Introduction

It’s time to discuss The Mosaic Company (NYSE:MOS). In early May, I wrote an article covering its strong earnings. Since then, the stock has dropped another 9%, bringing the year-to-date performance to -21%. MOS is now trading 45% below its 52-week high.

In this article, I’ll update the bull case, using the recent BMO Global Farm to Market Conference, economic developments, and the company’s investments in growth and shareholder distributions.

While MOS continues to benefit from strong tailwinds and a very attractive valuation, it lacks a catalyst that could trigger the return of optimistic buyers.

Hence, a big part of this article will focus on explaining what a potential catalyst might look like and why it could unlock a lot of value for shareholders.

So, let’s get to it!

What’s The Catalyst?

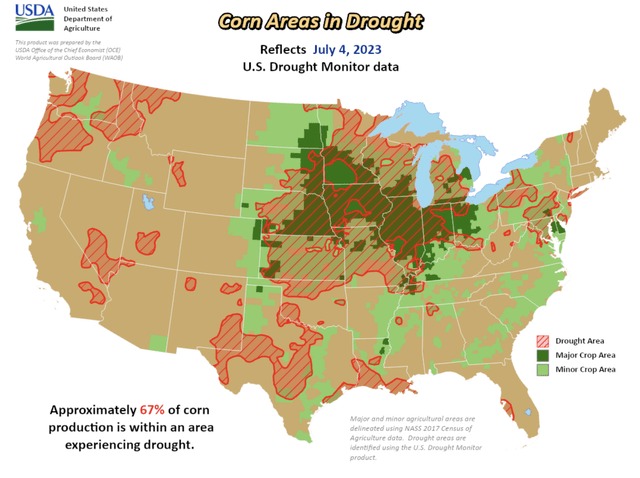

A few weeks ago, traders started to bet on a very weak harvest in the United States, as key crops like corn are experiencing drought. As of July 4, 67% of corn production is experiencing drought. Almost the entire Corn Belt is dealing with these issues.

United States Department of Agriculture

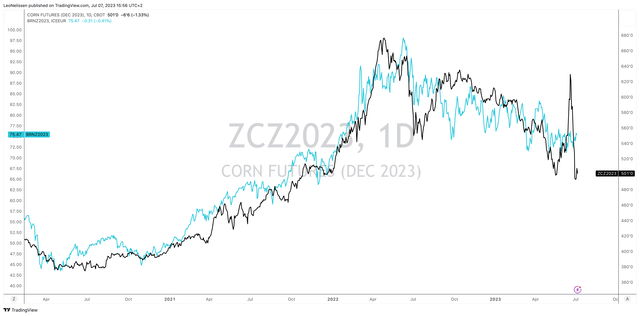

When looking at the chart below, we see that December corn futures (black line) soared to almost $6.40 per bushel when drought issues started to appear. However, that surge was quickly followed by a steep decline to a new multi-year low.

TradingView (December Corn, December Brent)

The chart above also shows the price of December Brent oil (blue line). Last month, I used this chart to keep people from buying the surge in corn prices.

What amazes most people is the strong correlation between corn and oil. This isn’t just because 40% of corn is used in ethanol, which is tied to the energy sector, but because energy prices are a big driver of agriculture crop production costs.

Given that farming is an industry with a lot of competition and low entry barriers (low margins), prices usually trade barely above production costs. Hence, energy costs tend to drive agriculture prices.

The same applies to Mosaic.

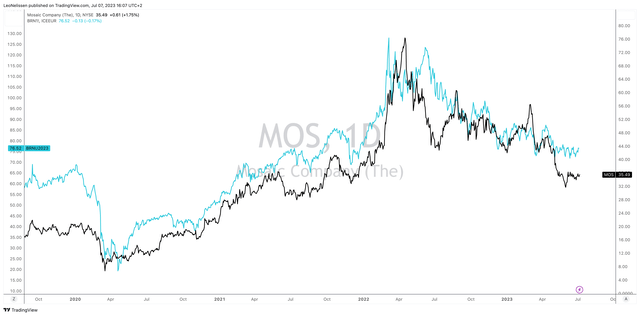

Mosaic’s share price has suffered since the second quarter of last year. Like the price of corn, it’s highly correlated to oil. However, Mosaic doesn’t produce oil. It also doesn’t produce nitrogen-based fertilizers, which are correlated to natural gas prices and interregional price differentials.

TradingView (MOS, Brent)

With that in mind, let me show you the next chart.

While MOS continues to do very well (more info on that later in this article), investors aren’t giving the stock any credit. The big problem is an unwillingness to buy cyclical commodity stocks.

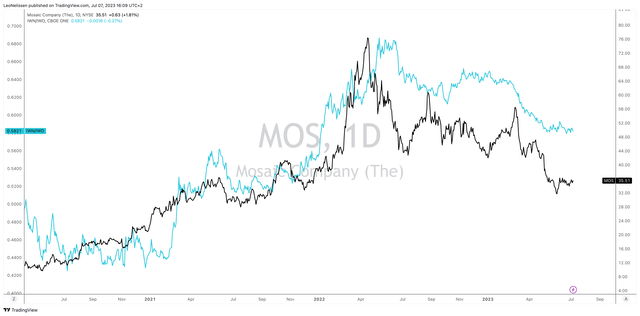

The chart below compares the MOS stock price to the ratio between value (IWN) and growth stocks (IWO). While the correlation isn’t perfect, bigger moves are usually supported by this ratio. For example, until early 2022, value stocks did very well before the market started to bet on slowing inflation. Now, growth stocks are crushing value stocks, as the market believes that inflation will soon normalize, supported by a soft economic landing that could allow the Fed to slowly cut rates again.

TradingView (MOS, IWN/IWO Ratio)

As much as I hope that this will happen, I’m not willing to bet on such an outcome. Even if inflation comes down, I believe that normalization cannot be achieved without severe economic weakness, which could trigger the Fed to act more quickly. That could pave the way for a second wave of inflation.

At that point, we’re back where we were in 2021, which was the start of a strong move from growth to value.

That’s the catalyst I’m looking for.

How’s Mosaic Doing?

The first part of this article would be useless if Mosaic had issues.

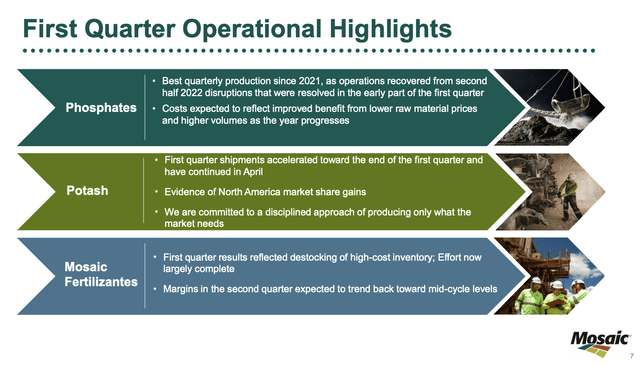

During this year’s BMO Global Farm to Market Conference, the company reiterated the tailwinds it is enjoying.

The company’s CEO, James O’Rourke, started the conference by addressing the question of why the market is not moving faster despite restrictions on potash and phosphates supply – which is a question on a lot of people’s minds.

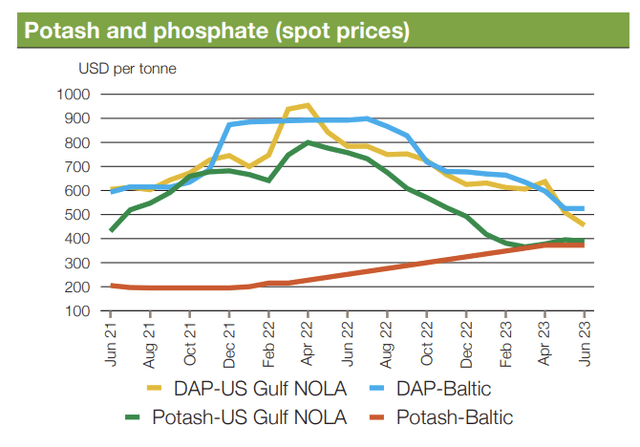

After all, despite supply issues, prices of key fertilizers continue to fall.

AMIS – July 2023 Market Monitor

This is what AMIS wrote in its July 2023 Market Monitor on potash fertilizer:

Potash prices were marginally down in the US Gulf due to lower demand. Prices in Brazil also continued their decent as inventories remained high. A low Chinese contract price contributed a softer tone to the market.

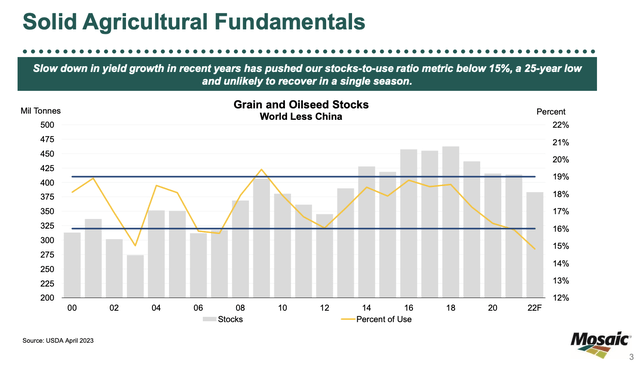

Going back to the question asked to Mr. O’Rourke, he highlighted that the global stocks-to-use ratio for grains and oilseeds is below 15%, which strongly supports grain prices, particularly for corn and soybeans. These high grain prices are expected to hold or improve over time due to the demand for last year’s harvest. I believe it will take at least two extremely healthy crop years to somewhat normalize inventories. Given the weather in 2023 so far, I think we won’t see a normalization anytime soon.

Mosaic Company

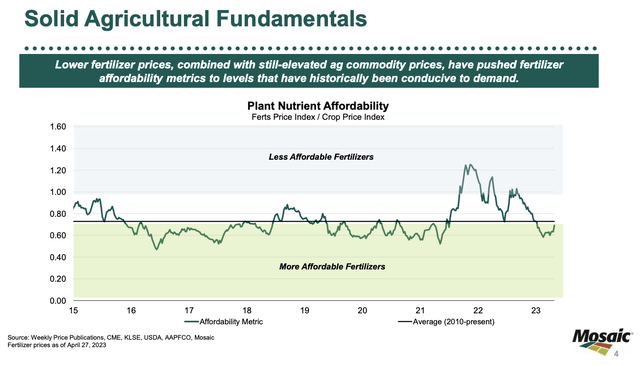

Mr. O’Rourke also explained that the decrease in fertilizer prices coupled with the stable grain prices makes fertilizers more affordable for farmers, leading to an anticipated increase in demand.

Mosaic Company

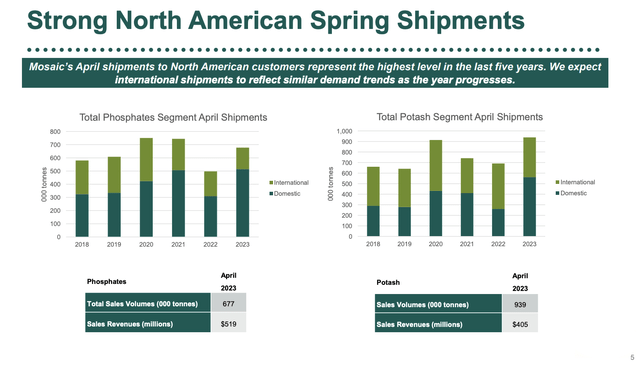

In North America, where the farming season is underway, there has been a significant increase in purchases of phosphates and potash, making it the best April in five years.

Mosaic Company

O’Rourke emphasized that this trend demonstrates both volume and price movements, indicating a positive market outlook. I believe these developments could put a floor under potash and phosphate prices at current levels.

Mosaic expects similar market dynamics to unfold in Brazil and the rest of the world and highlighted the importance of consistent fertilizer application for sustained crop growth, which is something I cannot stop talking about – especially in light of ongoing crop supply concerns.

Furthermore, in the first quarter, the company gained 200 basis points in its market share in potash, achieving the highest price realization in the North American market.

Mosaic Company

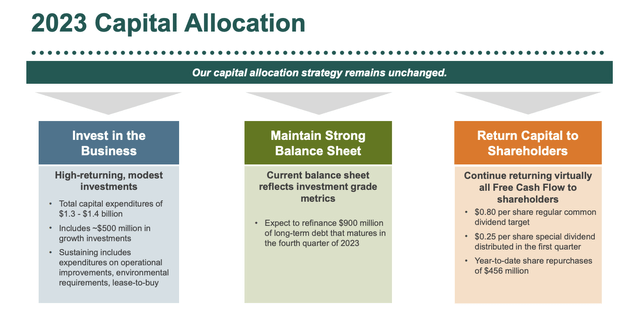

Based on this context, there are two important topics left to discuss – both tied to capital expenditures.

- Growth investments.

- Shareholder distributions.

Mosaic remains committed to investing in its business and has several value-adding projects underway. These projects include the development of the next generation of MicroEssentials, expanding the distribution business in Brazil, ramping up the Esterhazy mine, and introducing new flotation at Esterhazy.

Mosaic Company

This is what I wrote with regard to MicroEssentials in March:

The company’s MicroEssentials project is expected to be completed by the end of this year. By then, Mosaic will be able to turn half of its North American phosphates into value-added performance products. The budget of $40 million for this project will be recouped in a period of fewer than two years.

In addition to the volume and margin-enhancing ability of these projects, the company emphasized the favorable payback period of these projects, ranging from 1 to 2 years.

Thanks to the company’s healthy balance sheet (1.1x 2023E EBITDA net leverage ratio), it aims to distribute almost all free cash flow to shareholders through buybacks and dividends.

For now, the impact of buybacks and dividends is minimal – especially in light of the weak stock price. However, once MOS starts a sustainable uptrend with higher fertilizer prices, I expect buybacks and dividends to become a big deal.

Valuation

Putting a valuation on stocks that tend to move in lockstep with certain commodities is tricky, especially because finding an entry mainly relies on one’s view of a certain commodity.

What’s interesting is that Mosaic seems to agree with me. During the aforementioned conference, the company made clear that it believes that investors have misunderstood the strength of the fundamentals in the fertilizer industry. They expect the earnings power of the company to be recognized as the market dynamics improve.

I agree with that, which is why I wrote this article.

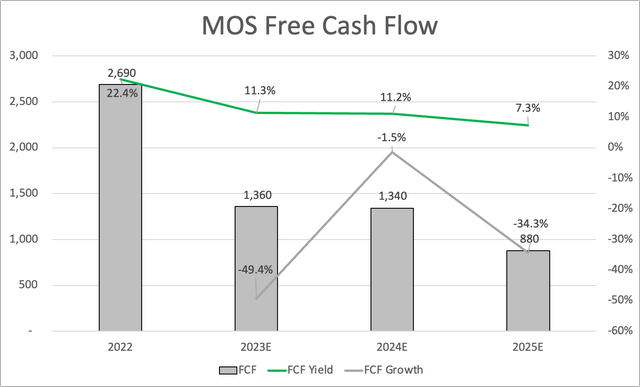

Looking at the chart below, the company is trading at roughly 9x 2023/2024 free cash flow.

Leo Nelissen

Not only do I believe that free cash flow expectations will be adjusted higher in the next few quarters, but I also believe that 9x free cash flow is too cheap.

Hence, I stick to what I wrote in my prior article. I believe that MOS shares will rise to the $70 to $80 range once we’re seeing a more sustainable shift from growth to value.

Takeaway

Mosaic faces a lack of catalysts to attract optimistic buyers despite benefiting from strong tailwinds and an attractive valuation.

However, a potential catalyst could lie in the correlation between corn and oil prices, which directly affects Mosaic due to energy costs driving agriculture prices.

Furthermore, the company’s performance remains robust, with increased purchases of phosphates and potash in North America and growth investments underway.

Mosaic expects market dynamics to unfold favorably worldwide and emphasizes the importance of consistent fertilizer application for sustained crop growth.

With a healthy balance sheet and commitment to shareholder distributions, including buybacks and dividends, MOS has the potential to deliver significant value once fertilizer prices rise.

Currently trading at around 9x 2023/2024 free cash flow, MOS appears undervalued, and a shift from growth to value could drive the stock toward the $70 to $80 range.

Read the full article here