The duration bear market, it appears, is officially over as the Fed begins to pivot towards a rate-cutting cycle. It remains to be seen however when a bond credit bear market takes place. I’ve been admittedly wrong in my timing around credit risks permeating throughout markets, and maybe I will continue to be. If you’re bullish on bonds and want to take some credit risk but not too much because you share some of the similar concerns I have, then you may want to consider the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSEARCA:LQD).

The fund delivers broad exposure to the US investment-grade corporate bond market. The ETF represents an excellent option for investors looking for a steady income stream by participating in one of the most prevalent types of corporate debt. Launched in 2002, LQD ETF tracks the Markit iBoxx USD Liquid Investment Grade Index using a passive approach. LQD invests its assets in high-quality corporate issuers with maturities longer than three years, diversified across sectors and industries.

A Look At The Holdings

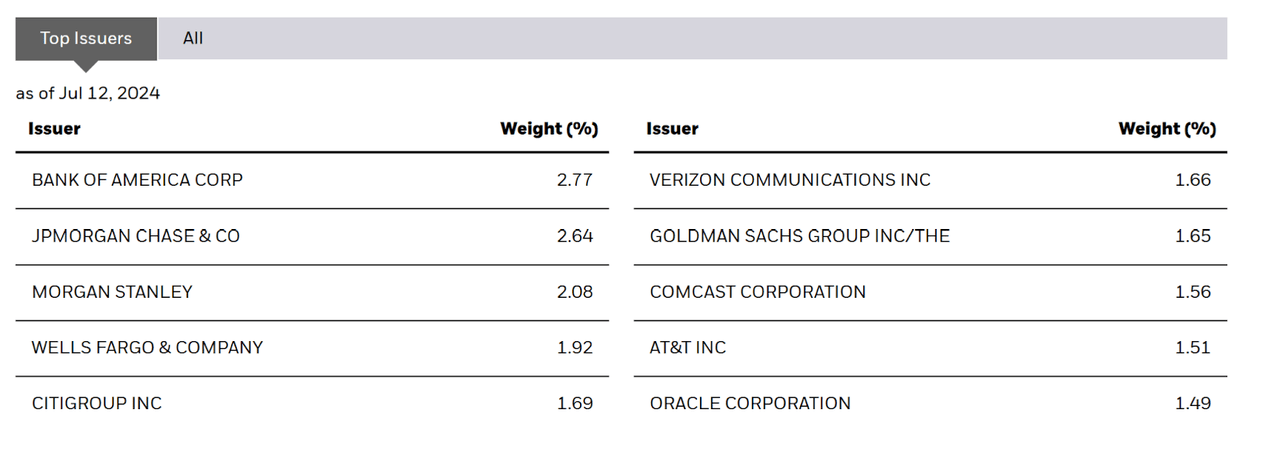

The fund currently has over 2,700 holdings and has incredible diversity. No single bond issuer makes up more than 2.77% of the fund’s total AUM.

iShares.com

If we drill down into some of the actual positions, we find familiar names. Anheuser-Busch InBev, for example, has a 0.25% weighting. It’s the world’s largest brewer. CVS Health Corp is a large healthcare company running a large chain of retail pharmacies and providing healthcare services. T-Mobile is a giant telecom company. And Goldman Sachs is the quintessential investment bank.

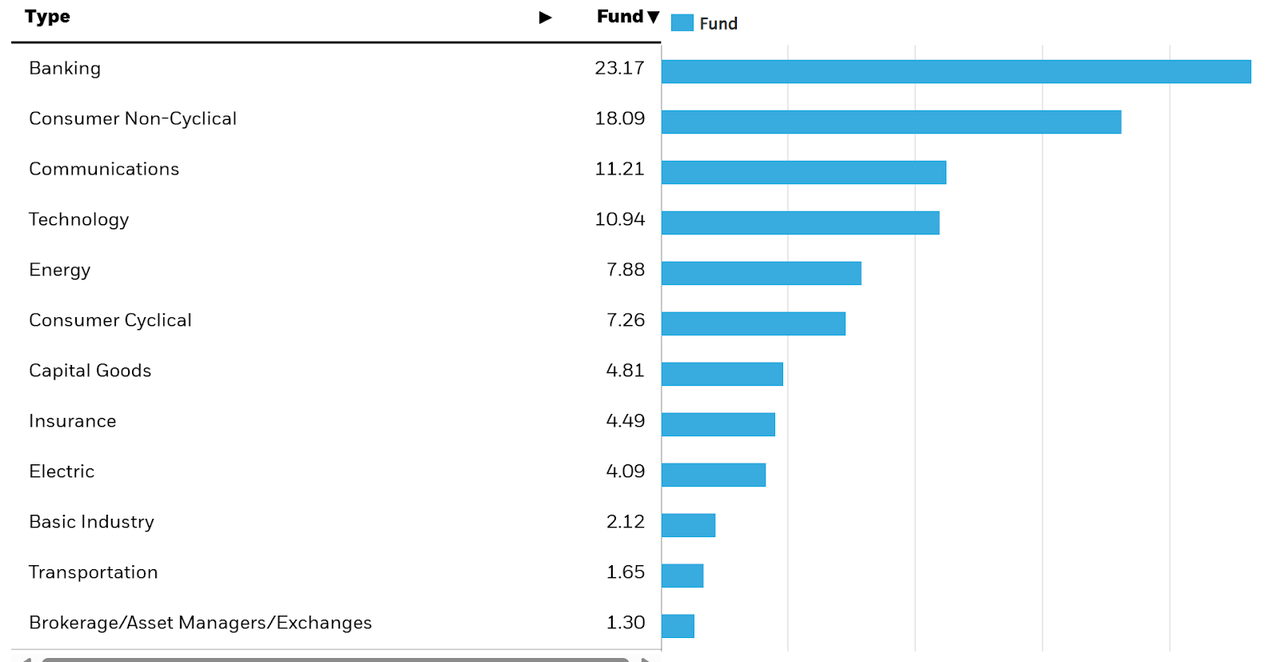

Sector Composition

From a sector perspective, Banking makes up the largest allocation, followed by Consumer Non-Cyclical and Communications.

iShares.com

Some might be concerned about the largest allocation to the banks given concerns around regional banks last year, but keep in mind that the individual holdings have low weights in the portfolio, and are of high investment-grade quality.

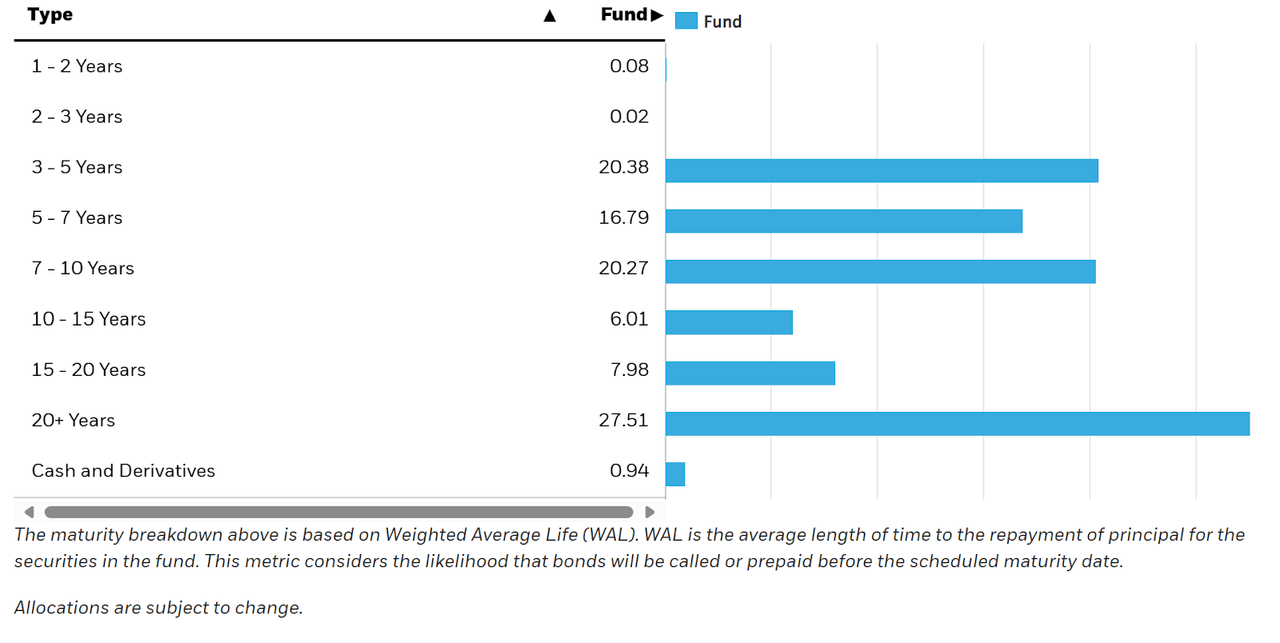

When we look at the maturity profile, as noted, everything is above 3 years, with the largest allocation 20+ years out. This leaves the portfolio with a duration of 8.36 years. This means the fund is indeed sensitive to the direction of interest rates, which may not be a bad thing going forward as the Fed cuts.

iShares.com

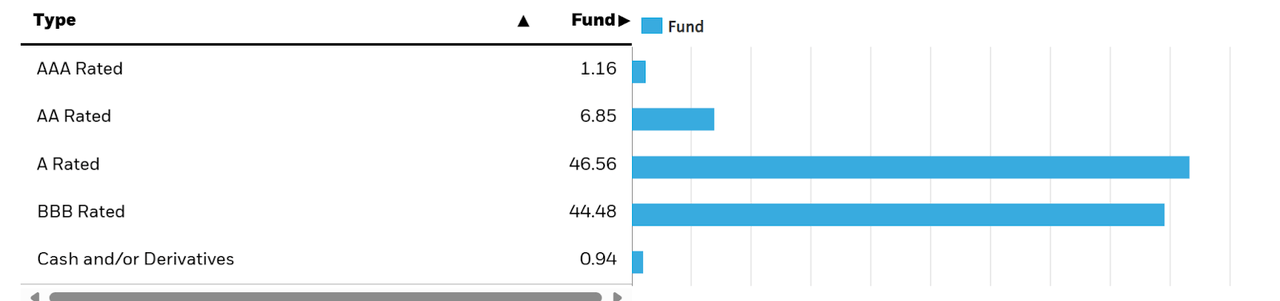

As to credit quality, the bulk is either rated A or BBB. Again – some credit risk, but really not much overall.

iShares.com

Peer Comparison

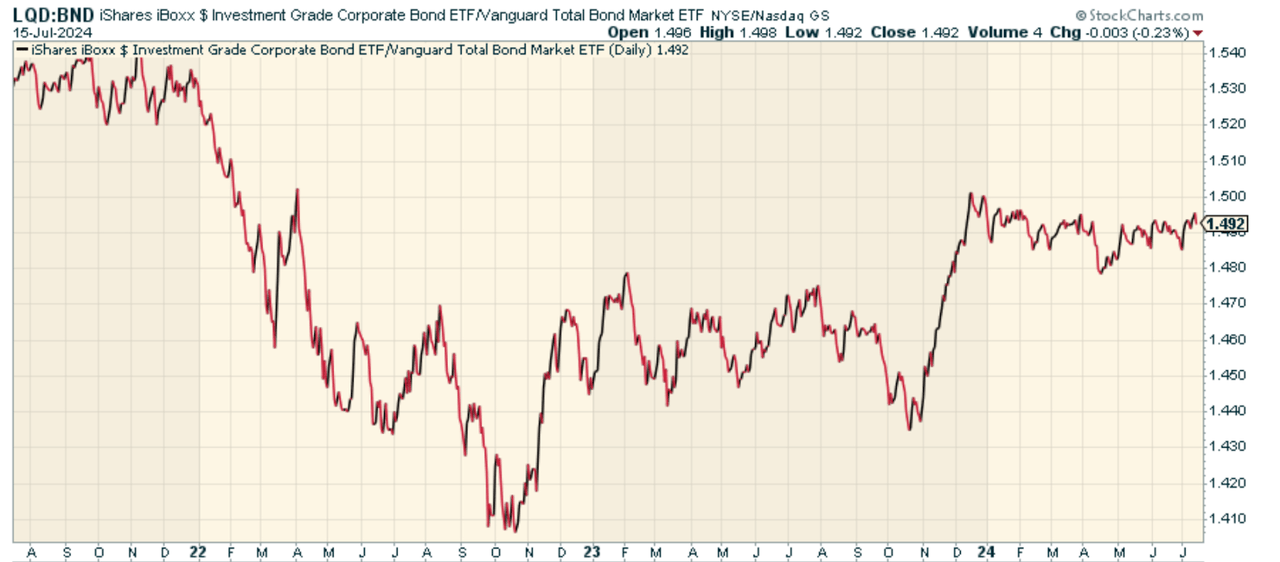

One fund worth comparing LQD against is the Vanguard Total Bond Market Index Fund ETF Shares (BND), which invests in the entire US investment-grade bond market, covering government, corporate, and securitised bonds. BND gives a much broader exposure to the market in bonds, while LQD provides a way to access the narrower universe of investment-grade corporate bonds. When we look at the price ratio of LQD to BND, we find that the two have performed roughly in line with each other since 2022. I might prefer BND to LQD going forward if credit risk rises, but for now, the two largely are acting the same.

StockCharts.com

Pros and Cons

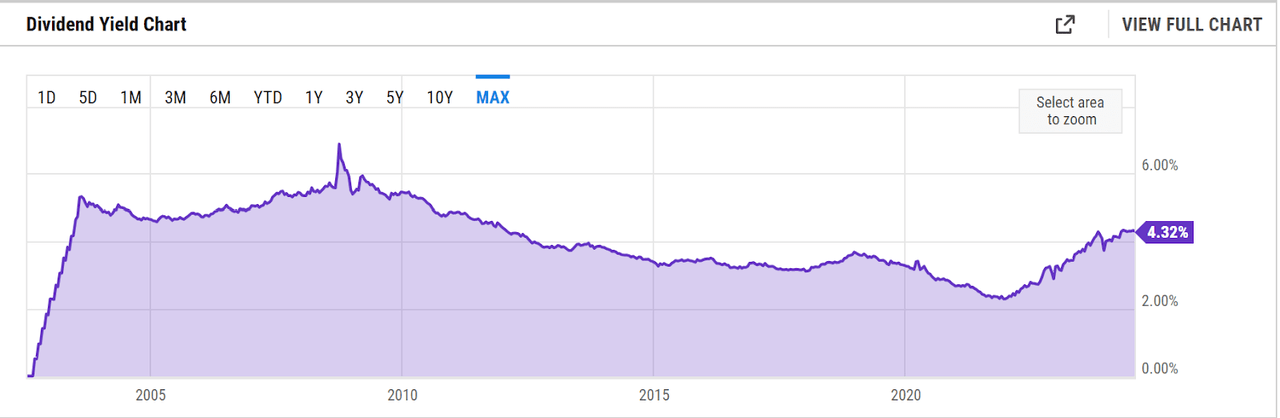

On the plus side, the broad investment-grade focus of the ETF provides diversification and stability for investors who are interested in receiving a steady income stream from high-quality corporate bonds. And a 4.32% yield isn’t bad at all with upside appreciation potential.

YCharts.com

The credit quality of this ETF is enhanced by its reliance on bonds issued by companies that have sound financial profiles and relatively low risk of default. Furthermore, LQD is a cheap way to invest in corporate bonds: it charges just 0.14 percent in fees for its management.

The downside? It does still have some credit risk in the portfolio, and the sector allocation means the fund would get hit in an economic recession/slow down whereby credit spreads widen. This hasn’t been a concern yet, but can be sooner than most realize if the Fed is unable to pull off the soft landing.

Conclusion

If you are seeking exposure to the US investment-grade corporate bond market, LQD is a great way to do so. It’s well diversified, doesn’t have too much credit risk, and pays a nice yield while providing some duration, which can be beneficial as the Fed cuts rates. I like the fund and think it’s worth considering overall.

Read the full article here