One of the biggest mistakes that investors can make is to become married to an idea. You become so firm in your conviction that your original assessment is correct that, no matter what the data says, you remain convinced that your original call was not incorrect. I personally have been the victim of that in the past. And the best thing you can do is learn from it. To demonstrate how far I have come in recognizing my own mistakes, I would like to present you with this article regarding big data company Palantir Technologies (NYSE:PLTR).

In early August of this year, I wrote a bearish article in which I insisted that shares were drastically overpriced. Even with attractive growth, the company appeared to offer limited upside in the near term. This ultimately led me to rate the business a ‘sell’. But since then, things have gotten a little crazy. Shares have increased by over 29% at a time when the S&P 500 has barely budged. Clearly, the market disagrees with me. But that’s not why I am changing my mind today. There have been other instances in which the market has strongly disagreed with me. And when I am convinced that I am right, I take advantage of the appropriate buying opportunities. And usually, that’s to great effect.

The reason for this change of heart has far less to do with how the market has treated the stock and far more to do with recent data provided by management. The company has demonstrated a significant increase in demand for its services, with much of this centered around its potential as a facilitator of artificial intelligence. I do still think the stock is very pricey at the moment. And unless something changes significantly, there is no way that I see myself taking a bullish stance on the firm. But recent developments have convinced me that a ‘hold’ rating is appropriate at this time.

The picture keeps improving

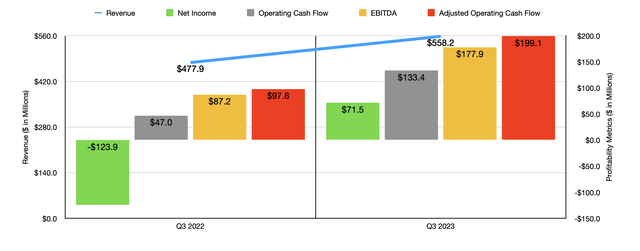

Operationally speaking, Palantir Technologies is doing a fine job. The purpose of this article is not to focus on the specific earnings figures that the company reported for the third quarter of its latest fiscal year just recently. But touching on those numbers at a high level certainly helps to demonstrate my point. Revenue for the latest quarter came in at $558.2 million. That’s 16.8% above the $477.9 million in sales generated one year earlier. The company has seen a massive improvement in profitability as well thanks to the growth in revenue and management really pushing for positive cash flow. The end result has been a shift in net profits from a loss of $123.9 million to a gain of $71.5 million. Operating cash flow nearly tripled from $47.1 million to $133.4 million. And if we adjust for changes in working capital, it more than doubled from $97.8 million to $199.1 million. Finally, EBITDA for the company surged from $87.2 million to $177.9 million.

Author – SEC EDGAR Data

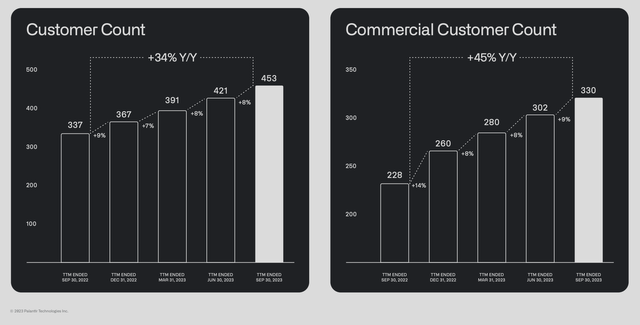

These massive improvements can really be chalked up to an increase in demand for the company’s services. For instance, the number of customers the business has grew in the latest quarter to 453. That’s a sizable improvement over the 421 reported only one quarter earlier and it’s 34% higher than the 337 that the company reported for the same time last year. Commercial customer count has been the leading charge. Back in the third quarter of 2022, the company had only 228 commercial customers. That number has now shot up 45% to 330. In fact, during the third quarter, the company engaged in a lot of activities. It closed 80 different deals that were individually worth $1 million or more. 29 of these were worth at least $5 million, while 12 were worth $10 million or more.

Palantir Technologies

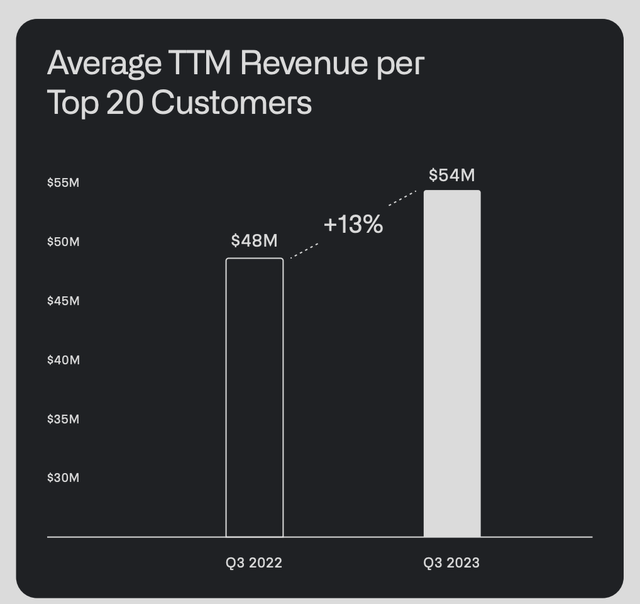

The increase in customer count certainly is bullish for the firm. But you also have the fact that the average revenue for its top 20 largest customers continues to grow also. In the third quarter of last year, this came out to $48 million on an annual basis. As of the third quarter of this year, that number has now grown to $54 million. What this says is that, in addition to growing the number of customers that the company has, its existing customers are also spending more on its platform year after year.

Palantir Technologies

All of this is great. But what needs to be said is that a lot of this activity seems to be coming from the perspective of artificial intelligence. In the company’s latest investor presentation, it lauded its AIP (Artificial Intelligence Platform). This platform can be used for all sorts of reasons, including defense, commercial, and more. The objective of this platform is to empower companies to deploy their own AI software, including large language models, with relative ease. And in the first five months of its existence, its AIP has grown from having no users to having nearly 300 organizations utilizing it. The enterprise continues to notch wins on that front. As an example, on October 26th, it announced that it had been ranked the number one vendor in AI, data science, and machine learning by Dresner Advisory Services in a formal market study. And only a couple of weeks earlier, on October 10th, the firm announced that it had been awarded a contract by the army that involves AI and machine learning. That individual contract, which is expected to last over a three-year window, is worth $250 million.

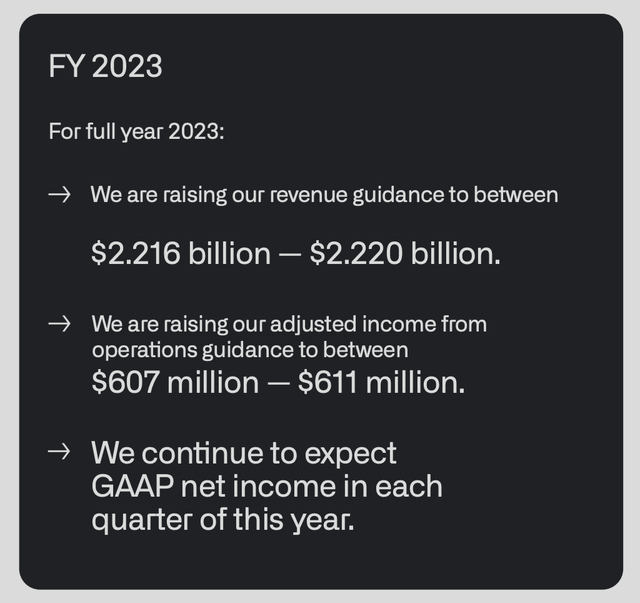

This surge in demand for the company’s services has had a big impact when it comes to the firm’s forecast for the current fiscal year. Previously, management was expecting revenue of around $2.212 billion. That number has now been pushed higher to between $2.216 billion and $2.22 billion. That’s a fairly small move in the grand scheme of things. But what was not small was the increase in guidance when it comes to adjusted operating income. Management previously forecasted this to come in at around $576 million. Now, it should be between $607 million and $611 million.

Palantir Technologies

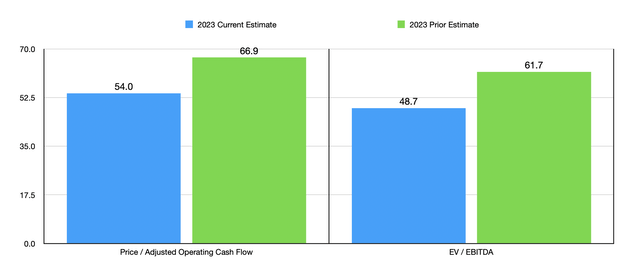

In terms of valuing the business, this does wonders. Keep in mind that shares have been up over 29% since I last rated the company. If we equate adjusted operating income to both operating cash flow and EBITDA, then the company is trading at a forward price to operating cash flow multiple of 54 and at an EV to EBITDA multiple of 48.7. These are astronomically high figures that I shy away from. However, despite the surge in share price, the stock has actually gotten cheaper since my last article. Using the prior estimates provided by management, I calculated multiples of 66.9 and 61.7, respectively. This, combined with the prospect of additional contracts facilitating even greater growth next year, is plenty reason to change my stance on the firm.

Author

Takeaway

As much as I hate to admit it, I believe that my prior opinion regarding Palantir Technologies was off to some extent. I still have no intention to pick up shares in the company because the stock is far too expensive for me at this time. But the surge in demand for its services and the guidance increase has been very promising. Given these factors, I do believe that a more appropriate rating for the company at this time is a ‘hold’, but it’s a rating that could change rather quickly should growth falter whatsoever.

Read the full article here