Investment Rundown

In the last 12 months, the share price of Newpark Resources, Inc. (NYSE:NR) has run up very impressively at over 80% so far. This appreciation in value seems to have been caused by continued strong operational performances, as Industrial Solutions grew by 12% YoY, reaching over $57 million. NR operates in the oil and gas industry and even though there might be a lot of investments going into renewables right now as a means of replacing traditional energy sources, I still think there is a lot of opportunity in this space still.

Right now NR doesn’t have a dividend but has been buying back shares at a decent rate the last few years. I think that given the rapid increase in the stock price and the p/e now sitting above 19 on an FWD basis means that a solid margin of safety is not possible to get here, unfortunately. I do still acknowledge the long-term possibilities of the company as a strong investment serving the oil and gas industry. This leads to NR being a hold in my opinion.

Company Segments

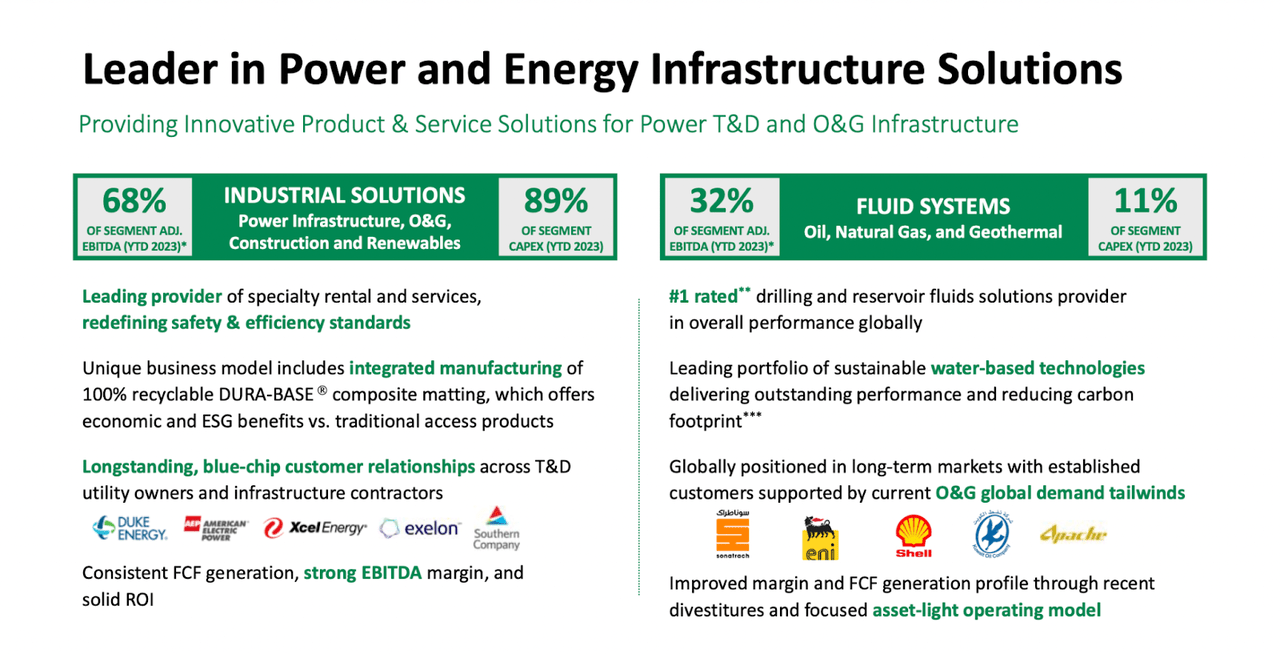

NR is a key player in catering to the needs of the oil and natural gas exploration and production industry by offering a diverse range of products, rentals, and services. The company’s operations are structured into two distinct segments, namely Fluids Systems and Industrial Solutions.

Company Overview (Investor Presentation)

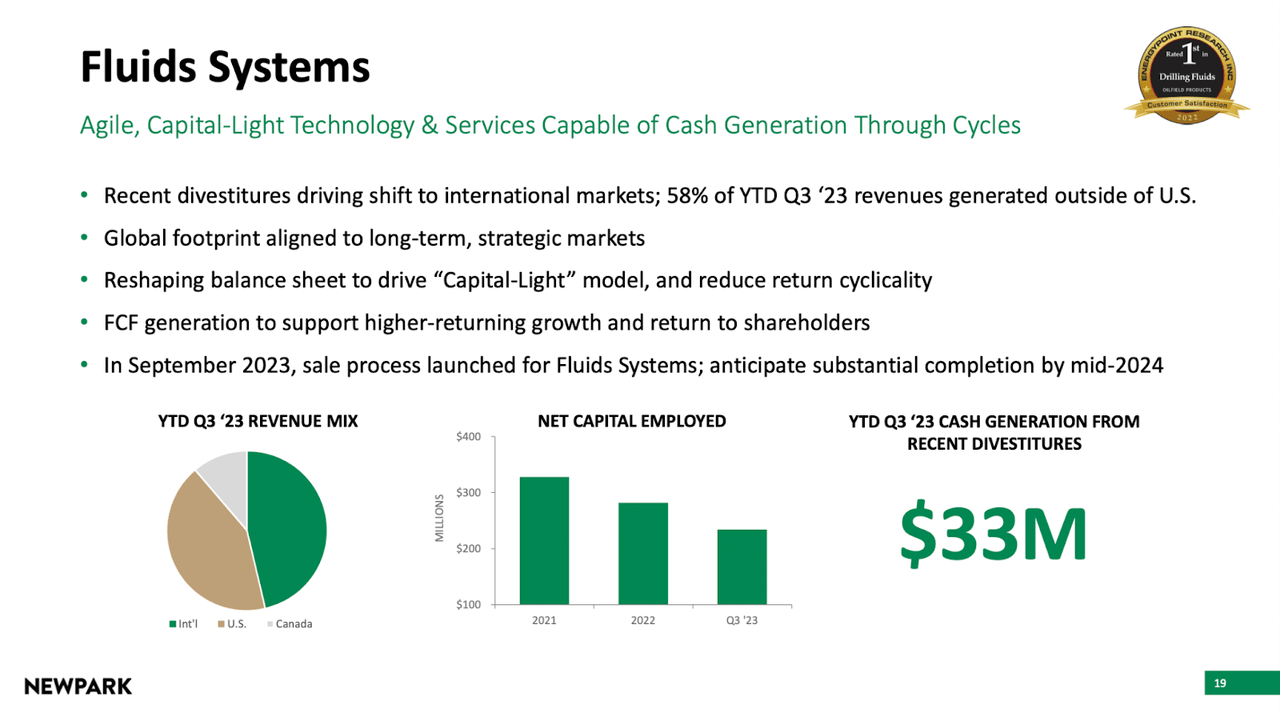

Within the fluid systems segment, NR focuses on delivering a comprehensive suite of products and technical services related to drilling, completion, and stimulation fluids. This array of offerings serves customers primarily across North America, Europe, the Middle East, and Africa, as well as several countries in the Asia Pacific and Latin America. By strategically positioning itself in these geographically diverse markets, NR positions itself as a global partner for entities engaged in E&P activities.

I think one of the main appeals right now with the company is the well-diversified nature and global footprint. There are a lot of investments going into oil and gas in the US, but the same is true in the Middle East as well for oil and the European gas market continues to climb steadily as well in size. Going forward, it seems that NR will continue to focus on expanding its rental and service revenue sources, which I think is a very good choice seeing as it would bring foundational support to the FCF and enhance the company’s ability to invest heavily and grow as well. So far the YoY growth there has been 25%.

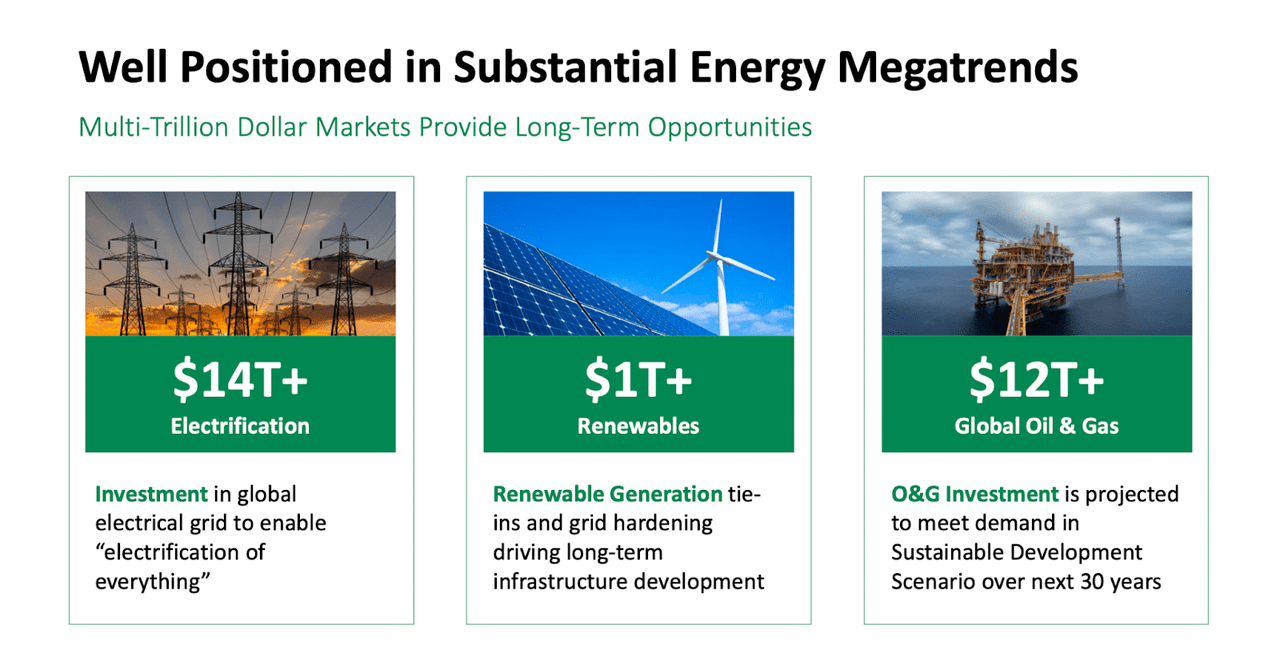

Markets They Are In

Market Overview (Investor Presentation)

I believe I have made NR out to be a pretty well-diversified business with a lot of servable markets right now. Some of these include the global oil and gas industry which is valued at over $12 trillion, but also the Electrification around the world valued at over $14 trillion. The outlook for oil and gas might be under pressure, but the fact is that right now we are still generating about 80% of energy globally from fossil fuels and the sheer amount of infrastructure investments and materials needed to be fully reusable in the world simply isn’t possible to achieve in a short time. This is a generational move, but something that is happening, and something investors need to acknowledge as well. I however still find there to be a lot of value in investing in and holding shares in businesses like NR which is using this continued growth to reward shareholders. In the last 12 months, for example, there has been a reduction in outstanding shares by about 8% YoY.

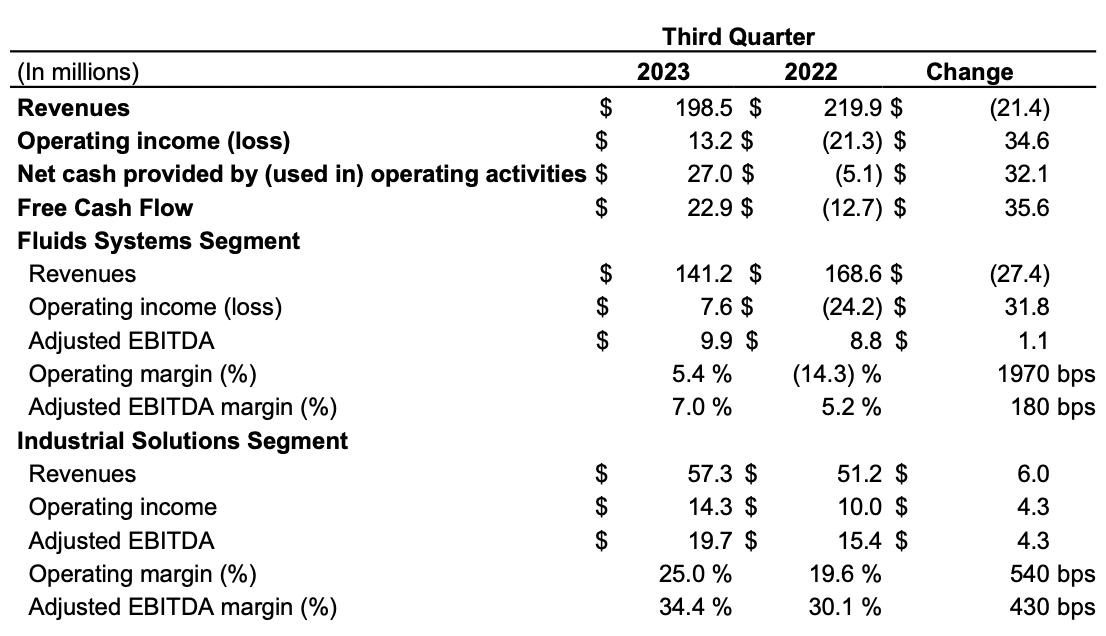

Earnings Highlights

Income Statement (Earnings Report)

On October 31, 2023, the last earnings report was released from the company and I think it contained some very solid results. The top line might have declined by $21 million, but this is the result of lower commodity prices, which has softened the demand somewhat. Long-term, there is still strong demand underlying the industry. The strongest progress was seen in the operating margin I think as it reached a positive 5.4% for the quarter, up from a negative 14.3% the last year. With improved margins, the company has been able to spend more to reward shareholders, which YTD has resulted in $26 million worth of shares being bought back.

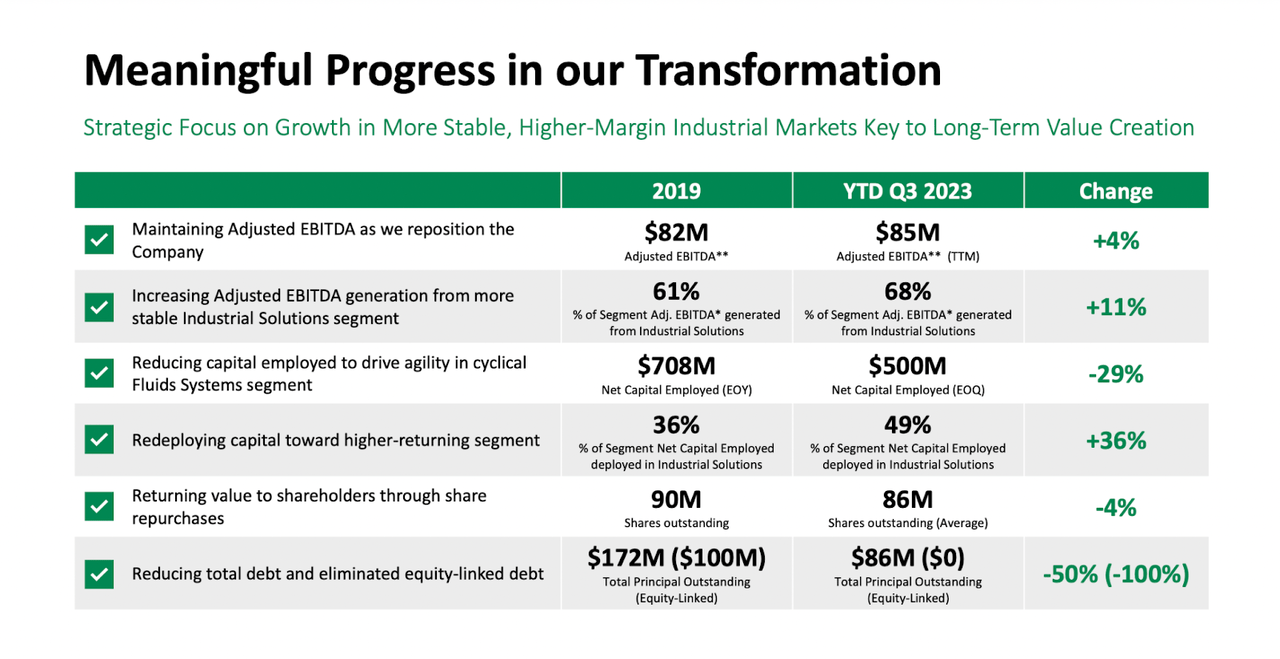

Transformation (Investor Presentation)

Compared to 2019 there has been a lot of progress on the side of NR. One of the key features I looked at was the deleveraging and reduction in total debts.

Debts (Seeking Alpha)

It seems that the decline in the debt position has led to a higher p/b as well for the business, reaching similar levels it had back in 2019. The sector trades at an average FWD p/b of 1.58, and I think it could be justified that NR would be there too, which leaves an over 10% upside potential right now. However, when we assess the p/e of the company, I think it looks a little expensive right now, unfortunately. A 19x FWD p/e is too high to pay for a service business focused on oil and gas companies. I would imagine that a 15x p/e would be more reasonable if the current growth can be maintained. Paying a 19x multiple to FWD earnings is a premium of 110% to the rest of the sector, and I just don’t see NR putting up the growth numbers and results to justify that right now. I land at my 15x p/e much because of the potential of future earnings returning to where they were pre-pandemic. I think the exit of its fluid business will be a catalyst for the bottom line potentially. With a more streamlined business model, I think the management can focus more heavily on raising margins. That hope and prediction I think can justify the 15x earnings multiple I have, since we are looking at a potential growth story. With potentially decreasing interest rates next year, financing further expansions should be less costly as well. I will for the coming quarters be looking at the margin improvements in the Fluid systems segment, which delivered the strong EBITDA margin in 5 years in the last quarter. This was because of improved activity in Europe and Africa. With the quick rise in the share price as well as in the last 12 months, I think we might be in for a slight pullback or consolidation phase here. I want at least a 15% margin of safety from today’s price levels, which gives us a target price of $5.75 right now. The 15% margin of safety would be adequate to invest safely on a p/b basis I think seeing as it’s trading at a discount there and a lowered leverage improves the upside potential further.

Risks

The risks linked to NR are undergoing a notable shift, transitioning from a strong correlation with the oil and gas prices to a more broad-based concern about the overall economic outlook. This shift implies that the company is becoming less tethered to the fluctuations in oil and gas prices, potentially opening up room for a higher valuation multiple. This reduced reliance on oil and gas prices could be seen as a positive development, lowering the inherent risk associated with the company.

Segment Overview (Investor Presentation)

However, it’s crucial to recognize that if the anticipated expansion in the fluids systems segment doesn’t yield the expected results, the current valuation might face a swift downward correction, exposing investors to a significant downside. This underscores the importance of closely monitoring the performance of the fluids systems expansion and assessing its impact on the company’s overall financial health.

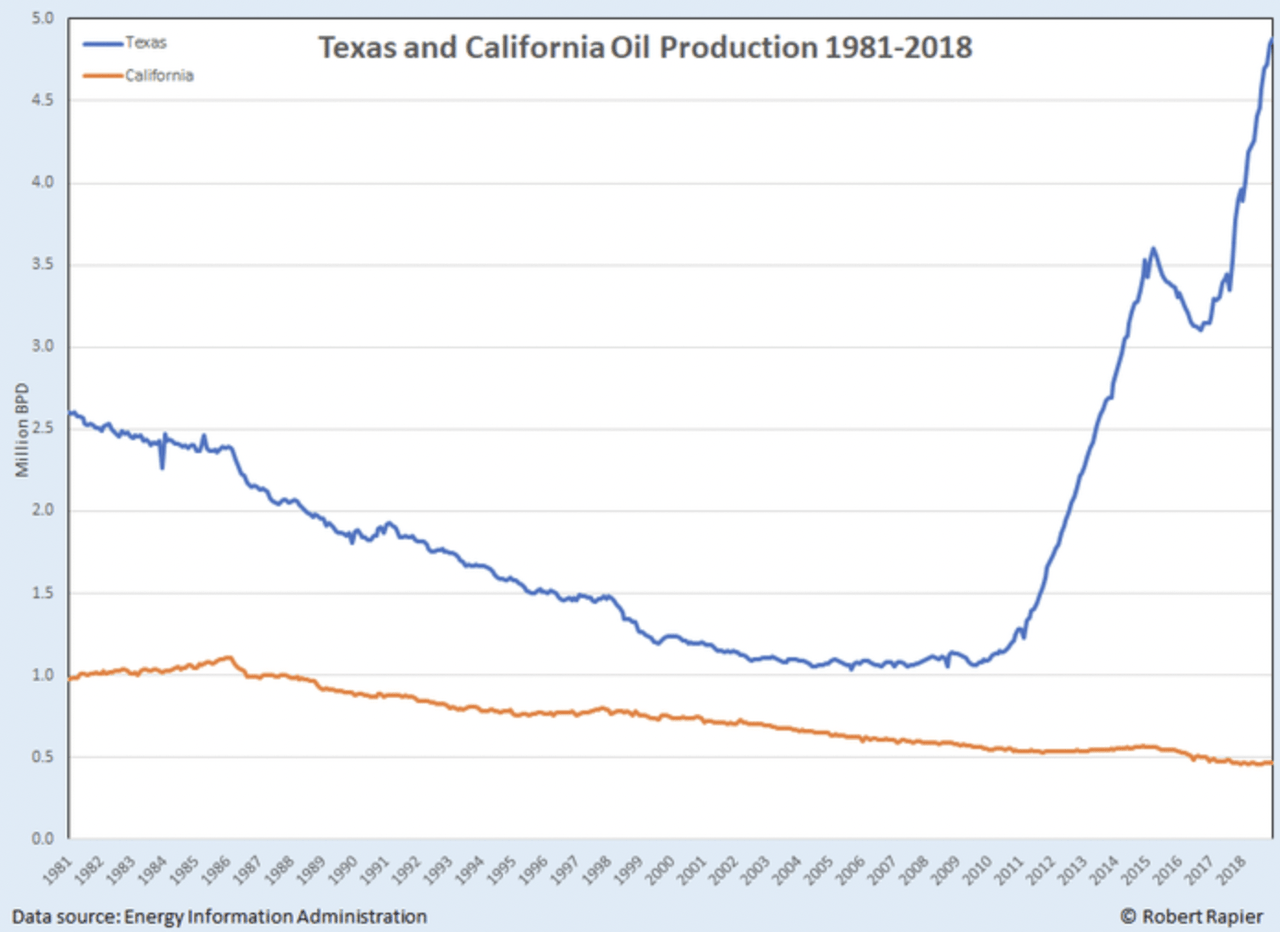

Oil Production (EIA)

Another major risk involves the negative sentiment surrounding the oil and gas sector. Heightened awareness of climate change has led to increased scrutiny and criticism of the industry’s impact on the environment. Environmental, social, and governance concerns are influencing public opinion, potentially resulting in stricter regulations and divestment movements. Poor sentiment can affect the industry’s social license to operate, impacting investor confidence and making it more challenging to secure funding for projects. In California for example, there is a continued push against oil and instead a lot of incentives to expand renewables instead, which puts pressure on NR and other peers. The chart above showcases how the market in California continues to be difficult to navigate and has resulted in a steady trend downward in production, whilst Texas has seen a massive boom instead, much because of more positive legislation and incentives for companies such as NR.

As for operations in these areas, NR only works in Texas and not in California. But since NR is well positioned to benefit from renewable generation buildout, much of that being in California, it opens up a different market opportunity for the company as opposed to its more traditional ways being around gas and oil. In Texas, the company has a footprint and some of the industries it serves here are utilities, pipelines, and rail & others. Texas is a growing economy and these industries are going to be beneficiaries of this, so I think this will benefit NR in the end as well.

Final Words

The oil and gas industry is essential to NR, as it provides various services and products to companies there. In the last few years though there have been a lot of improvements in the fluids segment of NR and I think that might be a significant factor for further price appreciation. The last quarter resulted in the strongest EBITDA margin in 5 years for the segment. However, I would like a 15% discount from today’s prices to make a buy case here. I think the price has run perhaps a little too high, and we might be in for a pullback in the short-term and then also a potential buying opportunity as well. For the moment, I will have NR as a hold.

Read the full article here