Aeronautical engineer Rolls-Royce (OTCPK:RYCEF) has sharply improved its business performance lately. The share price has also been doing very well. Indeed, they are up 184% over the past year (although that still leaves them 13% lower than five years ago).

I last covered the name with my June “hold” piece Rolls-Royce: No Obvious Upside From Here (Rating Upgrade), since when the shares have gone up 58% (cue SpliffMeister’s comment, “this aged well like a fine wine.”).

Business Continues to Improve Performance

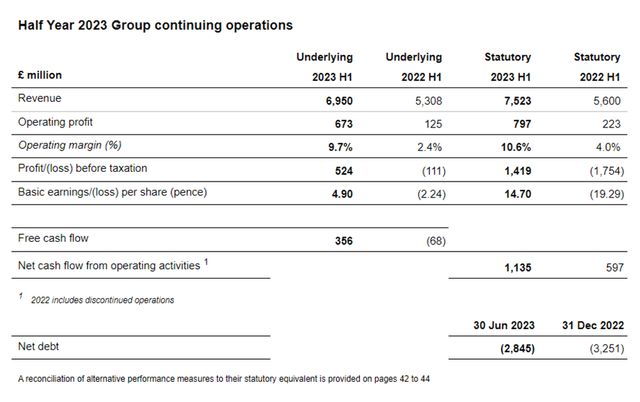

At its interim results stage in August, the company demonstrated its improving performance. Revenues and operating profits were up versus the same period last year, and operating margins more than trebled to nearly 10%. At the profit level, the company also moved into the black after still being in the red this time last year.

Company Announcement

That came hot on the heels of the company upgrading its full-year guidance. The firm now expects underlying operating profit of £1.2bn-£1.4bn and free cash flow of £0.9bn-£1.0bn.

The company also announced last month that it expects to cut several thousand roles. This is the sort of cost-cutting that was widely expected under the newish chief executive. I see it as positive for the share price in the short- to medium-term as it helps reduce costs. Longer term, though, after previous rounds of cost-cutting in the past decade, I think the question will be whether a further few thousand role losses really improve efficiency or not and also what impact they may have on staff morale and customer confidence.

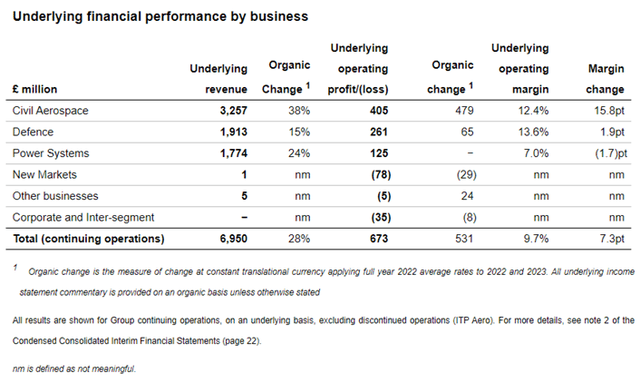

Taken together, the message from Rolls is clearly that there is positive momentum and the business has the wind in its sails. This partly reflects an improving demand environment for civil aviation (it saw 38% year-on-year organic underlying revenue growth) as well as some of the benefits of the organisational changes that have been ongoing across the past few years.

I think that, under current management, we can expect to see some topline improvement over the next few years and an ongoing (most welcome) focus on bottom line delivery. That said, historically the company has tended to struggle with cyclical performance over the long run and I do not see any particular reason to expect that to change.

Balance Sheet is Improving

The company has been improving its balance sheet, with net debt falling to £2.8bn at the half-year point from £3.3bn at the same point last year.

With its substantial cash flow generation, debt is not the concern to me that it once was. I expect the business’ net debt position to keep improving.

Possible Upside Drivers

Other comments on my last piece included potential upside drivers seen by those commenters: new engines, sustainable fuel for planes, small modular nuclear reactors and propulsion for submarines for the U.S., U.K., and Australia.

Perhaps those could be future value drivers, though small modular reactions and sub propulsion have been on the drawing board for a while. That said, Rolls-Royce has been selected to provide the reactors for Australia’s nuclear-powered submarines from the early 2040s, as part of the AUKUS trilateral agreement. It has begun to expand its Derby sub site accordingly.

New engines could yet drive or destroy value. This year, Rolls has successfully completed the first tests of its “Ultrafan” engine and also the first successful fuel burn for a small gas turbine developed for hybrid-electric flight. Sustainable fuel is part of the analytical fulcrum here. The point is that Rolls is developing new engines, and they could ultimately result in sizeable revenues and perhaps profits down the line. That remains to be seen, though, as even successful engine development programmes can take years or decades to break into profit (as Rolls knows from its own experience).

For now, the various divisions are showing different levels of performance. Civil aerospace is growing strongly, but that partly reflects how much demand fell during the pandemic, as compared to defence and power systems.

Interim Results

One area of interest to note given that the business now has a very detail-oriented, numbers-driven leader is the fact that the power systems division’s underlying operating margin is around half that of the other two divisions. It is also the smallest in terms of revenue. Does it have a place in the Rolls-Royce business portfolio long term, or could it be on the block at some point? The company expects higher full-year operating margin in the division thanks to pricing moves, cost efficiencies, and seasonally higher volumes.

Long term, though, I expect the power systems division will either need to improve its financial performance or face the prospect of being sold off. That may be a fillip to the share price at some point.

Valuation

So, have I changed my view on valuation since June?

Even after the recent increase, the shares trade on a price-to-earnings ratio of 13. That is exactly the same as U.S. rival General Electric (GE) but dramatically lower than the 36 seen at Raytheon owner RTX Corporation (RTX).

Given the potential for ongoing earnings improvement at Rolls, the prospective P/E ratio could be even more attractive.

On that basis, if one buys into the hypothesis that Rolls is back, business is improving, and further improvement is likely, then the current valuation looks like fair value.

I maintain my “hold” rating, though, because I see ongoing execution risks from the company’s cost-cutting programme and continue to think the exposure of civil aviation to demand shocks remains a big threat for the company and its peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here