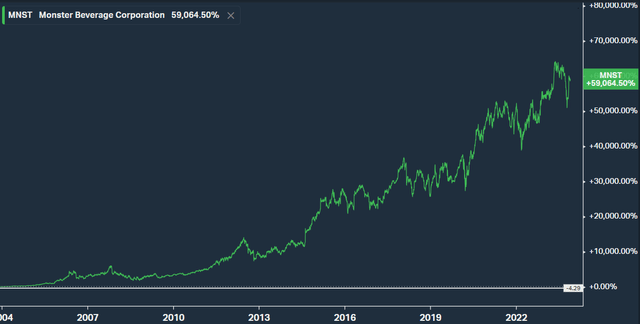

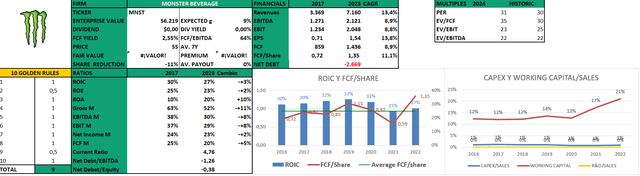

As everyone knows, Monster Beverage (NASDAQ:MNST) has been a stock that has given spectacular returns to its shareholders so far for decades. It has been the example of how to do things well: a product with a very short finite life that is liked by its consumers and that generate high ROICs, the correct construction of a brand image, and the association with KO for distribution. Moreover, we should take into consideration the great work of the CEOs and Co-founders Rodney Sacks and Hilton Schlosberg. In any case, there is a company that is doing things even better and that may endanger Monster’s sovereignty in the future. We’ll talk about her later.

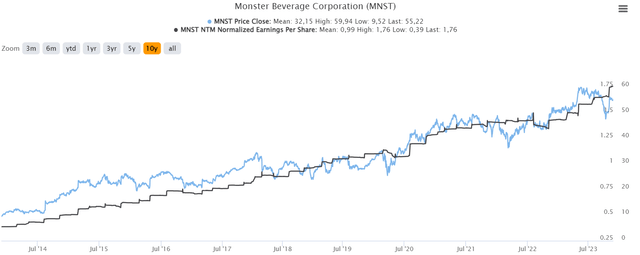

Source: Koyfin

Business model

Monster develops, markets, and distributes energy drinks under its Monster, Reign, and now Bang brands, among others. The company does not manufacture them; it sells the ingredients to distributors or bottlers, or ready-made cans to supermarkets, pubs, retail and wholesale stores…

Monster does not operate finished product manufacturing facilities but rather outsources the manufacturing process to third-party bottlers and contract packers. This makes the business much less capital-intensive and has lower debt. In addition, it also provides them with greater flexibility in the face of unexpected changes, since they do not have to build a new factory, but rather subcontract production to an existing one. Contracts are usually signed for at least 20 years.

American Fruit & Flavors develops the flavors of the Monster Energy Drinks segment. AFF was bought by Monster in 2016 for $690 M. They have been developing flavors and juices since 1972. With this, Monster not only secured the intellectual property of all its important flavors, but they also achieved an indefinite collaboration with a company with which Rodney Sacks (CEO of Monster) had been working for 20 years. It’s a textbook vertical integration.

Monster also purchased CANarchy in 2022 to expand its product portfolio into beers. These are products that have lower margins, a figure that will be reflected in Monster’s results. Although I am not enthusiastic about this new vertical oriented towards alcoholic beverages, I trust management’s decisions. Finally, this year it purchased the energy drink brand, Bang Energy, for $362 million and a beverage production facility in Phoenix, Arizona. I don’t really know what their intentions are with the brand.

More cyclical than it seems

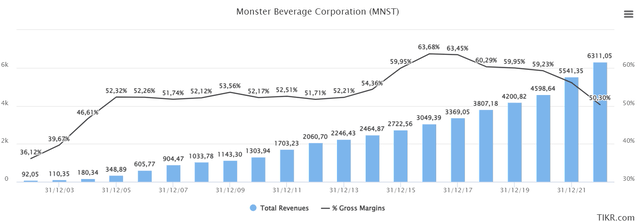

This has been one of the most important points of the thesis in recent years. Due to a spike in inflation, bottlenecks, rising raw material prices and a collapse in storage ports, in 2021 and 2022 Monster’s margins were compressed as costs increased.

Monster’s demand did not suffer during the pandemic, since supermarkets remained open and despite the cancellation of events, they managed to increase their revenue by 9.5%. The bad thing comes from the costs. Despite being an asset light business, since it has 1% capex/sales, Monster is not immune to fluctuations in raw materials such as aluminum and fuel. They directly buy the aluminum for the bottlers and are in charge of distribution, so they face the cost directly.

This can very negatively affect its margins, in 2021, its margins fall to around 3 %-4 %. In a year in which their sales raised 20%, their net income decreased 3%. This makes Monster a somewhat cyclical company, not on the demand side, since it has never had a year with a decline in sales, but on the cost side, which causes its margins to fluctuate.

Source: Koyfin

Moats

Monster has the two most important moats within the energy drink sector. Brand image, which it has been building since its inception and allocating around 10% of its sales to marketing expenses, including sponsorship at events such as the UFC or contracts with influencers, such as Lewis Hamilton. The logo of green claws on a black background is already in everyone’s head and this is a sign of successful marketing.

The second most important moat is distribution. Thanks to its agreement with KO, which owns 16% of the company’s shares, Monster can use its transportation and bottling network for its drinks. This makes the company not very capital intensive, and it can enjoy the best logistics network in the sector. In addition, it gives you space on the shelves of retail stores or in gyms and vending machines throughout the country.

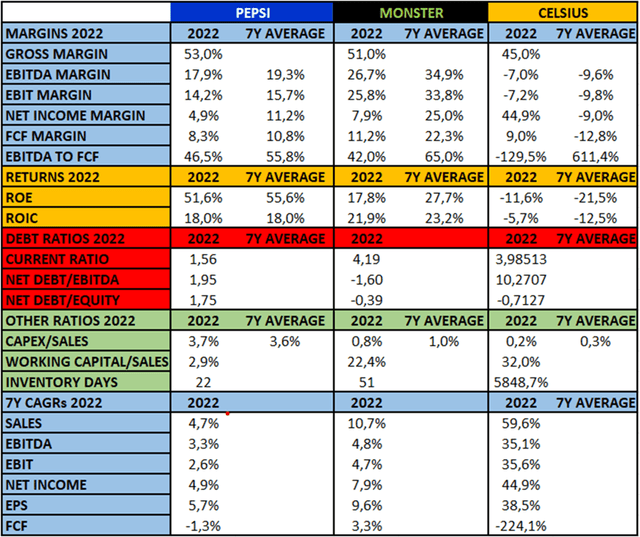

Competition

I’m not going to dwell too much on this point, but I find it interesting to show it. Below we have the compared figures of MNST PEP and CELH, each one in a different business life phase. We can see how PEP has much slower growth, as well as greater capital intensity. On the contrary, CELH enjoys explosive growth, but has a P&L that leaves something to be desired (the figures are from 2022, I am aware that Celsius is going to generate positive Net Income this year). In fact, I have already written an article about PEP and another about CELH.

Source: Author’s representation

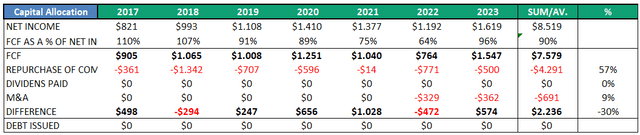

Management and Capital allocation

The CEOs and Co-founders (Rodney Sacks and Hilton Schlosberg) have been leading the company since 1990. They each own approximately 9% of outstanding shares, so their interests are aligned with shareholders. KO and Vanguard own 25% between the two.

The ROICS have remained very high (30% on average in recent years), they have repurchased 11% of the shares in circulation. They usually approve buyback packages worth $500M, which is usually 1% of the market cap. They leave a large part of their FCF here, since they do not distribute dividends, and they have barely made acquisitions. Where they invest a lot is also in marketing. They usually spend 10% of sales (between $400M and $600M). It seems like a good use to me, since to a large extent, Monster is an advertising brand, like Red Bull.

Source: Author’s representation

Financials

Monster’s financials are spectacular. The CAGRs in most of its figures have been high; it has a net cash position; the returns on equity and capital are very high; and it has very good margins, thanks to its asset-light business model. All of this makes valuation multiples always seem expensive, but I will provide a solution for this in the valuation part.

Source: author’s representation

Valuation

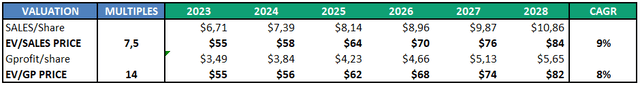

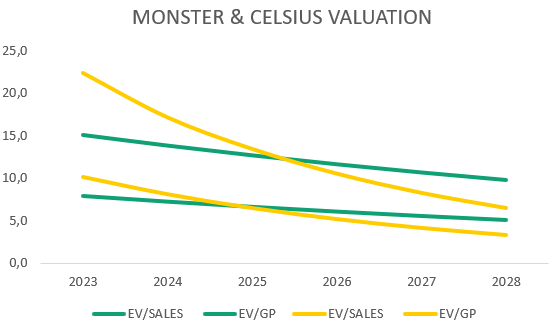

As we have mentioned before, Monster seems to me to be a cyclical company on the cost side. This makes the bottom line much more erratic than the topline. That is why this is one of the only exceptions I make, since I prefer to value it by EV/Sales rather than by EV/FCF. Monster has been trading between 6x-10x EV/Sales per share for 10 years (as shares outstanding will decline), with an average of 7.5X. We could also even value it by EV/gross profit per share, which gives us an average of 14x. We do this to include COGS, since the fluctuation in costs occurs here. I estimate that Monster can grow at least 9% CAGR in sales over the next 5 years (in line with its market) and expand its gross margin to 56% in 2028. All this gives me returns of between 8%-9% CAGR, being a base case, since it is likely that Monster can continue to grow at rates above its sector.

Source: author’s representation

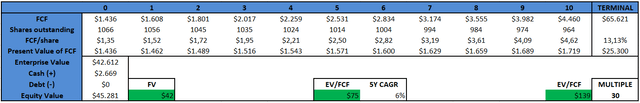

We could also calculate it by a DCF. In this model, I am using 12% CAGR for FCF, 3% terminal growth rate, and 10% as discount rate. The price it gives me is $42, 24% lower than the current price. But I have already said that I prefer to valuate it the other way. For all these reasons, I rate Monster as a hold.

Source: author’s representation

Other important graphs

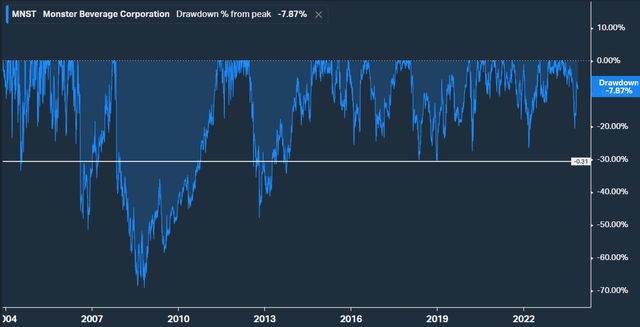

Monster almost never exceeds 30% drawdown from highs, so we could incorporate it as a fairly defensive stock in the portfolio.

Source: Koyfin

Share price and EPS tend to converge over time, so divergences in this can be seen as opportunities.

Source: Tikr

Risks

Aside from fluctuations in its costs, I think Monster’s biggest risk is Celsius. I think the energy drink market is big enough for Monster, Celsius and Red Bull to coexist, but as I said in my Celsius article, I think this one is doing things better than Monster. It is getting its drink associated with being a healthier alternative to energy drinks (the so-called functional drinks). This is greatly expanding its TAM, since it is targeting population groups that traditional energy drinks had never successfully penetrated. I’m talking about a female audience or adults who don’t like energy drinks. This association with a healthier drink can free it from future regulations on energy or sugary drinks. Furthermore, thanks to its agreement with Pepsi (just like the one Monster has with KO) its distribution is improving significantly and it is having access to places such as gyms or universities, where Monster’s potential customer target is located. This may end up taking away market share and we are already seeing CELH’s incredible growth (81% CAGR in sales over the last 6 years).

All of this makes me think that CELH is going to be a better investment than Monster in the future, and that its optionality and potential TAM is greater. In addition, it only has 6% of sales outside the USA, compared to Monster’s 35%, so growth on this part also promises to be great. To all this we must add that their evaluations are not very far from each other either. (Monster in green, Celsius in Orange) I discuss all of these issues in more detail in my Celsius article.

Source: author’s representation

Conclusion

As we have seen, Monster has been a success story on Wall Street. A recurring product, which is liked, with a good brand image and an aligned directive. We have already seen that the returns that an investor could expect from Monster can be in the high single digits. In any case, I can’t help but think that Celsius is a more attractive investment alternative, also with more risk, so it will depend on the risk aversion of each investor, which stock to buy.

Read the full article here