ILHMF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], James Bay Minerals Ltd [ASX:JBY], Jindalee Lithium Limited [ASX:JLL] (OTCQX:JNDAF), Kali Metals [ASX:KM1], Kodal Minerals (LSE-AIM:KOD), Larvotto Resources [ASX:LRV], Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (LRTTF), Li-FT Power [TSXV:LIFT] [FSE:WS0](OTCQX:LIFFF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Plus Minerals [ASX:LPM], Lithium Springs Limited [ASX:LS1], Loyal Lithium [ASX:LLI], Megado Minerals [ASX:MEG], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], Midland Exploration [TSXV:MD] (OTCPK:MIDLF), MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), Oceana Lithium [ASX:OCN], Omnia Metals Group [ASX:OM1], One World Lithium [CSE:OWLI] (OTC:OWRDF), Patriot Lithium [ASX:PAT], Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCQB:PWRMF), Power Minerals [ASX:PNN], Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Pure Resources Limited [ASX:PR1], Q2 Metals [TSXV:QTWO] (OTCQB:QUEXF) (QTWO), Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Stelar Metals [ASX:SLB], Solis Minerals [ASX:SLM], Spod Lithium Corp. [CSE:SPOD] (OTCQB:SPODF), Stria Lithium [TSXV:SRA] (OTCPK:SRCAF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Tantalex Lithium Resources [CSE:TTX], [FSE:1T0], Tearlach Resources [TSXV:TEA] (OTCPK:TELHF), Tyranna Resources [ASX:TYX], Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), X-Terra Resources [TSXV:XTT] (OTCPK:XTRRF), Zinnwald Lithium [LN:ZNWD].

Conclusion

February lithium prices were generally flat.

Highlights for the month were:

- Liontown Resources Kathleen Valley Project was 72% complete at end 2023. Commenced discussions on a revised, smaller debt facility.

- AFR: Wesfarmers Mt Holland project won’t make money off lithium at current prices.

- Eramet achieves €109m net income in 2023, targets 5-7kt LCE in 2024.

- Atlas Lithium expands Anitta 3 pegmatite.

- Atlantic Lithium Ewoyaa Lithium Project JV drills 83m at 1% Li2O from 36m.

- Vulcan Energy Resources announced European Investment Bank proposed €500m (~A$825m) financing for Zero Carbon Lithium™ Project.

- Galan Lithium’s HNW Project is progressing well with Pond 1 liner installation 50% complete. Successful A$19.5 million equity raising.

- Latin Resources – New assays confirm Planalto discovery at Salinas Project.

- Global Lithium Resources drills 26m @ 1.53% Li2O at Manna Project.

- Patriot Battery Materials extends the strike lenghths at CV5 and CV13. Drills 89.5 m at 1.01% Li2O, 17.9 m at Corvette.

- Azure Minerals entered a binding Transaction Implementation Deed (takeover offer) at A$3.70 per share from SQM and and Hancock Prospecting Pty Ltd for 100% of the shares in Azure. Drills 165.2m @ 1.33% Li2O from 306.6m (ANDD0295) at the Andover Project.

- Delta Lithium drills 26m @ 1.7% Li2O from 180m at Yinnetharra Project.

- Winsome Resources reports 61.9m at 1.40% Li2O from 3.5m (AD-23-135, MZ), 52.8m at 1.46% Li2O from 19.0m (AD-23-129, MZ), 40.5m at 1.93% Li2O from 69.5m (AD-23-093, MZ) at Adina.

- AVZ Minerals – Manono Project Mineral Resource increases 47% to 842Mt grading 1.61% Li2O, 709ppm Sn and 37ppm Ta.

- Snow Lake expands its lithium portfolio with mineral claims near Kenora, Ontario.

- Green Technology Metals strategy delivery on course to become the first lithium concentrates and chemical producer in Ontario.

- Lithium Energy Limited Lanshen resin (DLE) testwork recovers 92% of lithium from Solaroz Brine.

As usual, all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here