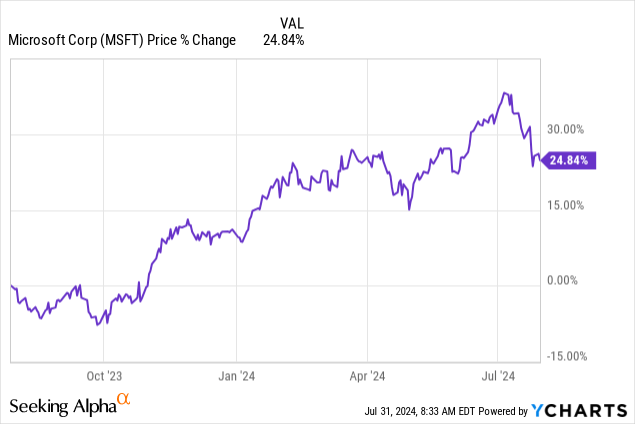

Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) presented better than expected fourth fiscal quarter results on Tuesday, but shares have not reacted positively to the tech company’s report card. The quarterly earnings sheet was impressive, however, in terms of free cash flow generation and margins and momentum in Azure Cloud growth, which is in part driven by new AI tools. Microsoft beat Wall Street’s expectations on both the bottom and the top line, and the software company continues to have a lot of potential. While I like Microsoft’s business setup, cash flow power and Cloud/AI momentum, shares are still a little bit on the expensive side. Given the strength in FCF margins, however, I am upgrading shares to hold!

Previous rating

I rated shares of Microsoft a sell after the company’s previous earnings report card — Wait For A Drop Before Buying — mainly because Microsoft’s valuation had run ahead of the fundamentals, so my main argument. From a non-valuation point of view, however, Microsoft is executing very well, especially in the Cloud business, and the company has been able to grow its free cash flow margins in the last quarter. I am upgrading shares of Microsoft to hold due to growth in free cash flow and higher margins, but remain still a bit on the fence in terms of the company’s high valuation.

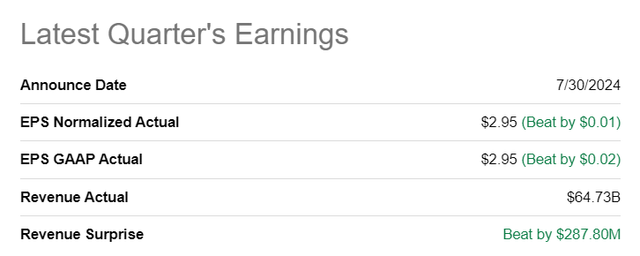

Microsoft beats earnings

Microsoft generated $2.95 per-share in adjusted earnings in the fourth fiscal quarter on revenues of $64.73B. Earnings came in slightly better than expected (+$0.01 per-share) and revenues beat by $287.8M, chiefly because of continual Cloud momentum.

Seeking Alpha

Strong Q4’24 financial performance, Azure growth and free cash flow

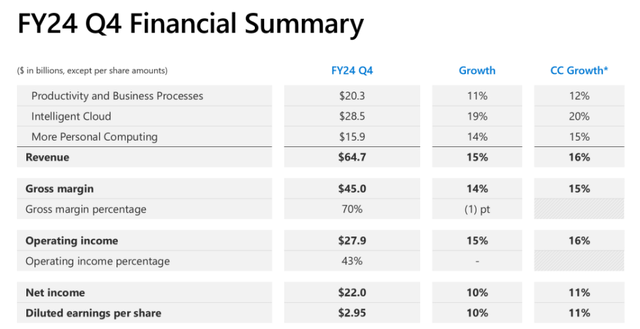

Microsoft generated solid financial results for its fourth fiscal quarter, resulting in a top line of $64.7B. Revenues grew 15% year over year, which marked a 2 PP revenue growth deceleration compared to the previous quarter. Intelligent Cloud, which includes Microsoft’s Cloud platform Azure, remained a growth engine for the software company and delivered by far the fastest segment top line growth with 19%. Overall, Microsoft’s Q4’24 results were very solid, with double-digit revenue growth and free cash flow margins at their highest level in three quarters.

Microsoft

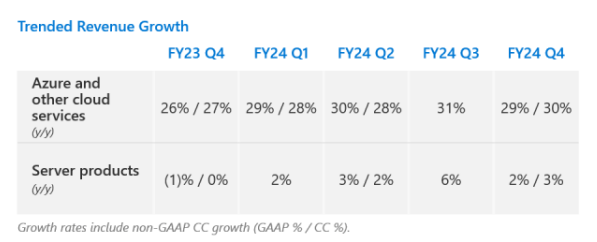

Microsoft’s Azure business kept up its solid performance in the June quarter, leading to revenue growth of 29% year over year. While growth slowed 2 PP quarter over quarter, Azure is by far the most significant segment for Microsoft in terms of revenue growth for Microsoft. No other segment is growing as fast as Cloud, which is the same take-away investors got from Alphabet’s (GOOG) earnings release for Q2’24.

Microsoft

Microsoft Azure continues to have attractive growth potential going forward as the number two ranked U.S. public cloud infrastructure company. Microsoft is investing heavily into its AI capabilities across its product stack, including AI-driven applications and security. One of the company’s key products includes Azure AI, as an example, which includes large language model functionality that appeals chiefly to the enterprise market. Investors also shouldn’t forget that Microsoft invested a solid $10B into OpenAI, the ChatGPT-creator, which increased the company’s exposure to the AI market drastically last year.

Microsoft is further investing into products such as Copilot AI, an AI-powered assistant that offers customers productivity tools. Copilot is very popular with enterprise customers and has seen growing product adoption by Fortune 500 companies this financial year. AI applications, whether in Microsoft 365’s productivity suite or in the Cloud business, could be an accelerant for Microsoft’s top line performance in the coming quarters and further help the company grow its free cash flow margins.

When it comes to software companies, the most important figure to look at, in my opinion, is free cash flow because it is the ultimate amount of resources that are available to the company to finance new [AI] investments and that can be returned to shareholders, mainly through buybacks. In the June quarter, Microsoft generated $23.3B in free cash flow — the largest quarterly amount in the last year — which calculates to a free cash flow margin of 36% (the highest margin since the first fiscal quarter of FY 2024).

Microsoft’s 18% Y/Y growth in free cash flow and FCF margin expansion, combined with a recent drop in the share price, are the main reasons for my rating upgrade.

|

$billions |

FQ4’23 |

FQ3’24 |

FQ2’24 |

FQ1’24 |

FQ4’23 |

Y/Y Growth |

|

Revenues |

$64,727 |

$61,858 |

$62,020 |

$56,517 |

$56,189 |

15% |

|

Cash Flow From Operating Activities |

$37,195 |

$31,917 |

$18,853 |

$30,583 |

$28,770 |

29% |

|

Capital Expenditures |

($13,873) |

($10,952) |

($9,735) |

($9,917) |

($8,943) |

55% |

|

Free Cash Flow |

$23,322 |

$20,965 |

$9,118 |

$20,666 |

$19,827 |

18% |

|

Free Cash Flow Margin |

36.0% |

33.9% |

14.7% |

36.6% |

35.3% |

2% |

(Source: Author)

Microsoft’s valuation

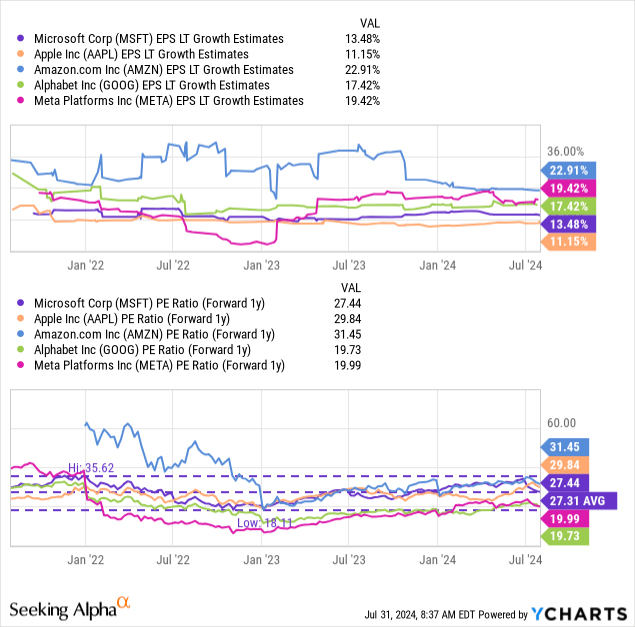

Microsoft’s shares are not cheap and have not been for a quite a while. Investors love Microsoft’s growth story, especially in Cloud/AI, which resulted in a 25% share price upside revaluation in the last year. Currently, shares of Microsoft are valued at a price-to-earnings ratio of 27.4X which compares to an industry group average P/E ratio of 25.7X.

The industry group average includes the top five tech companies, Apple (AAPL), Amazon (AMZN), Alphabet, and Meta Platforms (META). Shares of Microsoft are also still trading above the longer term (3-year) average P/E ratio of 27.3X, so I believe MSFT is about fairly valued here.

In my last work on the company, I indicated that I saw a fair value of $400, which I maintain following Microsoft’s Q4’24 earnings. Relative to companies like Google and Meta Platforms, which are also extremely free cash flow-profitable, Microsoft’s shares are expensive, however.

Meta Platforms and Google are not only cheaper than Microsoft, but they are expected to grow their long term EPS (19% and 17%) at faster rates than Microsoft (13% in the long term). Google especially is an extremely attractive investment for Cloud/AI investors, chiefly because shares are so outrageously cheap given the opportunity for AI-driven growth: Google’s Valuation Makes No Sense.

Microsoft’s risks

The biggest risk for Microsoft, as I see it, is the potential slowdown in the Azure business as competition is heating up between the various public cloud infrastructure companies. Azure is still Microsoft’s growth engine and the segment has considerable potential for growth given that companies are set to bring more AI workloads to the Cloud. What would change my mind about Microsoft is if the company were to see a drastic drop-off in its free cash flows and margins.

Closing thoughts

Microsoft did not disappoint and delivered a solid earnings report for the fourth fiscal quarter that showed continual growth and momentum in Azure, Microsoft’s Cloud platform, double-digit growth in free cash flow, higher FCF margins and the company remains attractive as an AI play as it invests billions of dollars into artificial intelligence opportunities across its product stack, led by Azure AI. Microsoft’s free cash flow margins hit 36% in the last quarter and the company generates so much recurring FCF that it could acquire a ton of AI start-ups in the future or decide to return much more cash to shareholders. The only thing that I don’t like as much is Microsoft’s steep price. Given the strong AI monetization opportunity, growth in FCF and generally favorable outlook for Azure, however, I am upgrading my rating to hold despite my concerns about valuation!

Read the full article here