Back in August last year, I wrote an article on Oaktree Specialty Lending (NASDAQ:NASDAQ:OCSL), which is one of the largest BDCs in the world with a market cap of ~ $1.7 billion.

My thesis back then was purely interest rate driven and supported with the benefits of OCSL’s scale that provide a competitive advantage in financing larger transactions and accessing cheaper debt at the BDC level.

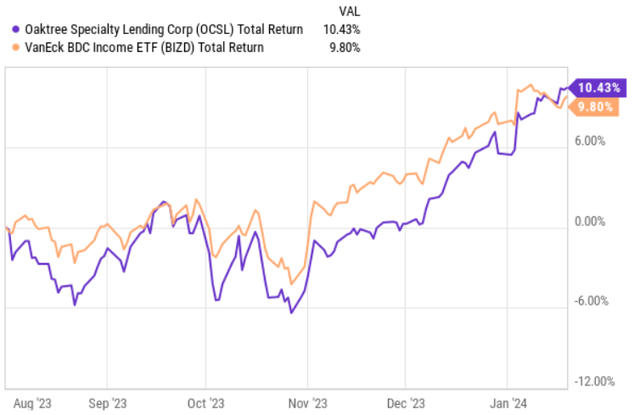

Since then OCSL has performed in line with the market (even slightly outperforming it), which is very positive.

Ycharts

Now, the objective of this article is to review the previous buy thesis against the backdrop of the recent runup in the share price, relatively fresh quarterly results and the prevailing market environment.

Thesis update

In terms of the key fundamentals the picture remains the same with all of the inherent advantages still intact.

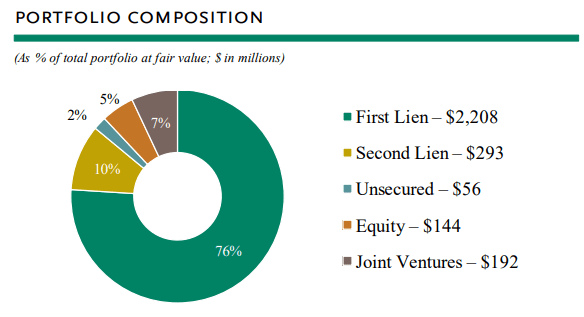

For example, the current portfolio is nicely spread across the usual BDC investment categories with first lien consuming the lion’s share of the total portfolio. The non-first lien categories account for ~24% of the book, which is within the usual range that we see across other well-capitalized BDCs. If we peeled the onion a bit deeper, we would notice that the JV category itself carries a further exposure in the first lien, which bring the total underlying exposure to the safest BDC investment category up from an already acceptable level of 76%.

OCSL Investor Presentation

Looking at the recent investment dynamics (as outlined in Q4, 2023 results), we can also spot some positive dynamics in the context of portfolio quality.

Namely, OCSL managed to conduct $117 million in new investment fundings at a weighted average yield of 12%, which is above the total portfolio yield. The most critical nuance here is that all of these new investments (or the actual new investment commitment part) were structured as first lien instruments that should further enhance the quality of its portfolio.

The second aspect, which we have to appreciate is the fact over the recent quarter, OCSL managed to de-risk its balance sheet in a notable fashion.

In other words, the net debt to equity ratio dropped from 1.14x in Q3, 2023 to 1.01x in Q4, 2024. Compared to the average leverage in the BDC space, OCSL is clearly below that, which in combination with the BDC’s defensive characteristics (e.g., portfolio diversification, bias towards first lien) positions the underlying business in a great spot. It introduces a stronger margin of safety in the case of rising corporate defaults as well as helps the Management be more flexible and opportunistic in funding emerging investment opportunities without worrying of getting the balance sheet out of whack.

OCSL Investor Presentation

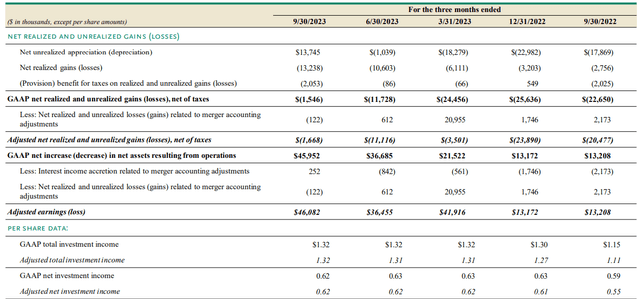

The third aspect, which has to be really contextualized with the reduction in leverage and increasing exposure to the first lien category is the situation in the net investment income per share results.

In essence, both deleveraging and putting higher emphasize on the first lien segment create headwinds for the net investment income generation. For instance, the lower the leverage the smaller the base from which the BDC can generate attractive spreads (i.e., the difference between cost of capital and investment yield).

However, the table above indicates that despite these dynamics OCSL’s adjusted net investment income per share has remained flat. What this means is that OCSL is able to produce the same level of cash carrying a lower risk profile than before.

So, currently, OCSL is well-positioned in terms of the underlying dividend coverage, where just purely from net investment income the BDC is able to accommodate the ~10.2% dividend without tapping into the realized gains component. The current net investment income payout ratio is ~88%, which could be deemed rather satisfactory given the double digit yield level.

Finally, during this period OCSL has also registered positive statistics on the non-performing loan end.

According to Chris McKown – CFO & Treasurer – (in the recent conference call):

Credit quality improved modestly during the quarter and remained solid overall, with four investments in non-accrual status at quarter end, representing just 1.8% of the portfolio at fair value and 2.4% of the portfolio at cost.

Having ~2.4% of portfolio’s fair value under a non-accrual status is clearly indicative of how resilient OCSL’s investment really are (while the sector average is almost 2x from OCSL’s level).

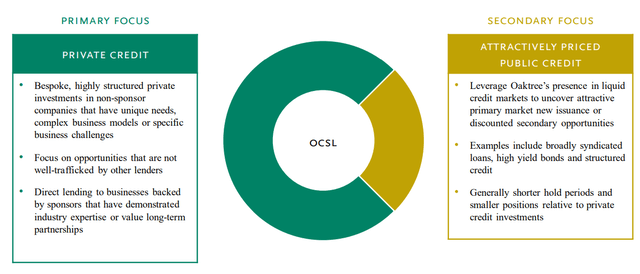

The final point I would like to make around OCLS is the exposure to public debt, which is not typical among other BDC peers. Usually, BDCs stick to private credit with tactical deviations into equity or CLO structures.

OCSL Investor Presentation

In OCLS’s case, however, a notable chunk of the portfolio lies in public debt, which, in my opinion, should help generate alpha going forward.

The essence stems from the fact that currently many public bonds trade below par and/or are already refinanced at higher coupons that resemble the prevailing interest rate environment.

Now, given that the interest rates have already reached their peak and are very likely to start going down this year, public bonds should benefit greatly from this activity. As opposed to private credit, public bonds are subject to daily pricing that allows the owners to not only capture the income streams but also register price appreciation component, which under a falling interest rate environment embodies a notable return potential.

The bottom line

Putting all of the aforementioned elements together (i.e., de-risked balance sheet, more bias towards first lien, improved non-performing loan status, and the potential stemming from public bonds), OCSL has become a more attractive investment from the moment, when I issued my first article on the BDC back in August, 2023.

In my humble opinion, BDC is still a buy despite the recent runup in the share price.

Read the full article here