Nasdaq (NASDAQ:NDAQ) has been strengthening its Solutions business through internal investments and acquisitions. The business encompasses data analytics and software, boasting very high recurring revenue. Following the Adenza acquisition, they aim for 8-11% organic revenue growth in their Solutions Business. While many investors perceive Nasdaq solely as an exchange business, I believe it is gradually evolving into a software and technology company. The stock price is undervalued, and I am initiating coverage with a ‘Strong Buy’ rating and a fair value estimate of $65 per share.

Solutions Business Drives Recurring Revenue Growth

Nasdaq’s Solutions Business comprises Marketplace Technology, Data and Listing Services, Index, Workflow and Insights, as well as Anti-Crime and financial technology acquired from Adenza. These software and technology segments are expected to contribute approximately 77% of the group’s revenue following the Adenza acquisition. While many may perceive Nasdaq primarily as a stock exchange company, the listing business only represented around 10% of group revenue before the Adenza acquisition. Nasdaq has strategically invested internally and acquired various software companies to transition into a software and technology-focused entity.

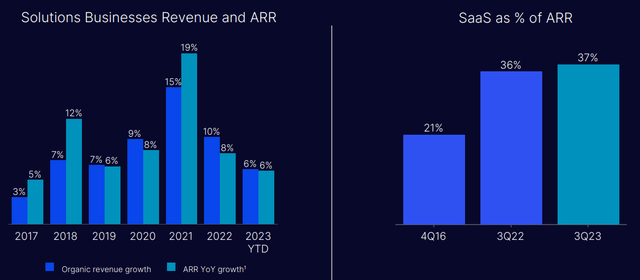

Post-Adenza acquisition, Nasdaq is targeting 8-11% organic revenue growth in their Solutions Business. The business delivered a notable 10% growth in FY22 and achieved 8% organic growth in Q3 FY23 even without the contribution from Adenza.

Nasdaq Q3 FY23 Presentation

Acquisitions have played a crucial role for Nasdaq, with the notable addition of Verafin in 2021. Verafin is a leading service provider for anti-financial crime management solutions, operating as a Software as a Service with recurring revenue. The Anti-Crime business has shown significant growth in recent years, with Nasdaq’s anti-crime segment expanding by approximately 20% in the past four quarters. This acquisition has proven to be highly successful for Nasdaq, aligning seamlessly with their corporate strategy.

Adenza Acquisition Accelerate Software and Technology Journey

In 2023, Nasdaq acquired Azenda, a mission-critical risk management and regulatory software provider for the financial services industry. Azenda is anticipated to generate $500 million in revenue with a robust 58% adjusted EBITDA margin. Following the acquisition, Nasdaq’s solutions business is expected to account for approximately 77% of the group’s revenue.

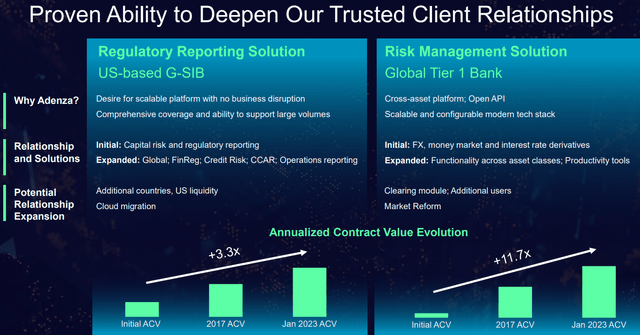

Nasdaq Acquires Adenza Presentation

I believe Azenda’s acquisition will significantly expedite Nasdaq’s transformation into a software technology company. Firstly, Azenda’s technology, particularly its risk and regulatory technology platform, will enhance Nasdaq’s ability to serve customers in the financial markets comprehensively. This allows Nasdaq to offer holistic solutions, addressing needs such as data analytics, risk management, regulatory reporting, and exchange data.

Secondly, the risk and regulatory software provided by Azenda is mission-critical for global financial institutions, and the business model is characterized by high recurrence. Lastly, Nasdaq can capitalize on its robust sales force within financial institutions to cross-sell Azenda’s services. In my view, the potential for revenue synergy is substantial.

Growth Drivers within Solutions Business

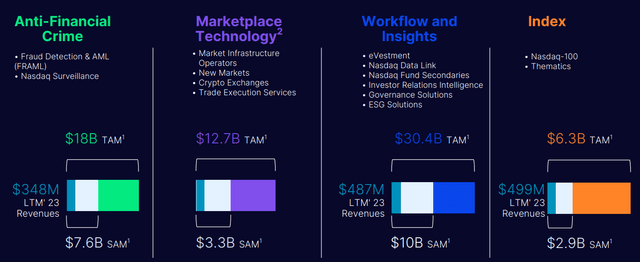

Before the acquisition of Azenda, Nasdaq’s Solutions Business growth was propelled by various segments, including anti-financial crime, marketplace software, workflow and insights, and Nasdaq index.

The demand for anti-financial crime solutions has surged in recent years, driven by the increasing complexity of financial markets and investments. The shift of financial institutions to digital banking has made conducting financial crimes easier, making anti-financial crime measures mission-critical.

The index business has gained momentum due to the rising market share of passive index funds and ETFs, driven by their lower management fees. Investment management companies designing passive index funds rely on index data for daily rebalancing.

Marketplace technology facilitates market participants’ connection to markets for a fee. For example, Nasdaq offers colocation services within their data centers and provides software development for customers seeking customized technology solutions. This business operates on a Software as a Service (SaaS) model and is driven by existing capital market growth and new market penetrations, including crypto exchanges.

Workflow and Insights represent a steady growth business, offering services such as investor relations intelligence and governance solutions. In 2022, Nasdaq entered the ESG solutions space through the acquisition of Metrio, expanding its portfolio.

Nasdaq Q3 FY23 Presentation

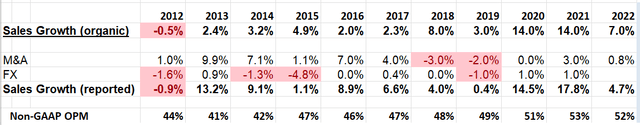

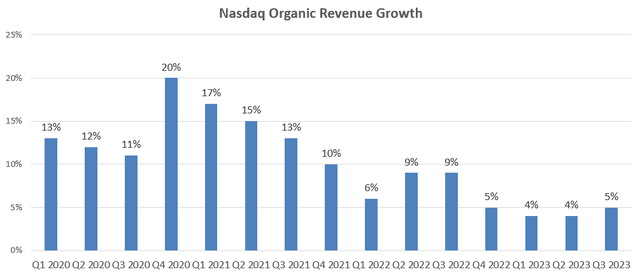

Thanks to the robust growth in their Solutions Business, Nasdaq has achieved strong organic growth in recent times. Their strategic shift towards a greater revenue mix from software and technology has made their growth more recurring in nature.

Nasdaq 10Ks

Recent Financials and Outlook

In Q3 FY23, Nasdaq achieved a 5% organic revenue growth and an 8% year-over-year increase in organic revenue for their Solutions Business. On the margin side, adjusted operating profits grew by 4% year-over-year. During the quarter, they distributed $108 million in dividends without any shares repurchase.

They refined the full-year non-GAAP operating expense guidance, narrowing it to a range of $1.785 to $1.805 billion, with the midpoint $5 million lower than the previous guidance. This new guidance implies a 4.5% growth in operating expenses for FY23. It seems they are effectively managing their expenses amid a low-growth fiscal year. The lower organic revenue growth this year is attributed to the cooling capital markets, with transaction volumes and the listing business experiencing a downturn in FY23.

Nasdaq Quarterly Earnings

I find encouragement in the growth of their Solutions Business. Specifically, Capital Access Platforms achieved an 8% organic growth, and Anti-Crime saw a remarkable 21% year-over-year increase. Notably, Nasdaq successfully completed the acquisition of Adenza on November 1, 2023. During the Q3 FY23 earnings call, the management expressed expectations for Adenza to grow at a low-to-mid-teens rate in the medium-term outlook. Based on the analysis above, I anticipate Adenza to be a significant growth driver for Nasdaq in the coming years.

Examining the balance sheet, the adjusted total debt to trailing 12 months non-GAAP EBITDA ratio decreased to 2.4x from 2.6x in the last quarter. I find their debt leverage quite manageable, especially considering Nasdaq’s proven track record of deleveraging their balance sheet. For example, their debt leverage increased to 3.5x with the acquisition of Verafin, but they successfully deleveraged to 2.6x before finalizing the Azenda deal.

Key Risks

List Business: The listing business represented approximately 10% of group revenue before the Azenda acquisition. This segment is closely linked to the number of companies listing on the Nasdaq stock exchange each year, as well as the annual fees from existing listings. Growth in this area tends to be uneven. In Q3 FY23, Nasdaq’s Listing Service business remained flat, impacted by a subdued IPO market and some de-listings. Given the current high-interest economic environment, I anticipate the listing business to continue experiencing modest growth.

SEC new fee rules on trading market data system: In September 2023, the SEC approved new rules concerning the funding of a market surveillance system. The objective of these rules is to distribute the cost burden equally among exchanges, buyers, and sellers. According to Nasdaq’s Q3 FY23 earnings call, the management indicated that while the new rules are anticipated to be implemented in 2024, many specific details are still under debate, and the outcomes remain uncertain at this moment. It is worth noting that these fee rules could potentially impact Nasdaq’s data business.

Valuations

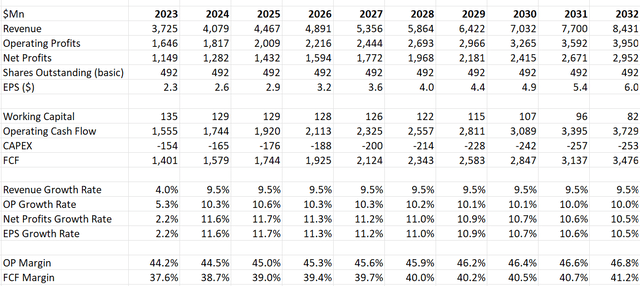

I project that the Solutions Business will contribute 80% to the group revenue in the future, reflecting Nasdaq’s ongoing shift of internal resources towards the software technology sector. The model utilizes the mid-point of Nasdaq’s growth target for Solutions, set at 9.5%. Simultaneously, other market-related businesses are expected to maintain a growth rate of 6.5%, aligning with their historical trend. The calculated normalized organic revenue growth rate stands at 9%, with an additional 0.5% attributed to growth from acquisitions. With 9% organic revenue growth and 5% expense growth, the model anticipates Nasdaq achieving approximately 20 basis points of annual margin expansion.

Nasdaq DCF – Author’s Calculation

The model employs a 10% discount rate, assumes a 4% terminal growth rate, and applies a 25% tax rate. Based on these parameters, the projected fair value is $65 per share.

Takeaways

Nasdaq is making significant strides in its transformation into a software technology company through strategic internal investments and acquisitions. Given the evolving nature of the company, I believe the current stock price undervalues its potential. The market may recognize that applying a low multiple to Nasdaq, as a software company, might not be warranted in the future. Hence, I am initiating coverage with a ‘Strong Buy’ rating and a fair value estimate of $65 per share.

Read the full article here