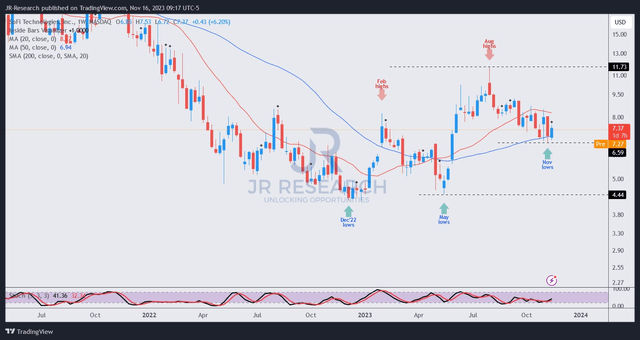

SoFi Technologies, Inc. (NASDAQ:SOFI) buyers have attempted to bottom out for the past two weeks since its robust third-quarter or FQ3 earnings release. It’s a pivotal level for buyers to defend. If that level fails, buyers might need to brace for more pain, suggesting a return to SOFI’s May 2023 lows ($4.50 level) could be possible.

Notwithstanding my caution, I’m confident that the worst in SOFI is likely over, even though the market reaction to SoFi’s earnings scorecard has been somewhat tepid since its initial surge.

Investors should recall that the digital consumer finance company posted a solid beat for Q3 and raised guidance for FY23. The company is also confident of achieving GAAP net income profitability in Q4, marking a significant milestone toward its long-term model.

In a recent November conference, management reminded investors about the broadening of SoFi’s revenue and profitability growth from FY24. While its lending segment is still the near-term profitability growth driver, SoFi expects the financial services segment to play a more prominent role as it reported positive contribution profit in Q3.

Accordingly, SoFi’s financial services segment posted a contribution profit of about $3.26M in Q3, well above last year’s loss of $52.6M. The company expects continued operating leverage growth in this segment, driven by its high-quality deposit base, mainly underpinned by direct deposits. SoFi stressed that the “growth in overall deposits is driven by 90% direct deposit members, with 98% of deposits fully insured by the FDIC.”

Clearly, its customer base has benefited from the high APY (4.6%) offered to its direct deposit customers. It helps SoFi open the door for cross-selling into its breadth of financial services, as the company aims to be a leading one-stop shop in its field.

In addition, the company’s ability to continue driving loan growth through its marked growth in deposits (reaching $15.7B in Q3) has allowed it to benefit from a higher net interest income. Observant investors should recall that its lending segment net interest income grew 90%, helping to drive a 16% growth in net revenue for the segment.

With the resumption of student loans driving origination volume (up 101% YoY), the headwinds against SoFi’s long-term recovery are likely falling apart, as we are not expected to fall into a recession.

Moreover, by having a sound deposit franchise, SoFi proved its mettle during the regional banking crisis earlier this year. While there were concerns over whether it could offload its loans, management isn’t unduly worried. Its recent securitization deal with BlackRock (BLK) underscores management’s confidence in the high quality of SoFi’s personal loans segment.

Therefore, I assessed that the market seems increasingly confident about a further recovery in SOFI, even though patience is needed, given the recent market volatility.

SOFI price chart (weekly) (TradingView)

SOFI buyers are trying to defend the $6.50 to $6.60 zone, formed in the week before its Q3 earnings. Bulls must hold that zone, as there’s a massive gap toward its May 2023 lows ($4.50 level). That gap is attributed to the significant surge between its May 2023 lows and early June 2023 highs. In other words, these dip buyers could consider taking profits quickly if they anticipate SOFI’s $6.50 zone isn’t expected to be sustained, resulting in potentially steep technical selling.

Notwithstanding that caution, I’m confident that SoFi’s robust operating performance has proffered more credibility for investors looking to invest in a high-growth digital finance company. While bearish investors could argue the lack of a sustainable moat, SOFI has outperformed its financial sector (XLF) peers since late 2022. Also, it has demonstrated the resilience of its deposit franchise, suggesting it has a sticky and loyal direct deposit base on which to depend.

With that in mind, I urge investors to look forward (and not backward), as the company is still in the early innings of delivering its long-term adjusted EBITDA margin target of 30%.

Rating: Upgraded to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here