As a major holding in our The Gold Bull Portfolio, Osisko Gold Royalties Ltd (NYSE:OR) demands our attention, especially following its latest Q3 results.

In my last public coverage on August 24, I highlighted the positive outlook for Osisko, particularly focusing on a key lithium asset under development, in which Osisko owns a potentially valuable NSR royalty.

So, what’s changed since then, and is Osisko stock still a buy? Here’s my analysis.

Osisko’s Q3 Results and Financial Overview

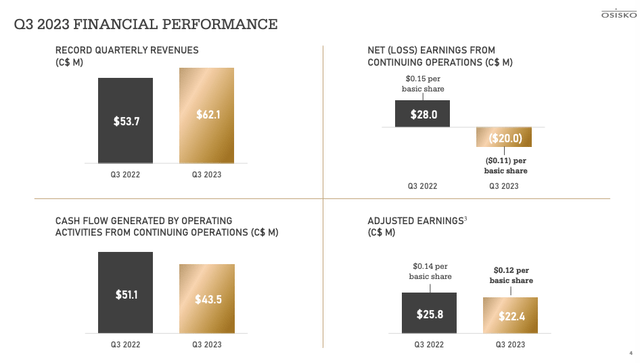

Osisko’s recent Q3 results present a mixed picture, primarily due to the headline net loss of -$20 million or -$0.11 per share.

This loss was largely attributed to a non-cash impairment charge and a write-off connected to the Renard diamond mine, influenced by reduced diamond prices and operational challenges.

Interim CEO Paul Martin hinted at a possible but reduced contribution from the mine in Q4, dependent on rough diamond prices.

“Osisko might now actually expect a GEO contribution from the mine during the fourth quarter, however, this will depend largely on rough diamond prices, and will come in materially lower than what was originally budgeted for the period,” Martin said.

Was Q3 really that bad?

Osisko GR

While the quarter may appear mediocre, it’s not as bleak as market reactions suggest.

First, Osisko’s annual GEO production is anticipated to be at the lower end of its 95,000 – 105,000 GEOs guidance, but production will still likely fall within its guidance, and this can be viewed as a positive given some of its partners’ challenges in 2023.

Second, this quarter saw the company earning 23,292 GEOs, with royalties and stream revenues hitting $62.1 million, an increase from $53.7 million in Q3 2022.

Here’s a closer look at the quarter:

-

Gold equivalent ounces earned: 23,292 (down only slightly from 23,850 in Q3 2022).

-

Cash flows from operations: $43.5 million (down from $51.1 million in Q3 2022).

-

Adjusted earnings: $22.4 million, or $0.12 per basic share (down from $25.8 million, or $0.14 per basic share in Q3 2022).

Bullish corporate moves

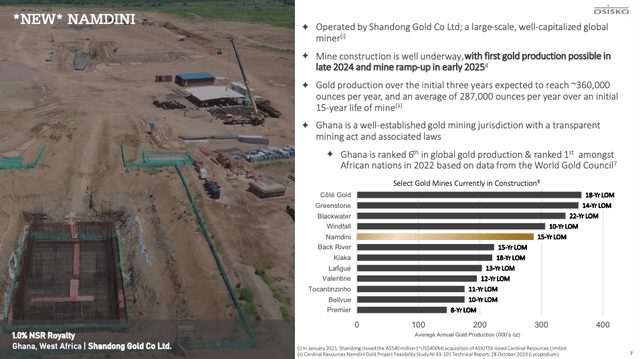

Osisko’s Namdini royalty is a premier asset. (Osisko GR)

Moving beyond the financials, Osisko’s corporate maneuvers have been notably bullish.

The acquisition of a 1.0% NSR royalty on the Namdini Gold Project in Ghana for US$35 million underscores a strategic investment by Osisko, in a high-potential asset that’s going to be producing gold very soon (late 2024).

Additionally, the acquisition of a 3% gold NSR and 1% copper NSR on the Costa Fuego project for US$15 million reflects a diversification into copper, marking a strategic expansion into the critical metal. (Some analysts think a copper deficit will last the entire decade).

Osisko’s partnership with Patriot Battery Metals, of course, has also yielded strong results to date.

We’ve seen the release of a large maiden mineral resource estimate for the CV5 Spodumene Pegmatite at the Corvette Property, where Osisko holds a sliding scale royalty. Subsequently, large lithium producer Albemarle Corporation (ALB) took an equity stake in Patriot following the resource news.

This could be a huge royalty for Osisko in the future. It not only diversifies Osisko’s portfolio but also leverages lithium price upside, as many analysts expect a large lithium deficit in the future due to the rise in EV demand.

Osisko’s Financial Health: A Closer Look

In addition, I think the balance sheet is in great shape here. It ended the quarter with $315 million in long-term debt, however, this is balanced by $77 million in cash and short-term investments, plus a substantial $314 million investment in associates, including equity stakes in Osisko Mining and Osisko Development.

The additional $99 million in other investments suggests a healthy financial position, potentially translating to positive net debt when considering these assets. Moreover, with $435 million in available credit, I think Osisko is well-positioned for further strategic acquisitions.

Future Outlook: Bright Prospects Ahead

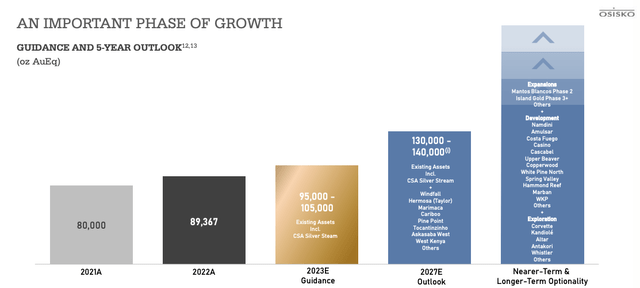

Osisko’s growth outlook remains the best in the industry. (Osisko GR)

Looking ahead to 2024, several catalysts could propel Osisko’s growth.

The Namdini mine, operated by Shandong Gold, is expected to commence production by the end of next year, potentially adding considerable annual royalty revenue at current gold prices.

Other near-term catalysts include the first copper stream deliveries, feasibility study updates, and new resource estimates from various projects.

By 2027, Osisko anticipates significant growth, targeting 130,000 – 140,000 GEOs annually based on existing assets.

Of course, it’s highly likely that Osisko will acquire more royalties and streams before then, so I expect its GEO production to ultimately exceed 140,000 GEOs in 2027. The longer-term upside is even greater with the potential for 150,000+ oz Au per year.

Osisko’s updated valuation

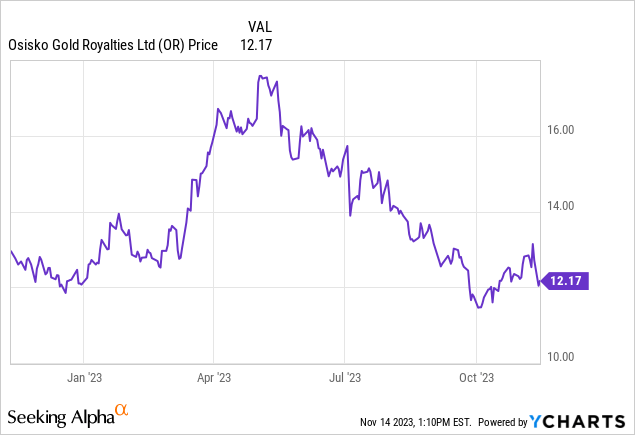

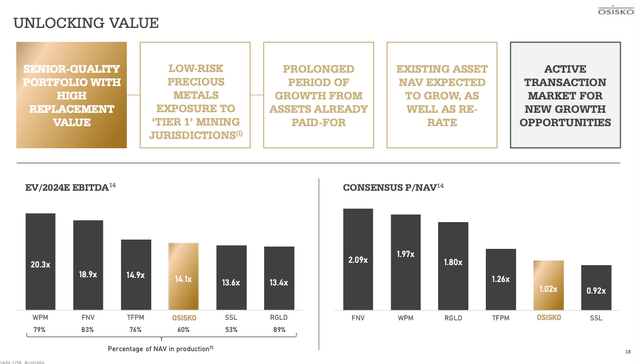

Osisko shares look undervalued. (Osisko GR)

Meanwhile, while Osisko shares are no longer the deep undervalued shares they once were, the stock continues to trade at a pretty good value.

Despite a 4% decline in stock price post-earnings, Osisko’s valuation remains attractive. The stock is trading at an EV/EBITDA of 13.5x, which is in line with peers Sandstorm Gold Ltd. (SAND) and Royal Gold, Inc. (RGLD), but its price-to-NAV ratio is 1.04x, with only Sandstorm having a lower ratio (.89x); these figures are based on Osisko’s own estimates, but my research find the figures accurate.

The company’s possession of some of the best royalty and streaming assets, combined with a low jurisdictional risk profile, positions it favorably for outperformance in the coming years.

In conclusion, while the Q3 results might have sparked a selloff, a deeper analysis reveals that Osisko Gold Royalties is navigating its challenges adeptly and is poised for future growth. Investors should consider the long-term potential and strategic positioning that makes Osisko an attractive investment in the gold royalty sector.

Read the full article here