Overview

Saratoga Investment Corporation (NYSE:SAR) is a private credit investment entity, formally a Business Development Company, that focuses on the middle market. Saratoga states its focus as the ‘lower end of the middle market’. The firm screens prospective investments and elects to work with companies that are already operating with both positive cash flow and EBITDA.

Saratoga Investment Corporation

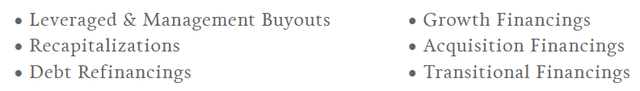

Investments made by Saratoga tend to be tailored to the company it is investing in and range across the capital structure. This can include equity financing in addition to loans. As a BDC, it is legally mandated to invest 70% or more of its assets into companies with a market capitalization of $250M or less.

Saratoga Investment Corporation

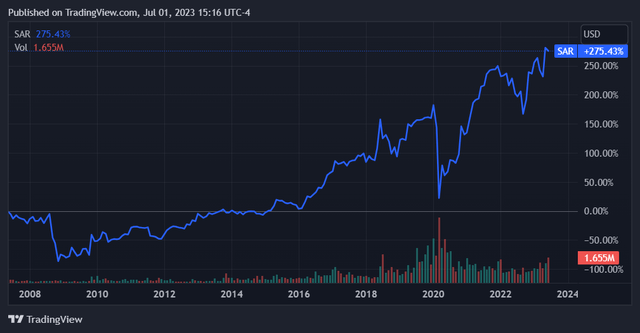

As with many BDC’s, Saratoga pays a hefty dividend. At its current share price of $27 the company has a TTM yield of 9.67%; this is expected to increase to 10.37% on a one-year forward basis. While this can be considered a good yield, I would not consider it exceptional in the current rates context.

Furthermore, we can contextualize this security by noting that its yield is the central element of its return profile. This is best illustrated by the fact that Saratoga’s shares have depreciated 80% since its 2007 IPO, but that the firm has still returned 275% on a total return basis (dividends included & assumed to be reinvested).

Seeking Alpha Seeking Alpha

It’s clear that this is a stock to own for its dividend, but that investors should not expect too much in the way of share price appreciation. This total return price chart is also interesting because it has a fairly high degree of variance. It is worth noting that returns appeared to be accruing steadily until 2020, during which they dropped off a cliff owing to pandemic uncertainty. The firm’s holdings appeared to recover well thereafter, and total return has continued to grow overall.

To that end, I would like to explore the firm’s financials to see how it’s positioned as to paying dividends and growing its total return. This will contextualize the quality and relative value of the company’s distributions going forward, allowing us to determine if it’s worth buying shares. I will note that the company’s year-to-date total return of 9.42% trails that of the S&P500’s, which is 17.36%.

Financials

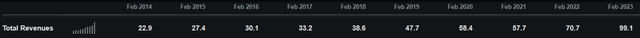

Since this company has been in business for some time, we can take a broad view of its financials and look at how things have progressed over the past decade.

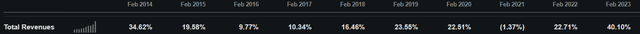

Revenue has grown significantly over the past decade and has more than quadrupled throughout this time. The firm has only had one down year and has put up impressive double-digit rates of growth in most years.

Seeking Alpha Seeking Alpha

Since its revenue decline in fiscal year 2021 the firm has had two stellar years of growth, with fiscal year 2022 showing 22.7% top-line growth and fiscal year 2023 coming in at 40.1%. This recent acceleration in revenue growth is a preliminary indicator that the firm has managed its capital structure well throughout a period of increasing rates, although that will have to be illustrated conclusively by bottom line metrics. Overall, this revenue trendline looks quite good, in my opinion.

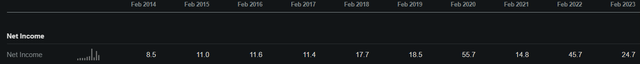

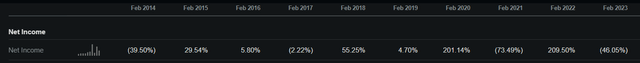

Looking over to profitability, we see a much more volatile picture. The firm’s profits fluctuate much more than its revenues, and y/y declines are much more commonplace. We must also note that the latest year, fiscal year 2023, showed a 46% decrease in profit even while revenue grew 40.1%. It now appears that higher rates may not have netted out positively for Saratoga.

Seeking Alpha Seeking Alpha

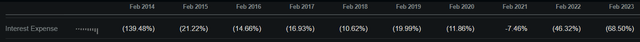

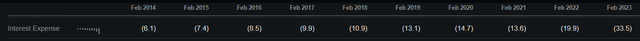

Looking into this further, we can see that profitability has indeed been affected by higher interest costs and not operating expenses. Last year saw the firm’s operating expenses decrease roughly 2.75% from the year prior, but interest costs increased 68.5%. The percentages here are listed as negative due to accounting conventions.

Seeking Alpha

This has resulted in a situation wherein the company is paying the highest interest expenses that it has in a decade and even throughout its entire operating history. As we saw in the most recent fiscal year, this netted out to decreasing profits – and thus pressure on distributions – for the firm.

Seeking Alpha

Since this company’s entire business involves generating higher returns on capital than it pays on capital, these recent results are a concern. While higher rates have of course increased yields on debt instruments across the board, driving up revenues for Saratoga, they appear to have put pressure on its capital structure and have ultimately decreased its margins. The forward picture here will be determined by the company’s ability to rebalance this central relationship between return on capital and cost of capital.

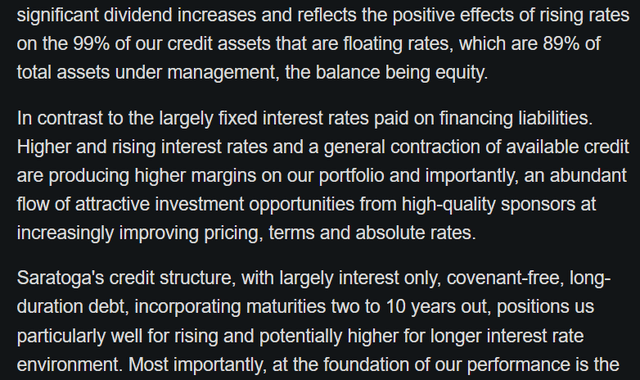

Looking into this further, however, the picture is not as bad as it appears. Saratoga’s net investment income per share has actually continued to climb throughout the most recent period, with a 27% increase between fiscal year 2022/2023 as well as 85% y/y increase in NII for the quarter. Performance has actually been improving, but has not yet been translated into results for the firm at large.

Seeking Alpha

Furthermore, the company’s capital structure makes it well-positioned to continue benefitting from rising rates. This is because Saratoga provides floating rate debt to its customers while being subject to fixed-rate debt for itself. The company states that 89% of its AUM is floating rate. Its own capital structure is primarily composed of 2-10-year debt that is fixed-rate and only requires principal to be repaid at maturity.

Seeking Alpha

From this, we can conclude that Saratoga’s business has actually been improving and is positioned well for it to continue to improve. The lag between investment earnings and that capital flowing through the firm is what’s responsible for the y/y performance declines that we have been seeing in recent periods. Ultimately, the firm must ensure a smooth payout schedule and has to operate its business in a way that allows for that.

My concerns around the firm’s cost structure are alleviated by the structure of its debt, and I can safely say that the growth in interest expenses is due to new debt and not higher payments on debt outstanding. This is not a BDC that is particularly exposed to the negative implications of higher rates.

Yield, Risks, and Conclusion

This brings us back to our original question of whether this is a good yield at which to buy shares for now and into the future. I will first say that one should consider this yield as more secure than share price appreciation over the next 2 quarters. While it is unclear which way the market will go, I am confident that the firm will deliver on its 10.37% forward yield over this timeframe. This provides a good way for an investor to lock in a certain level of return without having to worry about the vagaries of share price and the market as a whole.

The risk here is centered around the company’s client base and its ability to continue paying down its debt obligations to Saratoga. While Saratoga may have a robust capital structure that is defensible within the current context, it is still a lender to what are relatively small companies. Given that these companies are subject to floating rate debt agreements, they are now paying much higher rates of interest. This combination could lead to higher levels of missed payments and potential write-downs on debt held by Saratoga. Additionally, a recession or significant macroeconomic shock could affect this set of companies significantly. Since the jury is still out on where the economy is headed, I would consider this as something to keep in mind.

Overall, however, my view nets out positively on this company. I think it is a good firm for investors that want exposure to the middle market and a much more secure return profile for the 2 quarters ahead. While it is difficult to say what will happen beyond that, this stock presents a good avenue for investors interested in a 10% yield over this timeframe. The uncertainty underlying this trade is that the market as a whole could continue appreciating over the next 2 quarters, making this yield relatively inferior – which it already is year-to-date.

On the other hand, a bear market in stocks for the rest of this year would see Saratoga’s yield increase as to its relative value and its total return metric to get closer to parity with the S&P500’s total return for 2023. The choice here should then be based on what the investor thinks will occur going forward. Since there continue to be expectations of a recession in the near-term, there is a good degree of uncertainty for stocks over the next 2 quarters. As such, the expected value of share price returns (probability * return) for the market overall is diminished. This increases the appeal of Saratoga’s yield, the probability of which does not appear to have been overly impacted. On this basis, I will call it a buy through to the end of the year.

Read the full article here