Thesis

PagerDuty (NASDAQ:PD) has a strong business, but I am uncertain of its uses of equity. That said, I think it is at a fair price and can be a candidate for accumulation or for selling out-of-money puts.

The Business

PagerDuty is an operations management platform. Its PagerDuty Operations Cloud serves as a platform for mission-critical and time-critical operations work in the modern enterprise. It leverages AI and automation to detect and diagnose disruptive events, mobilizes responses, and streamlines infrastructure and workflows across a company’s digital operations.

It has four offerings, namely Incident Response, Process Automation, AIOps, and Customer Service Ops. Incident responses are what PagerDuty is known for and the best in breed, while in my opinion, the other solutions are developed to extend and round out the customer experiences.

PagerDuty Operations Cloud (PagerDuty’s website)

Recent Developments

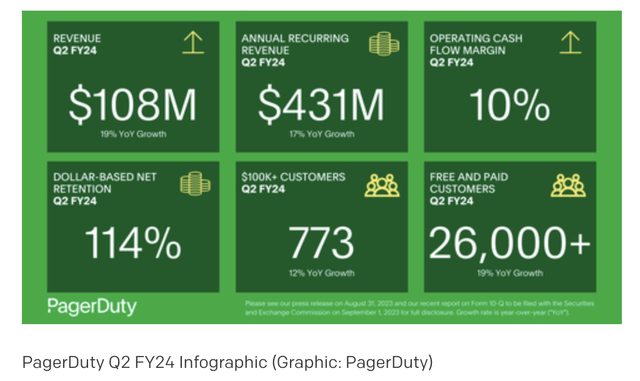

PagerDuty’s Q2 results are strong and saw double-digit year-to-year growth in both revenue and total customer count (paid and free).

It launched AIOps, which the company touts as “apply ML to reduce noise, provide real-time context, and eliminate manual tasks”. Interestingly, the company chooses the consumption pricing model for it, where the customers pay the amount they use. AI capabilities are often baked into the core offerings, so in my opinion, PagerDuty’s choices to create a separate SKU and adopt a pay-as-you-use model are equivalent to a pricing increase, perhaps in a discreet and cautious manner. I see this as a positive development.

PagerDuty’s Q2 2024 earnings presentation (PagerDuty’s website)

Bull Case

Bull case for PagerDuty is simple. Its business is strong and resilient. Its Q2 revenue was up 19% year-over-year, and it achieved 114% dollar-based net retention. For the full year 2024, it guided for 15-16% growth rate. Given the macro-environment, I think the numbers are admirable.

Secondly, I believe PagerDuty is a dominant player in the incident management space. Its best-known competitor Opsgenie is most likely at least 10 times smaller in terms of revenue. Meanwhile, PagerDuty has also scooped up potential disruptors, as witnessed by its announcement of Jeli acquisition.

Bear Case

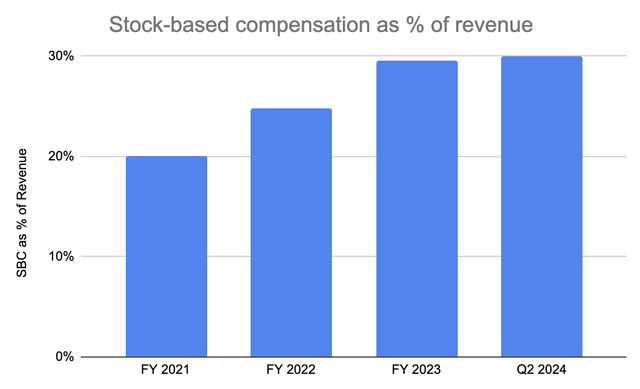

The risks around PagerDuty are its equity dilution and valuations. Firstly, stock-based compensation has been extremely high at almost 30% and shows no sign of abating.

% stock-based compensation to revenue (Author’s calculation)

Secondly, the company also has a habit of issuing senior convertible notes. It announced in October that its intention for a $350M private placement of convertible senior notes, with an option of an additional $52.5M, mostly as a replacement for existing convertible notes and the remainder as proceeds for G&A expenses. This creates pressure on the stock price in worry of equity dilution, and I do wonder if the company is going to keep kicking the can down the road, or if it has a plan on financing its growth through its operation cash flows.

Valuation

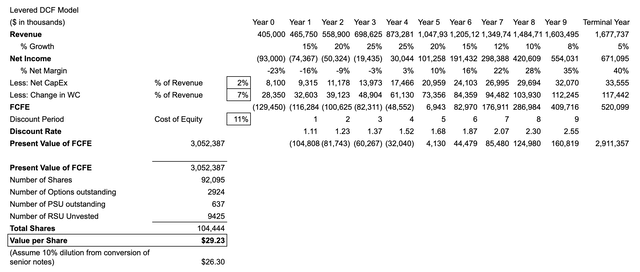

I estimated PD’s share price using DCF valuations:

DCF calculations (Author’s calculations)

Cost of Equity

Cost of equity is calculated using the CAPM, i.e., risk-free rate + beta x equity risk premium.

-

Risk-free rate = 4.63%, the rate of 10-year T-bill

-

Levered Beta = unlevered beta of software industry x [1 + (1- marginal tax rate) x (net debt/market equity)] = 1.37 x [1 + (1-25%) x (-205/1980)] = 1.26.

-

Equity risk premium = 5%.

This gives us a cost of equity of 10.95%.

Starting Numbers and Assumptions

Summing the numbers from the most recent quarters:

-

Starting revenue is $405 million and net loss is $93 million, resulting in a starting net margin of -23%.

-

Management has guided for revenue growth of 15% at the midpoint for the full year 2023.

-

Net CapEx is assumed to be 2% of revenue and change in WC is 7% of revenue. I do not add back stock-based compensation since I believe this is a real ongoing expense.

-

Terminal Revenue growth = 4.63%.

-

Terminal Net Margin = 40%.

Denominator of the Number of Shares

-

Current total shares outstanding = 92 million.

-

Number of unvested RSUs = 9.4 million.

-

Number of options outstanding = 5.6 million at a weighted average exercise price of $10.78.

- Number of PSU outstanding = 0.6 million

Number of shares used as denominator = 92 million + 9.4 million + 5.6 million * (22.50-10.78)/22.50 + 0.6million = 104 million.

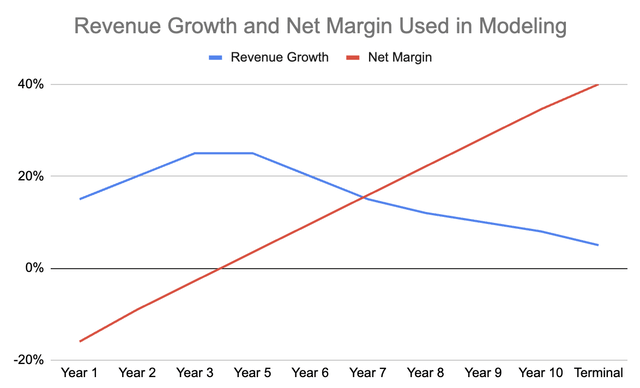

Revenue Growth & Net Margin

Since PD still has negative earnings, I estimated 10-year cash flows and adjusted the revenue growth and net margin each year to arrive at the terminal assumptions. The trajectory is as follows:

Revenue growth and net margin assumptions used in author’s model (Author’s assumptions)

The estimated value is $29.23/share. If we assume the terms of the senior convertible notes recently announced are similar to those of the ones due 2025, then the conversion price should be 30% north of the current stock price. At $29.23, we can assume the conversion will happen. Assuming 10% dilution based on the market reaction after the news, we arrive at a price of $26.30/share, a 24% upside based on the share price as of writing.

This is based on my belief that the revenue growth will re-accelerate. If we repeat the exercise by keeping the revenue growth rate around 15%, the price comes to $22.28.

The Bottom Line

PagerDuty has a fantastic business but is saddled with the potential of equity dilution. With the Q3 earning report coming shortly, I will pay attention to their net customer retention rate and their use of stock-based compensation. We should also hopefully get more details on the new placement of convertible senior notes. Finally, we will want to look out for cash flows as the management had mentioned in the previous earning call that a shift in expenses benefited cash flows in Q2 in expense of Q3. Overall, I believe there is a mild upside to PagerDuty, and I ultimately hope to understand how the company plans to sustain its operations through its cash and consistent positive cash flows.

Read the full article here