What Happens

Micron Technology (NASDAQ:MU) just reported decent results for its 3Q FY2023 earnings, even though it faced a significant headwind due to China’s ban on its memory chips. The management anticipates that approximately 25% of the company’s global revenue comes from mainland China and Hong Kong, making it a large exposure for the company. However, in the earnings presentation, they also highlighted that about 50% of their revenue from China is currently at risk.

A key factor contributing to Micron’s potential vulnerability to import restrictions is the widespread availability of memory chips. Actually, many other companies around the world, including those from Korea, also sell similar memory chips in China. This means there are plenty of alternative options available to Chinese customers. As a result, MU could easily lose its market share in China.

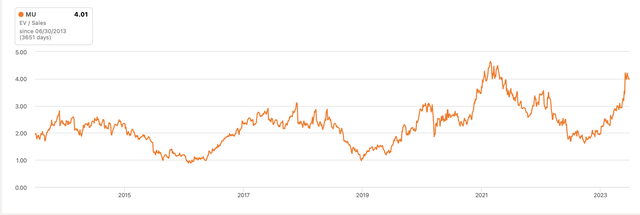

In terms of MU’s valuation, the stock appears to be expensive. The stock’s growth has declined significantly, leading to a sharp increase in the EV/Sales TTM, which is approaching to its highest level in the last 10 years. Therefore, I rated sell on MU, considering the uncertainties posed by the China ban and its potential impact on the company’s revenue and margins.

3Q FY2023 Takeaway

Despite China’s restriction on MU’s memory chips, the company not only beat the non-GAAP EPS consensus but also slightly topped the street’s revenue estimates. As a result, we saw a modest 4% gain in the aftermarket. However, the rally quickly reversed its course and closed almost 4% below the pre-earnings price level on the next day, as the company acknowledged that China’s recent decision regarding Micron products and cybersecurity risks poses a “significant headwind” that will impact the outlook going forward and slow the company’s recovery from the ongoing downturn. In the earnings call, the management remained a cautious tone, the CEO explained.

“While supply demand balance is improving, due to the excess inventory, profitability and cash flow will remain extremely challenged for some time.”

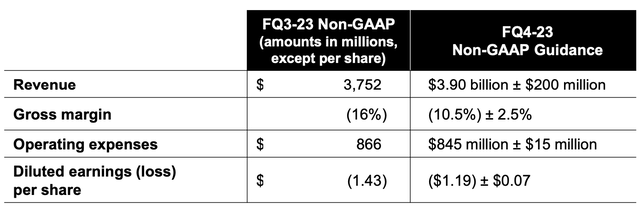

3Q23 Presentation

As shown in the table, the company’s 4Q FY2023 guidance ranges from $3.7 billion to $4.1 billion, which is slightly below the street consensus of $3.87 billion. While the guidance implies sequential growth on a QoQ basis, I’m concerned about the company’s growth outlook and margins contraction, which can largely impact its profitability and FCF generation. The table indicates a wide range and lower-than-expected gross margin. Moreover, the upper bound of non-GAAP diluted EPS guidance to be $-1.12, falling below the consensus of $-1.10, has also disappointed investors.

Significant Revenue Slowdown

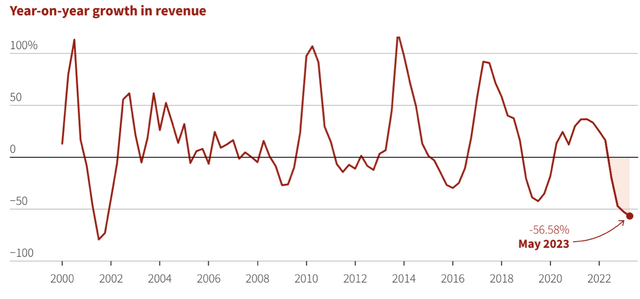

Refinitiv Eikon | Reuters, June 28, 2023 | By Vineet Sachdev

We have to admit that MU’s revenue growth has decelerated significantly, reaching its lowest YoY growth since 2001. This slowdown can be largely attributed to the impact of China’s recent ban, coupled with the macro headwinds faced by the global chip industry.

Looking at the company’s guidance for 4Q FY2023, the mid-point revenue projection of $3.9 billion indicates another record -55% decline YoY. The continued plunge in revenue is a concerning sign for investors, suggesting that the company’s recovery may take longer than initially anticipated. The CEO in the earnings call added,

“Our expectations for calendar 2023 industry bit demand growth have been further reduced to low- to mid-single digits in DRAM and to high-single digits in NAND, which are well below the expected long-term CAGR of mid-teens percentage range in DRAM and low 20%s range in NAND. While the AI-driven demand has been stronger than our expectations three months ago, the PC, smartphone and traditional server demand forecasts are now lower. “

Revenue Exposure in China

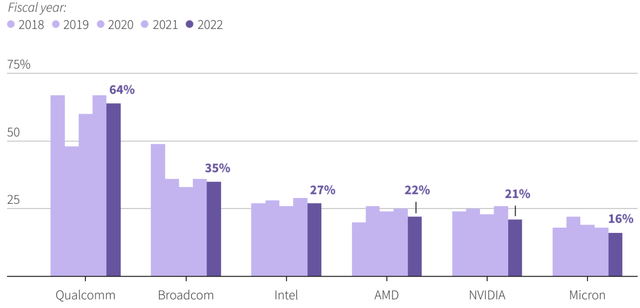

Refinitiv Eikon, Company annual reports | Reuters. June 28, 2023 | Bv Kripa Javaram and Sumanta Sen

Looking at this chart, we can observe that over the past years, MU’s revenue exposure in China has been decreasing. In FY2022, its revenue exposure was only at 16%, which was below other peers. While the geographic revenue segment is only disclosed in the company’s annual 10Ks, the company estimated that China now makes up 25% of its total sales in 3Q FY2023, indicating a significant increase in revenue exposure to China in the current fiscal year.

While the full impact of China’s ban is still uncertain, it may affect around one-third of Micron’s sales to Chinese customers. The company’s management expects its sales to be slightly lower by single-digit percentages. Moreover, the potential impact of the ban on MU’s manufacturing facilities in Taiwan and China remains unclear. The specific markets targeted by the ban have not been specified, but we should know that most of MU’s sales in China are for memory used in PCs and smartphones, rather than server and networking components.

Given the uncertainties surrounding the full impact of the import restrictions in China, it would be prudent for investors to remain cautious on the stock. The situation in China could have further deteriorations that have not yet materialized. We should be mindful that uncertainty around geopolitical issues or regulatory actions can create fear among investors, which could trigger irrational selloffs on the stock.

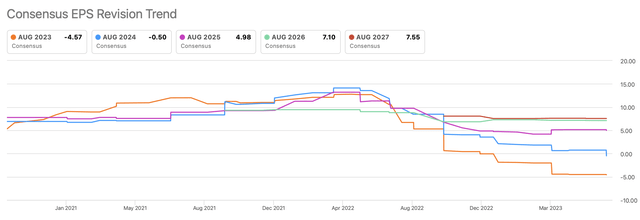

Downward Earnings Revisions

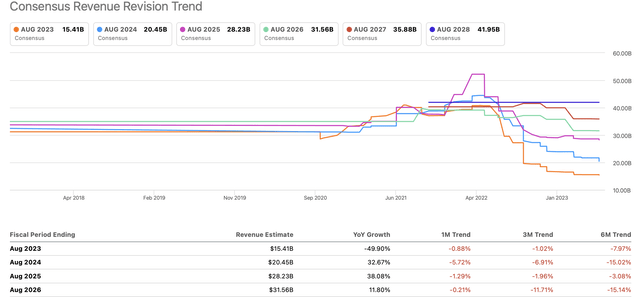

Seeking Alpha

In general, a stock’s positive momentum is usually supported by continuous upward revisions. This indicates an increasing price level without a significant expansion of its valuation. However, in the case of MU, we have observed a significant reduction in revenue consensus by analysts since last year, and there hasn’t been any upward revision yet.

Again, given the management’s cautious tone regarding the revenue headwind caused by China’s ban, I think it’s likely that MU’s price action and valuation will continue to be under pressure.

Seeking Alpha

Furthermore, we also have seen a sharp decline in MU’s earnings estimates, as analysts express concern about the company’s contracting margins. I admit that there is a secular tailwind on memory chips resulting from the recent AI revolution, I believe MU’s growth outlook will be sub-par compared to other peers. Therefore, due to the negative revenue growth in recent quarters, we can see that MU appears to be getting more expensive as the stock continues to fall.

Valuation

Seeking Alpha

Given that MU has recently maintained negative balances in non-GAAP operating income and EPS, we can rely on the revenue to gauge its valuation. The stock is currently trading at 4x EV/Sales TTM, which is nearing its pandemic high and significantly above the 10-year average. This is a warning sign for investors: When the stock price decreases, the valuation multiple becomes more expensive.

Therefore, I believe holding a position in MU under these circumstances could potentially result in a high opportunity cost. However, we should closely monitor its forward guidance, particularly the FY2024 outlook, in the next earnings release to assess potential growth inflections and any upgrades to the stock.

Conclusion

In sum, I’m still skeptical about MU’s ability to regain a significant upside momentum. I think China’s ban can significantly impact MU’s revenue growth and margins, as the company’s revenue exposure to China has increased. We also don’t know the full impact of this restriction. Additionally, despite better-than expected earnings results in the last quarter, MU’s earnings outlook have plummeted due to concerns about margins contraction. The stock’s valuation has become expensive, as the price declines while the multiple rises. Consequently, I rated sell on MU as holding the stock at this juncture may carry a high opportunity cost. Lastly, to gauge potential growth inflections and stock upgrades, we should watch closely the company’s FY2024 revenue outlook in the upcoming earnings release.

Read the full article here