We present our note on OMV (OTCPK:OMVKY) (OTCPK:OMVJF), an Austrian global oil and gas and chemicals group with a Buy rating. We are drawn by OMV’s portfolio positioning, attractive valuation, and increase in capital returns. We will briefly describe OMV and its portfolio, explore key value creation drivers, lay out our thesis, analyze risks, and value OMV’s shares.

Introduction to OMV

OMV is a Vienna-based global energy and chemicals company. OMV explores and produces oil and gas in Central and Eastern Europe, the North Sea, the Middle East and Africa and owns gas storage facilities in Germany and Austria. Moreover, it produces and markets fuels and feedstock for the chemical industry, operating refineries in Europe and a JV in the UAE. The firm operates more than 1.7k filling stations across Europe. In addition, through its subsidiary Borealis, it is a leader in polyolefin solutions, base chemicals, fertilizers, and plastic recycling. OMV is Austria’s largest listed industrial group and has a current market capitalization of ~€13 billion. The Austrian State Holding Company owns 31.5% of OMV’s shares.

Portfolio transformation

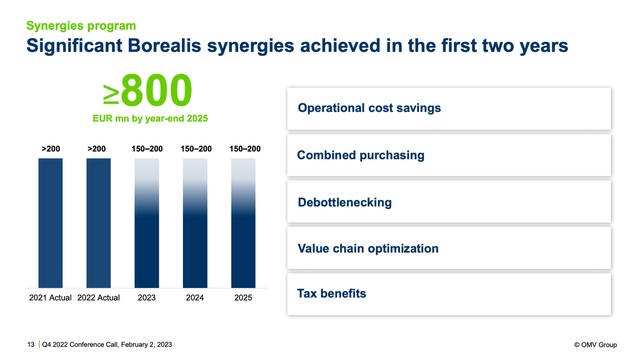

Over the last few years, OMV’s downstream assets portfolio has changed significantly, and the firm has entered new markets. Notably, OMV acquired Borealis in 2020, becoming a key player in the polyolefins market and moving higher up the chemicals value chain while transitioning to a lower emissions future. The acquisition has been successful and more than €200 million of annual synergies have been realized. Moreover, OMV’s upstream portfolio has substantially improved moving lower in the cost curve, becoming more profitable and resilient, and generating higher IRRs. Eventually, OMV aims to decrease oil production by 30% and gas production by 15% by the year 2030, as highlighted in its capital markets day presentation. Investment will be focused on gas asset development, increasing the share of gas to 60%. We have a constructive outlook on OMV’s transformation, with a focus on chemicals and sustainable fuels, however, it is important to avoid capital allocation/investment and strategic pitfalls while navigating the green transition.

OMV Quarterly Presentation

Weakness in chemicals – Uninspiring Q2

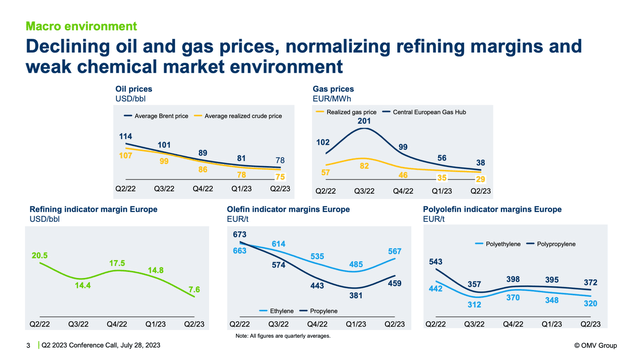

Q2 results were slightly disappointing with operating results coming in 7% below consensus with negative performance in chemicals and upstream, and cash flow significantly below consensus mostly explained by the payment of cash windfall tax.

The chemicals outlook is challenging and the business is facing short-term headwinds due to lower demand especially in Asia and increased supply i.e., new plants coming online. We believe this is baked into the share price and expect the situation to normalize in the latter half of 2024.

Moreover, OMV announced details about its negotiations with ADNOC to pursue a combination of Borealis and Bourouge which would allow the company to pursue various M&A deals it could not have on its own. Both companies would be equal partners while none would have a majority stake if the transaction is eventually successful.

OMV Quarterly Presentation

Valuation and investment recommendation

Similar to other oil & gas E&P and petrochemical companies, we value OMV using PE multiples and FCF yields. In line with sell-side analyst consensus, we forecast €45.0 billion of sales and €8.9 billion of EBITDA in FY2024e. Our oil and gas price and refining margin assumptions are reasonably conservative and reflect a more normalized environment. As with other commodity-based businesses, we would like to point out that financial projections are sensitive to underlying assumptions and commodity strategists forecast a wide range of prices over the timeframe of our exercise.

We then project a net profit of €2.3 billion and FCF of €2.2 billion (a close to 96% conversion), implying a forward PE ratio of 5.5x and an FCF/EV yield of 15%. At current commodity prices, the forward PE ratio and FCF yield look cheaper.

OMV is trading at a significant discount to its 5-year and 10-year historical ratio, and a significant discount to European oil majors which command 20-50% higher multiples. Using P/NAV or EV/DACF the gap is somewhat smaller. Despite the uninspiring chemicals outlook and business mix, we believe such a discount is unwarranted, especially given the level of capital distributions: 20-30% of cash flow when the leverage ratio is below 30%. We project €3.5 of dividend per share, implying a dividend yield of 8.7%, significantly higher than peers.

Given the increased downstream and upstream portfolio quality, despite challenges in chemicals, we believe the gap vs European oil majors should at least narrow somewhat and we apply a lower-end 7x PE multiple, implying a 27% upside, and a share price of €51 per share. Together with a dividend yield of ~9%, we think this is highly attractive. We believe OMV could produce a mid to high teens IRR over the next three years.

Risks

Downside risks include but are not limited to weaker macroeconomic conditions, lower than expected oil and gas prices resulting in lower sales and profit, delays in production, operational underperformance, lower refining margins and petrochemical margins, higher than expected operational costs, higher than expected capex expenditure resulting in lower returns on capital, misallocation of capital to low return investments, unfavorable legal and regulatory changes, geopolitical risk especially in disrupted regions such as Libya, windfall taxes, foreign exchange risk, energy transition and climate change risk, accidents, and weather events.

Conclusion

We have a positive outlook on OMV and find the risk/reward attractive. We recommend buying OMV shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here