Overview

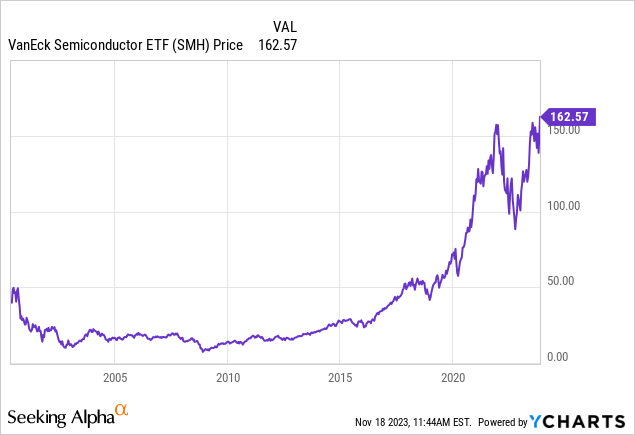

The semiconductor industry, a dynamic force in the world of technology, is currently in the spotlight as the VanEck Semiconductor ETF (NASDAQ:SMH) breaks all-time highs. However, the market narrative recently took a fascinating turn with Michael Burry, the investor known for predicting the 2008 housing market crash in “The Big Short,” revealed a significant short position this week in the semiconductor industry. He bought put options with a notional value of $47.4 million against the iShares Semiconductor ETF (SOXX), according to the filing. Burry also appeared to have closed out his previous bearish options against the broader U.S. market, specifically the Nasdaq 100. It’s unclear how his performance was for those positions.

Now that Burry has publicly released his current views against this volatile technology sub-sector, investors might be unsure what’s to come. The semiconductor industry, a linchpin in the technological landscape, has always been marked by its cyclical patterns. Booms and busts are inherent, shaped by factors such as technological advancements, global economic trends, and consumer demand for electronic devices. As SMH reaches unprecedented highs, it’s essential to understand the dynamics at play. We’ll see if this trend can continue into 2024 after beating market expectations his year. Many investors were expecting the industry to struggle greatly, but that has not been the case.

Michael Burry’s short position in the semiconductor industry adds a layer of complexity to the story. His reputation as a market contrarian with a knack for foreseeing downturns makes his warning worth noting. Investors are now faced with a nuanced situation — the bullish surge in SMH and the bearish outlook from a seasoned investor. The current success of SMH reflects the robust demand for semiconductors, driven by the ever-expanding tech ecosystem. This demand is expected to rebound in 2024; the International Data Corporation or IDC for short, sees year-over-year growth of 20.2% to $633 billion, up from $626 billion in the prior forecast. From smartphones to electric vehicles, semiconductors are the backbone of modern innovations. Currently, the semiconductor industry is experiencing a boom fueled by factors such as the rise of 5G technology, the Internet of Things (IoT), and the global push toward electric vehicles. These trends contribute to a surge in demand for semiconductors, reflected in SMH’s remarkable performance. However, as the industry revels in its current success, it’s crucial to recognize the cyclical nature that has defined its history. The semiconductor industry has witnessed periods of rapid growth followed by downturns, and historical trends indicate that caution is warranted in times of exuberance. As investors celebrate the highs of today, the cyclical nature of the industry prompts us to consider what might lie on the horizon.

Michael Burry’s Warning: A Cautionary Tale

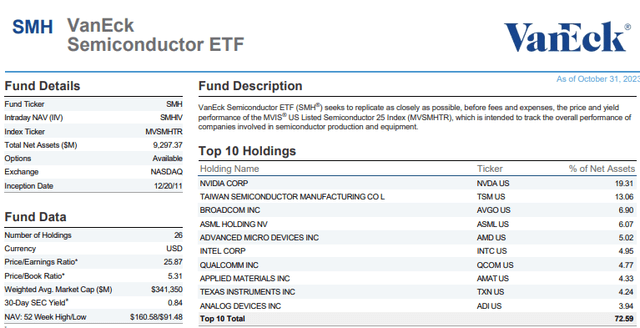

Amidst the industry’s bullish run, Michael Burry’s warning serves as a cautionary tale. His reputation as a contrarian investor who foresaw the housing market crash in 2008 lends weight to his bearish stance on semiconductors. Burry’s rationale for the short position revolves around concerns of overheated valuations, speculative excess, and the potential for a correction in the semiconductor industry. While his predictions have garnered attention, investors need to conduct thorough research and assess the broader economic landscape. According to investment advisor VanEck, the SMH ETF currently has a trailing Price/Earnings ratio of 25.87x vs. the S&P 500 at 21.2x

VanEck

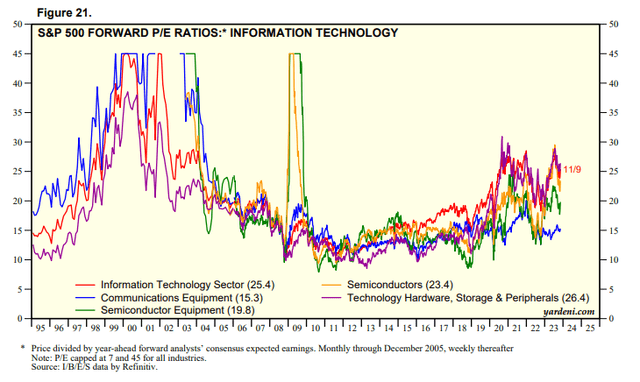

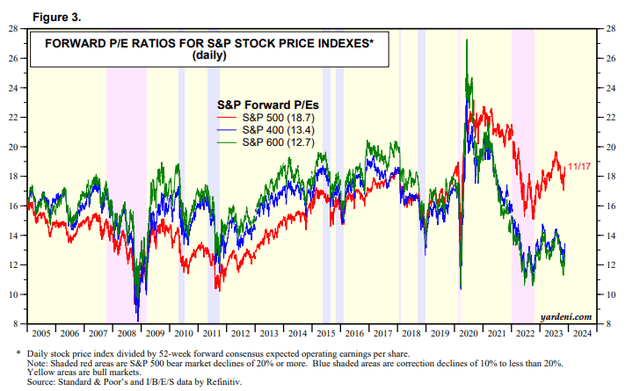

Some may argue that trailing P/E is not an accurate indicator since semiconductors are expected to grow at a faster rate than the broader S&P 500 in 2024. However, even if we adjust for expected forward earnings, the semiconductor index is still trading at a multiple that is 20% higher.

Forward P/E Is Considerably Higher For Semiconductors vs. the S&P 500 (23.4x vs. 18.7x)

Yardeni.com Yardeni.com

Diversification and Risk Management Are Key To Success

In the face of market uncertainties, diversification and risk management will always be an invaluable tool for investors. If an investor still believes this tech rally will continue and is looking for exposure to the semiconductor industry, using a diversified ETF such as SMH is a much better way than adding individual stocks in my view. As investors navigate the waves of the semiconductor market, it’s crucial to remain vigilant and adaptable. The unpredictability of the industry demands a proactive stance, where investors stay informed about market trends, monitor economic indicators, and adjust their strategies accordingly.

Conclusion

The semiconductor industry’s cyclical nature implies that periods of growth will be followed by corrections. While the current surge in SMH is a testament to the industry’s vitality, investors should be prepared for potential headwinds. Anticipating market trends requires a forward-looking approach. Monitoring developments in technology, global economic conditions, and geopolitical factors can provide valuable insights into the trajectory of the semiconductor industry. As innovations continue to shape the tech landscape, investors must remain adaptable and ready to pivot their strategies based on evolving market dynamics. The juxtaposition of SMH’s all-time highs and Michael Burry’s warning creates a nuanced narrative for investors in the semiconductor industry. As the industry rides the current wave of success, it’s imperative to recognize the cyclical nature that defines its history.

Read the full article here