Nvidia Corporation (NASDAQ:NVDA) reported much better than expected results for its fiscal third quarter last Tuesday. The chipmaker is seeing a massive acceleration of its revenue growth due to a strong showing in the Data Center business and benefited from a massive up-lift in gross margins that I previously did not expect. Although the gross margin picture has changed for the better and the company has a huge opportunity in generative artificial intelligence, or AI, the market seemed suspiciously unimpressed by Nvidia’s blowout results. Despite being wrong so far with regard to my Nvidia rating, the chipmaker in my view continues to have a valuation problem, not a growth problem!

Previous rating and what changed

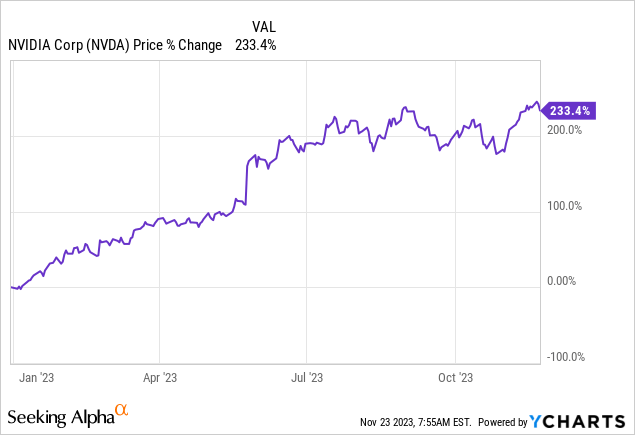

I rated Nvidia as a strong sell — Priced For Perfection — after the company reported quarterly results in August due to its aggressive valuation. Since then, shares of Nvidia are up 0.35%. I am still standing by my strong sell rating, however, despite an improved gross margin picture and a strong outlook for the next quarter. The current valuation remains a concern for investors (and also the lack of a positive price reaction after FQ3 ’23 results). While Nvidia has potential, especially with its AI Foundry, I am concerned that investors are widely overpaying for Nvidia’s revenue potential.

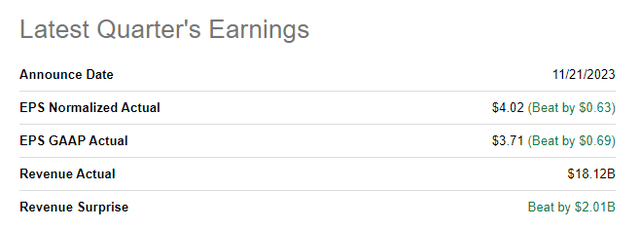

Nvidia crushed top and bottom line estimates

Nvidia beat both top and bottom line estimates by significant margins, indicating that the chip demand situation in the artificial intelligence market is extremely robust: the chip maker earned $4.02 per-share in adjusted earnings on a top line of $18.12B. Earnings beat by approximately 19% while revenues came in about $2.0B higher than expected.

Source: Seeking Alpha

Favorable revenue trend and improving gross margin profile

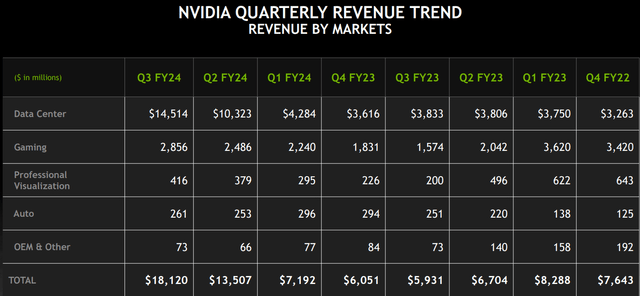

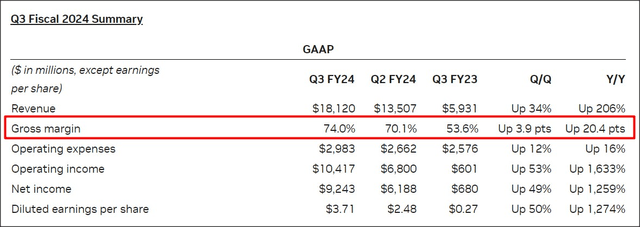

Nvidia posted revenues for the third fiscal quarter of $18.12B, showing 206% year-over-year growth, chiefly due to booming demand for AI chips in its Data Center business. In this segment, revenues totaled $14.51B, showing a massive Y/Y increase of 279%. This growth comes chiefly from soaring demand for Nvidia’s high-performance processors that are specifically tailored to support AI applications. With artificial intelligence finding widespread adoption on both the consumer and enterprise side of Nvidia’s business, the momentum for (generative) AI is real, and Nvidia is in a strong position to capitalize on growing demand for AI-supported computing power.

Nvidia

This AI-driven growth has led to Nvidia growing its gross margins to 74% in the third fiscal quarter, showing a more than 20 PP increase compared to the year-earlier period. Importantly, Nvidia managed to grow its gross margin 3.9 PP quarter-over-quarter, meaning the incremental growth the company has generated in the last quarter has led to higher profitability. Growth in Nvidia’s gross margins is both driven by growth in volume shipments as well as a strong pricing environment for AI chips.

Nvidia

Generative AI market size and Nvidia AI Foundry

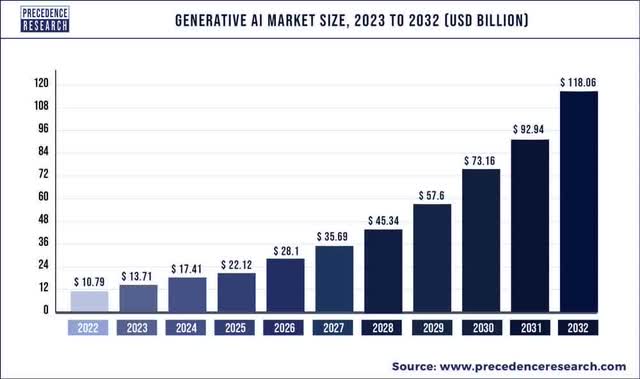

According to Precedence Research, the market for generative artificial intelligence is booming and expected to grow in size from $10.79B in FY 2022 to $118.1B in FY 2032… which calculates to an annual average growth rate of approximately 27%.

Precedence Research

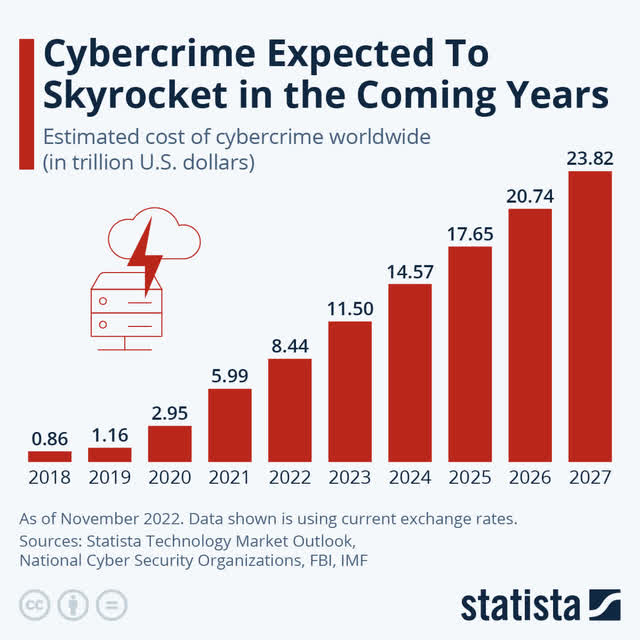

The potential of generative AI goes well beyond the commonly understood use cases, like content creation, however. Nvidia is very specifically targeting the market for generative AI by demonstrating other use cases, in cybersecurity, as an example: large language models can help cybersecurity professionals detect and analyze threats. Cybercrime is growing rapidly and costing companies (and governments) trillions of dollars, creating a powerful catalyst for sector-specific AI growth.

Statista

Another growth opportunity for Nvidia going forward is its new AI Foundry, for which Nvidia already signed up corporate clients like SAP and Getty Images.

Utilizing the cloud platform strength of Microsoft Azure, Nvidia’s new AI Foundry allows enterprise clients to develop custom generative AI applications. By using Nvidia AI Enterprise software, companies can quickly and efficiently run their own customized AI models at scale. The use of Nvidia generative AI Foundry Services potentially allows clients to potentially improve productivity, efficiency, output and may lead to lower corporate costs/higher capital returns.

Nvidia’s outlook for FQ4 ’24

Nvidia guided for $20.0B, +/- 2% in revenues for the fourth fiscal quarter of FY 2024, which implies a year-over-year top line growth rate of 231%. It also implies that Nvidia plans with a sequential revenue acceleration, indicating the company continues to have a favorable take on the AI chip demand situation.

Suspiciously unenthusiastic market reaction after Nvidia’s FQ3

Nvidia delivered an incredibly impressive earnings sheet for FQ3’23, but the market’s reaction to the earnings report shows me that the market has run out of enthusiasm for shares of Nvidia. This is concerning because it may be an indication that investors are responding to increasingly impressive results with significantly less excitement… which is a potential sign that investor exuberance has already peaked and that sentiment risks are growing.

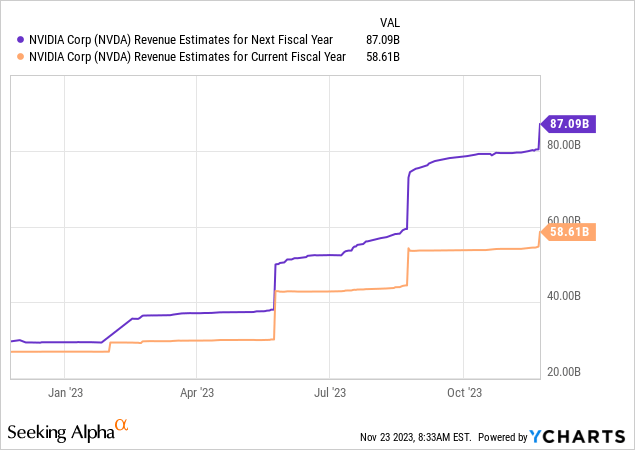

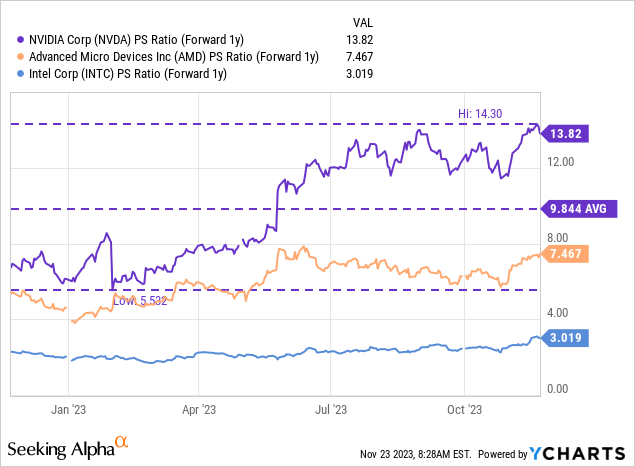

Nvidia’s shares are trading at a rich price-to-revenue multiplier of 13.8X which has contracted compared to last time I wrote about Nvidia, because of rising revenue estimates. And although revenue estimates have risen sharply, actual revenue growth rates are set to come down drastically: analysts expect a much more normalized revenue picture next year, with Nvidia projected to grow its top line 50%… compared to 117% this year.

Nvidia does have the underlying growth to back up a high valuation factor, but nearly 14 times revenues remains excessive. A 14x revenue multiplier factor implies a solid 40% premium to the average P/S ratio in the last year. The valuation strongly suggests that investors are overpaying for Nvidia’s top line potential, and the fact that the market hardly responded to Nvidia’s blowout earnings is a warning sign as well, in my opinion.

Advanced Micro Devices (AMD) and Intel (INTC) both trade at much more attractive P/S ratios, and AMD’s super-successful EPYC processor series is a powerful driver of the firm’s own Data Center-related revenue growth. Intel may be less of an AI play than Nvidia, but the company has seen fundamental business improvements in the last three months: The Bleeding Has Stopped (Rating Upgrade).

Risks with Nvidia

The biggest commercial risk for Nvidia, as I see it, relates to the performance in the Data Segment, which is instrumental for the firm’s overall top line growth. Specifically, declining demand for Data Center chips could result in a slowdown in Nvidia’s consolidated top line growth and weaker gross margins… which would likely pose significant valuation risks for the chip maker.

Final thoughts

Nvidia submitted an extremely strong earnings sheet for the third-quarter that indicated that demand for Nvidia’s AI chips is much stronger than even the best predictions indicated. Nvidia flew past top and bottom line estimates, and the outlook for the fourth fiscal quarter was equally impressive.

However, I cannot help but notice that Nvidia’s earnings release and revenue forecast was met with a stunning lack of enthusiasm, indicating that Nvidia will have a much harder time to impress going forward.

Nvidia did achieve a significant improvement in gross margins in the last quarter as well, but the valuation remains a huge problem, especially with top line growth expected to moderate next year. While I like Nvidia’s products, its potential in generative AI and its AI Foundry offering, the lack of an enthusiastic market reaction following FQ3 results strongly suggests that the market’s optimism about Nvidia has peaked already!

Read the full article here