Saratoga Investment Corp (NYSE:SAR) is a business development company or BDC with a rather conventional focus – i.e., investing and issuing loans to the lower end of the middle market companies that are already cash flow positive with annual sales between $8 and $250 million, and EBITDA north of $2 million.

While this is the core business, SAR has also made allocations through separate subsidiaries into collateralized loan obligations or CLO funds. Plus, SAR has stepped into a joint venture with other partners in managing some additional amount of CLOs.

It is not uncommon for BDCs to carry an exposure towards CLOs as this way an element of diversification in combination with enhanced return prospects is captured. With that being said, this is something that is worth factoring into the equation before potentially going long SAR.

Furthermore, when looking at SAR we have to recognize the fact that it is one of the smallest BDCs out there with an NAV of ~ $360 million that is way below the sector mean of ~ $1.4 billion. I will elaborate on this below, but, in essence, I would consider this as a disadvantage in the context of the prevailing market environment.

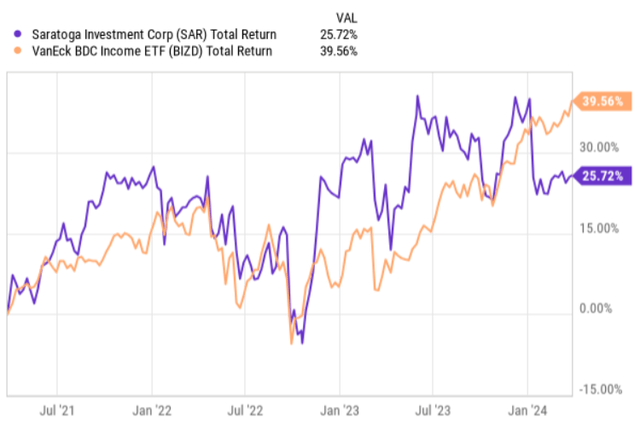

From the total return perspective, SAR has been quite consistent in outperforming the overall BDC market for the larger part of the trailing three-year period. However, on a YTD basis, SAR has considerably lagged behind the index, experiencing ~10% price drop due to unfavorable Q3, 2024 earnings result.

Ycharts

Let’s now assess the underlying details of SAR and try to determine whether the recent divergence from the BDC market offers a sufficiently attractive opportunity to buy the BDC.

Thesis

Starting with the basics, there are three distinct structural aspects that are worth highlighting.

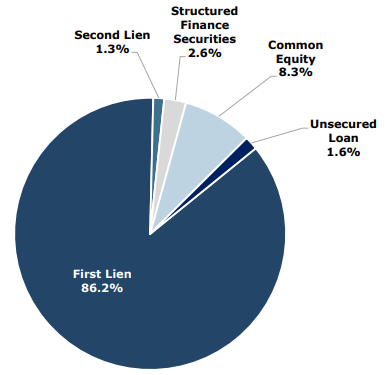

First, the core portfolio of SAR is heavily skewed towards first-lien bucket with the remaining chunk mostly being explained by the allocations into common equity.

SAR Investor Presentation

What this does is it injects an important layer of safety, where in the case of a broader corporate distress or even formation of non-accruals in the portfolio, SAR enjoys larger probabilities of recovering the invested capital.

Here it is also worth noting that the CLOs do not really play an important role in the context of overall portfolio and yield generation, which helps de-risk the situation further.

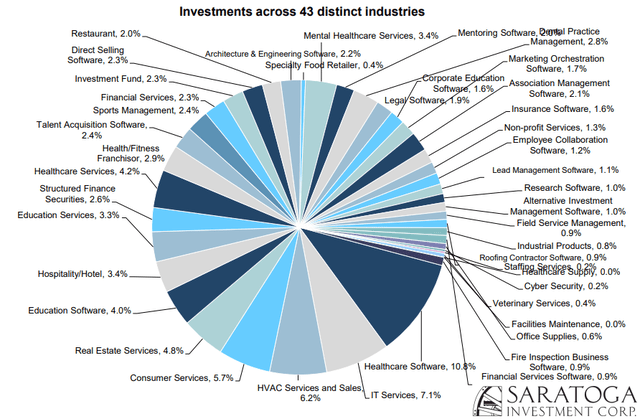

Second, portfolio diversification is strong and greatly distributed among many industries. Looking at the chart below, we can see that the largest industry exposure is associated with investment in the healthcare software companies that together account for around 10% of the portfolio value.

SAR Investor Presentation

Having this kind of diversification in conjunction with the focus on already cash-flowing businesses is again a solid sign of the underlying strength/resiliency in the portfolio.

Third, the borrowings or external leverage part takes the opposite direction from the two aforementioned aspects. In other words, as of now, SAR is the most indebted BDC out there with a debt to equity exceeding 220%, which is approximately 103% above the sector average. The second most indebted BDC has a debt-to-equity ratio of ~180%.

Besides the clear risks this level of leverage brings (e.g., magnified losses in the case of non-accruals, huge sensitivity to the economic downturn), the structure of underlying borrowings is something that definitely deserves attention.

The lion’s share of SAR’s borrowings are assumed at fixed rates that currently are below the market-level cost of debt. The maturity dates vary depending on the instrument, but the bulk of outstanding borrowings will mature in the upcoming 2-3 year period, thereby triggering interest expense convergence to the market level rates. Granted, it could be that by that time interest rates will already be down into accommodative territory which would in turn help SAR avoid suffering from a massive surge in financing costs. Yet, there is also a decent probability that this is not the case. In such an event, we could expect a massive wave of headwinds for SAR’s NII generation going forward.

Why SAR has diverged from the index?

Now, the key reason why SAR’s share price reacted as it did once the earnings came out is two-fold.

One of the most important metrics measuring BDC performance – adjusted NII – decreased compared to last quarter. The sequential quarterly per share decrease equated to $0.07, which stemmed from the notable equity issuance that SAR conducted during the most recent quarter. The attraction of additional equity was made with the aim of lowering the leverage profile.

The unpleasant factor in this context was that these incremental shares were issued at a massive discount to the NAV as SAR trades roughly 20% below its fair value. For the existing shareholders, this implies value-destructive dilution. Also, if we take a step back and put ourselves in management’s shoes, we can just think of how critical it was (and still is) to reduce the financial risk in the system.

The second driver behind the decreased share price was the fact that during Q3’24, SAR originated no new portfolio investments. This sends an uncomfortable signal on SAR’s ability to navigate the current environment, where there are in general depressed capital markets and M&A activity that could fuel the portfolio growth of BDCs or at least shield the existing levels. For BDCs, it is important to have a large asset base from which to capture spreads between cheap cost of capital and enticing portfolio yields. In this situation, size matters, where SAR has no advantage.

The bottom line

Saratoga Investment Corp is an interesting investment case. On the one hand, it has the necessary characteristics at the fundamental level for being considered an attractive investment play (e.g., diversification, bias to first-lien, and cash-generating businesses). Yet, on the other hand, it carries structurally unfavorable aspects that increase the overall risk level dramatically. The fact that SAR has the highest leverage in the entire BDC space, while also being one of the smallest players (from the NAV perspective) introduces too much risk. Namely, it is not the right time to go long SAR, when a defense stance is preferred given the backdrop of a coordinated uptick in BDC non-accruals and more shallow net investment volumes across the board.

In light of this, my recommendation is to avoid (hold) Saratoga Investment Corp. I would not short it as the inherent leverage in SAR could, with any positive dynamic at the sector level, cause a major jump in the stock price.

Read the full article here