Investment Thesis

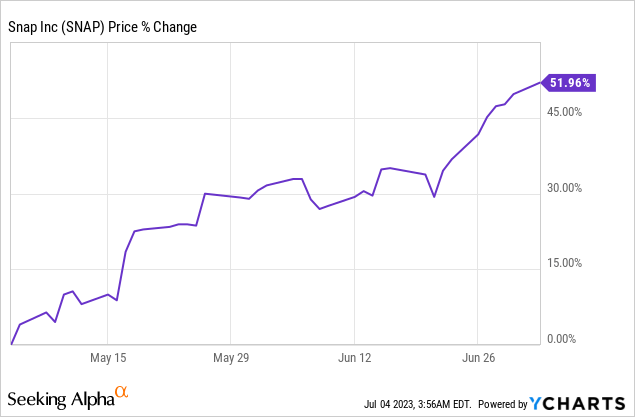

Snap (NYSE:SNAP) has jumped over 50% in the past two months amid improving market sentiment and enthusiasm around AI (artificial intelligence). However, the rally seems unjustified as its fundamentals remain unappealing.

The company is trying to improve monetization through product expansion, but the outcome has been disappointing. The increase in R&D expenses is also in turn weighing on the bottom line. Besides, the current valuation is extremely expensive, with multiples meaningfully above peers. I do not think the risk-to-reward ratio is favorable at the moment, and I rate the company as a sell.

Monetization Issue

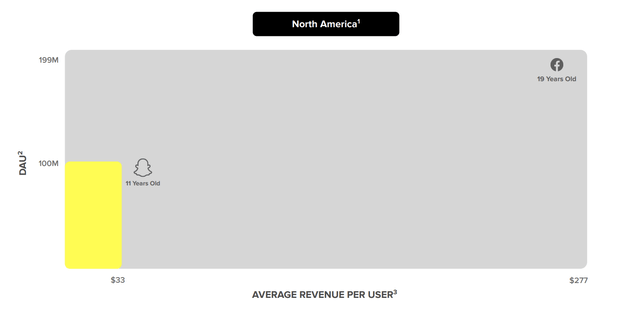

Snap, or Snapchat, is one of the largest social media companies in the world, especially among younger populations that age between 13-34 years old. The California-based company currently has over 380 million DAU (daily active users) and over 750 million MAU (monthly active users). Its user base has been growing steadily, but it continues to struggle with monetization. For instance, the company’s current ARPU (average revenue per user) in North America is only $33, which is 88% lower than Facebook’s $277.

In order to improve monetization, the company has been investing heavily in production expansion, hoping to further expand its ad formats and increase engagement. Recent notable launches include Snapchat+ and My AI. While management’s objective of this initiative is nice, the results have been quite underwhelming. The significant increase in R&D (research and development) spending is also weighing heavily on profitability.

Snap

Snapchat+

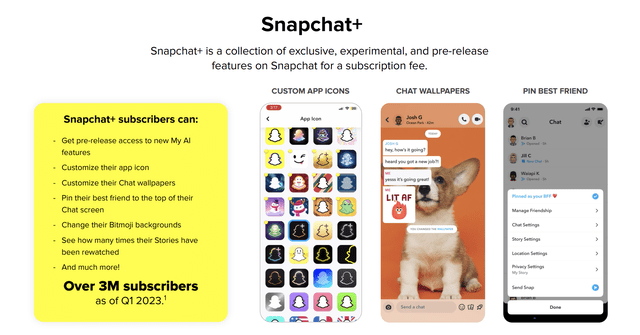

Snapchat+ has been the company’s primary focus, as it presents another revenue stream other than advertising, which is very cyclical. Snapchat+ is a paid subscription service launched last year, which gives subscribers access to exclusive and pre-release features. For example, subscribers are able to customize their app, boost their story, or get priority replies.

Snapchat+ is expected to hit 4 million subscribers this year, but its impact on financials remains extremely minimal. For instance, it is expected to generate only around $190 million in ARR (annual recurring revenue), as the service costs just $3.99 per month. This will give the company’s revenue a mere 4.2% boost. The service’s penetration rate will have to grow substantially for it to make a meaningful impact, but that is unlikely in my opinion.

I believe the value proposition of Snapchat+ is very weak, as most of the features provide minimal benefits. Besides certain highly-engaged users, most casual users do not care about what their chat wallpaper or app icon looks like and certainly won’t pay a subscription fee for it in my opinion. The weak value proposition will weigh on pricing and the demand for the service should also remain muted moving forward.

Snap

Questionable Investment Decisions

My AI is another questionable move from Snap. My AI is a chatbot powered by OpenAI’s GPT technology, which can answer general questions and provide suggestions (e.g., birthday gift suggestions). This is a head-scratching launch in my opinion, as the product does not align with users’ motives. Most users use Snapchat to interact with friends or to share their life, so a chatbot does not fit well in the ecosystem and offers minimal synergy or value in my view. The product is also pretty much identical to ChatGPT or other chatbots, which gives it little to no competitive advantage.

While the company has not been able to generate adequate returns from its investments, the increase in R&D expenses is also weighing significantly on its bottom line. During the latest quarter, the company spent around $455 million on R&D, which accounts for 46% of revenue alone. The elevated R&D spending resulted in the operating loss widening 34% YoY (year over year) from $272 million to $365 million.

Unjustified Valuation

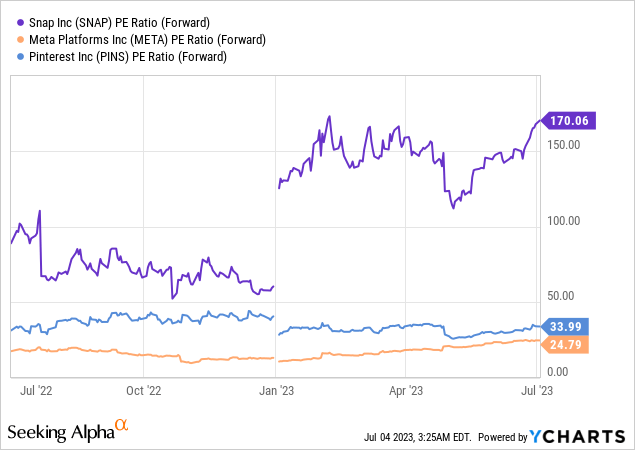

Despite being down over 80% from its all-time high in 2021, Snap’s valuation is still extremely expensive in my opinion. The company is currently trading at a fwd PE ratio of 170x, which is significantly higher than other social media companies such as Meta Platforms (META) and Pinterest (PINS), as shown in the first chart below. Peers have an average PE of just 29.4, which represent a discount of 83% compared to Snap. Even if we use the EPS estimate for FY24, the company still trades at an elevated PE ratio of 50.6x.

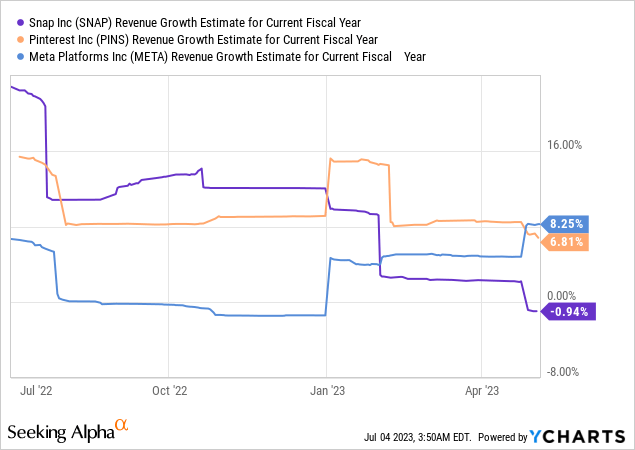

The massive valuation gap is hard to justify as Snap’s revenue is expected to decline by 1% YoY (year over year) this year, while Meta and Pinterest are set to grow by 6.8% and 8.3% respectively, as shown in the second chart below.

Upside Risks

While Snap’s track record in product investments has been disappointing, the company may still end up launching something significant. For instance, the company’s AR (augmented reality) technology has great potential as it actually provides useful features such as product try-on, sizing, and a 3D viewer. If the potential of its technology materializes, the company may see a surprising acceleration in growth, which will impact my thesis.

Investors Takeaway

I believe Snap’s recent price action is purely speculation amid the AI enthusiasm rather than an actual improvement in fundamentals. Monetization continues to be an issue and the latest offerings such as Snapchat+ and My AI are both underwhelming with weak value propositions. This is also impacting the company’s profitability, as operating loss deteriorated substantially amid the heavy R&D spending. Not to mention a potential economic slowdown may put further pressure on financials. The current multiple is also extremely elevated compared to peers, and it is hard to justify such a valuation considering its weak fundamentals. Therefore, I rate Snap as a sell.

Read the full article here